2019 Agent Product Training - Messer Financial · Training Overview. 2. 3 ... North Carolina, Inc....

Transcript of 2019 Agent Product Training - Messer Financial · Training Overview. 2. 3 ... North Carolina, Inc....

Confidential

2019Agent

Product Training

Confidential

• Introduction

• Plan Benefits

• Providers

• Part D Information

• Appeals and Grievances

• Sales & Marketing

• Enrollments

• Agent Compensation

• Healthcare Concierge

• Agent Concierge

• Agent Oversight

• Important Information

• End of Training

Training Overview

2

3

Introduction

Confidential4

Ownership & Operations

• HealthTeam Advantage (HTA) is a wholly owned subsidiary of Cone Health, an integrated healthcare network with facilities across the Triad.

• Currently serve nearly 15,000 lives.

• Legal name is Care N’ Care Insurance Company of North Carolina, Inc. d/b/a HealthTeam Advantage.

• All operations are in Greensboro, North Carolina. With more than 50 employees.

• Committed to continuing to grow across the state.

Confidential5

HealthTeam Advantage:Vision, Mission and Values

VisionBe the leading health solutions plan dedicated to exceptional and caring experiences

MissionImprove the health and well-being of our communities through a commitment to personalized

service, quality and enhanced care experiences

Values

Integrity Ingenuity Caring ExcellenceWe operate with a high level of integrity, doing the right thing in every

situation.

We seek to maintain what works well today

and be forward-thinking and anticipate what will

be needed for tomorrow.

We care for our communities and for

each other.

We strive for excellence at every touch-point

with every member and partner.

The team members you will be interfacing with from the Greensboro office.

Include:

3

IntroductionThe Team!

Joleen Katula, Director of Operations

Emily Wright, Marketing Manager

Luba Nemcow, Community Outreach

Supervisor

Jennie Ahlgren, Marketing Coordinator

Joleen oversees agent relations, claims, provider network, customer service,

enrollment, product and benefits, and sales and

marketing.

Emily will be leading branding and marketing

efforts, including co-branding opportunities.

Luba is HealthTeam Advantage’s in-house

licensed agent, and will be working on increased community outreach and

support.

Jennie supports sales and marketing functions,

including events, collateral and website

maintenance.

3

Service Area ExpansionHealthTeam Advantage2018 – HTA is currently in four counties:• Guilford, Rockingham, Randolph and Alamance

2019 – HTA is expanding into:• Forsyth

Service Area ExpansionTeal Premier

• HTA is entering a joint partnership with Atrium Health (formerly Carolinas Health System)

• Product name is Teal Premier (TP)

• New PPO MA plan will be expanding into Burke, Lincoln, Cleveland, Stanly, Union and Anson counties in 2019

• Identical benefits will be offered – PPO plan, two options

• Back-end management to be run by Care N’ Care Insurance Company of North Carolina, Inc.

HealthTeam Advantage & Teal Premier Selling HealthTeam Advantage and Teal Premier

• Agents can set-up one appointment. Which means, one certification training and exam is required to sell for both plans

• Each plan will have separate marketing and collateral items, since service areas don’t overlap

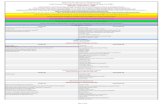

2019Plan Benefits

10

Plan Benefits Summary

Exciting changes to embed preventive services for all available plans.

Dental Vision Hearing FitnessAll plans include dental

coverage which includes basic cleanings &

preventative visits, with optional buy-up plan for

additional services.

Annual vision exams included in plans, with additional benefits for

eyeglasses and contact lenses.

Hearing screenings and copayment options for

hearing aids included in all plans.

Fitness benefits provided with Silver Sneakers.

Plan Benefits Summary

• Overall plan benefits are very similar 2018 offering.• Some adjustments to copay amounts.

• Most of the specialist co-pays are staying the same in 2019. However, we listing ranges on general materials since different services often require different copay amounts.

• In network PCP copay removed.• In network Home Health Services copay removed.

Plan Benefits Summary

2019

HealthTeam Advantage Plan I (PPO) 004(H9808)

HealthTeam Advantage Plan II (PPO)005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Monthly Plan Premium $0 $60

Deductibles (Medical and Rx) $0 $0

IN MOOP $3,400 $3,100

OON MOOP $5,100 $5,100

IN PCP Visit $0 copay $0 copay

OON PCP Visit $50 copay $45 copay

IN Specialist* Visit $20 copay $15 copay

OON Specialist* Visit $50 copay $50 copay

*Specialist copays can vary for specific specialists. Please contact the plan for more information.

Plan Benefits Summary, cont.

2019

HealthTeam Advantage Plan I (PPO) 004(H9808)

HealthTeam Advantage Plan II (PPO)005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

IN Preventative Care $0 copay $0 copay

OON Preventative Care $30 copay $30 copay

IN Home Health Svcs $0 copay $0 copay

OON Home Health Svcs $50 copay $45 copay

INN and OON Urgently Needed Services $30 copay $30 copay

INN and OON Emergency Care/Post-Stabilization Care

$120 copay $100 copay

IN and OON Ambulance Ground $225 copay for Medicare-covered ambulance

benefits per one-way trip.

$200 copay for Medicare-covered ambulance

benefits per one-way trip.

IN and OON Ambulance Air $300 copay for Medicare-covered air ambulance

benefits per one-way trip.

$300 copay for Medicare-covered air ambulance

benefits per one-way trip.

2019

HealthTeam Advantage Plan I (PPO) 004(H9808)

HealthTeam Advantage Plan II (PPO)005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Plan Benefits Summary, cont.

IN Diagnostic Test and Procedures $0 copay at a laboratory facility$5 copay at an outpatient hospital facility

$0 copay at a laboratory facility$5 copay at an outpatient hospital facility

OON Diagnostic Test and Procedures $10 copay at a laboratory facility$25 copay at an outpatient hospital

facility

$10 copay at a laboratory facility$25 copay at an outpatient hospital

facility

IN Durable Medical Equipment (DME) 20% of the cost 20% of the cost

OON Durable Medical Equipment (DME) 30% of the cost 30% of the cost

IN Diabetic Supplies & Svcs $0 copay $0 copay

OON Diabetic Supplies & Svcs 20% of the cost 20% of the cost

Meal and Transportation Benefits Not Covered Not Covered

Plan Benefits Dental: Preventive*

2019

HealthTeam Advantage Plan I (PPO) 004(H9808)

HealthTeam Advantage Plan II (PPO)005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Preventive Dental IN Office Visit $0 copay $0 copay

Preventive OON Office Visit $25 to $50 copay $25 to $50 copay

Preventive IN Oral Exam, Prophylaxis (Cleaning), and X - Rays

$0 copay $0 copay

Preventive OON Oral Exam, Prophylaxis (Cleaning), and X - Rays

$25 to $50 copay $25 to $50 copay

Preventive Dental Plan Coverage Maximum

$500 per year $500 per year

*Please see EOB for benefit details.

