2016 BP Madrid Forum on WORKING GROUP FOR Energy ... · 7 March Santiago de Compostela(Galicia) -...

Transcript of 2016 BP Madrid Forum on WORKING GROUP FOR Energy ... · 7 March Santiago de Compostela(Galicia) -...

Prepared by Peter Sweatman, CEO Climate Strategy

2016 BP Madrid Forum on Energy & Sustainability

An Energy Transition for Spain – The Residential Sector

September 28th 2016

WORKING GROUP FOR

BUILDINGS RENOVATION (GTR)Sponsored by:

2

Valentín Alfaya Director de Calidad y Medio Ambiente del Grupo Ferrovial.

Luis Álvarez-Ude Arquitecto

Xavier Casanovas Director de Rehabilitación y Medio Ambiente del Colegio de Aparejadoresy Arquitectos Técnicos de Barcelona.

Albert Cuchí Universitat Politècnica de Catalunya. Barcelona Tech.Enrique Jiménez Larrea Abogado, ex-Director del IDAE.

Francisco J. González Profesor de la Escuela de Arquitectura de la Universidad Europea de Madrid.Fernando Prats Asesor del Centro Complutense de Estudios e Información Medioambiental

para el programa Cambio Global España 2020/50.Juan Rubio del Val Director de la Sociedad Municipal de Rehabilitación de Zaragoza.

Peter Sweatman Director general de Climate Strategy & Partners.

Alicia Torrego Gerente de la Fundación Conama.

Ignacio de La Puerta Arquitecto

Dolores Huerta Secretaria Técnica de GBCe

GTR Members

Coordinated by:

GTR is a Rehabilitation Working Group of 12 Experts workingon Energy Transition of Spain’s Builidngs since 2011

Sponsored by:

3

Context: Some of Europe’s most Needy Buildings, a Great Plan, but very Limited Activity…

Spanish Housing, 1% of homes have rating of energy excellence

Only 16% of Spanish homes have an energy rating between A and D. One out two Spaniards is not aware of energy efficiency ratings.

August 8th, 2016

The government ought to implement EU Directives effectively Despite of having drafted one of the best docs and strategies for the EU, the Spanish rehabilitation sector issitll unable to take off September 12th, 2016

4

More Context: 11% of Spanish homeowners can’t afford to heat their home properly in Winter

Percentage of inhabitants that cannot afford

to heat their home properly during Winter in the EU27

Graph by Asociación de Ciencias Ambientales (ACA) using data from EU-SILC and Eurostat, 2016

Percentage of Spanish Households that allocate a particular

amount of their income towards energy 2006 - 2014

Graph by ACA using data from EPF and INE, 2016

% H

omes

5

GTR 2011 Report

Has gained momentum among Spanish policy makers and private sector

GTR 2012 Report

It is an update which has furthered the model and its conclusions

GTR 2014 Report

A National Strategy for Rehabilitation

2015-2016

Assessment of the Autonomous Communities

Study onfinancing tools. GTR Finance

Review of the2017 National

Strategy:

Since 2011, GTR has been analyzing opportunities to assist theenergy transition of Spanish Buildings…

GTR = Working Group for Buildings Renovation 2011-2016

6

1) GTR LOCAL

2) GTR FINANCE

3) GTR CONCLUSIONS

Since Spain entered its “Political Transition”, GTR has focusedat the local level and on finance…

7

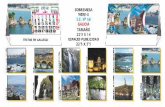

March

Santiago de Compostela (Galicia) -

1st Build Upon Workshop with Autonomous Communities

(CCAA) Reps (14)

50 participants

April

Madrid -Roundtable about

the Future and Innovation in

Mature Sectors 60 participants

June JulyMay September

Madrid –Leader’s Summit200 participants

“GTR Local” targets engagement with Spanish Regions and Cities to identify opportunities, projects and barriers to ET(R)…

