20180618 S EP 835 · makes $6.5 mil profi t EP11 Done Deals Price divide at prime districts EP12...

Transcript of 20180618 S EP 835 · makes $6.5 mil profi t EP11 Done Deals Price divide at prime districts EP12...

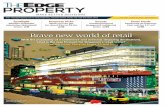

Park House breaks en blocprice ceilingAt $2,910 psf ppr, this latest collective sale price for the prime Orchard Road site is the highest so far. See our Cover Story on Pages 6 and 7.

PROPERTY PERSONALISED

Visit EdgeProp.sg to nd properties, research market trends and read the latest news The week of June 18, 2018 | ISSUE 835-56

MCI (P) 136/08/2017 PPS 1519/09/2012 (022805)

Co-WorkingWeWork growing strong;

Found carves a nicheEP3&4

Gains and LossesSeller at Nassim Mansion

makes $6.5 mil profi tEP11

Done DealsPrice divide atprime districts

EP12

Deal WatchReignwood Hamilton Scotts unit going for

$8 mil EP14

Park House, located at the corner of Orchard Boulevard and Tomlinson Road

SAMUEL ISAAC CHUA/THE EDGE SINGAPORE

EP2 • EDGEPROP | JUNE 18, 2018

| BY CAMILLA RUSSO |

Last month, Ryan Kunzmann went to a bar in New

York to see his 58,000 sq ft property. No, it is not

the world’s biggest bar — his holdings are virtual.

Kunzmann was one of about 20 people meet-

ing to chat and compare their little slices of Gen-

esis City, a digital metropolis they are hoping will

eventually become a major hub for virtual-reality

commerce. Kunzmann, who does tech support for

a property management website, says he intends

to turn one of his larger stretches into a virtual mu-

seum or art gallery. “There’s a lot of great art out

there that people don’t get to see,” he says. “Espe-

cially if you don’t live in a big city.”

While this sounds like a lark, or perhaps another

iteration of the faded online world Second Life, there

is already real money behind the blockchain-based

real estate. In December, Kunzmann paid US$15,000

($20,021) for 62 plots of about 1,100 sq ft apiece,

and he recouped his investment three months later

by reselling a mere eight of them. Today, resellers

can reliably get as much as US$30,000 for a Gen-

esis City plot. Credit network Ripio.com paid al-

most US$150,000 for a spot next to the main square

where visitors appear when they enter the city. The

record is US$200,000, sold by a user who had re-

cently bought the same plot for US$13,000.

Scarcity is driving the speculation. Unlike Second

Life, or games such as SimCity, Genesis has fixed vir-

tual dimensions, some 90,000 plots that make it about

the size of a digital Washington, DC. Argentine cod-

ers Esteban Ordano and Ari Meilich created the city,

part of a broader digital world called Decentraland,

using the Ethereum blockchain. Another key factor,

they say, is that no single corporation can suddenly

change the terms of their virtual world or own users’

data, which helped Decentraland’s initial coin offer-

ing (ICO) raise about US$26 million in 30 seconds

last year. The decentralised nature of Ethereum has

also made it easy for users to trade the fixed supply

of Genesis real estate among themselves, which con-

tributed to a jump in virtual land values after an auc-

tion of plots helped raise an additional US$28 million.

The early adopters have not built much on their

plots yet, but they have already divvied up Genesis

City into themed neighbourhoods, including ones

modelled on Las Vegas, cyberpunk fiction such as Blade Runner, and — this being the internet — a

red-light district. What is there so far looks like a

piecemeal mash-up of video game aesthetics and

projects in need of developers. “Once virtual reality

becomes a mass movement, and we’re heading in

that direction, we’ll come to a critical mass of us-

ers that will need a platform to discover content,”

says Meilich. Besides VR headsets, visitors will be

able to use web browsers to view the plots.

Like other founders of start-ups who have raised

money through ICOs, Meilich and Ordano have based

their business model on their cryptocurrency, Mana to-

kens. The tokens, which were worth two cents apiece

when they began trading in September, rose as high

as 29 cents in January, and are now about 12 cents,

according to cryptocurrency rankings site CoinMar-

ketCap. Decentraland is usually among the 20 most

used applications on the Ethereum network, according

to DAppBoard, a website that monitors such activity.

Ordano and Meilich acknowledge that a VR fu-

ture is a ways off. They will not have even a ba-

sic Genesis City up and running for at least a few

months, by which time they are hoping landowners

will have built up more of the neighbourhoods. And

plot-buyers have little guarantee that the network

will become anything remotely useful, let alone as

commercially valuable as they imagine. But users

such as Kunzmann and Ripio CEO Sebastian Serra-

no say they are patient. Kunzmann is slowly learn-

ing how to code his art gallery, though he says he

will probably subcontract the bulk of the work.

Serrano says he will use his prime virtual real

estate to pitch cryptocurrency loans and other fi-

nancial services. For now, he is hawking mortgag-

es for Genesis City plots on his regular website. “It

allows us to explore at low costs, with less money

at stake and within something that’s like a game,

how blockchain-based mortgages can work,” he

says. “Yes, it sounds crazy.” — Bloomberg LP E

New appointments at Credit Suisse’s SEA businessCredit Suisse has announced two sen-

ior appointments at its Southeast Asia

Investment Banking business.

Yvonne Voon will assume the role of

head of Southeast Asia, real estate in in-

vestment banking and capital markets,

while Felicity Chan has been appointed

head of equity syndicate for Southeast

Asia, in the company’s markets business.

In her new role, Voon will be expand-

ing the bank’s client footprint and de-

livering advisory, capital markets and

financing solutions to companies in

real estate. She has spent 12 years at

Credit Suisse and was previously lead-

ing the company’s property equity re-

search team in Singapore.

Chan will build on the bank’s in-

vestment and private banking platform

to cater for clients in Southeast Asian

countries. She has spent 14 years with

the company and was previously part

of the region’s corporate finance team,

covering equity, debt and merger and

acquisition advisory.

Paya Lebar Quarter signs on two new office tenants Paya Lebar Quarter (PLQ) (above, left) has added two new tenants — local insur-

ance companies Great Eastern and NTUC

Income — at its Grade A office space.

Slated for completion in 1H2019,

PLQ comprises a retail complex with

200 shops, three Grade A office towers

spanning one million sq ft and three res-

idential towers with 429 units.

Great Eastern has leased roughly

125,000 sq ft across four floors in of-

fice Tower 3, while NTUC Income will

occupy 55,000 sq ft across two levels

of office Tower 2.

Meanwhile, listed office outsourc-

ing company IWG is in talks to lease

about 52,000 sq ft in office Tower 1

for Spaces, the co-working business

that it bought in 2015.

Also occupying office Tower 3 are

SMRT Corp, leasing 97,000 sq ft across

three levels, and property consultancy

CBRE, taking up 31,000 sq ft or one of-

fice floor. CBRE will house 600 employ-

ees at its dedicated innovation centre at

PLQ, focused on testing and developing

proptech solutions for clients.

In January, Australian property group

Lendlease announced that over 50% of

PLQ’s office space was either leased, un-

der final offer or in advanced negotia-

tions. Prospective tenants include leading

corporations from the financial services,

infrastructure, real estate and co-work-

ing sectors, as well as a premium gym.

PLQ is a 30:70 joint venture between

Lendlease and Abu Dhabi Investment

Authority. It is located next to Paya Leb-

ar MRT station.

The office spaces are expected to be

completed in 3Q2019.

Frasers unveils serviced residence in Tianjin, China Frasers Hospitality, part of the Frasers

Property Group, has unveiled its second

serviced residence in Tianjin, China.

Fraser Place Binhai Tianjin, targeting

short- and long-term business and lux-

ury travellers, has 224 units, spanning

studio to two-bedroom apartments. It is

located in the Tianjin Economic-Techno-

logical Development Area, close to BMT

station and TEDA MSD shopping centre.

Guests will be able to enjoy dining,

WiFi and room service all day, and have

access to facilities such as a swimming

pool, gym and bar. Business travellers

will be able to use function rooms for

meetings.

“China is key to our future growth, as

it currently represents a quarter of our

portfolio,” says Choe Peng Sum, CEO of

Frasers Hospitality. “In addition to en-

tering new Chinese cities, we are also

building on our presence in cities that

we already operate in so that we may

better provide travellers with more op-

tions that cater for their needs.”

Frasers’ first serviced apartment in

Tianjin, called Fraser Place Tianjin, was

opened in 2016. At present, it records

an average occupancy upwards of 90%,

according to Choe.

