2014/09/14 - DAWNBREAKER - Financials (Mfg of Product/Software and/or Services)

-

Upload

epics-qt-collaboration -

Category

Government & Nonprofit

-

view

119 -

download

4

description

Transcript of 2014/09/14 - DAWNBREAKER - Financials (Mfg of Product/Software and/or Services)

A Component of the Dawnbreaker Administered DOE

Commercialization Planning Program

Presented by Jon Sienkowski

1Dawnbreaker Proprietary

UNDERSTANDING FINANCIALS FOR

COMPANIES MANUFACTURING PRODUCTS,

SELLING SOFTWARE, OR PROVIDING

SERVICES

Outline

• Motivation

• DOE Guidelines

• Projecting Financials

– Basics

– Income Statement

– Manufacturing, Software, Services

– Strategies

• Cash Flow

Dawnbreaker Proprietary 2

Motivation / Approach

• Evolving from R&D company to commercial

enterprise – will need to address investor

and business requirements

• Developing financials helps to expose holes

in the plan, identifies key milestones, and

shows key levers for the business

• Best to start early in the process and iterate

• Keep it simpleDawnbreaker Proprietary 3

DOE Guidelines

• Pro forma Income Statement for SBIR Phase II period and next three years is required. – Statement of Cash Flow and Balance Sheet may be

included if they are considered critical for your strategy.

– Extend time period if sales and/or profitability are further out

• DOE Investment Multiplier calculation worksheet is required– Net Present Value of DOE’s investment with 10 year

outlook

• Well documented, clear assumptions– Validation from customers, end users, industry literature,

etc. Dawnbreaker Proprietary 4

5

Templates on eLearning websitehttp://www.dawnbreaker.com/elearning/

Assumptions

Dawnbreaker Proprietary 6

• Basis of calculating the served available market size

• Growth assumptions by year

Market(Sect 1.4)

• Identify sources of revenues – Products, parts, services or royalty from licensing (pricing assumptions)

Revenue(Sect 4.3, 4.4)

• State any assumptions you used along with your methodology for calculating/estimating the expenses in this section.

Expenses(Sect 4.4)

Basics

• Income Statement = profit and loss for a given

period

• Balance Sheet = snapshot of assets, liabilities

and shareholders equity at period end

• Statement of Cash Flow = change in cash for

given period

• Good article from SEC: http://www.sec.gov/investor/pubs/begfinstmtguide.htm

Dawnbreaker Proprietary 7

Basics Principles

• Keep it simple, easy to follow

• Not trying to make you accountants, just

familiar with key terms

• Revenue in Section 4 is only for products

associated w/ DOE funding

• View the technology as a stand alone

Strategic Business Unit (SBU).

– Develop the financials as an incremental approach

over base line business, assigning support costs as

appropriate.

Dawnbreaker Proprietary 8

Income Statement

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, equipmentdepreciation, labor, energy, maintenance, etc.)

= Gross Profit

- Selling, General, & Administrative, R&D Expenses

= Operating Profit (EBIT)

- Taxes, Interest, non-recurring items

= Net Income

Dawnbreaker Proprietary 9

General form of income statement that public companies report (Generally Accepted Accounting Principles or GAAP)

Taxes, capital structure vary by company and industry, therefore taxes and interest are less relevant for the purposes of your pro forma

Income Statement

Manufacturing Goods Selling Software Selling Services

Product Revenue Product Revenue (perpetual licenses, subscriptions, etc.)

Product Revenue(testing, measuring, performing maintenance, etc.)

- Cost of Goods Sold(materials, purchased parts, equipmentdepreciation, labor, energy, maintenance, etc.)

- Cost of Sales(hosting, software licenses, training, maintenance)

- Cost of Services(labor, materials, other costs of providing services)

= Gross Profit = Gross Profit = Gross Profit

- Selling, General, & Administrative, R&D Expenses

- Selling, General, & Administrative, R&D Expenses

- Selling, General, & Administrative, R&D Expenses

= Operating Profit (EBIT) = Operating Profit (EBIT) = Operating Profit (EBIT)

Dawnbreaker Proprietary 10

Income Statement Examples

$B or $M, (% of Revenue) Ford 2013(manufacturing)

3M 2013(manufacturing)

Ansys 2013(software)

Transcat 2013(services)

Product Revenue$147B (100%) $30.8B (100%) $861M (100%) $118M (100%)

- Cost of Goods Sold(materials, purchased parts, equipment depreciation, labor,energy, maintenance, etc.)