Zaragoza (Aragón) -2nd Build Upon Workshop,

formation of CCAA Working Group and meeting of

GTR Cities repsGeneral Directors from

Andalucía, Cataluña, Aragón y

Castilla León

Madrid -Event “Sustainable and Future

Cities” by the FundaciónRenovables

90 participants

Madrid -II Casa que Ahorra Forum incl,

reps from 4 main political parties

35 participants

Valladolid (Castilla y León) -

3rd Build Upon Workshop,

60 participants

Madrid -Event “Connected Cities, Cities with Future” by the Fundación

Alternativas40 participants

Madrid -2nd meeting of the CCAA

Working GroupReps of 8 CAAA

8

“Autonomous Communities: The EssentialAdministrative Step for Renovation”

1) Catalytic Role of the Autonomous Communities:Review of Administrative Role

• Took place in Santiago de Compostella, Galicia. • Organized with the assistance of the Instituto Galego de Vivienda e Solo• Representatives from 14 CCAA• 50 participants

9

“Municipalities for Urban Renovation”

Step 2) Extension and Dialogue betweenRegions and City Administration on Renovation

• Took place in Zaragoza, Aragón• Cities have the power to conduct urban renewal activities

which can embed EE in their works

Organized with the assistance of:

10

“Financing, The last or first barrier for the Energy Rehabilitation of Buildings”

Step 3) Understanding the Role of Finance

• Took place in Valladolid, Castilla y León• 60 participants• Touched upon the key role of financing as an enabler of EE

Organized with the assistance of:

11

The city of Zaragoza invested € 4 million in July

2016 to retrofit 35 building and 345 homes.

100% financed by the city

Case Study 1 – City Funded Deep Renovation:35 buildings and 345 homes in Zaragoza improve their EE

Retrofits aim to reduce energy consumption by

50% in buildings older than 45 years.

Zaragoza is moving in the right direction when

reducing emissions. Building’s emissions were

reduced by 8% in the 2005 – 2015 period.

Image by Zaragoza Vivienda, 2016

Image by Zaragoza Vivienda, 2016

12

Launched in 2016, provides subsidies for

EE measures in homes.

€ 16 million in funding.

Subsidies of 35% for majority of

homes in Madrid

Subsidies of up to 70% in low

income áreas (see graph)

Expected to create 3,500 jobs.

Case Study 2: Urban Renewal in MadridMadrid’s Plan MAD-RE

Graph by Idealista using data from City of Madrid, 2016

Preferential Areas to Promote Urban Renewal

13

Renovation of 854 homes located in 14

blocks in the Canyelles neighborhood in

Barcelona.

Project worth € 13 million.

60% financed by the Catalan

Generalitat

25% financed by the City of Barcelona

Homeowners have contributed 15% of

the capital

If home owners have incomes below

€ 24.000, subsidies can cover up to

100% of the renovation works

Case Study 3: Urban Renewal in CataloniaCatalan Generalitat renovates 854 homes in Barcelona

Images by el Digital D Barcelona, 2015

In parallel, GTR established a “Finance working group”with 50 members and supported by the CNC…

• GTR Finance Mandate:‒ Define those essential and much

needed instruments for thefinancing of the sector;

‒ Identifiy changes needed to increase the economic activityregarding energy works

• 50 participants in the GTR Finance TG • Participants belonged to multiple

sectors:‒ Banks, Private Sector, Public

Sector, Experts, Industry, ESCOs, SMEs, Trade Associations, Distributors of plumbing and electricity supplies, SpanishBanking Association, ConstructionCompanies, and NGOs

14

Central Administration, 7, 15.20% Regional or Municipal

Administration, 1 , 2.20%

Government Agency, 0, 0.00%

Bank, 3, 6.50%

Consultancy, 6, 13.00%

Coorporate, 7, 15.20%

Independent Expert, 5, 10.90%

University / I+D, 7, 15.20%

NGO, 8, 17.40%

ESCO/ Industry, 4, 8.70%

Other (Please specificy), 12, 26.10%

GTR Finance = Seeks to solve financing needs for the energy rehabilitation of buildings

