2016 Benefit Guide LGBS

description

Transcript of 2016 Benefit Guide LGBS

EFFECTIVE:

07/01/2016 - 6/31/2017

BENEFIT GUIDE

www.mybenefitshub.com/lgbs

LGBS

Benefit Contact Information 3 How to Enroll 4-5 Annual Benefit Enrollment 6-9 1. Benefit Updates 6 4. Eligibility Requirements 7 AUL a OneAmerica company Life and AD&D 8-11 Voya Hospital Indemnity 12-13 AUL OneAmerica company Disability 14-17 Voya Accident 18-21 Voya Critical Illness 22-23 5 Star FPP TI with Quality of Life Rider 24-27

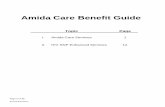

Table of Contents

HOW TO ENROLL

PG. 4

YOUR BENEFIT UPDATES: WHAT’S NEW

PG. 6

YOUR BENEFITS PACKAGE

PG. 8

FLIP TO...

Benefit Contact Information

BENEFIT ADMINISTRATORS HOSPITAL INDEMNITY CRITICAL ILLNESS Financial Benefit Services (800) 583-6908 www.mybenefitshub.com/lgbs

VOYA (800) 955-7736 www.voya.com

VOYA (800) 955-7736 www.voya.com

LGBS ADMINISTRATOR DISABILITY VOLUNTARY LIFE Christal Walker (512) 447-6675 [email protected]

AUL a OneAmerica company (800) 553-5318 Claims: (855) 517-6365 www.oneamerica.com

AUL a OneAmerica company (800) 583-6908 www.oneamerica.com

BASIC LIFE ACCIDENT INDIVIDUAL LIFE

AUL a OneAmerica (800) 553-5318 www.oneamerica.com

VOYA (800) 955-7736 www.voya.com

5 Star Life Insurance Company (800) 776-2322 www.5starlifeinsurance.com

Benefit Contact Information

!

How to Enroll

On Your Computer Access THEbenefitsHUB from your

computer, tablet or smartphone!

Our online benefit enrollment

platform provides a simple and

easy to navigate process. Enroll

at your own pace, whether at

home or at work.

www.mybenefitshub.com/lgbs

delivers important benefit

information with 24/7 access,

as well as detailed plan

information, rates and product

videos.

TEXT

“lgbs”

TO

313131

On Your Device Enrolling in your benefits just got

a lot easier! Text “lgbs” to 313131

to receive everything you need to

complete your enrollment.

Avoid typing long URLs and scan

directly to your benefits website,

to access plan information,

benefit guide, benefit videos, and

more!

SCAN: TRY ME

GO www.mybenefitshub.com/lgbs 1

2

Login Steps

3

Go to:

Click Login

Enter Username & Password

OR SCAN

All login credentials have been RESET to the default

described below:

Username:

The first six (6) characters of your payroll last name,

followed by the first letter of your payroll first name,

followed by the last four (4) digits of your Social

Security Number.

If you have six (6) or less characters in your payroll last

name, use your full payroll last name, followed by the

first letter of your payroll first name, followed by the

last four (4) digits of your Social Security Number.

Default Password:

Payroll Last Name* (lowercase, excluding punctuation)

followed by the last four (4) digits of your Social

Security Number.

Sample Password

l incola1234

l incoln1234

If you have trouble

logging in, click on the

“Login Help Video”

for assistance.

Click on “Enrollment Instructions” for more information about how to enroll.

Sample Username

LOGIN

Open Enrollment Tip

For your User ID: If you have less than six (6) characters in your payroll

last name, use your full payroll last name, followed by the first letter of

your payroll first name, followed by the last four (4) digits of your Social

Security Number.

All new supplemental benefits will be effective 7/1/2016

(Coverage requiring evidence of insurability may have a later effective date, if approved).

New carriers effective 7/1/2016: AUL a OneAmerica company: Basic Life and

AD&D, Voluntary Group Life & AD&D and Long Term Disability

Voya: Critical Illness Voya: Accident

Previous carriers will no longer be payroll deducted as of 7/1/2016 are:

UNUM basic and voluntary life Lincoln Critical Illness UNUM Accident UNUM Long Term Disability

IMPORTANT:

If you wish to maintain coverage in the above benefits you MUST login and re-enroll with the new carriers. If you do not, you will lose your coverage effective 7/1/2016.

New benefits available effective 7/1/2016: Voya: Hospital Indemnity AUL a OneAmerica company: Short Term

Disability 5 Star Family Protection Plan: Individual Life

Individual life policies with UNUM and

Fidelity will remain on payroll deduction. Voluntary Group Term Life:

The Voluntary Group Life plan is available this year on a guarantee issue basis (no health questions asked) for up to 5 times salary to a max of $250,000 for employee, $50,000 for spouse and $10,000 for children. For new coverage to become effective, employees must be actively at work on 7/1/2016 and dependents cannot be disabled.

Dates for open enrollment 5/23/2016 – 6/10/2016

Benefit Updates - What’s New:

SUMMARY PAGES

Annual Benefit Enrollment

SUMMARY PAGES

PLAN CARRIER MAXIMUM AGE

Accident VOYA Up to 26

Hospital Indemnity VOYA Up to 26

Critical Illness VOYA Up to 26

Voluntary Life AUL a OneAmerica company Up to 26

Individual Life 5 Star Up to 23

Employee Eligibility Requirements

Employees must work 30 regularly scheduled hours each week

for all supplemental benefits.

Eligible employees must be actively at work on the plan effective

date for new benefits to be effective, meaning you are physically

capable of performing the functions of your job on the first day

of work concurrent with the plan effective date. For example, if

your 2016 benefits become effective on July 1, 2016, you must

be actively-at-work on July 1, 2016 to be eligible for your new

benefits. Exempt employees are eligible for benefits first month

following 30 days and non exempt employees are eligible for

benefits first of month following 60 days.

Dependent Eligibility Requirements

Dependent Eligibility: You can cover eligible dependent

children under a benefit that offers dependent coverage,

provided you participate in the same benefit, through the

maximum age listed below. Dependents cannot be double

covered by married spouses within the LGBS or as both

employees and dependents.

If your dependent is disabled, coverage can continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your HR/Benefit Administrator to request a continuation of coverage.

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family. Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

About this Benefit

Life and AD&D YOUR BENEFITS PACKAGE

DID YOU KNOW?

AUL A ONEAMERICA COMPANY

This is a general overview of your plan benefits. If the terms of this outline differ from your policy, the policy will govern. Additional plan details on covered expenses, limitations and exclusions are included in the summary plan description located on the

LGBS Benefits Website: www.mybenefitshub.com/lgbs

cause of accidental deaths in the US, followed by poisoning, falls,

drowning, and choking.

#1

Motor vehicle crashes are the

Group Term Life including matching AD&D Coverage Life and AD&D insurance coverage amount of $15,000 at no

cost to you

Waiver of premium benefit

Accelerated life benefit

Additional AD&D Benefits: Seat Belt, Air Bag, Repatriation, Child Higher Education, Child Care, Paralysis/Loss of Use, Severe Burns

AUL's Group Voluntary Term Life Insurance Terms and Definitions

Eligible Employees: This benefit is available for employees who are actively at work on the effective date and working a minimum of 30 hours per week.

Flexible Choices: Since everyone's needs are different, this plan offers flexibility for you to choose a benefit amount that fits your needs and budget.

Accidental Death & Dismemberment (AD&D) If approved for this benefit, additional life insurance benefits may be payable in the event of an accident which results in death or dismemberment as defined in the contract. AD&D coverage is not included for dependents.

Guaranteed Issue Amounts: This is the most coverage you can purchase without having to answer any health questions. If you decline insurance coverage now and decide to enroll later, you will need to provide Evidence of Insurability.

Timely Enrollment: Enrolling timely means you have enrolled during the initial enrollment period when benefits were first offered by AUL, or as a newly hired employee within 31 days following completion of any applicable waiting period.

Evidence of Insurability: If you elect a benefit amount over the Guaranteed Issue Amount shown above for you or your eligible dependents, or you do not enroll timely, you will need to submit a Statement of Insurability form for review. Based on health history, you and / or your dependents will be approved or declined for insurance coverage by AUL.

Guaranteed Increase in Benefit: If eligible, this benefit allows you to increase your coverage every year as your life insurance needs change. You may be able to increase your benefit amount by $10,000 every year until you reach your maximum amount, without providing Evidence of Insurability. If Evidence of Insurability is applied for and denied, please be aware Guaranteed Increase in Benefits will not be made available to you in the future.

Life Event Benefit: You may be able to add coverage or increase your benefit amount if you apply within 31 days from the date of a life event. Examples of a life event include marriage, the birth of a child, or adoption.

Continuation of Coverage Options: Portability Should your coverage terminate for any reason, you may be eligible to take this term life insurance with you without providing Evidence of Insurability. You must apply within 31 days from the last day you are eligible. The Portability option is available until you reach age 70.

OR

Conversion Should your life insurance coverage, or a portion of it, cease for any reason, you may be eligible to convert your Group Term Coverage to Individual Coverage without providing Evidence of Insurability. You must apply within 31 days from the last day you are eligible. Accelerated Life Benefit: If diagnosed with a terminal illness and have less than 12 months to live, you may apply to receive 25%, 50% or 75% of your life insurance benefit to use for whatever you choose. Waiver of Premium: If approved, this benefit waives your and your dependents' insurance premium in case you become totally disabled and are unable to collect a paycheck. Reductions: Upon reaching certain ages, your original benefit amount will reduce to a percentage as shown in the following schedule.

This invitation to inquire allows eligible employees an opportunity to inquire further about AUL's group insurance and is limited to a brief description of any losses for which benefits are payable. The contract has exclusions, limitations reduction of benefits, and terms under which the contract may be continued in force or discontinued.

Life and AD&D

Age: 65 70 75 80

Reduces To: 65% 40% 25% 15%

Employee Guaranteed Issue Amount $250,000

Spouse Guaranteed Issue Amount $50,000

Child Guaranteed Issue Amount $10,000

Life and AD&D

Monthly Payroll Deduction Illustration

About your benefit options:

You may select a minimum benefit of $10,000 up to a maximum amount of $1,000,000, in increments of $10,000, not to exceed 5 times your annual base salary only, rounded to the next higher $10,000. AD&D coverage is not included for dependents.

Amounts requested above $250,000 for an Employee, $50,000 for a Spouse, or any amount not requested timely will require Evidence of Insurability.

Employee must select coverage to select any Dependent coverage.

Dependent coverage cannot exceed 100% of the Voluntary Term Life amount selected by the Employee.

EMPLOYEE ONLY OPTIONS (based on Employee's age as of 06/01)

Life & AD&D 0-19 20-24 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75+

$10,000 $.50 $.50 $.50 $.70 $.90 $1.50 $2.60 $4.10 $7.30 $12.90 $20.40 $29.90 $29.90

$20,000 $1.00 $1.00 $1.00 $1.40 $1.80 $3.00 $5.20 $8.20 $14.60 $25.80 $40.80 $59.80 $59.80

$30,000 $1.50 $1.50 $1.50 $2.10 $2.70 $4.50 $7.80 $12.30 $21.90 $38.70 $61.20 $89.70 $89.70

$40,000 $2.00 $2.00 $2.00 $2.80 $3.60 $6.00 $10.40 $16.40 $29.20 $51.60 $81.60 $119.60 $119.60

$50,000 $2.50 $2.50 $2.50 $3.50 $4.50 $7.50 $13.00 $20.50 $36.50 $64.50 $102.00 $149.50 $149.50

$90,000 $4.50 $4.50 $4.50 $6.30 $8.10 $13.50 $23.40 $36.90 $65.70 $116.10 $183.60 $269.10 $269.10

$100,000 $5.00 $5.00 $5.00 $7.00 $9.00 $15.00 $26.00 $41.00 $73.00 $129.00 $204.00 $299.00 $299.00

$150,000 $7.50 $7.50 $7.50 $10.50 $13.50 $22.50 $39.00 $61.50 $109.50 $193.50 $306.00 $448.50 $448.50

$200,000 $10.00 $10.00 $10.00 $14.00 $18.00 $30.00 $52.00 $82.00 $146.00 $258.00 $408.00 $598.00 $598.00

$250,000 $12.50 $12.50 $12.50 $17.50 $22.50 $37.50 $65.00 $102.50 $182.50 $322.50 $510.00 $747.50 $747.50

SPOUSE ONLY OPTIONS (based on Employee's Age as of 06/01

Life Options 0-19 20-24 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75+

$10,000 $.30 $.30 $.30 $.50 $.70 $1.30 $2.40 $3.90 $7.10 $12.70 $20.20 $29.70 $29.70

$20,000 $.60 $.60 $.60 $1.00 $1.40 $2.60 $4.80 $7.80 $14.20 $25.40 $40.40 $59.40 $59.40

$30,000 $.90 $.90 $.90 $1.50 $2.10 $3.90 $7.20 $11.70 $21.30 $38.10 $60.60 $89.10 $89.10

$40,000 $1.20 $1.20 $1.20 $2.00 $2.80 $5.20 $9.60 $15.60 $28.40 $50.80 $80.80 $118.80 $118.80

$50,000 $1.50 $1.50 $1.50 $2.50 $3.50 $6.50 $12.00 $19.50 $35.50 $63.50 $101.00 $148.50 $148.50

Life and AD&D

CHILD(REN) OPTIONS (Premium shown for Child(ren) reflects the cost for all eligible dependent children)

Child(ren) 6 months to age 26 Child(ren) live birth to 6 months Monthly Payroll Deduction Life

Amount

Option 1: $10,000 $1,000 $1.70

About Premiums: The premiums shown above may vary slightly due to rounding; actual premiums will be calculated by American United Life Insurance Company® (AUL), and may increase upon reaching certain age brackets, according to contract terms, and are subject to change.

Hospital Confinement Indemnity Insurance pays a daily benefit if you have a covered stay in a hospital*, critical care unit and rehabilitation facility. The benefit amount is determined based on the type of facility and the number of days you stay. Hospital Confinement Indemnity Insurance is a limited benefit policy. It is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act.

About this Benefit

Hospital Indemnity YOUR BENEFITS PACKAGE

The median hospital costs per stay have steadily grown to over

$10,000.

DID YOU KNOW?

VOYA

This is a general overview of your plan benefits. If the terms of this outline differ from your policy, the policy will govern. Additional plan details on covered expenses, limitations and exclusions are included in the summary plan description located on the

LGBS Benefits Website: www.mybenefitshub.com/lgbs

2003 2008 2012

$8,800 9,600 10,400

Hospital Indemnity

What Hospital Confinement Indemnity Insurance benefits are available? The following list includes the benefits provided by Hospital Confinement Indemnity Insurance. The benefit amounts paid depend on the type of facility and number of days of confinement. For a list of standard exclusions and limitations, go to the end of this document. For a complete description of your available benefits, along with applicable provisions, conditions on benefit determination, exclusions and limitations, see your certificate of insurance and any riders. You employer offers you the opportunity to purchase a daily benefit amount of $100 or $300. The benefit amount is determined by the type of facility in which you are confined:

Hospital—The benefit is 1x the daily benefit amount ($100 or $300), up to 30 days per confinement.

Critical care unit (CCU)—The benefit is 2x the daily benefit amount ($200 or $600), up to 15 days per confinement.

Rehabilitation facility—The benefit is one-half of the daily benefit amount ($50 or $150), up to 30 days per confinement.

How much does Hospital Confinement Indemnity Insurance cost? All employees pay the same rate, no matter their age. See the chart below for the premium amounts. Rates shown are guaranteed until July 1, 2018.

*See the certificate of insurance and any riders for a complete list of available benefits, along with applicable provisions, exclusions and limitations.

Exclusions and Limitations Exclusions in the Certificate, Initial Confinement Benefit, Spouse Hospital Confinement Indemnity Insurance and Child Hospital Confinement Indemnity Insurance are listed below. (These may vary by state.) Benefits are not payable for any loss caused in whole or directly by any of the following*:

Participation or attempt to participate in a felony or illegal activity.

Operation of a motorized vehicle while intoxicated.

Suicide, attempted suicide or any intentionally self-inflicted injury, while sane or insane.

War or any act of war, whether declared or undeclared, other than acts of terrorism.

Loss that occurs while on full-time active duty as a member of the armed forces of any nation. We will refund, upon written notice of such service, any premium which has been accepted for any period not covered as a result of this exclusion.

Alcoholism, drug abuse, or misuse of alcohol or taking of drugs, other than under the direction of a doctor.

Elective surgery, except when required for appropriate care as a result of the covered person’s injury or sickness.**

Riding in or driving any motor-driven vehicle in a race, stunt show or speed test.

Operating, or training to operate, or service as a crew member of, or jumping, parachuting or falling from, any aircraft or hot air balloon, including those which are not motor-driven. Flying as a fare-paying passenger is not excluded.

Engaging in hang-gliding, bungee jumping, parachuting, sail gliding, parasailing, parakiting, kite surfing or any similar activities.

Practicing for, or participating in, any semiprofessional or professional competitive athletic contests for which any type of compensation or remuneration is received.

Tier Daily Benefit Monthly Rate

Employee $100 14.88

EE +Spouse $100 29.13

EE + Children $100 22.83

EE + Family $100 37.08

Tier Daily Benefit Monthly Rate

Employee $300 42.13

EE +Spouse $300 82.39

EE + Children $300 63.48

EE + Family $300 103.74

Low Option:

High Option:

About this Benefit

Disability YOUR BENEFITS PACKAGE

Just over 1 in 4 of today's 20 year-olds will become disabled before

they retire.

DID YOU KNOW?

34.6 months is the duration of the

average disability claim.

This is a general overview of your plan benefits. If the terms of this outline differ from your policy, the policy will govern. Additional plan details on covered expenses, limitations and exclusions are included in the summary plan description located on the

LGBS Benefits Website: www.mybenefitshub.com/lgbs

AUL A ONEAMERICA COMPANY

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

Long Term Disability

Eligible Employees: This benefit is available for employees who are actively at work on the effective date and working a minimum of 30 hours per week.

Flexible Choices: Since everyone's needs are different, these plans offer flexibility for you to choose a benefit option that fits your income replacement needs and budget.

Portability: Should your coverage terminate, you may be eligible to take this disability insurance with you without providing Evidence of Insurability. You must apply within 31 days from the last day you are eligible.

Waiver of Premium: If approved, this benefit waives your Disability insurance premium in case you become disabled and are unable to collect a paycheck. Elimination Period: This is a period of consecutive days of disability before benefits may become payable under the contract.

Total Disability: You are considered disabled if, because of injury or sickness, you cannot perform the material and substantial duties of your regular occupation, you are not working in any occupation and are under the regular attendance of a physician for that injury or sickness.

Partial Disability: You may be paid a partial disability benefit, if because of injury or sickness, you are unable to perform every material and substantial duty of your regular occupation on a full-time basis, are performing at least one of the material and substantial duties of your regular occupation, or another occupation, on a full or part- time basis, and are earning less than 50% of your pre-disability earnings due to the same injury or sickness. Partial Disability is applicable to option 1.

Residual: The elimination period can be satisfied by total disability, partial disability, or a combination of both. Residual is applicable to option 1.

Return to Work: You may be able to return to work for a specified time period without having your partial disability benefits reduced according to the contract. The Return to Work Benefit is

offered up to a maximum of 12 months. Return to Work is applicable to option 1.

Integration: The method by which your benefit may be reduced by Other Income Benefits. Integration is applicable to option 1.

Pre-Existing Condition Limitations: The pre-existing period is 3/12. Certain disabilities are not covered if the cause of the disability is traceable to a condition existing prior to your effective date of coverage. A pre-existing condition is any condition for which a person would have received medical treatment or consultation, taken or were prescribed drugs or medicine, or received care or services, including diagnostic measures, within a time-frame specified in the contract. You must also be treatment-free for a time-frame specified in some contracts following your individual effective date of coverage.

About Your Benefits: Long Term Disability (LTD) benefits are illustrated and paid

on a monthly basis.

Maximum benefit amounts are based upon a percentage of covered earnings. Potential benefits are reduced by other income offsets including but not limited to Social Security benefits.

To Determine Your Estimated Monthly Benefit Enter your Monthly Salary:

Multiply Step 1 by 60%: . If this number is less than $10,000, this is your estimated Monthly Benefit. If this number is $10,000 or greater, your estimated Monthly Benefit is $10,000.

Option 1 WDL

Benefit Percentage 60%

Maximum Monthly Benefit

$10,000

Elimination Period 90/90

Maximum Benefit Duration

SSFRA

Pre-Existing Condition Period

3/12

Short Term Disability

Eligible Employees: This benefit is available for employees who are actively at work on the effective date and working a minimum of 30 hours per week.

Flexible Choices: Since everyone's needs are different, these plans offer flexibility for you to choose a benefit option that fits your income replacement needs and budget.

Portability: Should your coverage terminate, you may be eligible to take this disability insurance with you without providing Evidence of Insurability. You must apply within 31 days from the last day you are eligible.

Waiver of Premium: If approved, this benefit waives your Disability insurance premium in case you become disabled and are unable to collect a paycheck. Elimination Period: This is a period of consecutive days of disability before benefits may become payable under the contract.

Total Disability: You are considered disabled if, because of injury or sickness, you cannot perform the material and substantial duties of your regular occupation, you are not working in any occupation and are under the regular attendance of a physician for that injury or sickness.

Partial Disability: You may be paid a partial disability benefit, if because of injury or sickness, you are unable to perform every material and substantial duty of your regular occupation on a full-time basis, are performing at least one of the material and substantial duties of your regular occupation, or another occupation, on a full or part- time basis, and are earning less than 80% of your pre-disability earnings due to the same injury or sickness. Partial Disability is applicable to option 1.

Residual: The elimination period can be satisfied by total disability, partial disability, or a combination of both. Residual is applicable to option 1.

Return to Work: You may be able to return to work for a specified time period without having your partial disability benefits reduced according to the contract. The Return to Work Benefit is

offered up to a maximum of 12 months. Return to Work is applicable to option 1.

Integration: The method by which your benefit may be reduced by Other Income Benefits. Integration is applicable to option 1.

Pre-Existing Condition Limitations: The pre-existing period is 3/12. Certain disabilities are not covered if the cause of the disability is traceable to a condition existing prior to your effective date of coverage. A pre-existing condition is any condition for which a person would have received medical treatment or consultation, taken or were prescribed drugs or medicine, or received care or services, including diagnostic measures, within a time-frame specified in the contract. You must also be treatment-free for a time-frame specified in some contracts following your individual effective date of coverage.

About Your Benefits: Short Term Disability (STD) benefits are illustrated and

paid on a weekly basis.

Amounts not requested timely will require Evidence of Insurability.

Maximum benefit amounts are based upon a percentage of covered earnings. Potential benefits are reduced by other income offsets including but not limited to Social Security benefits.

To Determine Your Estimated Weekly Benefit Enter your Weekly Salary:

Multiply Step 1 by 60%: . If this number is less than $1,500, this is your estimated Weekly Benefit. If this number is $1,500 or greater, your estimated Weekly Benefit is $1,500.

Option 1 -WDS

Benefit Percentage 60%

Maximum Weekly Benefit

$1,500

Elimination Period 14/14

Maximum Benefit Duration

11 weeks

Pre-Existing Condition Period

3/12

Disability Rates

Long Term Disability

MONTHLY PREMIUM RATES PER $100 OF COVERED MONTHLY EARNINGS

(based on Employee's age as of 07/01)

Age Brackets Opt 1 WDL

0 - 19 $.135

20 - 24 $.135

25 - 29 $.135

30 - 34 $.194

35 - 39 $.303

40 - 44 $.438

45 - 49 $.565

50 - 54 $.793

55 - 59 $1.088

60 - 64 $1.400

65 - 69 $1.484

70 - 74 $1.855

75+ $1.855

Short Term Disability

About Premiums: The premiums shown above may vary slightly due to rounding; actual premiums will be calculated by American United Life Insurance Company® (AUL), and may increase upon reaching certain age brackets, according to contract terms, and are subject to change.

MONTHLY PREMIUM RATES PER $10 OF COVERED WEEKLY EARNINGS

(based on Employee's age as of 07/01)

Age Brackets Opt 1 WDL

0 - 19 $.770

20 - 24 $.770

25 - 29 $.770

30 - 34 $.770

35 - 39 $.590

40 - 44 $.500

45 - 49 $.540

50 - 54 $.650

55 - 59 $.800

60 - 64 $.930

65 - 69 $1.000

70 - 74 $1.000

75+ $1.000

Accident insurance is designed to supplement your medical insurance coverage by covering indirect costs that can arise with a serious, or a not-so-serious, injury. Accident coverage is low cost protection available to you and your family without evidence of insurability.

About this Benefit

Accident YOUR BENEFITS PACKAGE

of disabling injuries suffered by American workers are not work related.

DID YOU KNOW?

36% of American workers report they always or usually live paycheck to paycheck.

2/3

VOYA

This is a general overview of your plan benefits. If the terms of this outline differ from your policy, the policy will govern. Additional plan details on covered expenses, limitations and exclusions are included in the summary plan description located on the

LGBS Benefits Website: www.mybenefitshub.com/lgbs

Accident

What accident benefits are available?

The following list includes the benefits provided by Accident Insurance. The benefit amounts paid depend on the type of injury and care received. You may be required to seek care for your injury within a set amount of time. You must be insured under the policy for 30 days before benefits are payable. Note

that there may be some variation by state. For a list of standard exclusions and limitations, go to the end of this document. For a complete description of your available benefits, along with applicable provisions, exclusions and limitations, see your certificate of insurance and any riders.

EVENT BENEFIT

Accident Hospital Care

Surgery Open abdominal, thoracic

$2,500

Surgery exploratory or without repair

$250

Blood, plasma, platelets $400

Hospital admission $1,400

Hospital confinement Per day up to 365

$300

Critical care unit confinement per day, up to 15 days

$600

Rehabilitation facility confinement per day for 90 days

$175

Coma Duration of 14 or more days

$7,000

Transportation per trip, up to 3 per accident

$400

Lodging Per day, up to 30 days

$150

Family care per child, up to 45 days

$30

Follow-up care

Medical equipment duration of 14 or more days

$250

Physical therapy duration of 14 or more days

$50

Prosthetic device (one) $1,200

Prosthetic device (two or more) duration of 14 or more days

$2,400

Common injuries

Burns second degree, at least 36% of the body

$1,250

Burns 3rd degree, at least 9 but less than 35 square inches of the

body $2,500

Burns 3rd degree, 35 or more square inches of the body

$18,000

Skin Grafts 25% of burn benefit

Emergency dental work while hospital confined

$250 crown, $125 extraction

Eye Injury removal of foreign object

$75

Eye Injury surgery

$300

Torn Knee Cartilage surgery with no repair or if cartilage is shaved

$150

Torn Knee Cartilage surgical repair

$750

Laceration1 treated no sutures

$60

Accident

EVENT BENEFIT Laceration1 sutures up to 2”

$120

Laceration1 sutures 2” – 6”

$480

Laceration1 sutures over 6”

$960

Ruptured Disk surgical repair

$600

Tendon/Ligament/Rotator Cuff One, surgical repair

$600

Tendon/Ligament/Rotator Cuff Two or more, surgical repair

$900

Tendon/Ligament/Rotator Cuff Exploratory Arthroscopic Surgery with no repair

$200

Concussion $250

Paralysis quadriplegia $15,000

Paralysis paraplegia $7500

Dislocations Closed/open reduction2

Hip joint $2,500/$5,000

Knee $1,500/$3,000

Ankle or foot bone(s) Other than toes

$1,200/$2,400

Shoulder $500/$1,000

Elbow $500/$1,000

Wrist $500/$1,000

Finger/toe $150/$300

Hand bone(s) Other than fingers

$500/$1,000

Lower jaw $500/$1,000

Collarbone $500/$1,000

Partial dislocations 25% of the closed reduction amount

Fractures Closed/open reduction3

Hip $2,500/$5,000

Leg $1,250/$2,500

Ankle $500/$1,000

Kneecap $500/$1,000

Foot Excluding toes, heel

$500/$1,000

Upper arm $550/$1,100

Forearm, Hand, Wrist Except fingers

$500/$1,000

Finger, Toe $100/$200

Vertebral body $1,200/$2,400

Vertebral processes $500/$1,000

Pelvis Except coccyx

$1,200/$2,400

Coccyx $350/$700

Bones of face Except nose

$550/$1,100

Nose $150/$300

Upper jaw $550/$1,100

Lower jaw $500/$1,000

Collarbone $500/$1,000

Rib or ribs $450/$900

Accident

EVENT BENEFIT Skull – simple Except bones of face $1,500/$3,000

Skull – depressed Except bones of face $5,000/$10,000

Sternum $500/$1,000

Shoulder blade $500/$1,000

Chip fractures 25% of the closed reduction amount

Emergency care benefits

Ground ambulance $200

Air ambulance $1000

Emergency room treatment $300

Initial doctor visit $80

Follow-up doctor visit $80

1 Laceration benefits are a total of all lacerations per accident.

2 Closed Reduction of Dislocation = Non-surgical reduction of a

completely separated joint. Open Reduction of Dislocation =

Surgical reduction of a completely separated joint.

3 Closed Reduction of Fracture = Non-surgical. Open Reduction

of Fracture = Surgical.

*Benefit reduces to 50% at age 65, and to 25% of the

original benefit amount at age 70.

Catastrophic Accident Rider (in $s)

Employee* 120,000

Spouse* 60,000

Children 30,000

Home Modification Benefit 5,000

Vehicle Modification Benefit 5,000

How much does Accident Insurance cost?

All employees pay the same rate, no matter their age. See the chart below for the premium amounts.

Exclusions and Limitations Exclusions in the Certificate, Spouse Accident Insurance, Children’s Accident Insurance and AD&D Benefit are listed below. (These may vary by state.) Benefits are not payable for any loss caused in whole or directly by any of the following*:

Participation or attempt to participate in a felony or illegal activity.

An accident while the covered person is operating a motorized vehicle while intoxicated. Intoxication means

the covered person’s blood alcohol content meets or exceeds the legal presumption of intoxication under the laws of the state where the accident occurred.

Suicide, attempted suicide or any intentionally self-inflicted injury, while sane or insane.

War or any act of war, whether declared or undeclared, other than acts of terrorism.

Loss that occurs while on full-time active duty as a member of the armed forces of any nation. We will refund, upon written notice of such service, any premium which has been accepted for any period not covered as a result of this exclusion.

Alcoholism, drug abuse, or misuse of alcohol or taking of drugs, other than under the direction of a doctor.

Riding in or driving any motor-driven vehicle in a race, stunt show or speed test.

Operating, or training to operate, or service as a crew member of, or jumping, parachuting or falling from, any aircraft or hot air balloon, including those which are not motor-driven. Flying as a fare-paying passenger is not excluded.

Engaging in hang-gliding, bungee jumping, parachuting, sail gliding, parasailing, parakiting, kite surfing or any similar activities.

Practicing for, or participating in, any semiprofessional or professional competitive athletic contests for which any type of compensation or remuneration is received.

Any sickness or declining process caused by a sickness. *See the certificate of insurance and riders for a complete list of available benefits, along with applicable provisions, exclusions and limitations.

Exclusions and limitations in the Catastrophic Accident Benefit are the same as in the Certificate, plus :

The catastrophic accident benefit is not payable if the covered person is in a coma at the end of the catastrophic accident elimination period.

The catastrophic accident benefit reduces to 50% at age 65 and to 25% of the initial benefit amount at age 70.

Monthly Rates

Employee Employee and

Spouse Employee and

Children Family

$16.38 $23.40 $31.20 $38.22

Rates shown are guaranteed until July 1, 2018.

Critical illness insurance is designed to supplement your medical and disability coverage easing the financial impacts by covering some of your additional expenses. It provides a benefit payable directly to the insured upon diagnosis of a covered condition or event, like a heart attack or stroke.

About this Benefit

YOUR BENEFITS PACKAGE Critical Illness

Is the aggregate cost of a hospital stay for a heart

attack.

DID YOU KNOW?

$16,500

This is a general overview of your plan benefits. If the terms of this outline differ from your policy, the policy will govern. Additional plan details on covered expenses, limitations and exclusions are included in the summary plan description located on the

LGBS Benefits Website: www.mybenefitshub.com/lgbs

VOYA

Critical Illness

For what critical illnesses and conditions are benefits available? Critical illness insurance provides a benefit for the following illnesses and conditions. Benefits are paid at 100% of the Maximum Critical Illness Benefit unless otherwise stated. For a complete description of your benefits, along with applicable provisions, exclusions and limitations, see your certificate of insurance and any riders. BASE MODEL

Heart attack

Stroke

Coronary artery bypass (25%)

Coma

Major organ failure

Permanent paralysis

End stage renal (kidney) failure CANCER MODEL Cancer

Skin cancer (10%)

Carcinoma in situ (25%)

How much does Critical Illness Insurance cost? See chart for the premium amounts. Rate shown are guaranteed until July 1, 2018. Benefits reduce 50% for the employee and/or covered spouse on the policy anniversary following the 70th birthday, however, premiums do not reduce as a result of this benefit change .

Exclusions and Limitations Benefits are not payable for any critical illness caused in whole or directly by any of the following*:

Participation or attempt to participate in a felony or illegal activity.

Suicide, attempted suicide or any intentionally self-inflicted injury, while sane or insane.

War or any act of war, whether declared or undeclared, other than acts of terrorism.

Loss that occurs while on full-time active duty as a member of the armed forces of any nation. We will refund, upon written notice of such service, any premium which has been accepted for any period not covered as a result of this exclusion.

Alcoholism, drug abuse, or misuse of alcohol or taking of drugs, other than under the direction of a doctor.

*See the certificate of insurance and any riders for a complete list of available benefits, along with applicable provisions, exclusions and limitations.

Employee Coverage Monthly Rates Includes Wellness Benefit Rider

NON- TOBACCO USER

Issue Age $5,000 $10,000 $15,000 $20,000 $25,000 $30,000

Under 30 $2.25 $4.50 $6.75 $9.00 $11.25 $13.50

30-39 $3.30 $6.60 $9.90 $13.20 $16.50 $19.80

40-49 $6.35 $12.70 $19.05 $25.40 $31.75 $38.10

50-59 $11.05 $22.10 $33.15 $44.20 $55.25 $66.30

60-64 $15.45 $30.90 $46.35 $61.80 $77.25 $92.70

65-69 $20.05 $40.10 $60.15 $80.20 $100.25 $120.30

70+ $29.25 $58.50 $87.75 $117.00 $146.25 $175.50

TOBACCO USER

Issue Age $5,000 $10,000 $15,000 $20,000 $25,000 $30,000

Under 30 $3.00 $6.00 $9.00 $12.00 $15.00 $18.00

30-39 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00

40-49 $9.95 $19.90 $29.85 $39.80 $49.75 $59.70

50-59 $17.90 $35.80 $53.70 $71.60 $89.50 $107.40

60-64 $25.85 $51.70 $77.55 $103.40 $129.25 $155.10

65-69 $30.60 $61.20 $91.80 $122.40 $153.00 $183.60

70+ $44.50 $89.00 $133.50 $178.00 $222.50 $267.00

Spouse Coverage* Monthly Rate

Includes Wellness Benefit Rider

NON-TOBACCO USER

Issue Age $5,000 $10,000 $15,000

Under 30 $2.70 $5.40 $8.10

30-39 $3.80 $7.60 $11.40

40-49 $7.50 $15.00 $22.50

50-59 $13.45 $26.90 $40.35

60-64 $18.72 $37.43 $56.15

65-69 $25.40 $50.80 $76.20

TOBACCO USER

Issue Age $5,000 $10,000 $15,000

Under 30 $3.65 $7.30 $10.95

30-39 $5.65 $11.30 $16.95

40-49 $11.70 $23.40 $35.10

50-59 $21.80 $43.60 $65.40

60-64 $31.40 $62.80 $94.20

65-69 $39.20 $78.40 $117.60

Children Coverage Monthly Rates Includes Wellness Benefit Rider

Coverage Amount Rate

$1,000 $0.87

$2,500 $2.18

$5,000 $4.35

$10,000 $8.70

Individual life is a policy that provides a specified death benefit to your beneficiary at the time of death. The advantage of having an individual life insurance plan as opposed to a group supplemental term life plan is that this plan is guaranteed renewable, portable and typically premiums remain the same over the life of the policy.

About this Benefit

Individual Life YOUR BENEFITS PACKAGE

x 10

Experts recommend at least

your gross annual income in coverage when purchasing life insurance.

DID YOU KNOW?

5 STAR

This is a general overview of your plan benefits. If the terms of this outline differ from your policy, the policy will govern. Additional plan details on covered expenses, limitations and exclusions are included in the summary plan description located on the

LGBS Benefits Website: www.mybenefitshub.com/lgbs

Term Life with Terminal Illness and Quality of Life Rider

The Family Protection Plan: Term Life Insurance with Terminal Illness Coverage to Age 100

Nearly 85% of Americans say most people need life insurance; unfortunately only 62% have coverage and a staggering 33% say they don’t have enough life insurance, including one-fourth who already have life insurance coverage.** Nobody wants to be a statistic - especially during a period of grief. That’s why 5Star Life Insurance Company developed its FPP policy - to ensure you and your loved ones are covered during a period of loss.

Affordability - With several options to choose from, select the coverage that best meets the needs of your family. Terminal Illness - This plan pays the insured 30% (25% in Connecticut and Michigan) of the policy coverage amount in a lump sum upon the occurrence of a terminal condition that will result in a limited life span of less than 12 months. Portability - You and your family continue coverage with no loss of benefits or increase in cost should you terminate employment after the first premium is paid. If this happens, we can simply bill you directly. Coverage can never be cancelled by the insurance company or your employer unless you stop paying premiums. Family Protection - Individual policies can be purchased on the employee, their spouse, children and grandchildren (ages newborn through 23). Quality of Life Benefit - Following a diagnosis of either a chronic illness or cognitive impairment, this rider accelerates a portion of the death benefit on a monthly basis – 4%; up to 75% of your benefit, and payable directly to you on a tax favored basis for the following:

Permanent inability to perform at least two of the six Activities of Daily Living (ADLs) without substantial assistance; or

Permanent severe cognitive impairment, such as dementia, Alzheimer’s disease and other forms of senility, requiring substantial supervision.

Convenience - Premiums are taken care of simply and easily through payroll deductions. Protection You Can Count On - Within 24 hours after receiving notice of an insured’s death, an emergency death benefit of the lesser of 50% of the coverage amount, or $10,000, will be mailed to the insured’s beneficiary, unless the death is within the two-year contestability period and/or under investigation. This product also contains no war or terrorism exclusions.

* Life insurance product underwritten by 5Star Life Insurance Company (a Baton Rouge, Louisiana company). Product may not be available in all states or territories. Request FPP insurance from Dell Perot, Post Office Box 83043, Lincoln, Nebraska 68501, (866) 863-9753.

DID YOU KNOW?

Protecting your financial well being is easier than you think. It’s like trading in a daily latte

for peace of mind.

$4.30 per day to start your morning with a

gourmet coffee OR

$1.75 per day to enrich your employee

benefits package

It’s less expensive than you think.

Term Life with Terminal Illness and Quality of Life Rider

Monthly Rates with Quality of Life Rider Defined Benefit

Age on App. Date

Employee Coverage Amounts

$10,000 $25,000 $50,000 $75,000 $100,000

18-25 $7.56 $12.40 $20.46 $28.52 $36.58

26 $7.58 $12.46 $20.58 $28.71 $36.83

27 $7.65 $12.63 $20.92 $29.21 $37.50

28 $7.74 $12.85 $21.38 $29.90 $38.42

29 $7.88 $13.21 $22.08 $30.96 $39.83

30 $8.07 $13.67 $23.00 $32.33 $41.67

31 $8.27 $14.17 $24.00 $33.83 $43.67

32 $8.49 $14.73 $25.13 $35.52 $45.92

33 $8.73 $15.31 $26.29 $37.27 $48.25

34 $9.00 $16.00 $27.67 $39.33 $51.00

35 $9.30 $16.75 $29.17 $41.58 $54.00

36 $9.64 $17.60 $30.88 $44.15 $57.42

37 $10.02 $18.54 $32.75 $46.96 $61.17

38 $10.41 $19.52 $34.71 $49.90 $65.08

39 $10.84 $20.60 $36.88 $53.15 $69.42

40 $11.31 $21.77 $39.21 $56.65 $74.08

41 $11.83 $23.08 $41.83 $60.58 $79.33

42 $12.41 $24.52 $44.71 $64.90 $85.08

43 $13.00 $26.00 $47.67 $69.33 $91.00

44 $13.63 $27.56 $50.79 $74.02 $97.25

45 $14.28 $29.19 $54.04 $78.90 $103.75

46 $14.97 $30.92 $57.50 $84.08 $110.67

47 $15.69 $32.73 $61.13 $89.52 $117.92

*Quality of Life not available ages 66 - 70. Quality of Life benefits not available for children.Child life coverage available only on children and grandchildren of employee (age on application date: full term new born to 23 years). $4.98 monthly for $10,000 coverage and $9.97 monthly for $20,000 coverage

Term Life with Terminal Illness and Quality of Life Rider

Monthly Rates with Quality of Life Rider Defined Benefit (cntd.)

*Quality of Life not available ages 66 - 70. Quality of Life benefits not available for children.Child life coverage available only on children and grandchildren of employee (age on application date: full term new born to 23 years). $4.98 monthly for $10,000 coverage and $9.97 monthly for $20,000 coverage

Age on App. Date

Employee Coverage Amounts

$10,000 $25,000 $50,000 $75,000 $100,000

48 $16.43 $34.56 $64.79 $95.02 $125.25

49 $17.22 $36.54 $68.75 $100.96 $133.17

50 $18.08 $38.69 $73.04 $107.40 $141.75

51 $19.04 $41.10 $77.88 $114.65 $151.42

52 $20.16 $43.90 $83.46 $123.02 $162.58

53 $21.40 $47.00 $89.67 $132.33 $175.00

54 $22.79 $50.48 $96.63 $142.77 $188.92

55 $24.27 $54.17 $104.00 $153.83 $203.67

56 $25.93 $58.33 $112.33 $166.33 $220.33

57 $27.66 $62.65 $120.96 $179.27 $237.58

58 $29.42 $67.04 $129.75 $192.46 $255.17

59 $31.23 $71.56 $138.79 $206.02 $273.25

60 $33.12 $76.29 $148.25 $220.21 $292.17

61 $35.08 $81.19 $158.04 $234.90 $311.75

62 $37.13 $86.31 $168.29 $250.27 $332.25

63 $39.31 $91.77 $179.21 $266.65 $354.08

64 $41.68 $97.71 $191.08 $284.46 $377.83

65 $44.33 $104.33 $204.33 $304.33 $404.33

66* $44.93 $105.81 $207.29 $308.77 $410.25

67* $48.25 $114.13 $223.92 $333.71 $443.50

68* $52.03 $123.58 $242.83 $362.08 $481.33

69* $56.33 $134.31 $264.29 $394.27 $524.25

70* $61.17 $146.42 $288.50 $430.58 $572.67

NOTES

NOTES

www.mybenefitshub.com/lgbs