He attributes the demand in Chi-

na’s market to the country’s huge pop-

ulation and rising consumption power.

Chinese millennials are also driving

growth, he notes.

To date, Frasers Hospitality has 16 prop-

erties in 11 cities in China: Beijing, Chang-

sha, Chengdu, Dalian, Guangzhou, Nan-

jing, Shanghai, Shenzhen, Tianjin, Wuhan

and Wuxi. It has another 16 properties

in the pipeline in various Chinese cities.

Jervois Hill bungalow sold for record $2,730 psf, at $41.2 millionA freehold bungalow in Jervois Hill

(above, right), on a 15,094 sq ft land

plot, was sold for $41.2 million ($2,730

psf), fetching a record psf price for a

Good Class Bungalow (GCB).

This transaction was followed by a

bungalow in Cluny Hill, on a land plot

of 15,105 sq ft, near Botanic Gardens,

which fetched $2,350 psf last year. The

buyer bought it for $35.5 million.

The Jervois Hill bungalow was sold

by George Lim, an entrepreneur who has

developed 11 GCBs and two semi-de-

tached houses in the past 12 years. It

was a joint collaboration between Lim

and architect Pau Loh, managing part-

ner of Tellus Design.

The entire house has three levels, in-

cluding the basement. The ground floor

features the living and dining areas,

family rooms, dry and wet kitchens, a

pool and a pond. The second floor has

five bedrooms — all with walk-in ward-

robes — and a living room with pantry.

Prominent design features include

a wall aquarium in the basement that

can fit 800 fish and a floating sculptural

staircase that was made using a special-

ly built giant oven to mould the acrylic.

Lim purchased the vacant freehold

site six years ago for $25.8 million

($1,709 psf).

His initial asking price for the bunga-

low was $45 million. He estimated that

the land would cost $28 million, and it

would cost $14 million to $15 million to

build a house with similar specifications.

The GCB comes with sustainable fea-

tures — 300 solar panels on the roof and

outdoor decks made of renewable wood.

Other spaces include a wine cellar,

home theatre, dedicated games room

and carpark that can fit 10 cars.

The sale was brokered by Newsman

Realty. — Compiled by Charlene Chin

PROPERTY BRIEFS

EDITORIALEDITOR | Cecilia ChowCONTRIBUTING EDITOR |Pek Tiong GeeWRITERS | Timothy Tay, Bong Xin Ying, Charlene ChinDIGITAL WRITER | Fiona Ho

COPY-EDITING DESK | Elaine Lim, Evelyn Tung, Chew Ru Ju, Shanthi MurugiahPHOTO EDITOR | Samuel Isaac ChuaPHOTOGRAPHER | Albert ChuaEDITORIAL COORDINATOR | Yen TanDESIGN DESK | Tan Siew Ching, Christine Ong, Monica Lim, Tun Mohd Zafi an Mohd Za’abah

ADVERTISING + MARKETING ADVERTISING SALES

DIRECTOR, COMMERCIAL OPERATIONS | Diana LimSENIOR ACCOUNT MANAGERS |Janice Zhu, James ChuaACCOUNT MANAGER |Bernard WongSALES STRATEGIST |Han YaoGuang

CIRCULATIONDIRECTOR | Dominic Kevin SimMANAGER | Bryan KekEXECUTIVES | Malliga Muthusamy, Ashikin Kader

CORPORATE CHIEF EXECUTIVE OFFICER | Bernard Tong

PUBLISHERThe Edge Property Pte Ltd150 Cecil Street #13-00Singapore 069543Tel: (65) 6232 8688Fax: (65) 6232 8620

PRINTERKHL Printing Co Pte Ltd57 Loyang DriveSingapore 508968Tel: (65) 6543 2222Fax: (65) 6545 3333

PERMISSION AND REPRINTSMaterial in The Edge Property may not be reproduced in any form without the written permission of the publisher

We welcome your commentsand criticism: [email protected]

Pseudonyms are allowed but please state your full name, address and contact number for us to verify.

Making a killing in virtual real estate

SAMUEL ISAAC CHUA/THE EDGE SINGAPORE

E

OFFSHORE

LENDLEASE

CO-WORKINGEDGEPROP | JUNE 18, 2018 • EP3

WeWork’s relentless growth continues| BY CECILIA CHOW &CHARLENE CHIN |

On a Friday morning on June

8, WeWork at 71 Robin-

son Road is bustling. And

it is not just people sitting

around drinking coffee and

looking ornamental. Discussions are

taking place at various seating spac-

es, while other parts of the commu-

nal areas are taken up by those sit-

ting solo with their coffee mugs and

laptops. There are also phone booths

for those making Skype calls. The

glass-enclosed office suites are mostly

occupied, with people glued to their

screens, chatting at doorways or hud-

dled around a white board or screen.

It is a typical workday in an atypi-

cal office. According to Turochas “T”

Fuad, WeWork managing director

for Southeast Asia, the space at 71

Robinson is already more than 90%

taken up. That is quite a feat, con-

sidering that it is WeWork’s second

and biggest space in Singapore by

far, with 1,400 desk spaces, span-

ning four floors and occupying a to-

tal space of 60,000 sq ft.

The flagship Singapore WeWork

space at Beach Centre was official-

ly launched last December. Its 690

desks across three floors in the sev-

en-storey Beach Centre on Beach

Road is fully taken up.

In the next month or so, WeWork is

opening two more spaces in the CBD.

One is a shophouse at 22 Cross Street,

which is part of China Square Cen-

tral complex and has a total space of

28,700 sq ft. The other is a 20,000 sq ft

space at Mapletree Anson, 60 Anson

Road. Next year, WeWork will be

opening a 34,000 sq ft space at City

House on Robinson Road and 40,000

sq ft at the new Funan.

The aggressive growth streak is

unlikely to slow. “I don’t think we

have enough WeWork spaces yet,”

says Fuad. “We’re offering more than

just co-working space. It’s about build-

ing our global network and commu-

nity to create something bigger than

ourselves.”

Global communityThis explains why WeWork, a New

York-based start-up founded in 2010

that popularised the concept of com-

munal office space, is now valued at

US$20 billion ($26.7 billion). It has

a global presence in 253 locations

and a community of 248,000 mem-

bers — roughly the population size

of Tampines.

Besides Singapore, WeWork is

also aggressively growing its foot-

print elsewhere in Southeast Asia.

In Jakarta, it is opening in two sky-

scrapers in the CBD: The WeWork

at Revenue Tower has about 2,000

desk spaces across five floors; and

the one at Sinarmas MSIG Tow-

er will have about 800 desk spac-

es. WeWork is also expanding into

Bangkok, Kuala Lumpur and Ma-

nila next.

“It’s part of the global playbook to

be right smack in the CBD,” says Fuad.

Exponential growthMore than 90% of flexible workspace

centres are still located in Singapore’s

CBD, with 200 centres currently op-

erating in the Central region, accord-

ing to global flexible workspace spe-

cialists The Instant Group in a report

on June 6.

Singapore’s flexible office market

grew 22% last year, making it the

third fastest-growing market after

Melbourne and New York, accord-

ing to The Instant Group.

Co-working and hybrid space in

Singapore have quadrupled over the

past four years. With an average desk

cost of $558 a month, Singapore’s rate

is said to be significantly lower than

in other key cities in Asia, such as

Shanghai and Hong Kong, and 57%

cheaper than in New York. Singapore

is set to see even further growth as

new operators set up in key locations,

says The Instant Group.

This year, the flexible workspace

market in Singapore has already seen

a 17% increase in the number of cen-

tres offering co-working, flexible and

hybrid office space.

‘Powered by We’With office rents on an uptrend, more

companies will seek out WeWork,

reckons Fuad. Incidentally, anoth-

er business offering is “Powered by

We”, which is basically offering of-

fice space as a service — construc-

tion, fitout, decoration, operating and

managing the space on behalf of a

company. WeWork employees will

also be on site to help with commu-

nity programmes.

In the US, WeWork is reportedly

managing buildings for companies

such as IBM, Airbnb and Amazon.

In Hong Kong, Standard Chartered

Bank’s office is going to be “Pow-

ered by We”. It will become, by ex-

tension, a node in the WeWork glob-

al community, says Fuad. And it will

be able to tap the WeWork global

network and applications available

to members.

According to Fuad, WeWork is

currently in discussions with sev-

eral MNCs and local corporations

in Singa pore on adopting Powered

by We.