16

GTR Finance’s survey determined “Top 10” Demand and Supply Drivers for Energy Renovation in Spain

DEMAND SUPPLYBehavioral Economics (personal priorities) Price of energy

Price of energy Definition and common understanding of the value of energy cost savings

(Individual/ Owner) Payment Capacity Sustainable Real Estate Funds

Clear Business Case Use of National Energy Eficiency Fund

Tailored Financial Product availability Use of European Structural & Investment FundsMeasurement, Reporting & Verification (MRV)

and Quality Assurance Communication between market actors

Body of Evidence (including Social Benefits and Costs) Regulatory Stability

Buildings Regulation, Certification and Energy Performance Certificates Fiscal Support

Awareness of appropriate timing for energy efficiency measures within the traditional

building cycle

Buildings Regulation, Certification and Energy Performance Certificates

"Green Premium" / Brown Discount Risk-return targets

Demand Drivers vary greatly by Segment

Tertiary / Commercial

Public

Primary Residence occupied by its owner

Rented Housing

Public Housing

17

Analysis: Results for Demand Drivers

18

GTR Finance notes the following results based on the Expert Survey:

Demand drivers are aligned across several sectors except in Public Buildings

Energy Efficiency is not a priority in any segment when compared to Other Priorities

There is a lack of awareness (except for the Public Sector) of the multiple economic

benefits inherent to energy efficiency upgrades

The Value Increase (“Green Premium”) due to retrofits is indeed a big driver within

housing and commercial buildings

A Tax benefit could significantly catalyze the retrofit of properties

Comparing Spain vs EU, Demand Drivers for Residential Properties are Surprisingly Similar…

Tertiary / Commercial

Public

Primary Residence occupied by its owner

Rented Housing

Public Housing

19

20

GTR Finance notes the following results based on the Expert Survey:

In Spain the price of energy and the availability of capital is more relevant than the

EU average, except in dwelling occupied by owners

The demand drivers for energy renovation in the Spanish public and comercial

sectors differs considerably other EU countries

Regulatory instability and human capacity are less important in Spain when

compared with other EU countries

In Spain, Technical asistance, Data and Rules on Accounting are not percieved as

such strong barriers as in other EU countries

Analysis: Spain vs EU, Demand By Segment

21

Analysis: Supply Drivers by Segment

Tertiary / Commercial

Public

Primary Residence occupied by its owner

Rented Housing

Public Housing

Analysis: Results for Supply Drivers

22

GTR Finance notes the following results based on the Expert Survey:

Price of energy is the most relevant factor for Financial Institutions finance supply

in all sectors

The understanding of the economic value of energy savings are certainly relevant

drivers except in properties for rent and public housing

For housing, risk-return targets for banks is a significant barrier – yet not for the

public and commercial sectors

Tax benefits could also catalyze the supply of financing for the rehabilitation of

housing

23

Analysis: Spain vs EU, Supply By Segment

Tertiary / Commercial

Public

Primary Residence occupied by its owner

Rented Housing

Public Housing

24

GTR Finance notes the following results based on the Expert Survey:

In the case of Housing in Spain, the price of energy and the availability of capital are

more relevant supply drivers than the EU average

The lack of funds and tailored financial products for rehabilitation in all sectors is

indeed very relevant in Spain

The supply of the so called “integral rehabilitation” of multiple measures (energy

and access) is also relevant

Standardization and Technical Issues are not perceived as barriers in terms of

supply drivers, contrary to the EU level survey

Analysis: Spain vs EU, Supply By Segment

25

GTR Finance: “Identify challenges and barriers that prevent the financing of the sector”

Barriers in terms of subsidies and private financing.

Clear identification of the collateral provider. Who will pay back the loan? The occupier/user, the

neighbors association, a third party?

Collateral ought to be clear and measurable. The monetization of energy savings is quite complex

for banks.