Plan Benefits Dental: Preventive*

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

IN Comprehensive Dental MC Benefits $35 copay $25 copay

OON Comprehensive Dental MC Benefits

$50 copay $45 copay

IN and OON Comprehensive Dental Periodontics Visit

$25-$50 copay $25-$50 copay

Comprehensive Dental Plan Coverage Maximum

$750 per year $750 per year

Periodontics Scaling & RootPlanning

$50, 4 quadrants every two years $50, 4 quadrants every two years

*Please see EOB for benefit details.

Plan Benefits Dental: Comprehensive Dental Rider

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Monthly Premium $25 Copay/Limitation(s) Copay/Limitation(s)

Fillings• Amalgam Filling - 1 surface

(D2140)• Amalgam Filling - 2 surfaces

(D2150)• Amalgam Filling - 3 surfaces

(D2160)• Resin-Based Composite Filling

Anterior - 1 surface (D2330)• Resin-Based Composite Filling

Anterior - 2 surfaces (D2331)• Resin-Based Composite Filling

Anterior - 3 surfaces (D2332)

$80 copayUp to 4 total fillings per year.

$80 copayUp to 4 total fillings per year.

Extractions• Erupted Tooth (D7140)

• Surgical (D7210)$70$90

Up to 4 per year.

$70$90

Up to 4 per year.

Crowns• Porcelain Fused to Base Metal

(D2751)• Porcelain Fused to Noble Metal

(D2752)• Full Cast Base Metal (D2791)• Full Cast Noble Metal (D2792)

$350 copayTotal of 2 per year. Crowns

have a 6 month waiting period.

$350 copayTotal of 2 per year. Crowns

have a 6 month waiting period.

Plan Benefits Dental: Comprehensive Dental Rider

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Monthly Premium $25 Copay/Limitation(s) Copay/Limitation(s)

Denture Adjustment (D5410/ D5411) $30 copayAdjustments are covered onnew dentures for the first 3

months post-delivery

$30 copayAdjustments are covered onnew dentures for the first 3

months post-delivery

Dentures• Complete denture, maxillary (D5110)

• Complete denture, mandibular(D5120)

• Immediate denture, maxillary(D5130)

• Immediate denture, mandibular(D5140)

• Maxillary partial denture, resin based(D5211)

• Mandibular partial denture, resinbased (D5212)

• Maxillary partial denture, cast metal ,resin based (D5213)

• Mandibular partial denture, castmetal, resin based (D5214)

$650 copay1 set of full or partial dentures

every 5 years.

$650 copay1 set of full or partial dentures

every 5 years.

Plan Benefits Vision

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Eye Exams

IN MC Benefits – Eye Exam $35 copay $25 copay

OON MC Benefits – Eye Exam $50 copay $45 copay

IN Routine Eye Exam One routine eye exam per year.

$5 copay $0 copay

OON Routine Eye ExamOne routine eye exam per year.

$30 copay $30 copay

Plan Benefits Vision, cont.

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Eye Wear

IN and OON MC Covered – Eye Wear $0 copay for Medicare-covered eyeglasses orcontact lenses after cataract surgery with a

maximum benefit amount not to exceed $100.

$0 copay for Medicare-covered eyeglasses orcontact lenses after cataract surgery with a

maximum benefit amount not to exceed $100.

OON Non- MC Benefits Reimbursement up to $50 Reimbursement up to $50

IN Contact Lenses 1 pair of contact lenses per year

$10 copay $0 copay

OON Contact Lenses1 pair of contact lenses per year

Reimbursement up to $50 Reimbursement up to $50

IN Eyeglasses (Lenses & Frames) 1 pair of eyeglasses. $200 limit for eyewear

value.

$10 copay $0 copay

OON Eye Wear Upgrade Reimbursement up to $50 Reimbursement up to $50

Plan Benefits Vision, cont.

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Eye Wear

IN and OON Eye Wear Coverage Maximum $200 $200

Eye Exam and Eye Wear – Authorization or Referrals

Not Required Not Required

OON Eyeglasses (Lenses & Frames)1 pair of eyeglasses. $200 limit for eyewear

value.

Reimbursement up to $50 Reimbursement up to $50

IN Eyeglass Lenses $10 copay $0 copay

OON Eyeglass Lenses Reimbursement up to $50 Reimbursement up to $50

IN Eyeglass Frames 1 per year

$10 copay $10 copay

OON Eyeglass Frames1 per year

Reimbursement up to $50 Reimbursement up to $50

IN Eye Wear Upgrade $50 copay $50 copay

Plan Benefits Hearing

Hearing Exams

IN MC Benefits - Hearing Exam One routine hearing exam per year.

$35 copay $25 copay

OON MC Benefits - Hearing ExamOne routine hearing exam per year.

$45 copay $45 copay

IN Routine Hearing Exam One routine hearing exam per year.

$5 copay $0 copay

OON Routine Hearing Exam One routine hearing exam per year.

$45 copay $45 copay

IN Fitting/Evaluation forHearing Aid

3 visits per year.

$0 copay $0 copay

OON Fitting/Evaluation forHearing Aid

3 visits per year.

$45 copay $45 copay

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Plan Benefits Hearing, cont.

Hearing Aids

IN and OON Hearing Aids Up to two TruHearing-branded hearing aids

every year (one per ear per year).

$499 - $699 $499 - $699

Hearing Exams and Hearing Aids –Authorization and Referrals

Not Required Not Required

2019HealthTeam Advantage Plan I (PPO)

004(H9808)HealthTeam Advantage Plan II (PPO)

005(H9808)

Teal Premier Pro (PPO)006(H9808)

Teal Premier Pro Plus (PPO)007(H9808)

Plan Benefit: Fitness

SilverSneakers Members can join to receive a membership at SilverSneakers fitness program at no cost. Staying healthy and active is important to a member’s overall health.

How can a member get started?1. Verify eligibility HealthTeam Advantage and Teal Premier are a participating health plan), enroll, and receive a

member ID2. Find near locations 3. Take the SilverSneakers card or 16-digit member ID to any location

What’s included?• Access to fitness equipment• Specially-designed, signature exercise classes for all fitness levels**• Pools, tennis courts and walking tracks**• 14,000+ fitness and community locations nationwide (you can enroll at multiple locations)• Social events in the community• Online resources with nutrition and fitness tips

**Classes and amenities vary by location. Classes not offered at all locations.

26

Providers

In-Network Providers

Selecting an In-Network ProviderChoosing the right physician can greatly influence many factors in our lives. At HTA and TP, quality of care is an important focus.