In the US, WeWork has launched

co-living spaces called WeLive. Late

last year, it opened its first lifestyle

gym branded Rise by We. In an at-

tempt to identify and groom budding

entrepreneurs, WeWork is entering

the education sector with a pilot el-

ementary school programme target-

ing five- to eight-year-olds. Interest-

ingly, WeWork has also invested in

Spain-based Wavegarden, a maker

of wave pools. “We’re changing the

way people work, live and play,”

says Fuad.

As such, he sees no other Singa-

pore co-working players as the com-

pany’s direct competitors. “We are

offering more than just space. We

have ‘Powered by We’ and a lot of

different offerings. For us, it’s about

bridging the different communities

around the globe.”

Nevertheless, WeWork is expected

to be the biggest co-working space

operator in Singapore by year-end.

Localisation and adaptationFor Fuad, adapting to local tradi-

tions and customs is also important.

There will be prayer rooms at We-

Work spaces in Jakarta and, in the

future, in Kuala Lumpur. The inte-

rior design of the space also incor-

porates the character of each neigh-

bourhood that WeWork is in.

For instance, the WeWork at 71 Rob-

inson Road has a “British and Perana-

kan feel”, with hardwood flooring and

artwork by in-house WeWork artists.

On Beach Road, given its location in

the vicinity of conservation shophous-

es, the colours are more vibrant, with

concrete flooring and arches reminis-

cent of the shophouses.

Most WeWork spaces already have

a mother’s nursing room, shower fa-

cilities and recreational areas. There

are also cosy meeting rooms for those

who want privacy. Besides coffee and

fast Internet speed, WeWork now of-

fers its own craft beer on tap. “Un-

derpinning that is our community,

which is something we focus a lot

on,” says Fuad.

Mobile workingThe mobile workforce is also a grow-

ing trend. A survey by International

Workplace Group published at end-

May found that, in Singapore, 63%

of employees work somewhere other

than in the office at least one day a

week. About 47% work remotely for

at least half the week, while 10% work

outside their company’s main office

location five times a week. “People

from Seattle to Singapore, London

to Lagos no longer need to spend

so much time in a particular office,”

says Mark Dixon, founder and CEO

of IWG. “This is a huge shift in the

workspace landscape globally, and

businesses are now looking closely

at what this means for their corpo-

rate real estate portfolios.”

According to The Instant Group,

businesses can save up to 73% by

choosing flexible office space over

conventional leased space in the

world’s major cities. They are also

able to set up in prime locations that

may otherwise be inaccessible. With

larger companies seeing the benefits,

demand continues to grow. The pro-

portion of office space occupied by

flexible workspace in Singapore is

projected to increase steadily as more

operators try to meet this demand.

Fuad: It’s more than just office space. It’s about changing the way people work, live and play.

A room for me-time at WeWork

The new WeWork 71 Robinson is the company’s second and biggest space in Singapore so far, with 1,400 desk spaces

The communal space at WeWork 71 Robinson E

PICTURES: SAMUEL ISAAC CHUA/THE EDGE SINGAPORE

CO-WORKINGEP4 • EDGEPROP | JUNE 18, 2018

| BY TIMOTHY TAY |

Grace Sai, CEO and co-founder of co-work-

ing niche operator Found, believes the

mainstream co-working space is “get-

ting too crowded”. She adds, “We’re

not interested in competing there.”

Found currently operates in two locations

in Singapore — an 8,000 sq ft space on Prin-

sep Street, and another 10,700 sq ft space

on the upper level of the row of shophous-

es at Cuppage Terrace. According to Sai, the

two spaces have an average occupancy rate

of about 80%.

A third space on Amoy Street will open in

September. It will be the operator’s first CBD

location. “Many of our members, as well as

others on our waiting list, have given us feed-

back that they are looking to settle in a CBD

location,” says Sai. The new space will also

be the operator’s flagship space, as it will be

its largest in Singapore, spanning four shop-

houses and occupying a total area of 23,000 sq

ft. It is expected to open with “a very healthy

occupancy rate”, she says.

Sai believes about half of the space at Amoy

Street will be taken up by “corporate inno-

vators” and the other half by start-ups. She

expects the member base to include several

blockchain and fintech enterprises. The new

space will include dedicated studios for idea-

tion and innovation, and an event area with

a capacity of 250 people.

Sai has ambitious plans for the company she

co-founded six years ago. Although Found’s

market share in Singapore is currently in the

single-digit, she hopes to grow it to 10% with-

in the next three years.

Cutting loose and FoundFound was established as the first Asian Impact

Hub six years ago. Impact Hub is the parent

body for a global network of hubs that foster

entrepreneurship, idea incubation and busi-

ness development. It also offers co-working

spaces for its members.

As the Asian pioneers of Impact Hub, Sai

and her team had the responsibility of grow-

ing Impact Hub’s Asian network. She says she

played a major role in selecting many of the

subsequent Asian Impact Hubs.

Last month, however, Sai and her compa-

ny officially parted ways with Impact Hub. She

says it was due to the “two companies having

different ambitions and expansion plans for the

region”. According to Sai, Impact Hub only op-

erates in one location per country; hence, she

would not have been able to increase the num-

ber of locations in Singapore even if she want-

ed to under the previous set-up.

It took two years for Found to separate its

operations from Impact Hub. But it has certainly

moved on. The company announced that it had

renamed itself as Found in May. “The name re-

flects the company’s mission to redefine what

being a founder means,” she says. “Being a

founder doesn’t necessarily mean being the

founder of a highly scalable start-up. Instead,

I believe that everyone can take personal own-

ership and influence a cause or problem they

feel needs to be solved.”

To create awareness in the upcoming Amoy

Street location, Found is working with URA to or-

ganise “Innovation Meets Heritage Festivals” and

set up “Car-Free Lunchtime events” with the hope

of pedestrianising the street during lunchtime.

Found plans to open spaces in Malaysia

and Indonesia by the end of this year and ex-

pand into Thailand and Vietnam by end-2019.

Sai’s target is to have about five to six loca-

tions across Southeast Asia by 2020.

New partnersLast July, Found became Google’s first tech-hub

partner in Southeast Asia, for the “Google for En-

trepreneurs” programme. Found members can

now benefit from Google for Entrepreneurs’ glob-

al network and resources, which span co-work-

ing and community spaces across 135 coun-

tries, says Sai.

Found members also receive mentorship from

technology industry veterans and professionals.

“About 80% of our members are in technology-re-

lated industries such as AI [artificial intelligence],

machine learning and data analytics,” she says.

Found currently has 550 members work-

ing at its physical spaces and another 150 vir-

tual members. They have access to network-

ing events hosted by Found, and can also rent

Co-working operator Found carves out a niche

Sai: We hope to take up about 10% of the [co-working] market share in Singapore in three years

The new space on Amoy Street will be Found’s flagship space in Singapore, occupying 23,000 sq ft across four shophouses

The 10,700 sq ft space on Cuppage Road currently houses about 300 members E

About 250 members work out of Found’s 8,000 sq ft space on Prinsep Street

work space at member rates. Current members

include KK Fund, Gorillaspace, Soho and Our

Better World. Past members are Mashable Asia,

Twilio, Braintree, Survey Monkey, Tech in Asia

and Golden Gate Ventures.

Some of these past members still partici-

pate in various events hosted by Found, as well

as contribute to a venture fund started by it.

These are considered “alumni members” and

number about 2,500, Sai estimates.

CompetitionAn emerging trend in co-working is the increas-

ing use of flexible workspaces by corporations,

either in their own building or in moving small

teams into such spaces, says Sai. She predicts

that 30% of the office workspace in Singapore

will evolve into flexible workspaces by 2030,

up from about 4% today.

In her view, larger operators such as WeWork

and JustCo have adopted a strategy of “space-grab-

bing” and often compete on price alone. “We

do not intend to participate in a price war with

them,” she says. “We will not have promotions

like three-month free rent/half price rent.”

Sai says there are more companies looking

to save cost on office space and are using flex-

ible workspaces as an alternative. She believes

the firm is able to capitalise on that niche and

establish itself as a market leader.

A hotdesk subscription at Found starts from

$350 a month per person, but with the addition

of a dedicated account manager and custom-

ised business solution programme, hotdesking

starts from $500 per person. Corporate mem-

bers, who opt for a dedicated account manager

and customised business solution programme,

pay $3,000 a month onwards.

DifferentiationFound differentiates itself by offering dedicat-

ed services that link corporations to the right

start-ups in the network that will help them

achieve their strategic aims. “Instead of the

usual front-desk or community managers, we

have account managers who look after the

growth of our members, as well as their cor-

porate innovation goals,” explains Sai.

These managers understand member com-

panies’ hiring needs, capital and fundrais-

ing goals, and eventually work with them to

chart their growth end-points for up to a year.

“This kind of collaboration between corpora-

tions, start-ups and co-working operators will

be the type of service co-working will evolve

into,” says Sai. Found has also formed a ven-

ture fund with its members to invest in select

early-stage tech companies in their community.

Found aims to serve a select number of

corporations looking for space to drive their

corporate innovation agenda. One successful

corporate partner is NTUC Social Enterprises,

which received help from Found to develop

new business models and create the frame-

works for digital products and services for its

organisation. Many of the innovations devel-

oped have been successfully executed.

So far, Found’s backers are predominantly fam-

ily-run offices. The latest backer is Nancy Pang-

estu, who owns the four shophouses on Amoy

street. She is also the daughter of Prajogo Pang-

estu, an Indonesian timber and rubber tycoon.

She has offered Found the master lease of the

four shophouses for five years, with an option

to extend the lease for a further five years at the

end of the term. She has also invested in fitting

out the space. In return, Pangestu will have a

profit-sharing arrangement with Found.

SAMUEL ISAAC CHUA/THE EDGE SINGAPORE

PICTURES: FOUND

EDGEPROP | JUNE 18, 2018 • EP5

COVER STORY

EP6 • EDGEPROP | JUNE 18, 2018

Park House breaksen bloc price ceiling| BY CECILIA CHOW |

Two blocks from St Regis Singa-

pore, where North Korean

leader Kim Jong-un stayed

for the historic summit with

US President Donald Trump, a

milestone of a different sort was set.

It was the collective sale of Park

House, a 15-storey building locat-

ed at the corner of Tomlinson Road

and Orchard Boulevard. The tender

for the building closed on May 31,

and the deal was sealed at 12.30am

on June 1. The purchase price was

$375.5 million, a 21.9% premium

to the guide price of $308 million

when the site was launched for sale

on April 23.

The buyer of Park House is said to

be Hong Kong-listed Shun Tak Hold-

ings, the company founded by Ma-

cau gaming tycoon Stanley Ho. It has

a market capitalisation of HK$10.88

billion ($1.85 billion). Now 95, Ho

stepped down as chairman of the firm

in June 2017, and was succeeded by

his daughter, Pansy Ho.

Shun Tak’s purchase price of

$375.5 million translates into a re-

cord breaking $2,910 psf per plot ra-

tio (ppr) for a collective sale. Jere-

my Lake, CBRE managing director

of capital markets, who brokered the

sale of Park House, also brokered

the last record-breaker — the for-

mer Hampton Court for $155 million

($2,526 psf ppr) in January 2013.

The buyer was Hong Kong-listed,

British conglomerate Swire Group’s

Swire Properties.

Roll of the dicePark House marks Shun Tak’s first

purchase of a residential property

development site in Singapore but

its third property investment in the

city state. So far, Shun Tak’s prefer-

ence has been in the prime Orchard

Road neighbourhood.

The first acquisition was in August

2016, when Shun Tak purchased the

bungalow at 9 Cuscaden Road for $145

million, or $2,145 psf ppr. The deal

was brokered by JLL. The bungalow

at 9 Cuscaden Road is behind Tanglin

Shopping Centre, which is adjacent

to St Regis Singapore, and near oth-

er luxury hotels such as The Regent

Singapore and Four Seasons Hotel.

In its FY2017 annual report, Shun

Tak says it plans to redevelop the

prime, freehold site into a five-star

hotel property with at least 140 keys.

The existing bungalow will be demo-

lished, and construction works are

expected to begin in 2H2018, with

completion scheduled for 2021.

In March last year, Shun Tak ac-

quired a 70% stake in TripleOne Som-

erset for $350 million from a con-

sortium led by Perennial Real Estate

Holdings. This marked Shun Tak’s

first significant commercial property

investment in Singapore.

TripleOne Somerset is also locat-

ed in the prime Orchard Road neigh-

bourhood. The commercial property,

which has a gross floor area (GFA) of

766,550 sq ft, is undergoing a $120

million asset enhancement work.

When completed, it will have a total

net area of 572,000 sq ft of offices,

medical suites and retail units. Ren-

ovation of the medical suites is ex-

pected to be completed by 2Q2018,

and the retail portion, by 3Q2018.

‘A bold number’CBRE’s Lake expects Park House to

be redeveloped into a luxury con-

dominium with 86 units, assuming

an average size of 1,500 sq ft each.

Based on the purchase price, the

breakeven price is expected to be

around $3,500 psf. “I guess it is a

bold number,” Lake says. “But it

will be fine.”

For comparison, Lake points to

the luxury 3 Orchard By-the-Park

by Malaysian developer YTL Group.

The development is separated from

Park House by a government land

site that also fetched a record price

last month. The 77-unit 3 Orchard

By-the-Park contains three 25-storey

towers designed by Italian architect

Antonio Citterio, famous for his de-

sign of the Bulgari Hotels & Resorts.

Located at the corner of Orchard

Boulevard and Orchard Spring Lane, 3

Orchard By-the-Park will be previewed

at the end of this month. Indicative

prices are “around $4,000 psf”, ac-

cording to appointed marketing agent

Dominic Lee, PropNex head of luxu-

ry team. Only one tower at 3 Orchard

By-the-Park will be released for pri-

vate preview. The tower contains 14

two-bedroom apartments of between

1,066 and 1,163 sq ft; and 15 four-bed-

room apartments of 2,250 sq ft.

Incidentally, 3 Orchard By-the-Park

is also a redevelopment of an en bloc

site — the former Westwood Apart-

ments — which YTL Group purchased

in November 2007 for $435 million. This

reflects a land rate of $2,525 psf ppr.

Meanwhile, a 7,836 sq ft penthouse

at New Futura hit a new record when

it was sold at $4,360 psf, or $36.28

million, in May. Recent units sold at

the 124-unit luxury condo on Leonie

Hill Road have surpassed $3,500 psf.

‘Bragging rights’With YTL Group’s selling prices

around $4,000 psf and New Futu-

ra’s prices above $3,500 psf, CBRE’s

Lake reckons that the expected sell-

ing price for the new development

at Park House “doesn’t seem be-

yond belief”.

Interest in the Park House site had

been intense when it was launched

for sale. “We were inundated by en-

quiries and we had 20 site inspec-

tions,” says Lake.

The appeal of Park House is its

location, at the corner of Orchard

Boulevard and Tomlinson Road,

“which is very visible and has brag-

ging rights”, notes Lake. Park House

occupies a freehold site in prime Dis-

trict 9 and is within walking distance

of the upcoming Orchard Boulevard

MRT station.

Next door, the greenfield govern-

ment land site was sold to a joint ven-

ture between Simon Cheong of SC

Global Developments and two Hong

Kong-listed groups — New World De-

velopment Corp and Far East Consor-

tium International. The joint-venture

partners bid $410 million, or $2,377

psf ppr, for the 61,597 sq ft, 99-year

leasehold site on Cuscaden Road.

According to the JV partners in

a release on May 17, the Cuscaden

Road site is “exceptional in Singa-

pore’s luxury residential market”.

Hong Kong groups on the hunt“We’re seeing a number of groups

originating from Hong Kong looking at

residential development sites,” notes

At $2,910 psf ppr, this latest collective sale price for the prime Orchard Road site is the highest so far

Lake: We were inundated by enquiries and had 20 site inspections

Park House was sold on June 1 for $375.5 million, or $2,910 psf ppr, in a deal brokered by CBRE

CBRE

COVER STORY

EDGEPROP | JUNE 18, 2018 • EP7

En bloc deals so far in 2018^

PROPERTY CONSULTANTS, MARKETING AGENTS

CBRE’s Lake. “Their focus has been

on the traditional prime districts of

9 and 10.” Besides Shun Tak, there

is New World Development and Far

East Consortium. The Cuscaden Road

site marks the duo’s second collab-

oration in Singapore. The first was

Artra, a 400-unit residential develop-

ment sitting on a commercial podi-

um, linked to the Redhill MRT sta-

tion on Alexandra View. Artra was

launched in April last year.

Far East Consortium has also been

ramping up its investments in the prime

districts of Singapore. Last week, the

group announced that it had purchased

Royal Oak Residence at 21 Anderson

Road for $93 million. The 34-unit free-

hold property has a GFA of 87,000 sq ft.

In March this year, Far East Con-

sortium purchased Hollandia en bloc

for $183.4 million ($1,703 psf ppr).

This was followed by the purchase

of The Estoril next door for $223.94

million ($1,654 psf ppr). At end-April,

Far East Consortium announced it had

tied up with Singapore-listed construc-

tion group-cum-developer Koh Broth-

ers Group in an 80:20 JV to redevelop

the two sites on Holland Road. The

intention was to amalgamate the sites

and build one single residential de-

velopment of 242,190 sq ft.

A unit of Li Ka-shing’s CK Hutch-

ison Holdings purchased City Tow-

ers on Bukit Timah Road en bloc

for $401.9 million ($1,847 psf ppr)

in February. It will be the ninth res-

idential development by CK Hutch-

ison (previously Cheung Kong Prop-

erty) in Singapore.

Lake reckons Hong Kong groups

are redirecting their attention to the

Singapore property market as Hong

Kong property prices remain at an

all-time high. “It’s a combination of

reasons: Some groups are looking

at diversification; others are happy

to roll the dice again and come into

Singapore to buy, especially since the

residential market has been relative-

ly subdued over the last four to five

years, but sentiment has turned posi-

tive over the past year,” he observes.

“The luxury segment has turned

around over the last six month, and

the expectation is that residential

prices in Singapore are going to rise.”

Prime sites on the radarEven though there are more groups

from Hong Kong sniffing at prime

sites in Singapore, whether they will

commit to a purchase remains to be

seen, says Lake.

To be sure, sites in the prime dis-

tricts have seen more activity. So far,

CBRE has brokered about $2 billion

in en bloc deals this year, primarily

in the prime districts, including the

biggest deal this year, Pacific Man-

sion, at $980 million ($1,806 psf ppr)

in March. The site was purchased by

a JV between Singapore-listed Guoco-

Land and subsidiaries of the private-

ly held Hong Leong Holdings — In-

trepid Investments and Hong Realty.

Up for sale in prime District 9 is

the freehold Elizabeth Towers, with a

reserve price of $610 million ($2,416

psf ppr). It is marketed by Knight

Frank. Also on the market is Leonie

Gardens, a 99-year leasehold con-

dominium on Leonie Hill with a re-

serve price of $800 million ($2,104

psf ppr). Leonie Gardens is marketed

by Huttons Asia. Launched for sale

last month was Cairnhill Astoria in

prime District 9, with a reserve price

of $196 million ($1,964 psf). Accord-

ing to marketing agent Colliers Inter-

national, Cairnhill Astoria’s price of

$1,964 psf ppr is inclusive of a de-

velopment charge of $16.34 million.

Other developments in prime Dis-

tricts 9 and 10 where owners are at-

tempting a collective sale include

High Point at Mount Elizabeth; 8

Orange Grove, located at the corner

of Anderson Road and Orange Grove

Road; and 27 Balmoral Park. These

projects have appointed CBRE as the

marketing agent and are in the pro-

cess of gathering interest from 80%

of the owners. “We’re in the melting

pot,” says CBRE’s Lake.

Orchard Bel-Air on Orchard Boule-

vard is also attempting a collective

sale, with Savills Singapore as its

marketing agent.

“We expect to see more prime col-

lective sale sites entering the market,

and these should appeal to develop-

ers who see value in the prime and

luxury residential segments as pric-

es in Singapore are still substantial-

ly cheaper than other cities, such as

Hong Kong,” says Lee Liat Yeang,

senior partner in Dentons Rodyk’s

real estate practice.

$1 bil en bloc sale within reachWith $9.4 billion worth of collective

sale deals done in the first half of

2018, Lake believes the figure could

exceed the $11.5 billion achieved in

2007, which was the peak of the last

en bloc sale boom. “We could be look-

ing at $15 billion this year,” he says.

While sites such as Park House,

which are priced in the $300 mil-

lion-to-$400 million range, remain

“very palatable” to developers, sites

priced in the $600 million-to-$800 mil-

lion range tend to meet with some

hesitation, adds Lake. It is possible

for sites to cross the $1 billion mark,

but they will take a little longer to

secure buyers, as they required “two

to three developers to come together

to form a consortium”, adds Lake.

There will be sites, however, that

“will struggle” to secure 80% con-

sensus for a collective sale or to

achieve their reserve price. “There’s

an awareness that there are quite a

lot of sites entering the market,” says

Lake. “Good sites will still get mul-

tiple bids and, for various reasons,

some may get no bids.”

The Cuscaden Road GLS site (above

and right) was sold to a joint venture

between SC Global and two Hong Kong groups for a record

$2,377 psf ppr

YTL Group’s 3 Orchard By-the-Park on Orchard Boulevard is expected to hold private previews later this month, with indicative prices of about $4,000 psf

E

PICTURES: SAMUEL ISAAC CHUA/THE EDGE SINGAPORE

NO PROPERTY LOCATION TENURE BUYER(S) NO OF LAND AREA PLOT GFA PRICE PRICE PSF PURCHASE MARKETING UNITS (SQ FT) RATIO (SQ FT) ($ MIL) PPR ($) DATE (2018) AGENT

1 Park West Condo Jalan Lempeng, off Clementi Avenue 6 99-year SingHaiyi Group and related parties 436 633,967 2.10 1,331,331 840.89 850 January Huttons

2 Kismis View and Lorong Kismis, off Toh Tuck Terrace 99-year Roxy-Pacifi c Holdings and Tong Eng 19 Lorong Kismis Group family vehicle 44 100,366 1.40 154,519 108.45 847 January JLL

3 Th e Wilshire Farrer Road Freehold Roxy-Pacifi c Holdings and Tong Eng Group family vehicle 20 39,130 1.60 64,310 98.80 1,536 January Savills

4 City Towers Bukit Timah Road Freehold Unit of CK Hutchison Holdings 79 104,531 2.10 219,516 401.90 1,847 February Colliers

5 Pearl Bank Apartments Pearl Bank, off Outram Park 99-year CapitaLand 288 82,376 7.45 613,530 728.00 1,515 February Colliers

6 Riviera Point Kim Yam Road Freehold Macly Group 33 14,579 3.38 49,265 72.00 1,461 February CBRE

7 Cairnhill Mansions Cairnhill Road Freehold Low Keng Huat 61 43,103 3.63 156,581 362.00 2,311 February CBRE

8 Brookvale Park Sunset Way, off Clementi Road 999-year Hoi Hup Realty and Sunway Developments 160 373,008 1.60 656,494 530.00 932 February JLL

9 Hollandia Holland Road Freehold Far East Consortium International and Koh Brothers Group 48 53,505 1.60 107,688 183.40 1,703 March Savills

10 Lotus at Jervois Jervois Road Freehold Fragrance Group 20 19,741 1.40 27,637 46.30 1,683 March CBRE

11 Toho Mansion Holland Road Freehold Koh Brothers Group 32 47,660 1.40 74,496 120.40 1,805 March ET&Co

12 Eunos Mansion Jalan Eunos, off Bedok

Reservoir Road Freehold Fragrance Group 107 111,735 1.60 178,776 220.00 1,118 March CushWake

13 Goodluck Garden Toh Tuck Road Freehold Qingjian Realty 208 360,130 1.40 504,182 610.00 1,110 March Knight Frank

14 Katong Park Towers Arthur Road, off Mountbatten Road 99-year Bukit Sembawang Estates 117 140,758 2.10 295,592 345.00 1,280 March CushWake

15 Pacifi c Mansion River Valley Close Freehold GuocoLand and Hong Leong Holdings 290 128,352 3.84 542,544 980.00 1,806 March CBRE

16 Makeway View Makeway Avenue, off Kampong Java Road Freehold Bukit Sembawang Estates 32 41,582 2.80 116,430 168.00 1,626 March ET&Co

17 Fairhaven Sophia Road Freehold Lafe Corp 15 16,660 2.10 34,986 57.00 1,629 March JLL

18 Ampas Apartment Jalan Ampas, off Balestier Road Freehold Oxley Holdings 43 90,863 1.40 139,929 95.00 1,073 March Huttons

19 Cairnhill Heights Cairnhill Rise Freehold Tiong Seng Holdings and Ocean Sky 20 15,408 2.80 47,455 72.59 1,530 April ERA

20 Th e Estoril Holland Road Freehold Far East Consortium International and Koh Brothers Group 44 84,600 1.60 148,896 223.94 1,654 April CBRE

21 Tulip Garden Farrer Road Freehold MCL Land and Yanlord Land Group 162 316,708 1.60 557,406 906.89 1,790 April Colliers

22 Olina Lodge Holland Hill Freehold Kheng Leong 67 84,289 1.60 148,348 230.90 1,712 April SRI

23 Dunearn Gardens Dunearn Road Freehold EL Development 114 95,442 3.08 267,239 468.00 1,841 April Knight Frank

24 Villa D’Este Dalvey Road Freehold KOP Ltd 12 55,000 1.40 49,072 93.00 1,898 May CBRE

25 Peak Court Th omson Road Freehold Tuan Sing Holdings and Rich Capital 20 57,378 1.40 80,329 118.88 1,558 May ET&Co

26 Chancery Court* Dunearn Road 99-year Far East Organization 144 259,134 1.40 362,788 401.78 1,610 May OrangeTee

27 Chinatown Plaza** Craig Road Freehold Affi liate of Royal Golden Eagle 71 33,953 4.00 135,742 260.00 1,915 May ET&Co

28 Landmark Tower Chin Swee Road 99-year ZACD Holdings and Sin Soon Lee Realty 139 60,821 4.00 244,136 286.00 1,406 May JLL

29 Park House*** Orchard Boulevard Freehold Shun Tak Holdings 60 46,084 2.80 129,035 375.50 2,910 June CBRE

Total 9,404.61

*136 residential units and eight strata commercial units **Mixed-use development with 38 apartments and 33 strata shops ***Mixed-use development with 56 apartments and four shops ^Updated as at June 12, 2018

PROPERTY TAKE

EP8 • EDGEPROP | JUNE 18, 2018

Why Lendlease decided to jointhe fight against climate change

| BY SIMON WILD |

More than 14 years ago, Aus-

tralian property and in-

frastructure group Lend-

lease made the decision

to “go green”. Today, sus-

tainability is our core guiding prin-

ciple. What are some of the things

we can share with aspiring compa-

nies in Singapore?

According to a United Nations En-

vironment Programme study, build-

ings and construction together ac-

count for 36% of global energy use

and 39% of energy-related carbon

dioxide (CO2) emissions. In Singa-

pore, the Building and Construction

Authority (BCA) estimates that the

building sector consumes up to 38%

of the nation’s electricity.

To ensure that Singapore remains

a vibrant and liveable city for current

and future generations, the govern-

ment has designated 2018 as the year

of climate action. To achieve its long-

term goals, Singapore is pursuing four

strategies: improving energy efficien-

cy; reducing carbon emissions from

power generation; developing and

demonstrating cutting-edge low-car-

bon technologies; and emphasising

the collective action of government

agencies, individuals, businesses and

the community.

The multiple benefits of such ac-

tivities are well documented. Less so

are the opportunities and the simple

question of “where do we start?”

Road to sustainabilityWhile there has been great support

to embrace Green Mark certification

to drive sustainability in new and ex-

isting buildings, it takes more than

execution to walk the talk. Very of-

ten, it extends to the very ethos of

the company and this is where some

companies can find opportunities to

drive change.

1. A case of push and pull: Defin-

ing sustainability

As a property and infrastructure

group, our vision is to create a sense

of place, pride and purpose — for

people from all walks of life. As our

founder, Dick Dussledorp, said in

1973, “There are two things in life.

You can be out for the maximum

amount of profit you can possibly

squeeze from your effort, or you can

aim at a reasonable profit and have

a feeling that you leave something

behind.” It has always been his view

that the company should make a gen-

uine and meaningful contribution to

the community. This consciousness

was pervasive in the company right

from the start.

So, when a 1992 report on water

shortages, congested transport and

increasing energy demands chal-

lenged building practices in Australia,

we took a hard look at how we ran

the business and made a pledge to

change the way we operate.

Without any framework to refer

to, we started small with an interim

initiative called the environmental-

ly sustainable development process

(ESD). It would require us to kick

start any project with a consulta-

tive approach with all stakeholders

— owners, the community, author-

ities, subject matter experts — that

had local and national interests. This

then led to formulating a manage-

ment strategy, performance criteria

and tracking method to ensure de-

livery against the targets.

It was when things came to a

head in the early 2000s that we had

to take a harder look in the mirror.

With an economic crisis, we went

through a down cycle, which affect-

ed our stock performance and em-

ployee confidence. We were also

having trouble attracting talent and

our taking-on of the relocation and

rebuilding of the old Bond Building

in 2002 in one of the most contam-

inated sites in Sydney was causing

alarm on all fronts.

Spurred by economics, business

and changing demographics, we

bravely took this time to rethink a

corporate strategy to revitalise Lend-

lease and re-establish our reputation

as the leading property group in the

industry. Equally important was our

need to rebuild employee and share-

holder confidence for the future of

the company.

The Bond project was an exper-

iment in which we tested our new

sustainability philosophy push by

focusing on lowering greenhouse

gas emissions. During this time, we

were also aware of the “sick building

syndrome” driving occupant health

problems and, through workspace

design, we aimed to improve indoor

environment quality. We also made

a commitment to engage the com-

munity during the development and

construction phases.

achieve in the long term.

So, defining what sustainability

means to your company will help

to focus efforts that are aligned with

your business strategy to establish ef-

fective and clear communication on

sustainability with your stakeholders.

2. Taking a bottom-up approach

A sustainability framework, which

pilots the company towards achiev-

ing its environmental objectives and

metrics for success, also needs to

create operational impact. Funnel-

ling down to the specifics of how

the framework will be delivered on

a day-to-day basis drives organisa-

tional performance and success in

this crucial area.

In our case, we focused on being

operationally efficient, which meant

that we had to be mindful of our us-

age of a) energy and b) water and c)

how we tackled waste.

Aligning what we were doing on

the ground to the overall strategy

meant constant reviews, tracking

of performance and adjustment of

plans. This requires concerted efforts

across different business units with-

in the organisation to see it through:

from people on the ground to middle

management who report and evalu-

ate to long-term commitment from

senior management.

3. Driving innovation through sus-

tainability

By taking the long-term view, we

found that over time our adoption of

sustainability practices — rather than

being restrictive — encouraged us to

pursue new and complementary ar-

eas of improvement. As we were al-

ways looking at ways to improve and

reduce, we explored a wide range of

technological innovations.

For example, at Paya Lebar Quar-

ter, we implemented high-efficiency

water fittings, along with monitoring

and leak detection systems, a move

that is expected to save more than

40% of water (and costs) annually.

We also anticipate energy savings

of more than 30% from a variety of

design solutions, such as high-per-

formance façades and the use of

light-emitting diodes (LEDs).

At 313@Somerset, we have also

installed solar panels on the roof to

harness the sun’s energy and con-

vert it into electricity, which enables

energy generation within the centre

and lowers energy use.

Across our retail assets, we have

installed food waste digesters to help

manage food waste by converting

it into non-potable water, helping

us reduce disposal costs. Moreover,

data collected will help better man-

age food waste in our malls.

Meanwhile, at the construction site,

we implemented Design for Manufac-

turing and Assembly (DfMA) tech-

nologies, which resulted in greater

labour efficiency, and a reduction

in on-site noise, air pollution and

waste, as many construction works

are done off-site.

4. Being tenacious

It has been a roller-coaster journey

at times, but the outcomes have

been immensely rewarding. We are

proud to say that, in FY2017, 98%

of our development pipeline has ei-

ther achieved or is targeting green

certification globally. In addition,

we are pleased to report meaning-

ful progress against our 2020 reduc-

tion targets of 20% for energy, water

and waste.

Everyone plays a partDrawing from our experience, we be-

lieve companies have a huge untapped

potential to steer public discourse and

change mindsets by pledging climate

action at their own places of work.

Having a vision, commitment from

senior management, empowered peo-

ple on the ground and alignment of

processes, as well as aspiring to best

practices and standards are critical

to companywide engagement. By

constantly engaging colleagues and

employees on ways to fight climate

change together internally and exter-

nally, the workplace can be a pivot-

al piece of the puzzle in fighting cli-

mate change in Singapore.

Looking back, we are proud at

how far we have come at realising

our founder’s desire to make a posi-

tive impact on society. It has given us

enormous satisfaction while building

a strong corporate identity. We hope

our story inspires Singapore compa-

nies to do the same. As they say, the

journey of a thousand miles begins

with the first step.

Simon Wild is head of sustainabilityfor Asia at Lendlease and is based in Singapore

The Bond project was a huge suc-

cess and gave our fledgling sustaina-

bility practices the validation it they

needed and a boost to our reputation. It

was the first office building in Austral-

ia to receive the five-star greenhouse

rating under the Australian Building

Greenhouse Rating scheme and has

one of the lowest running and main-

tenance costs of any building of its

size, signalling long-term costs sav-

ings. This reinforced our reputation

as a builder of efficient and resilient

buildings that maintain their value

over the longer term.

In 2004, we signed a sustainabil-

ity covenant with Environment Pro-

tection Authority Victoria to work

together to protect and contribute

to a more sustainable environment.

The aim of this declaration was to

ensure that Lendlease was empow-

ered to develop a strategic approach

to sustainability issues. In hindsight,

it was a precursor to the Sustainabili-

ty Framework we introduced in 2014.

Today, our Sustainability Frame-

work is a more refined and detailed

pledge that responds to the macro

trends affecting our world and de-

fines what sustainability means to

our business and what we want to

E

Lendlease’s mall on prime Orchard Road — 313@Somerset

LENDLEASE

EDGEPROP | JUNE 18, 2018 • EP9

SPOTLIGHT

EP10 • EDGEPROP | JUNE 18, 2018

Oakwood Premier offers luxury home away from home | BY BONG XIN YING |

Oakwood Premier OUE Singa-

pore opened on June 15

last year, and one year after

its opening, the occupan-

cy rate is now about 82%.

“We almost tripled our occupan-

cy in the first three months, and are

consistently increasing our occupan-

cy by 10% to 15% for most of the

months,” says Roy Liang, general

manager at Oakwood Premier OUE

Singapore.

Changing trend in demandHaving signed a management agree-

ment with OUE, Oakwood Asia Pacific

unveiled its Oakwood Premier-branded

serviced apartment with the launch

of Oakwood Premier OUE Singapore

at OUE Downtown.

The property houses 268 mid-

and high-level residences, with most

of the units comprising studios and

one-bedroom apartments, from 301

to 344 sq ft and from 323 to 624 sq ft

respectively. The remaining 47 units

are two-bedroom residences measur-

ing 753 to 1,055 sq ft. Liang notes that

they cater for “a small group of clients

who still bring their families over for

a travel period of about six months”.

The accommodation trend for ser-

viced apartments has shifted over

the years. Liang points out that, in

the 1990s, serviced apartments were

built like condominiums, with a range

of two- to four-bedrooms. As corpo-

rate travel and relocation was not the

norm then, people would go on busi-

ness trips with family members and

continue your training schedule in

whichever city you go to, which

saves C-suite executives the hassle of

finding a suitable gym,” says Liang.

Oakwood Premier OUE Singapore

is meticulous in catering for the needs

of its guests. An in-room tablet pro-

vides one-touch convenience. The

music broadcasted on the property is

specially curated, with upbeat music

played at the gym and evening jazz at

night. “The music is not like a broken

record that repeats itself,” says Liang.

Apart from the infinity pool, fit-

ness centre and lobby bar, another

highlight at Oakwood Premier OUE

Singapore is its in-house restaurant,

Se7enth. An in-house restaurant is an

uncommon sight in a serviced apart-

ment, for most will outsource their

meals to outside restaurants.

In addition, the chefs and waiters

at Oakwood Premier OUE Singapore

are recruited from five-star hotels

— the executive chef was scouted

from Mandarin Oriental Singapore

and the sous chef from The Wes-

tin Singapore. “I can safely say we

have the best breakfast in the con-

text of serviced apartments, as the

variety and quality are right at the

sweet spot, with each item very well

done,” says Liang.

Brand consistency and expansion plansThere is a total of eight Oakwood

Premier serviced apartments global-

ly, including in Guangzhou, Tokyo,

Jakarta and Seoul. In terms of their

business strategy and clientele, Liang

asserts that consistency is maintained

throughout the apartments. “Guests

who used to stay in our Korea and Ja-

pan Oakwood Premier, are also stay-

ing in the Singapore branch, as they

identify it with their own experience

back home,” says Liang.

He notes that Oakwood Premier

OUE Singapore has set a new bench-

mark for Oakwood Premier’s future

expansion, being the latest apartment

for the brand and, furthermore, with

the regional headquarters based in

Singapore.

He says: “We are highly confident

that Oakwood Premier OUE Singa-

pore will do well for a long period of

time. We are at a good position now,

and we just need to make sure we

keep up with the service techniques,

as the ‘software’ is something that

can be easily changed, but not eas-

ily maintained.”

Liang sees Singapore as a “world-

wide example” of how the serviced

apartment industry has blossomed over

the last 10 to 15 years. In fact, the big-

gest serviced apartments operators in

the world are either from Singapore or

owned by local companies, he notes.

Liang expressed high hopes for

Oakwood Premier OUE Singapore.

Asked about the property’s pros-

pects in five years’ time, he says,

“We would still be a market leader,

with an occupancy rate that is con-

sistently near 100%.”

town 1 gives guests the advantage

of accessibility to the financial dis-

trict. Liang adds that it wants to be

the best when it comes to serviced

apartments, and set an example with

impeccable service that is the equiv-

alent of a five-star hotel’s.

Mindful of its guests’ needs, Oak-

wood Premier OUE Singapore advo-

cates an active lifestyle, and this is

evident in its partnership with World

Trainer, a global network of personal

trainers, and Aquaspin, which con-

ducts tri-weekly water aerobics and

aquabiking sessions at its pool.

“The personal trainer at World

Trainer will have your records and

E

PICTURES: SAMUEL ISAAC CHUA/THE EDGE SINGAPORE

Liang: We are highly confident that Oakwood Premier OUE Singapore will do well for a long period of time

The infinity pool at Oakwood Premier OUE Singapore hints at a luxurious lifestyle

The two-bedroom units cater for small families

All units come with a fully equipped kitchen

presence of serviced apartments.

“Demand for serviced apartments

would be higher when they are lo-

cated in areas with heavy business

traffic,” he says. A firm believer in

the value that serviced apartments

provide, Liang says they are “anoth-

er option for real estate developers

to develop their assets into, rather

than just focusing on hotels alone”.

Five-star standardOakwood Premier OUE Singapore

is positioned to attract luxury cor-

porate travellers, with its clientele

being predominantly C-suite exec-

utives. Its location at OUE Down-

stay in a serviced apartment for as

long as two years, he says.

“Nowadays, people who stay in

serviced apartments are those who

come for short-term business trips

alone. They do not bring their fam-

ily with them, as there is no reason

to uproot their lives to another coun-

try,” observes Liang. In line with

that, most of the residences in ser-

viced apartments — Oakwood Pre-

mier OUE Singapore included — are

now one-bedroom or studio apart-

ments, he says.

Liang notes a strong correlation

between the city as a financial gate-

way and business capital, and the

GAINS AND LOSSES

EDGEPROP | JUNE 18, 2018 • EP11

Seller at Nassim Mansion makes $6.5 mil profit

E

Top 10 gains and losses from May 29 to June 5

URA, EDGEPROP

Most profi table deals (non-landed)

Note: Computed based on URA caveat data as at June 12 for private non-landed houses transacted between May 29 to June 5. Th e profi t-and-loss computation excludes transaction costs such as stamp duties.

Non-profi table deals PROJECT DISTRICT AREA (SQ FT) SOLD ON (2018) SALE PRICE ($ PSF) BOUGHT ON PURCHASE PRICE ($ PSF) LOSS ($) LOSS (%) ANNUALISED LOSS (%) HOLDING PERIOD (YEARS)

1 Parc Olympia 17 1,324 June 5 755 Nov 14, 2012 884 170,450 15 2.8 5.6

2 Ascentia Sky 3 1,851 May 31 1,259 Nov 13, 2013 1,350 170,000 7 1.5 4.5

3 Th e Centris 22 1,421 May 30 816 Jan 31, 2011 911 135,000 10 1.5 7.3

4 Oasis Garden 19 947 May 31 1,235 Sept 5, 2013 1,277 40,000 3 0.7 4.7

5 Urban Vista 16 560 May 31 1,528 April 10, 2013 1,584 31,688 4 0.7 5.1

6 Ripple Bay 18 484 May 31 1,177 April 26, 2013 1,239 30,000 5 1.0 5.1

7 Centro Residences 20 926 June 4 1,445 Jan 25, 2012 1,452 5,760 0.4 0.1 6.4

PROJECT DISTRICT AREA (SQ FT) SOLD ON (2018) SALE PRICE ($ PSF) BOUGHT ON PURCHASE PRICE ($ PSF) PROFIT ($) PROFIT (%) ANNUALISED PROFIT (%) HOLDING PERIOD (YEARS)

1 Nassim Mansion 10 3,520 June 5 2,841 Nov 20, 2003 994 6,500,000 186 7 14.6

2 Th e Shelford 11 1,851 May 31 1,836 Nov 15, 2005 675 2,150,000 172 8 12.5

3 Th e Esta 15 1,345 June 4 1,806 April 24, 2006 676 1,520,000 167 8 12.1

4 UE Square 9 1,528 June 5 1,603 May 20, 2002 713 1,360,000 125 5 16.1

5 Th e Tessarina 10 1,324 June 1 1,699 May 12, 2003 789 1,214,000 117 5 15.1

6 Goldenhill Park Condominium 20 1,335 May 31 1,534 Sept 15, 2004 644 1,188,000 138 7 13.7

7 Savannah Condopark 18 2,680 May 31 828 Jan 28, 2005 399 1,150,000 107 6 13.3

8 Riveredge 15 1,518 June 4 1,374 March 26, 2007 700 1,022,100 96 6 11.2

9 Jervois Jade Apartments 10 2,056 June 4 1,070 March 15, 2007 610 945,840 75 5 11.2

10 Water Place 15 1,561 June 5 1,262 April 4, 2001 665 932,000 90 4 17.2

| BY TIMOTHY TAY |

The sale of a 3,520 sq ft, four-bed-

room unit at Nassim Mansion

on Nassim Hill Road was the

most profitable transaction for

the week of May 29 to June 5.

The unit, which is on the third floor,

was first bought at $3.5 million ($994

psf) in 2003 and sold for $10 million

($2,841 psf) on June 5. The seller

walked away with a profit of $6.5 mil-

lion (186%), which translates into an

annualised profit of 7% over a hold-

ing period of 14 years

This is the second most profitable

sale at the 72-unit Nassim Mansion.

The most profitable was of a 7,115

sq ft penthouse on the 10th floor that

changed hands for $16 million ($2,249

psf) in 2007 As it was bought for $5.2

million ($731 psf) in 2004, this meant

a $10.8 million profit (207%) for its

seller, or a 40% annualised profit over

a three year holding period.

Located in prime District 10, the

freehold Nassim Mansion was com-

pleted in 1977 Profits from the sale

of units in the residence ranged from

$50,000 to $10.8 million over the past

15 years, according to caveats lodged.

The second most profitable trans-

action during the week under review

was the sale of a 1,851 sq ft unit at The

Shelford, located on Shelford Road in

prime District 11. The three-bedroom

unit was sold on May 31 for $3.4 mil-

lion ($1,836 psf) As it had previous-

ly changed hands for $1.25 million

($675 psf) in 2005 the seller made a

$2.15 million (172%) profit or an an-

nualised profit of 8% over a 12 year

holding period. The Shelford has seen

profits ranging from $1,654 to $2.47

million from the sale of its units over

the past 15 years, according to cav-

eats. The most profitable transaction

was the sale of a 2,411 sq ft maison-

ette in 2007. It was first bought from

the developer for $1.68 million ($715

psf) in 2002, and changed hands for

$4.15 million ($1,721 psf), generat-

ing a $2.47 million (147%) profit,

or an 18% annualised profit over a

five year holding period. The Shel-

ford is a freehold development with

215 units. It was completed in 2005.

A 1,345 sq ft unit at The Esta on

Amber Gardens in District 15 changed

hands for $2.43 million ($1,806 psf) on

June 4, becoming the third most prof-

itable transaction for the week. The

three-bedroom unit on the fifth floor

was bought for $910,000 ($676 psf) in

2006. Thus the seller walked away with

a $1.52 million (167%) profit, which

translates into an 8% annualised profit

over a 12 year holding period.

This was also the third most prof-

itable transaction at the 400-unit con-

dominium. Profits from sales at the

freehold development ranged from

$20,000 to $2.14 million over 12 years.

The most profitable sale was in Au-

gust 2009 when a 3,186 sq ft pent-

house on the 21st floor, which was

first bought at $2.11 million ($662

psf) in 2006, fetched $4.25 million

($1,334 psf). It made a $2.14 mil-

lion (102%) profit, which translates

into an annualised profit of 22%

over a 3½-year holding period. The

same unit recently changed hands

in March this year for $4.78 million

($1,500 psf). The most recent sell-

er thus made a $530,000 profit after

holding the property for eight years

The seller of a four-bedroom unit at Nassim Mansion made a $6.5 million profit on June 5

A three-bedroom unit at The Esta was sold for a profit of $1.52 million on June 4

SAMUEL ISAAC CHUA/THE EDGE SINGAPORE

THE EDGE SINGAPORE

E

EP12 • EDGEPROP | JUNE 18, 2018

Singapore — by postal district LOCALITIES DISTRICTSCity & Southwest 1 to 8

Orchard/Tanglin/Holland 9 and 10

Newton/Bukit Timah/Clementi 11 and 21

Balestier/MacPherson/Geylang 12 to 14

East Coast 15 and 16

Changi/Pasir Ris 17 and 18

Serangoon/Thomson 19 and 20

West 22 to 24

North 25 to 28

District 1 MARINA ONE RESIDENCES Apartment 99 years May 30, 2018 1,130 2,902,240 - 2,568 2017 New SaleMARINA ONE RESIDENCES Apartment 99 years May 30, 2018 1,141 3,039,010 - 2,663 2017 New SaleMARINA ONE RESIDENCES Apartment 99 years May 31, 2018 2,250 5,700,000 - 2,534 2017 New SaleRIVERWALK APARTMENTS Apartment 99 years May 31, 2018 818 1,260,000 - 1,540 1985 ResaleDistrict 2 ICON Apartment 99 years May 30, 2018 700 1,220,000 - 1,744 2007 ResaleSKYSUITES@ANSON Apartment 99 years May 31, 2018 366 970,000 - 2,650 2014 ResaleTHE ARRIS Apartment Freehold June 01, 2018 915 1,750,000 - 1,913 2002 ResaleWALLICH RESIDENCE Apartment 99 years May 30, 2018 646 2,120,000 - 3,283 2017 New SaleAT TANJONG PAGAR CENTRE WALLICH RESIDENCE Apartment 99 years May 31, 2018 1,744 6,520,350 - 3,739 2017 New SaleAT TANJONG PAGAR CENTRE District 3 ALESSANDREA Apartment Freehold May 31, 2018 1,098 1,440,000 - 1,312 2003 ResaleALEXIS Apartment Freehold May 31, 2018 517 880,000 - 1,703 2012 ResaleARTRA Apartment 99 years May 29, 2018 1,410 2,374,800 - 1,684 Uncompleted New SaleARTRA Apartment 99 years May 31, 2018 786 1,606,400 - 2,044 Uncompleted New SaleASCENTIA SKY Condominium 99 years May 30, 2018 1,819 2,730,000 - 1,501 2013 ResaleASCENTIA SKY Condominium 99 years May 30, 2018 1,012 1,500,000 - 1,482 2013 ResaleASCENTIA SKY Condominium 99 years May 31, 2018 1,851 2,330,000 - 1,259 2013 ResaleCOMMONWEALTH TOWERS Condominium 99 years June 01, 2018 441 870,000 - 1,971 2017 Sub SaleECHELON Condominium 99 years May 30, 2018 1,571 2,920,000 - 1,858 2016 ResaleMARGARET VILLE* Apartment 99 years June 01, 2018 700 1,268,000 - 1,812 Uncompleted New SaleMARGARET VILLE Apartment 99 years June 02, 2018 463 899,200 - 1,943 Uncompleted New SaleMARGARET VILLE Apartment 99 years June 02, 2018 463 967,500 - 2,090 Uncompleted New SaleQUEENS PEAK Condominium 99 years May 30, 2018 850 1,659,000 - 1,951 Uncompleted New SaleQUEENS PEAK Condominium 99 years June 01, 2018 2,002 3,325,000 - 1,661 Uncompleted New SaleQUEENS PEAK Condominium 99 years June 01, 2018 861 1,643,000 - 1,908 Uncompleted New SaleQUEENS PEAK Condominium 99 years June 02, 2018 1,001 1,893,000 - 1,891 Uncompleted New SaleQUEENS PEAK Condominium 99 years June 03, 2018 1,055 1,941,000 - 1,840 Uncompleted New SaleTHE ANCHORAGE Condominium Freehold June 01, 2018 1,464 1,920,000 - 1,312 1997 Resale