Payback periods of over 5 and 8 years are barriers for private banks, as they face ever changing

and complex regulatory barriers.

Loan Amounts. Increased financing leads to banks requiring greater collateral making access to

financing harder. This has a greater adverse effect on the integral rehabilitation rather than for

instance just changing boilers.

Assessment: Barriers for Private Financing

26

GTR Finance: “Identify challenges and barriers that prevent the financing of the sector”

Barriers in terms of subsidies and private financing.

Develop a single “Model-Type” for each segment: The challenge remains finding a tailored

business model with clear definition for each building segment and typology

Guarantee Scheme or Financing Collateral. Models that can increase finance flows include:

Registered claims in the Property Rights Registry, collective guarantees (eg. SAECA type) or partial coverage

(Junker Plan), payment insurance, “equity” like complex financial products, in addition ESCOs can also take part

in the financing or providing part of the collateral.

Clear Fiscal Signal: Fiscal measures ought to foster strategic economic activities. The possibilities to

provide incentives to users through these activities are sometimes more effective than those with direct subsidies

because they don’t require as much paperwork/ processing. VAT, deductions on personal income and property

taxes are fiscal instruments capable of promoting the energy rehabilitation of dwellings. Taxation on existing

subsidies remains a problem.

* SAECA is Spain’s Sociedad Anónima Estatal de Caución Agraria

Assessment: Barriers for Private Financing

28

0A Regulatory Framework

that Promotes a Culture that

Upholds Energy Efficiency#EnergyEfficiencyFirst

Spain lacks a massive offer of energy rehabilitation

supported by its energy companies, retail networks,

complemented by a fund that acts as a “Green

Bank” focused on the development of energy

efficiency projects.

Energy Prices are not good signals as they are

now more “fixed” than floating and prices are

influenced by Govtwhich poses uncertainty in the

future.

29

1Educate and train

“Accredited Agents” /

“Technical Tutors” /

“Project Managers”

Mainly for neighbor associationsas they need

professionals that understand and promote the

energy rehabilitation model and are trained

and accredited to manage suchprojects on

behalf of the owners.

These professionals ought to be

knowledgeable with the financing of the

projects as well

30

2 Industrialization & Replication of “Model Types”Each climatezone and building type ought to have a “model type”.

The supply chain for “model types” should be transparent and its financing

should be simple and accesible in all Banks’ branches.

31

3 A financing packet that is simple and tailored

specifically for energy retrofits

…and easy to explain

The financing packet for energy retrofits ought to provide key elements such as the loan, public

subsidies and precise instructions that would enable attaining tax deductions. Also, this packet

should be available via a network of accredited agents.

32

Spanish work connected to EEFIG which launchesPan-EU Database (DEEP) in October…

Users can access:

Latest EEFIG Report &

supporting materials

1 2

Engage with the

“Energy Efficiency De-risking Project”

Become a user and/or become a data

provider and engage in an expert

dialogue which contributes to

enhancement of the fundamentals of

energy efficiency

investments in the buildings and

corporate sectors

3

Use the “EEFIG National”

Tool & Database

It relies on used a standardized method

and process to engage with key expert

stakeholders in Spain, France, Germany,

Poland and Bulgaria over 12 months.

Each country’s results can be found with a

series of summaries as well as an

interactive review of the EU data

Thank you from GTR – @ClimateSt

33

This document has been prepared for specific use andshould not be published or circulated outside of its intendedaudience. The facts and figures are derived from publicsources and have not been independently verified byClimate Strategy who provides no guarantees for itsaccuracy nor completeness nor will assume any liabilitiesfor such arising from any third party use of the contents.Any opinions in this document constitute the presentopinion of Climate Strategy which is subject to changewithout notice. There are no financial services marketedhere nor intended as promoted herein.

Please refer to website for further information.

Coordinado por:

Thanks!Please download GTR reports at:

www.climatestrategy.esWORKING GROUP FOR

BUILDINGS RENOVATION (GTR)

Sponsored by: