201610 Convex LP monthly - Constant...

Transcript of 201610 Convex LP monthly - Constant...

CONVEX ASIA FUND LP | OCTOBER 2016 1

FOR PROFESSIONAL INVESTORS ONLY

CONVEX ASIA FUND LP

Monthly Update – October 2016

Monthly Review

The Convex Asia Fund LP, Class ‘A’ was down -0.85%* net for the month of October 2016.

Performance attribution

CCCCAF NetAF NetAF NetAF Net Outright NetOutright NetOutright NetOutright Net RV NetRV NetRV NetRV Net

OutrightOutrightOutrightOutright ----0.860.860.860.86%%%% REHEDGEREHEDGEREHEDGEREHEDGE 0.00%0.00%0.00%0.00% CarryCarryCarryCarry 0.00.00.00.02222%%%%

Relative ValueRelative ValueRelative ValueRelative Value ----0.0.0.0.00007777%%%% VARVARVARVAR ----0.0.0.0.28282828%%%% SkewSkewSkewSkew ----0.010.010.010.01%%%%

OtherOtherOtherOther 0.080.080.080.08%%%% VolVolVolVol ----0.0.0.0.01010101%%%% DeltaDeltaDeltaDelta 0.00%0.00%0.00%0.00%

----0.850.850.850.85%%%% TailTailTailTail ----0.570.570.570.57%%%% CurveCurveCurveCurve 0.00.00.00.00000%%%%

CVXCVXCVXCVX 0.00%0.00%0.00%0.00% SpreadSpreadSpreadSpread 0.00%0.00%0.00%0.00%

TactTactTactTact 0.00%0.00%0.00%0.00% VARSPREADVARSPREADVARSPREADVARSPREAD 0.00%0.00%0.00%0.00%

----0.860.860.860.86%%%% TermTermTermTerm 0.00%0.00%0.00%0.00%

CorrCorrCorrCorr 0.00%0.00%0.00%0.00%

TactTactTactTact ----0.0.0.0.08080808%%%%

VolVolVolVol 0.00%0.00%0.00%0.00%

----0.00.00.00.07777%%%%

*Reflects Convex Asia Fund LP – Class ‘A’ net investor returns.

Past performance is not a guarantee of future returns, and an investment in the Fund could lose value. Performance attribution is based

on the Trading Level of the Fund. Trading Level is defined as the product of the fund’s NAV multiplied by the Funding Factor. The

Funding Factor is 1x for Convex Asia Fund LP, while the Funding Factor is 2x for Convex Asia Fund PF LP. Fees and expenses are

allocated pro rata with the absolute gross return of each strategy in order to arrive at the net performance figures.

Source: City Financial, internal data

Market Review

Interest Rates

With an apparent flick of a switch, bond markets shifted from pricing “deflation” risk to pricing “inflation” risk

in October. Despite the general outlook for global growth remaining skewed towards weakness and below

trend growth, rates have moved higher. It is yet to be determined if this ‘inflation’ enthusiasm will expand to

anything more meaningful. Moves in October were modest, but, to be precise, US 10y bond yields rose

20.3bps, Korean 10y bond yields rose 22.2bps, Euro 10y bonds rose 21.7bps and 10y JGBs rose 2bps under

“YCC” (Yield Curve Control) governance. Modest moves in the context of the heavy compression of yields in

recent years, but significant given the overall low levels of yields. Given such moves, has the opportunity to

hedge higher rates become significantly more restricted? Quite the reverse, we would argue, as the

asymmetry that we track in the portfolio has accelerated over the last three months, so much so that we

have almost doubled our potential sensitivity to moves higher in rates over that period.

CONVEX ASIA FUND LP | OCTOBER 2016 2

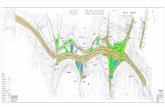

The following two charts are of the same underlying securities, indexed at 1, for US 10y bond, JGB 10y bond,

EUR 10y bond, KTB 10y bond, USD 3M Libor and Korean 90-day CD rate. The first chart shows a medium

term view, from March 2008 through to 31 October 2016, the other shows changes year to date. What is

striking is the expansion of USD 3M Libor on the second chart, which is tightening financial conditions

globally and pre-emptive with respect to Federal Reserve action.

US, JGB, EUR, KTB 10y Bond yields, USD 3m Libor, and KRW 90-day CD

Source: Bloomberg

US, JGB, EUR, KTB 10y Bond yields, USD 3m Libor, and KRW 90-day CD

Source: Bloomberg

Reflation and an end to Quantitative Easing (QE) in Europe and Japan are the biggest concerns currently for

interest rate markets. However, the cost of convexity does not reflect this; skew is still cheap in many

markets. QQEYCC in Japan has made interest rate volatility extremely attractive in some areas of the

volatility surface there. South Korea may be the next developed economy in line for QE and most bank

-0.5

0

0.5

1

1.5

2

Mar-2008 Jan-2009 Nov-2009 Sep-2010 Jul-2011 May-2012 Mar-2013 Jan-2014 Nov-2014 Sep-2015 Jul-2016

USGG10Y GJGB10Y GTEUR10Y US0003M GTKRW10Y KWCDC

-1.5

-1

-0.5

0

0.5

1

1.5

2

Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16

USGG10Y GJGB10Y GTEUR10Y US0003M GTKRW10Y KWCDC

CONVEX ASIA FUND LP | OCTOBER 2016 3

analysts expect the Bank of Korea (BoK) to cut rates by 25 - 75bps from the current rate of 1.25% over the

coming months.

The following grid shows on the X-axis the cost in (bps) premium for a 2y10y ATMF + 150bps payer and on

the Y-axis we show the skewness of the ATMF payer over the ATMF payer as a percentage. Despite moves

in the US, it appears with the lowest level of absolute skewness. However, the comparison also shows the US

to be the most costly market to hedge. Despite South Korean won (KRW) and Japanese yen (JPY) having a

higher cost of skewness in absolute terms, the cost of convexity is much less than in either Europe or the

USA. We are not saying that the US dollar or euro cost of convexity is expensive, as if you do an empirical

regression and study of skewness and at-the-money implied volatility they are both attractive in their own

right at these levels. However, the opportunity set that is afforded us in Asia makes ownership of rate

convexity more attractive for a scenario where inflation fears feed into higher rates.

2y10y ATMF + 150 Payer Premium vs Relative Skewness

Source: Bloomberg

FX

A quick trip around global markets last month and we note that Brazil cut rates by 25bps to 14%. In Europe,

the Riksbank further lowered its repo-rate forecast and announced a likelihood of an extension to QE by

December, and Norges Bank held rates. In our view, both macro dynamics and flow dynamics are quite

supportive of the US dollar at a higher level, especially vs the Chinese yuan (CNY) as latest data from the

People's Bank of China (PBoC) suggests that capital outflow pressure remains. Whilst foreign holdings of

Chinese equities and bonds increased in the third quarter by US$7bn and US$5bn respectively, foreign

holdings of onshore CNY deposits fell by US$21bn in the same period. Monthly foreign direct investment and

outward direct investment data (from the Ministry of Commerce) shows net outflows of US$6.9bn in

September, the highest net outflows since US$10.1bn in April 2016. Global uncertainty, Fed hike

expectations, RMB overvaluation, Bank of Japan (BoJ) tapering, European concerns around the banking

sector, the Italian December referendum and slower Chinese economic momentum seemingly all point

towards a stronger US dollar and weaker CNY.

EUR, 35, 126%USD, 54, 111%

KRW, 9.25, 138%

TWD, 15, 188%

JPY, 9, 248%

0%

50%

100%

150%

200%

250%

300%

0 10 20 30 40 50 60

CONVEX ASIA FUND LP | OCTOBER 2016 4

CFETS Onshore USDCNY Spot Trading Volume (US$ millions)

Source: Bloomberg

We can see empirically in the chart above that US$41bn traded on 27 October, indicating potential outflow

activity, higher than the US$39bn that traded on 7 January 2016 when concerns about CNY stability were at

their peak earlier this year.

The chart below shows the CNY FIX Daily YTD 2016. The PBoC has accelerated the higher fixing after the

China National Day holidays in early October, with the PBoC fixing daily above 6.70 from this period.

CNYMUSD Index YTD (2016)

Source: Bloomberg

This is a confirmation from a macro policy basis that the PBoC is willing to allow a measured weakening of

the CNY, which might become its preferred course of action in the face of further capital outflows.