Choosing in-network providers can help:

• Lower copayments and out of pocket costs for members• Ensure that plan benefits are properly coordinated, to

provide a seamless continuation of care• Ensure that plan providers follow plan processes to

minimize billing errors• Members properly and effectively manage challenging

and costly chronic health conditions• Assist in working towards higher STARS Ratings

Providers

Find a Provider At www.HealthTeamadvantage.com

At www.TealPremier.com

1. Click Find a Provider - “Search Now” on the homepage

2. From the Find a Provider listing, select “Find a Provider”The Provider Search Tool is updated several times per week to reflect network changes.

In-Network vs. Out-Of-Network Providers

Management of Out-Of-Network Medical Claims:

Every doctor is different on how they may choose to manage HTA and/or TP patients as Out-Of-Network. It is important that the member understand that even though we are a PPO, there may be some Primary Care Physicians, Specialists, and Facilities who will not accept HTA and/ or TP patients. We are willing to work with any Out-Of-Network doctors/facilities to help facilitate that claims process.

In many instances, the member may be expected to pay the entire bill up front and would then submit that receipt with all billable codes listed to their HCC for the reimbursable amount. That amount is based on the Medicare Allowable MINUS any applicable Out-Of-Network copay.

It is best to have the member check with the doctor’s office in advance of appointment to understand what they will be responsible for paying at the time of visit to avoid any confusion.

30

Part D Information

Part D Information

Part D Information Essential Information

• HTA and TP DOES NOT have a preferred pharmacy network. We have a national pharmacy network that includes over 65,000 pharmacies. There is a pharmacy locator tool available on the HTA and TP website.

• There are five (5) “cost-sharing tiers” for drugs on the Formulary (or Drug List).• The Part D benefit DOES NOT have a deductible.• There is a Medication Lookup tool and a Comprehensive Formulary (pdf) on the HTA and TP website that is updated monthly. We

also post a Formulary Addendum that contains the positive and negative changes that occur each month.• NOT ALL insulins are covered under Part D. If the insulin is being used in an infusion pump (considered Durable Medical

Equipment. (DME)) that was paid for by Medicare Part B or the supplies (DME) are being covered under Part B, THEN the insulin is covered under Part B.

• Generic medications can be found on any tier of the formulary. NOT ALL generics are low cost.

The Five Drug Tiers Definitions Tier Name Composition

Tier 1 Preferred Generics Generic drugs that are available at the lowest cost share for this plan

Tier 2 Generics Generic and some very low cost brand drugs that are available at a higher cost to you than drugs in Tier 1.

Tier 3 Preferred Brands Generic or brand drugs that are available at a lower cost to you than drugs in Tier 4

Tier 4 Non-Preferred Drugs Generic or brand drugs that are available at a higher cost to you than drugs in Tier 3

Tier 5 Specialty Drugs Generic or brand drugs that are the highest-cost. This tier is not eligible for a Tiering Exception

Part D Information

Copays or CoinsuranceStandard In-Network Retail or Mail Order

(Up to a 30- Day Supply)Standard In-Network Retail or Mail Order

(Up to a 90- Day Supply)

Tiers HTA Plan I (PPO) Teal Premier Pro (PPO)

HTA Plan I (PPO) Teal Premier Pro Plus(PPO)

1 – Preferred Generics2 – Generics3 – Preferred Brands4 – Non-Preferred Drugs5 – Specialty Drugs

$5 copay$15 copay$45 copay$90 copay

33% coinsurance

$10 copay$30 copay$90 copay

$180 copay33% coinsurance

Tiers HTA Plan II (PPO)Teal Premier Pro (PPO)

HTA Plan II (PPO)Teal Premier Pro Plus(PPO)

1 – Preferred Generics2 – Generics3 – Preferred Brands4 – Non-Preferred Drugs5 – Specialty Drugs

$0 copay$12 copay$40 copay$80 copay

33% coinsurance

$0 copay$24 copay$80 copay

$160 copay33% coinsurance

Part D Information Drug Payment Stages

Stage 1 Yearly Deductible Stage

Stage 2 Initial Coverage Stage

Stage 3 Coverage Gap Stage

Stage 4 Catastrophic Coverage Stage

Because there is NO deductible for the plan, this payment stage does NOT apply to the member..

Plan pays its share of the drug costs and the member pays their share.

Start in this stage - when the member fills first prescription of the year.During this stage - the plan pays its share of the cost of drugs and the member pays their share of the cost. Remain in this stage - until the year-to-date “total drug costs” (the members cost plus any Part D plan’s cost) total $3,820.

(Details are in the EOC)

Plan provides some drug coverage.

For Tier 1 generic drugs - member pays either Tier 1 copayment or 37% of the costs, whichever is lower. For all other covered generic drugs - the member pays 37% of the costs.For covered brand name drugs - the member pays 25% of the price (plus a portion of the dispensing fee).Remain in this stage - until the member year-to-date “out of-pocket costs” (the members cost or TrOOP) reach a total of $5,100.

This amount and rules for counting costs toward this amount have been set by Medicare.

(Details are in the EOC)

Plan pays most of the cost.

During this stage -the plan will pay most of the cost of the member drugs for the rest of the calendar year (through December 31, 2019).

(Details are in the EOC)

Part D Information

Part D vs. Part B prescription drugsDrugs that are covered under Part B of Original Medicare. HTA and TP covers services that include, but are not limited to:

• Drugs that usually aren’t self-administered by the member and are injected or infused while getting physician, hospital outpatient, or ambulatory surgical center services.

• Drugs taken using durable medical equipment (such as nebulizers or insulin pumps) that were authorized by the plan

• Self – administered drugs by the member as injection for hemophilia• Injectable osteoporosis drugs• Antigens• Certain oral anti-cancer drugs and anti-nausea drugs• Certain drugs for home dialysis• Intravenous Immune Globulin for the home treatment of primary immune deficiency diseases

Part D Information

Vaccine Benefits• Some vaccines are considered ALWAYS medical benefits. (Ex: Influenza vaccine and Pneumonia

vaccines)o Please see Chapter 4 of the EOC for coverage information

• Other vaccines are considered Part D drugs. (Ex: Shingles vaccine)o Part D covered vaccines will process at the Tier identified in the formulary.

Cost for Part D vaccines• Two parts to the coverage of Part D vaccines:

o The cost of the vaccine medication itself. o The cost of administration of the vaccine.

• Where is the vaccine being purchased and administered? o Pharmacy – North Carolina allows pharmacists to administer some vaccines but not all states

allow Member will only pay their share of the cost which is determined by the Tier and benefit

phase and the plan will pay the remaindero Doctors office

Member will have to pay the entire cost for both the vaccine medication and administration of the vaccine. Member can ask the plan to pay back for share of the cost by following the procedures described in Chapter 7 of the EOC.

Part D Information

Medication Look Up

At www.HealthTeamadvantage.com

At www.TealPremier.com

1. Click “For Members” on the homepage

2. Click “2019 Pharmacy Information”.

3. Click “Medication Look Up”.

4. Type the first three letters of the drug name.

5. Select the correct drug by the full name as well as

the dosage form and strength.

Examples to Reference

Testing may apply to specific examples

Example Search #2

Example Search #1

Part D Information

Formulary Restrictions

Part D Information

Part D Coverage Determinations • A coverage determination is an initial coverage decision made by the plan regarding a Medicare Part D prescription drug.

Here are examples of coverage decisions you ask us to make about your Part D drugs:o Formulary Exception Request: A member, their appointed representative*, or their prescriber can ask us to remove

the formulary restriction (i.e. prior authorization, step therapy of quantity limit) from a drug.o Nonformulary Exception Request: A member, their appointed representative*, or their prescriber can ask us to

cover a drug even if it is not on our formulary. If approved, this drug will be covered at the Tier 4 cost-sharing level, and would not be eligible for a Tiering Exception.

o Direct Member Reimbursement: The member or their appointed representative*, can ask us to pay for a prescription that they already bought.

o Tier Exception Request: A member, their appointed representative*, or their prescriber can ask us to cover a formulary drug at a lower cost-sharing level if this drug is not on the specialty tier. If approved this would lower the amount having to pay for the drug. You can ask us to pay for a prescription drug you already bought.

• The prescriber must provide a statement that explains the medical reasons for requesting an exception.• We can say yes or no to the request

o If we approve the request, the approval is valid until the end of the plan year, unless the CMS approved criteria lists a shorter duration.

o If we deny the request, the member, their appointed representative*, or their prescriber can request a redetermination

* The plan must have an Appointment of Representative” (AOR) form on file to review the request. This means that an agent cannot request an exception unless they have a signed AOR for from the member to act on their behalf.

Part D Information

Part D Coverage Determinations (cont.)• Timeframes for decisions

o Standard coverage determination – the plan will provide an answer within 72 hours. o Expedited coverage determination – the plan will provide an answer within 24 hours. An

expedited decision is only allowed if the member has not yet received the medication and the prescriber states that a delay could cause serious harm to the member’s health or hurt the member’s ability to function.

• When does the clock starto For Prior Authorization and Step Therapy requests the timeframe starts with the initial request

from the member, their appointed representative, or their prescriber.o For all other Formulary Exceptions the timeframe starts when the supporting statement is

received from the prescriber.

Part D Information

Part D Redeterminations (Appeals)• A redetermination is a 1st level appeal to the plan about an initial request that was denied. The request

must be submitted within 60 days of the date on the denial letter.• The prescriber must provide a statement that explains the medical reasons for the request.• We can say yes or no to the request

o If we approve the request, the approval is valid until the end of the plan year, unless the CMS approved criteria lists a shorter duration.

o If we deny the request, the member, their appointed representative*, or their prescriber can appeal the request to Maximus. The denial letter contains the contact information for Maximus.

• Timeframes for decisionso Standard redetermination – the plan will provide an answer within 7 days. o Expedited redetermination – the plan will provide an answer within 72 hours. An expedited

decision is only allowed if the member has not yet received the medication and the prescriber states that a delay could cause serious harm to the member’s health or hurt the member’s ability to function.

• When does the timeframe start?o The timeframe starts with the initial request from the member, their appointed representative, or

their prescriber.

41

Appeals and Grievances

Appeals &

Grievances

A & G Information Part C Organization Determinations, Appeals & Grievances

• Organization Determination: Is a decision (approval or denial) the plan makes regarding payment or benefits to which the member believes their entitled under Medicare Part C. An organization determination would involve these types of benefits:o Out of the area renal dialysis serviceso Payment for any other health services furnished by a providero Discontinuation of a service if you believe that continuation of the services is medically necessary.

How to request an organization determination: • The member, their appointed representative, or the prescribing physician may request an organization

determination. The member or their appointed representative can call, fax or mail in a request for an organization determination.

• However, the preferred method is to have the prescribing physician call the plan with a supporting statement for the members request. It is recommended but not required to have the doctor provide a supporting statement for the request.

To file a request, use the following contact information:

Phone: 1-888-965-1965 / TTY: 711 / Fax: 845-4104

Mail: HealthTeam Advantage or Teal Premier

Attn: Member Concierge

7800 McCloud Road, Suite 100

Greensboro, NC 27409

A & G Information

Part C Organization Determinations, Appeals & Grievances (cont.)• Appeal: Is a request the member makes if he or she disagree with the plans decision to deny an

authorization request for services to be received (Pre-Service), discontinue or stop services being received, deny services already received (Claims), or if he or she disagree with the amount of copayment or coinsurance their required to pay for services already received (Claims).

• Appeal requests for denials of services already received (Claims) or appeal requests for the amount of copayment or coinsurance being charged (Claims), will be responded to within 60 calendar days from the date we receive the request. These appeal requests cannot be expedited.

The member, or their appointed representative, may request this type of appeal.

Expedited or “Fast” Appeals can be requested verbally or in writing.• If the plan has denied an authorization for services to be received or a decision has been made to

discontinued or stop services being received, the member, their appointed representative, or the physician may request an expedited (fast) appeal.

• For appeals regarding the An Important Message From Medicare About Your Rights, members may follow the instructions on how to file an appeal.

• For appeals regarding the Notice of Medicare Non-Coverage, members may follow the instructions on how to file an appeal.

A & G Information

Part C Organization Determinations, Appeals & Grievances (cont.)• Grievance: Is any compliant or dispute, other than one that involves an organization

determination decision for services or payment, which expresses dissatisfaction with the manner in which HTA and/or TP provides health care services or one of our contracted providers. Examples of grievance issues can include, but not are not limited to, issues related to quality of care, waiting times, and the customer service received.

Grievances may be requested verbally or in writing. A written response will be provided to all grievances received in writing.

• Standard Grievances will be responded to within 30 calendar days from the date we receive the request. This timeframe may be extended with an addition of 14 calendar days if the beneficiary request an extension or if HTA and/or TP justify the need for additional time is in your best interest. We will provide the member with a written notification if an extension is taken.

• Expedited or “Fast” grievances can be requested if we have denied the request for an expedited organization determination, an expedited appeal, or if we have taken an extension on an organization determination or an appeal. Expedited or “Fast” grievances will be responded to within 24 hours of when we receive the request.

A & G Information

When to file an Appeal or Grievance?A member must request an appeal or a grievance within 60 calendar days from the date of denial or the date of the event that led to the dissatisfaction. A specific form is not required to file an appeal or a grievance.

Who can request an Appeal or a Grievance?The member or their appointed representative, may file an appeal or a grievance. The member may appoint an individual to act as their representative by completing the Appointment of Representative form and submit to HTA or TP.

The members physician may also request certain types of appeals on your behalf. See the “Appeals” section on each plan website for more information.

An appeal or a grievance request, by someone other than the member, is not valid until the appropriate documentation is received by HTA or TP. We cannot begin or complete our review until we receive the appropriate documentation.

How to request an Appeal or a Grievance?To request a verbal grievance or an expedited appeal, members may call HTA or TP Healthcare Concierge department. Hours: From October 1 – February 14, 8 am – 8 pm.., EST, seven days a week or February 15 – September 30, 8 am – 8 pm, EST, Monday through Friday, at this number: Phone: 1-888-965-1965 / TTY: 711

To file a written grievance or appeal, send to:Mail: HealthTeam Advantage or Teal Premier

Attn: Appeals and Grievances7800 McCloud Road, Suite 100

Greensboro, NC 27409Fax: 800-845-4104

A & G Information

Levels of Appeals and Process

Note: Amount in Controversy (AIC) amount is published yearly by CMS.

The chart reflects the amounts for calendar year 2018.

AIC = Amount in Controversy

ALJ = Administrative Law Judge

IRE = Independent Review Entity

*Plans must process 95% of all clean claims from out of network providers within 30 days. All other claims must be processed within 60 days.

**The AIC requirement for an ALJ hearing and Federal District Court is adjusted annually in accordance with the Medicare care component of the customer price index.

47

Sales &

Marketing

Sales & MarketingStandards of Professionalism and Responsibilities The following is applicable to all HTA and TP Sales Agents:

Be prompt to appointments and presentations. Reschedule as necessary while collaborating with HTA and TP Sales

Department.

Wear appropriate business attire to sales presentations and events.

Represent HTA and TP Medicare products with the highest level of honesty and integrity. Always putting the needs of

each Medicare prospective members ahead of any personal consideration.

Offer all available HTA and TP Medicare plans to each eligible Medicare prospective members with whom the Sales

Agent meets (non-discrimination). Help the beneficiary determine the most appropriate plan based on their personal

needs and life style.

Solicit and sell HTA and TP plans using only HTA and TP and CMS approved marketing, advertising, sales presentation,

and enrollment materials.

Validate the accuracy and full completion of all enrollment applications, prior to submitting to HTA and TP for processing.

Provide required documents, within the timeframe determined by HTA and TP. Provide any supporting documentation,

upon request. All documents must be readily accessible to HTA and TP.

Sales & MarketingStandards of Professionalism and Responsibilities, cont. The following is applicable to all HTA and TP Sales Agents:

Maintain document records for ten (11) years in a secure location.

Obey by all applicable federal and state laws, rules, regulations, and HTA and TP’s Policies and Procedures that pertain to

the solicitation, sales and administration of any HTA and TP Medicare plans, including the prevention of fraud, waste, and

abuse.

Actively cooperate with HTA and TP Sales, Appeals and Grievances, and Compliance team. For any Sales

Allegations/Complaints. Response to such inquires within two (2) calendar days of receipt.

Participate in HTA and TP Agent Oversight Committee or HTA and TP Agent Oversight Mandatory Meetings. As part as

regulatory concerns, allegations, type of misconduct, fraud, or any associated sales and marketing misrepresentation

issues.

Stay up to date with annual Medicare trainings and pass certification exams.

Shall not smoke, use of tobacco products, or be under the influence of illegal drugs when presenting, soliciting, or selling

HTA and TP plans.

Sales & Marketing

Sales Agents/Sales Entities may NOT engage in any of the following activities when conducting marketing activities: Engage in activities which mislead, confuse or misrepresent the plan

Engage in discriminatory practices

Offer gifts or payment as an inducement to enroll or solicit referrals

Solicit door-to-door for Medicare beneficiaries or through other unsolicited means of direct contact, including calling a

beneficiary without initiating the contact or giving express permission.

May not claim recommendation or endorsement by CMS or the CMS recommends that the person enroll in a HTA or TP

plan.

May not make erroneous written or oral statements including any statement, claim or promise that conflicts with, materially

alters, or erroneously expands upon the information contained in CMS approved materials.

Sales & Marketing

Sales Agents/Sales Entities may NOT engage in any of the following activities when conducting marketing activities, cont.: May not use providers or provider groups or distribute printed information comparing benefits of different health plans,

unless the materials have concurrence of all Medicare Advantage (MA) plans involved or the materials have received prior

approval from CMS.

May not cross-sell any non-health related products (such as annuities, life, insurance.) during any sales or marketing

activity or presentation conducted with respect to an MA plan or Part D plan.

May not provide meals of any sort, regardless of value, at any sales event at which plan benefits are being discussed

and/or plan materials are being distributed.

May not conduct sales or marketing activities at educational events

May not conduct sales or marketing activities in areas when patients primarily intend to receive health care services or

where health care is delivered.

52

Enrollments

Enrollments

Enrollment Steps

Determine Eligibility• Determine the Service Area, if End-Stage Renal Disease (permanent kidney failure) applies, and

identify the proper Election Period. Note: It is important to submit the Attestation of Eligibility Form along with the application to provide additional information for eligibility purposes.

Present the Plan Benefits• Determine which plan(s) better suites the prospective member.

o Explain the covered benefits, copays/cost, prescriptions (the different stages), providers, and more

Assist with an Online or Physical/Paper Enrollment Application Form• Fill out the following: Enrollment Applications (total of four (4) pages), the Scope Of Appointment/Sales,

Attestation of Eligibility Form , and the Application Checklist. o Explain the select a Payment Option, Welcome Package & Call, and the Disenrollment

Procedures. • Submit the Enrollment Application to HTA or TP within 48 hours of taking possession of the

application.• Use the proper benefit year form or link to complete the enrollment.

Enrollments

Application Breakdown & Additional Forms

Scope of Sale/Appointment (SOA) Application Page 1 Application Page 2 Application Page 3 Application Page 4 Attestation of Eligibility for an Enrollment Period Application Checklist Communication Preference

Scope of Sale/Appointment (SOA) - Agents must have a signed CMS-approved SOA form prior to any in-person meeting. SOA is required for all such meetings with current members or new prospective members to ensure understanding of what will be discussed between the agent and the Medicare beneficiary (or their authorized representative). Agent must disclose all product types to be discussed (i.e. MA, MAPD, PDP) during the appointment.

Exception Policy: If it is not feasible to obtain the SOA Form prior to the appointment, the agent may have the current member or new prospective member sign the form at the beginning of the appointment. Agent must record in writing and maintain documentation on why it was not feasible to obtain the SOA prior to the appointment.

EnrollmentsApplication Breakdown & Additional Forms, cont.

Page 1 – Plan Selection, Prospective Member Demographic Information, Contact Information, Medicare Claim Number, and Medicare Parts Effective Dates.

Note: As of 2018, Medicare cards no longer shows a Social Security number. Instead, the card will have a new “Medicare Beneficiary Identifier” (MBI).

o The MBI has 11 characters, like the HICN, which can have up to 11.o The MBI’s characters are “non-intelligent” so they don’t have any hidden or special meaning.o MBIs are numbers and upper-case letters. We’ll use numbers 0-9 and all letters from A to Z,

except for S, L, O, I, B, and Z. This will help the characters be easier to read.

Page 2 – Important Information and Premium Options. Note: The Social Security/RRB deduction may take two or more months to begin after Social Security or RRB approves the deduction. Advice members to call the plan for status and payment options.

Page 3- Eligibility Questions, Primary Care Physician, Language Format, and Important Information.

Page 4- Prospective Member Signature and Date, Authorized Representative, and Office Use Only. Note: Office Use Only section must be filled out by the Sales Agent (assisting) also providing the Receipt Date, Election Type, and Coverage Effective Date.

Enrollments

Application Breakdown & Additional Forms, cont. Attestation of Eligibility for an Enrollment Period: A list of statements that may exempt-allow the prospective member to

enroll in a MA plan outside the of AEP. Note: If later determine that the information is incorrect, the prospective member may be not be accepted by CMS or disenrolled from the plan. New for 2019: Statement to select MA OEP. “I am enrolled in a Medicare Advantage plan and want to make a change during the Medicare Advantage Open Enrollment

Period (MA OEP).”

During the MA OEP, MA plan enrollees may enroll in another MA plan or disenroll from their MA plan and return to Original Medicare. Individuals may make only one election during the MA OEP.This chart outlines who can use the MA OEP and when:

Individuals may add or drop Part D coverage during the MA OEP. Individuals enrolled in either MA-PD or MA-only plans can switch to:• MA-PD• MA-only• Original Medicare (with or without a stand-alone Part D plan)

Who can use the MA OEP: MA OEP occurs:

Individuals enrolled in MA plans as of January 1 January 1 – March 31

New Medicare beneficiaries who are enrolled in an MA plan during their ICEP

The month of entitlement to Part A and Part B – the last day of the 3rd month of entitlement

Enrollments

Application Checklist: To ensure accuracy and timely enrollment processing, agents must complete and submit an Application Checklist with all paper enrollment applications. All applicable items need to be filled out in its entirety. Initialed and signed by the prospective members . As well as signed and dated by the agent.

Communication Preference : New or existing members have the opportunity to receive future correspondence from HTA or TP electronically. Members have the ability to opt-in for certain correspondence or to receive all correspondence electronically.

Important Reminders: If HTA or TP receives multiple applications for a beneficiary, we recognize the Agent of Record (AOR)

as the agent associated with the most recent application on file. This is likely to occur during the Annual Enrollment Period.

If a member does a plan to plan change, the existing Agent of Record on the policy will remain. Agents do not acquire compensation for plan to plan changes.

Agent of Record changes are not offered by HTA and TP. Collaborate with HTA and TP to not duplicate or re-submit received applications. Failure to follow all requirements for submitting Enrollment applications may result in processing delays,

which may then impact beneficiaries requested coverage date. Could also impact a Sales Agent and/or Sales Entity commission payment.

Enrollments

Submitting Enrollment Application Forms You may submit an enrollment application by selecting from one of the methods below: 1. Complete an online enrollment as a Sales Agent. (Preferred Method)

Agent Enrollment Form Link: https://healthteamadvantage.com/sales-tools/ OR https://tealpremier.com/sales-tools/• Locate the proper online enrollment link, per benefit year under each plan website. • The “Agent ID” is the Nation Producer Number (NPN). • Agents will receive a Confirmation Number after the submission is complete. • Agents will have the option to save (pdf) and/or print the copy of the enrollment at the end. • Automatically feeds into our enrollments system.• Although it is not necessary to send the two additional forms to HTA or TP: 1. Scope of Appointment (SOA) 2.

Application Checklist. Specifically when entering an online enrollment please maintain a copy per your records and make accessible to HTA or TP upon request for audit and/or compliance purposes.

2. Fax the physical/paper enrollment application form. Agent Support General Fax Number: (800) 905-9131. • Agents will receive an email from the Agent Concierge staff confirming the received application. • If the email confirmation is NOT received within 4 hours, please contact Agent Concierge immediately by calling: 855-

547-0344.

Enrollments

Involuntary and Voluntary Disenrollment• Involuntary Disenrollment - Disenrollment made necessary due to the organization’s determination that the

individual is no longer eligible to remain enrolled in a plan, or when an organization otherwise initiates disenrollment (e.g. failure to pay plan premiums, plan termination).

The MA organization is responsible for submitting involuntary disenrollment transactions to CMS in a timely, accurate fashion.

• Voluntary Disenrollment - Disenrollment initiated by a member or his/her authorized representative.

After receipt of a completed disenrollment request from a member, the MA organization is responsible for submitting the disenrollment transaction to CMS in a timely, accurate fashion. Such transmissions must occur within 7 calendar days of receipt of the completed disenrollment request, in order to ensure the correct effective date.

The MA organization must maintain a system for receiving, controlling, and processing disenrollment's from the MA organization.

MA organization must send notice of the upcoming disenrollment that meets the following requirements:• Advises the member that the MA organization is planning to disenroll the member and why such action is

occurring;• Provides the effective date of termination• Includes an explanation of the members rights

Enrollments Reinstatements Reinstatements may be necessary if a disenrollment is not legally valid (refer to Chapter 2 of the Medicare Managed Care Manual to determine whether a disenrollment is not legally valid) or if the circumstances justify a reinstatement. The most common reasons warranting reinstatements are:• Erroneous Death Indicator• Erroneous Loss of Medicare Part A or Part B• Erroneous Incarceration Information• Erroneous Unlawful Presence Information• Plan error• Demonstration of good cause for failure to pay plan premiums or Part D-IRMAA timely.

When a disenrolled individual contacts the MA organization to state that he or she was disenrolled due to one of the listed items. The plan should follow the guidance outlined in Chapter 2 of the Medicare Managed Care Manual pertaining to those unique situations.

A reinstatement is viewed as a correction necessary to “erase” an invalid disenrollment action, and, as such, does not require an election period. Therefore, reinstatements may be made back to a date when an MA plan was closed for enrollment. Payment alone of past due premiums after the disenrollment date does not create an opportunity for reinstatement into the plan from which the individual was disenrolled for failure to pay premiums.

CMS (or its designee) will review requests for reinstatements on a case-by-case basis.

Within ten (10) calendar days of receipt of transmissions of the individual’s reinstatement, the organization must send the member notification of the reinstatement

61

Agent Compensation

Agent Compensation

Compensation Rate Adjustment for CY 2019As provided in 42 C.F.R. §§422.2274(b)(1) and 423.2274(b), the compensation amount paid to an independent agent or broker for an enrollment must be at or below the fair market value (FMV) cut-off amounts published yearly by CMS. The chart below summarizes the CY 2019 FMV cut-off amounts for all organizations.

The Initial Year amount is the maximum allowable to be paid for enrollments during compensation cycle-year 1.

The 2 renewal amount is the maximum allowable to be paid for enrollments during compensation cycle-years 2 and beyond.

• Proration Schedule - Commissions payable by the Plan will be distributed in the following manner:January February March April May June

Cycle Year 1 $482.00 $482.00 $482.00 $482.00 $482.00 $482.00

All Others* $241.00 $221.00 $201.00 $181.00 $161.00 $141.00

July August September October November December

Cycle Year 1 $482.00 $482.00 $482.00 $482.00 $482.00 $482.00

All Others* $121.00 $100.00 $80.00 $60.00 $40.00 $20.00

Note: The FMV amounts for CY 2019 are rounded to the nearest dollar.

Agent CompensationProcessing Payments Commissions are paid the month of the effective date and payments are made according to the guidelines set fourth

by the FMO (in agreement with the plan). FMO has the option to receive the full payment and they will distribute the agents portion or they can only received their

override portion and the agent portion will then be paid direct to the agent either by check or direct deposit. FMO’s also have the option to set up payments for sub agencies. Commissions payable by HTA and TP on the 15th of each month to all sales entities.

(Holidays and weekends may impact delivery date)

Important Reminders: To begin and/or continue offering plan benefits and receive compensation agents must be currently licensed by the North

Carolina Department of Insurance (NCDOI), complete all the annual trainings and re-certifications. o Such as the following: Medicare core, CMS FWA, CMS Compliance, and the Plan Training & Exam.

No commissions can be earned or paid without a fully executed Agent and FMO Agreement. Renewal Compensation for Renewal Years will not be paid if the Agreement is terminated for cause. Plan to Plan Changes are not compensated. Optional - Comprehensive Rider(s) are not compensated. Agent of Record changes are not offered by HTA and TP. The following forms offered by HTA and TP could impact a book of business and/or compensations:

o Book of Business Transfer Form, Assignment of Commission Form, and FMO Transfer Release Form.

Agent Compensation

Payment Type Definitions • Initial/New Product Sale – A maximum of four hundred eighty-two dollars ($482) will be paid by the plan for each CMS

determined Cycle 1 Enrollment into the plan completed by the Agent. o The beneficiaries first year of enrollment in any plan where the CMS report has a prior plan type of ‘None’.

o The beneficiary moves from an employer plan to a non-employer group plan (either within the same Parent Organization or between Parent Organizations)

o The beneficiary makes an “unlike plan change”.

• Like Product Sale – A maximum of two hundred forty–one dollars ($241) will be paid by the plan for each enrollment that is determined by CMS to be a Cycle Year other than 1.

• Unverified & True-Up – Plans should consult the CMS agent/broker compensation report to determine whether it’s appropriate to pay a Initial/New or Like Sale. This report is automatically released and disseminated monthly by the MARx system. If payment type is not verified (“Unverified”) at the time of the commission run the plan pays the Like Sale amount of based on the prorated monthly schedule, partial payment. Once verified, if it is a Initial/New Sale the plan will pay the rest of the amount as “True-Up”.

• Renewals - Enrollment year two (2) and beyond at a rate of 1/12th of fifty percent (50%) of the annual fair market value, as determined by CMS. 2019, the Renewal Compensation rate is twenty and 00/100 dollars ($20.00) per Enrollee, per month. Renewal Compensation for Renewal Years will not be paid if the Agreement is terminated for cause.

Agent Compensation

Payment Type Definitions, cont. • Chargeback - Plan shall have the right to require the Agent to promptly refund all compensation paid to Agent for any

Enrollee who:o Voluntarily dis-enrolls from a Plan Product within the first three (3) months of the Initial Enrollment Year; oro If CMS retroactively dis-enrolls the individual, to the date of such dis-enrollment.

• If an Enrollee dis-enrolls from a Plan Product after the first three (3) months, Plan will prorate the refund.

• Agent shall not be required to refund Agent Compensation if the reason for the dis-enrollment is on the list of reasons provided by CMS that specifically disallows such chargeback (i.e. death, move, low income subsidy eligibility).

• Plan shall have the right to withhold the amount of any refund due to Plan from all future payments of Compensation until the amount of the refund is satisfied.

• Adjustments - For a Payment or a Chargebacks (“Off-sets”) - Plan may offset any Agent Compensation by any amount owed by Agent to Plan or owed by Plan to the Agent. Retroactively pay or recoup funds based on retroactive beneficiary changes (retroactive enrollment or disenrollment) for the current calendar year and the previous calendar year.

66

Healthcare Concierge

Welcome CallAs part of its quality assurance process, a welcome call will be placed with each new enrollee. The purpose is to confirm the accuracy of the information on the enrollment form, ensure that the enrollee understands the plan information.

• The agent should cover the purpose of the welcome call during enrollment process.

The Welcome Call, covers the following:

• Verification of plan selection as well as any riders if applicable

• Verification of Primary Care Physician (PCP) selection and if they selected an Out-Of-Network provider, the HCC will cover the benefits of utilizing an IN-Network provider

• Reminder of the Welcome to Medicare Preventive Visit or Annual Wellness Visit

• Payment method for enrollment in plans with premiums

• Emergency contact information and who the member would like as their HIPAA contact and/ or if a Power of Attorney (POA)has to be placed on file.

Welcome Kits

Upon enrolling members receive a 2019 Welcome Kit, within 10 calendar days from CMS confirmation, or last day of month prior to effective date (whichever comes later).

The kit contains: Letter Evidence of Coverage Formulary Notice Insert Provider Directory Notice Insert Questionnaire/Health Assessment Business Reply Envelope for returning the questionnaire Personal Health Information form Healthcare Concierge Welcome Letter

Members will receive a separate envelope containing their member ID card.

69

Agent Concierge

Agent Concierge Role

Assisting Sales AgentsThe Agent Concierge team is dedicated to assist licensed agents who are contracted with HealthTeam Advantage and Teal Premier. Agent Concierge’s are here to help throughout the sales and enrollment process. As well as assisting with member matters, and more! An Agent Concierge Can Help: Check Application Status Check Enrollment Status Check Eligibility Answer Benefit Questions (does not guarantee coverage) Product Certification/Contracting Answer Commission Questions Provide Enrollment Kits & Supplies Online Application Support Redirect member matters to the Healthcare Concierge’s Department.

Contact Information HealthTeam Advantage & Teal Premier, Phone Number : (855) 547-0344

Email for Assistance: [email protected] or [email protected] to check an Application Status: [email protected] or [email protected]

The Agent Concierge team is available from 8 AM to 5 PM, Monday through Friday.

71

Agent Oversight

Agent OversightOversight of Sales Representatives/Sales Entities

Agent/Broker Complaints Tracking

Sales Agents/Sales Entities are subject to continuous oversight program, conducted by HTA or TP Sales Leadership and Compliance , to ensure the agents are marketing and selling HTA and TP products in accordance with all applicable federal and state laws , as well as Centers for Medicare and Medicaid Services (CMS) regulations, policies, and marketing guidelines.

When a complaint is received by HTA or TP involving a Sales Agent, The Compliance Department will contact the Sales Department who will then contact the Sales Agent and request statements of account for the complaint. The Sales Agent

will be asked to respond to the investigation inquiry within two (2) calendar days.

It is critical that Sales Agents respond in a timely manner.

Oversight Procedure1. Investigation Process2. Corrective Action 3. Summary Action During Investigation 4. Notice to the Sales Representative 5. Review of Non-Termination Corrective Action

Complaints may come in from, but are not limited to, the following sources: The CMS Complaints Tracking Module (CTM) in HPMS The CMS Regional Office The Member Service call center

Agent OversightCorrective Actions Agent compliance will be tracked using a scoring system that assigns points to complaints based on the

severity of the complaint. Agents crossing the threshold will be referred to the Agent Oversight Committee.

The Agent/Broker cooperation with HTA or TP is required during the investigation of the complaint, as well as during the implementation of any Corrective Action Plan (CAP) developed in response to such complaint.

Corrective Action(s) may include the following:• No Action

• Coaching/Immediate Need for Training (Re-Training and/or Re-Testing)

• Ride Along

• Verbal Disciplinary Action

• Written Disciplinary Action

• Suspension

• Suspension – Disciplinary Action

• Termination

• Termination – Disciplinary Action

• Report to State Department of Insurance

Agent Oversight

Agent Oversight Committee The Agent Oversight Committee will be responsible for review of adherence to various statutory and regulatory requirements as well as CMS Marketing guidelines of agent activities for Medicare health plans; institutes needed actions and ensures follow-up, as appropriate.

The committee will:• Provide performance monitoring and oversight of sales agents• Provide a mechanism for interdepartmental participation and collaboration in agent activities • Demonstrate quantifiable improvement in care and services • Give HTA or TP the opportunity to ensure that agents are not engaging in coercive or aggressive marketing

tactics.

Fraud & Termination of a Sales Agent Any documented incidence(s) of Sales representative fraud result in immediate termination and is subject to reporting the State Department of Insurance.

If a Sales Representative insurance license is terminated by the State, due to founded CMS/NCDOI violation, HTA or TP will electronically file with National Insurance Producers Registry (NIPR) to terminate the sales agent appointment with HTA or TP.

Agent Oversight

Addressing Fraud, Waste, and AbuseHealthTeam Advantage and Teal Premier is committed to detecting, correcting, and preventing fraud, waste and abuse. Doingthis is a vital component of our compliance and integrity plan.

How to Report Fraud, Waste, and AbuseIf you suspect fraud, waste, or abuse has occurred, we encourage you to report it to HealthTeam Advantage and Teal Premier’sCompliance Department and can do so anonymously and without fear of reprisal, or retaliation. We will investigate and takeappropriate action as necessary.

Phone: 1-855-741-4518Mail: 7800 McCloud Road, Suite 100, Greensboro, NC 27409

Internet: HealthTeam Advantage EthicsPoint Portal

Contact Compliance Officer Directly: Thomas Wilson, (336) 790-4387Email: [email protected]

Downloads - Accessible in each plan website Policy: HealthTeam Advantage Medicare Advantage and Part D Fraud, Waste, and Abuse Policy Policy: HealthTeam Advantage Code of Conduct

76

Important Information

Important InformationSetting Expectations Early On• It is important as an agent with both your reputation and the company’s reputation on the line to communicate accurate

information beginning with your first interaction/visit with the prospective member. This will help eliminate complaints/grievances against both you and the plan in the future.

• The following are some items that may help with some of the questions that you will be faced with during an appointment. • There is also additional information on what you can do as an agent to communicate with the member on what to expect

and some options available to them. The discussions around some of these items can help with our overall STARS rating which in the end effects both you and the member’s experience since the STARS rating can effect the benefits from year to year.

HealthTeam Advantage has been recognized by U.S. News and World Report 2018 Best Medicare Plans as one of the highest rated Medicare plans in North Carolina.

Important Information

SurveysCMS requires health plans to administer two surveys each year:• HTA and TP uses a third party vendor to administer the

surveys (SPH Analytics)• If selected, the member will receive a survey from SPH• Though long, the survey results are very important to the

overall STAR rating for HTA and TP• Please encourage members to complete the surveys and

return them by the deadline

Health Outcomes (HOS) Survey:STAR related measures are:• Improving or maintaining physical and mental health • Monitoring physical activity• Improving bladder control • Reducing the risk of falling

Consumer Assessment of Health Plan Satisfaction (CAHPS) Survey:Will ask members about their satisfaction with the health plan and their physicianSTAR related measures are:• Getting needed care• Getting appointments and care quickly• Customer service• Overall rating of health care quality• Overall rating of plan • Care coordination• Rating of drug plan • Getting needed prescription drugs• Getting information from the plan about prescription drug

coverage and cost • Annual flu vaccine

Important InformationMedication Therapy Management (MTM)

This is a Free Benefit! • Members will be automatically enrolled in HTA or TP MTM program if they meet 3 criteria (have the ability to opt-out)

• Taking at least eight Part D medications per month• Accumulate at least $1011 in medication costs in the previous quarter• Have at least three of the following conditions:

o Diabeteso High Cholesterolo Osteoporosiso High Blood Pressure o Chronic Obstructive Pulmonary Disease (COPD)

• The plan in conjunction with our Pharmacy Benefit Manager (PBM), EnvisionRx, identifies eligible members based on Part D claims

• If determined to be eligible, EnvisionRx will notify the member of enrollment in the MTM program• The program consists of two elements;

1. A detailed comprehensive medication review (CMR) by either a pharmacist or nurse or 2. A “targeted medication review” which identifies medications the member should be on, based on medical guidelines

and member’s medical conditions• Please encourage members to schedule and complete the CMR when EnvisionRx notifies them • The CMR completion rate is a STAR measure and is used to calculate the overall STAR rating for HTA or TP

If a member wishes to participate, or have questions, advice to call the EnvisionRx Options MTM Department at 1-866-342-2183 (TTY 711) weekdays from 9 a.m. to 5 p.m. (EST).

End of

Training

Why HTA & TP?

10 Reasons to Work with HealthTeam Advantage & Teal Premier

Dental, Vision & Hearing

CoverageFitnessBenefit

4 ½ StarRating

Easy to Work With

Low (or NO) Copays

Prescription Drug

CoverageConcierge

ServiceVirtual Care

Provider Managed

Local Plan Providers

End of Training - What’s Next?

Now that you’ve viewed each slide of the product training presentation, you may proceed to the 2019 HealthTeam Advantage and Teal Premier Certification Exam.

• You will have four attempts to successfully pass the exam with a minimum score of 85%.

Good luck!

• For a copy of this training presentation document please contact Agent Support.

• By calling (855) 547-0344 or send an email to: [email protected] or [email protected]

Thank you!