Interestingly, we think that this outcome is not currently being priced into markets.

0

5000

10000

15000

20000

25000

30000

35000

40000

45000

Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16

6.4

6.5

6.6

6.7

6.8

Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16

CONVEX ASIA FUND LP | OCTOBER 2016 5

Nearby, in Hong Kong, we look at the CNH HIBOR fixing (chart below) where it seems that, despite the

weakness of spot CNY and FIX, we are not seeing the authorities jack up the cost of funding in order to

remove any speculative short positions, as we have seen them to do in the past. CNY Fix is currently around

five-year highs, spot CNY or CNH (China Offshore Spot) rates are at circa five-year highs and yet CNH

implied volatility, CNH forward points, and CNH HIBOR are very stable. CNH HIBOR becomes much more

relevant when the Chinese authorities want to clean things up, so what we conclude from this is that, at

present, the PBoC is not concerned at current levels and a test of 6.80 looks imminent in November or

December. Overall, we believe the RMB depreciation trend will continue over the medium-term and the

recent lack of PBoC action and market positioning suggests we could continue to see bigger moves than the

forward market is pricing in in the near-term.

Regression below shows HIBOR rate is stable as USDCNH moves to its highest level.

Regression of CNH HIBOR vs USDCNH

Source: Bloomberg

Onshore corporates in China have been active in structured product markets via covered forwards, selling

$CNH topside calls versus buying CNH 12m Forward points. As a result, the supply of volatility has been

mainly at the front end of the volatility curve (1m, 3m expiry). Even with the covered forward issuance, and

forward point buying, plus the move in CNY Fix and spot CNY/CNH rates, it is interesting to see these points

not widening on speculative flows, even as we trade at the highest levels in five years. There appears to be a

breakdown between spot moves, risk reversals, butterflies, forward levels and implied volatility, while even

high strike skew volatility has been compressed. Under such a scenario there is still interesting convexity and

asymmetry in China that we would not expect to see given the risks that are evident to markets.

The second chart on the following page is a longer-dated history (minus CNH12m) of USDCNH 10 delta

butterfly, USDCNH 1y implied volatility, USDCNH 1y 10 delta Risk Reversal, CNH 12M Forward points,

indexed to 1. The risk reversal has compressed from US$ call to CNH call as CNY/CNH spot has weakened.

In January 2016, the risk reversal traded as high as 10.625 (to $ calls) but by end October closed at 3.2175.

Historically, these cost components of owning upside protection against USD/CNH have been highly

correlated to a rising spot exchange rate. That has not been the case with the most recent trend higher in

spot.

CONVEX ASIA FUND LP | OCTOBER 2016 6

Indexed CNH Implied Volatility, Risk Reversal, Butterfly and Forward Points.

Source: Bloomberg

Indexed CNH Implied Volatility, Risk Reversal, Butterfly.

Source: Bloomberg

Equities

The month of October saw equity risk premia cheapen across the board, although it was hard not to notice

the clouds gathering on the horizon:

• Rising populist sentiment (US Presidential elections/ Italian referendum)

• Involuntary reversal of easy monetary policy and rising interest rates

• Increasing FX volatility

• Credit events

0.5

1

1.5

2

2.5

3

3.5

Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16

USDCNH10B1Y USDCNHV1Y USDCNH10R1Y CNH12M

0

0.5

1

1.5

2

2.5

3

Nov-11 May-12 Nov-12 May-13 Nov-13 May-14 Nov-14 May-15 Nov-15 May-16

USDCNH10B1Y USDCNHV1Y USDCNH10R1Y

CONVEX ASIA FUND LP | OCTOBER 2016 7

With financial market leverage higher in many markets than just before the 2008 financial crisis , there

appears to be no shortage of crowded trades which will likely prove to have tiny exit doors, we think, when

the decision to trade out is taken. And yet, equity risk premia are back to the lows of the year and, more

ominously, back to levels seen in the second half of 2007. The Nikkei saw the fourth consecutive month of

declines in the cost of protection, and led the fall in volatility across virtually all markets.

Fresh from inflating an equity bubble and subsequently bursting it last year, the Chinese government appears

to have a pump in hand once more, this time turning attention to the property market. Down-payments for

mortgages were cut and a record amount of credit (financed by the PBoC) has been pumped into the

financial system this year, rivalling the quantum for all of 2009. Property funding in the second quarter 2016

was reported to account for almost 70% (up from 24% last year) of the growth in Total Social Financing

(TSF). Loans related to the property sector now account for 24% of the outstanding TSF. The lack of

alternative investments and the common belief that ‘the government will never allow housing prices to fall in

China’ continued to drive demand for property investments.

Across China, different forms of leverage, both on and off balance sheet, continue to build up in banks,

developers and peer-to-peer (P2P) platforms. P2P platforms use leverage to help small investors, who

cannot afford to participate in the property market alone, to invest in schemes with the prospect of high

returns (approximately 20% p.a). Property agents have been reported to use these platforms to supply

bridge loans to help buyers with their down-payments, which they would not ordinarily be able to afford.

Developers also lend out such bridging loans to home buyers, circumventing the requirements for down-

payments. We must also not forget the now less sensationalised wealth management products (WMP)

which continue to grow at a frightening pace, +56% year-on-year (YoY) in 2015, and worth approximately

RMB 23.5tr as of 2015. Extending leverage into housing and households could be construed badly; utilising

‘under-leveraged’ household balance sheets to continue financing growth after the corporate sector and local

provincial governments have tapped out. China’s household leverage (household debt to disposable income)

was understood to be under 50% in 2015, which is low in comparison to 100% in the US, 160% in South

Korea or almost 200% in Australia.

Chinese house price indices are up over 20% YoY, from an already high level. Tier 1 and 2 housing prices

climbed 29% and 13% YoY in September. The average selling price of the Tier 1 cities took five years to climb

41% (or 7% CAGR from 2010 to 2015) but took only one year (2015 to 2016) to climb another whopping

44%. This parabolic climb in property prices has also exacerbated capital outflows due to relative cheapness

of asset prices in other countries. The Chinese government has finally announced some macro-prudential

measures across 11 major cities, for example by raising down-payments for first and second mortgages, but

market activity would suggest the moves are having little impact.

The crux here is that most asset price bubbles historically are pricked by self-inflicted macro prudential

measures like the US equity market in the late 1920s, Japan housing bubble in late 1980s, Hong Kong

housing bubble in late 1990s and the China equity bubble in late 2015, for example. The Chinese property

market is a much larger beast compared to equity markets and might prove to be more robust. However, as

we look at hedging opportunities across equities, we can see very attractively priced protection in a

particular group of Asian countries that are highly susceptible to a burst in the Chinese credit bubble with

fixed or dirty-floating currency pegs. Interestingly, the cost of protection in these markets has become

cheaper in the past quarter and is now as cheap as it was in the second half of 2007.

CONVEX ASIA FUND LP | OCTOBER 2016 8

HSI Index Implied and Realised Volatility

Source: Bloomberg

Monthly Performance Asian Indices

Source: Bloomberg

Credit

In early 1994, bond yields were at a 20-year low while inflation had been subdued. The United States had just

escaped from a short recession between 1990-1991, an oil price shock in 1990, an asset bubble crash in

Japan (one of the US’ biggest trading partners), and a nine-year long savings and loan crisis (1980-1989).1

The Fed had begun raising short-term interest rates from 3% to 4.75% by September 1994. The 30-year

Treasury rate started the year at 6.2% but was 160 basis points higher at 7.8% by September. That year

ended in an estimated loss of over US$1tr worldwide from the decline of bond prices from a correlated spike

in long-dated yields across major countries including the US, Germany, the UK and Japan, as well as in the

emerging markets.

Back then, the outstanding bond market in the US was US$10.2 trillion, an all-time high at that time,

constituting around 57% of the global bond market. With short-term yields at 20-year lows (in 1994), the

spread between long- and short-dated yields was at a high. By way of illustration, the spread between the 2-

year and 30-year US Treasury yields peaked at 3.6% in 1992. This encouraged a huge amount of bond

issuance and carry trades which resulted in lower yields and reflexively higher bond prices, thus spiralling

into a leveraged bond bubble.

1 http://fortune.com/2013/02/03/the-great-bond-massacre-fortune-1994/

CONVEX ASIA FUND LP | OCTOBER 2016 9

The US bond market has grown to almost US$37tr in 2015 (still around 42% of the global bond market) with

issuance at new all-time highs, coupled with near all-time lows in rates globally. The explosion of the global

monetary base led by the US, Japan and the Eurozone (5x, 4.5x and 2.5x December 2007 levels) added a

massive dose of impetus to an already insatiable hunt for yield. The US bond market is around 1.5 times the

size of the US stock market and nearly twice the total size of the five largest foreign stock markets combined

(London, Japan, China, Europe and Hong Kong).

To find out how far the carry trade has caused risk premia to diverge from fundamentals, you need look no

further than the sovereign credit spread of South Korea, one of the largest emerging market countries. The

sovereign credit spread at 42bps is at nine year lows and at a level last seen in 2007. Currently, the country

is seeing the lowest five-year average GDP growth rate since 1975, the weakest PMI among all the major

Asian countries, weak export growth, surging NPL ratios and record high household leverage. Likewise,

ITRAXX Japan and Asia credit indices are also trading at lows for the year, as well as historical lows.

Fed Fund rate, US PCE Core Index, US GDP and the US 30Y vs 2Y spread between 1970 - 1994

Source: Bloomberg

Fed Fund rate, US PCE Core Index, US GDP and the US 30Y vs 2Y spread between 1970 - 2016

Source: Bloomberg

CONVEX ASIA FUND LP | OCTOBER 2016 10

Korea 5Y CDS Spread

Source: Bloomberg

Credit Benchmarks

Source: Bloomberg

Risk Update

No doubt, November 2016 is a big month. The United States is going to make history, one way or another.

Whether the outcome is a potential spark in the accumulated plains of dry trees and grass, we will only know

in hindsight.

What we do have a pretty good idea of is the proliferation of dry grass (a.k.a. risk) in the mass pursuit of

yield. We always aim to differentiate between what is a view (what one thinks will happen) and what is risk

(what really hurts if it happens). As many of you are aware, we think one of, if not the, key risks in the system

is rising interest rates. We see it in the volatility supply of yield enhancing structured products on the

dangerous belief that yields will never go higher. That “lower for longer” is the only alternative for global

Central Banks. As you have heard us say before, the only thing necessary for rates to go up, is for them to

CONVEX ASIA FUND LP | OCTOBER 2016 11

stop going down, and from one rate cutting/ZIRP/QE/NIRP country to the next, rates have stopped going

down. At least for the time being.

USD 10yr Swap

Source: Bloomberg

KRW 10yr ND IRS

Source: Bloomberg

CONVEX ASIA FUND LP | OCTOBER 2016 12

JPY 10yr Swap

Source: Bloomberg

GBP 10yr Swap

Source: Bloomberg

CONVEX ASIA FUND LP | OCTOBER 2016 13

EUR 10yr Swap

Source: Bloomberg

We could go on with chart after chart, but the above should get our two main points across: 1) At least for

the moment, rates have stopped going down; and 2) there is a large degree of correlation in interest rates.

So, in terms of “fire” danger, the big question is how much leverage/risk/vol selling has built up in

anticipation of ever lower rates. If this move higher continues and/or we do get a shock of some sort that

accelerates risk unwinds, we are likely to find out. As aggressively valued as equity markets, in general, are,

we think the bigger risk in the system likely lies around interest rates.

Despite the subtle move higher in the back end of yield curves across the world, markets in general continue

to trot along calmly, virtually unconcerned about any potential shakiness generated by the pending US

election. Equity volatility is low. Credit spreads are tight. Rates volatility, and in particular specific areas of

skew, are downright cheap. Somehow, a continued, or worse still an accelerated, move higher in yields is

likely to unhinge this complacency.

SGD/JPY Cyclical/Seasonal Chart

Source: Bloomberg

CONVEX ASIA FUND LP | OCTOBER 2016 14

CONVEX ASIA FUND RETURNS(1)

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD 2012 0.41% -1.11% -0.80% -0.63% -1.09% -0.90% -0.68% -0.39% ----5.08%5.08%5.08%5.08%

2013 -0.36% -0.26% -0.37% -0.33% 0.73% 1.16% -0.61% -0.06% -1.54% -0.94% -0.44% -0.59% ----3.58%3.58%3.58%3.58%

2014 -0.05% -0.40% -0.72% -0.57% -1.01% -1.14% -0.16% -0.78% 0.25% -0.55% 0.01% -0.15% ----5.15%5.15%5.15%5.15%

2015 0.77% -0.93% -0.51% -0.45% -0.42% 0.04% -0.24% 3.20% 0.31% -3.33% -0.75% -0.74% ----3.13%3.13%3.13%3.13%

2016 2.87% 1.81% -3.19% -0.14% -1.29% 0.31% -1.77% -1.67% -1.46% -0.85% ----5.39%5.39%5.39%5.39%

Past performance is no guarantee of future results, and an investment in the Fund could lose value. __________________________ (1) The investment services being offered in connection with this track record are neither offered by, nor associated with, Fortress Investment Group LLC, its affiliates or the directors, officers, employees, members, partners, shareholders or controlling persons of any of the foregoing (collectively, “Fortress”). This track record reflects investment returns resulting from the investment activities of the Fortress Convex Asia Master Fund of which Mr David Dredge as CIO and Mr Julian Ings-Chambers as Managing Director from 11 October 2011 through the termination date, 30 June 2016, on behalf of Fortress clients during the period specified above, during which the track record was maintained by Fortress in the normal course of business solely for Fortress’s use. For the avoidance of doubt, this document is not associated with Fortress’s business in any way, and Fortress will not have any future association with the investment funds or advisory services discussed herein. Further, you should not view the inclusion of the track record herein as an indication that Fortress endorses any such investment fund or services because Fortress expressly disclaims any such endorsement. Fortress disclaims all liability associated with these materials. To the extent you choose to make an investment or otherwise engage in a relationship with any person based on this track record, you do so at your own risk and there can be no assurance that results similar to those in the track record will be achieved.

All performance figures through 2014 and 2015 are based on audited financial information and, with respect to 2016, are based on estimated and unaudited financial information and are, in each case, confidential. The performance data set forth above reflect returns, net of all fees and expenses, for both Class A and Class B day one “new issue” eligible investors. Allocation of “new issues” to “new issue” eligible investors may result in returns that are higher than returns earned by other investors.

Investors in Class A are subject to 1.5% management fee, 20% incentive allocation, and other expenses. The descriptions of the management fees, incentive allocations, and other expenses to which investors are subject are set forth in detail in the Fund's offering documents. The summaries in this paragraph are not binding and do not alter the terms of such documents, which govern in all respects.

The Class A returns are hypothetical and projected from the Class B returns (a share class traded pari passu with Class A), with the Class A fee structure imposed upon them. The Class A returns do not represent profit and loss that any investor has actually received.

The Class B returns have not been provided as this class is now closed to new investment.

CONVEX ASIA FUND LP - CLASS A NET INVESTOR RETURNS

CONVEX ASIA FUND LP | OCTOBER 2016 15

DISCLOSURE

This document is intended for professional use only; it should not be relied upon by private clients. It is provided for information

purposes only and should not be interpreted as investment advice. It does not purport to be an inducement, recommendation or offer to

invest in any fund. Any offering is made only pursuant to the relevant offering document, together with the current audited financial

statements of the relevant fund, if available, and the relevant subscription/application, all of which must be read in their entirety. No

offer to purchase securities will be made or accepted prior to receipt by the offeree of these documents and the completion of all

appropriate documentation. Whilst the information contained in this document has been prepared in good faith, no representation or

warranty, express or implied, is given by City Financial Investment Company Limited or any of its Directors, partners, officers, affiliates

or employees. Past performance is not a guide to future performance. City Financial Investment Company Limited (Registration No.

020473901) is incorporated in England and Wales and the registered office is at 62 Queen Street, London EC4R 1EB. The company is

authorised and regulated by the Financial Conduct Authority. The representative of the Fund in Switzerland is Hugo Fund Services SA, 6

Cours de Rive, 1204 Geneva. The distribution of Shares in Switzerland must exclusively be made to qualified investors. The place of

performance for Shares in the Fund distributed in Switzerland is at the registered office of the Representative.