$128B (87%) $16.1B (52%) $147M (17%) $89M (75%)

= Gross Profit $18.8B (13%) $14.8B (48%) $714M (83%) $19M (25%)

- Selling, General, & Administrative, R&D Expenses

$13.1B (9%) $8.1B (26%) $370M (43%) $13M (19%)

= Operating Profit (EBIT)

$7.0B (5%) $6.7B (22%) $321M (37%) $7M (6%)

Dawnbreaker Proprietary 11

Ford: http://finance.yahoo.com/q/is?s=F+Income+Statement&annual

3M: http://finance.yahoo.com/q/is?s=MMM+Income+Statement&annual

Ansys: http://finance.yahoo.com/q/is?s=ANSS+Income+Statement&annual

Transcat: http://finance.yahoo.com/q/is?s=TRNS+Income+Statement&annual

Income Statement

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, equipmentdepreciation, labor, energy, maintenance, etc.)

= Gross Profit

- Selling, General, & Administrative, R&D Expenses

= Operating Profit (EBIT)

+ Depreciation and Amortization

= EBITDA

Dawnbreaker Proprietary 12

EBIT = Earnings Before Interest and Taxes

EBITDA = Earnings Before Interest Taxes and Depreciation

EBITDA is a close proxy to cash flow, most investors look at EBITDA as a key metric, thus important for startups to track.

This income is available for paying back your investors and reinvesting in your company

Income Statement - Simplified

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, equipmentdepreciation, labor, energy, maintenance, etc.)

= Gross Profit

- Selling, General, & Administrative, R&D Expenses

= Operating Profit (EBIT)

+ Depreciation and Amortization

= EBITDA

Dawnbreaker Proprietary 13

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, equipment depreciation, labor, energy, maintenance, etc.)

= Gross Profit*

- Selling, General, & Administrative, R&D Expenses

= EBITDA

*Does not include depreciation

Income Statement

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, labor,energy, maintenance, etc.)

= Gross Profit*

- Selling, General, & Administrative, R&D Expenses

= EBITDA

Dawnbreaker Proprietary 14

• Revenue = Price X Quantity Sold

• Only include revenue for products related to the funded technology

• Break out revenue by different revenue streams for clarity

• Some companies have a mix of products, services, and licensing. Modify template as appropriate

• Recognize revenue in the period the product is delivered to your customer*Does not include depreciation

Income Statement

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, labor,energy, maintenance, etc.)

= Gross Profit*

- Selling, General, & Administrative, R&D Expenses

= EBITDA

Dawnbreaker Proprietary 15

Cost of Goods Sold (COGS) is generally all expenses directly attributed to producing your product.

Upcoming webinar on cost analysis covers this further

Note: Some companies will include depreciation here (if so, change EBITDA below to EBIT)

*Does not include depreciation

Income Statement

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, labor,energy, maintenance, etc.)

= Gross Profit*

- Selling, General, & Administrative, R&D Expenses

= EBITDA

Dawnbreaker Proprietary 16

Gross Profit Margin will vary across industries – ranging from 10% to over 80%.

Important measure as what is left over will be used to cover operation of your business and paying back investments.

Resource:http://www.sba.gov/blogs/understanding-gross-margin-and-how-it-can-make-or-break-your-startup

*Does not include depreciation

Income Statement

Manufacturing Goods

Product Revenue

- Cost of Goods Sold(materials, purchased parts, labor,energy, maintenance, etc.)

= Gross Profit*

- Selling, General, & Administrative, R&D Expenses

= EBITDA

Dawnbreaker Proprietary 17

• Operating expenses are those that are not directly attributable to producing parts

• Examples include CEO pay, sales & marketing expenses, IT, legal & accounting fees, R&D expense, etc.

• If your business sells multiple products already, this should be the % attributable to this product line

*Does not include depreciation

Income Statement

Manufacturing Goods Selling Software Selling Services

Product Revenue Product Revenue (perpetual licenses, subscriptions, etc.)

Product Revenue(testing, measuring, performing maintenance, etc.)

- Cost of Goods Sold(materials, purchased parts, labor,energy, maintenance, etc.)

- Cost of Sales(hosting, software licenses, training, maintenance)

- Cost of Services(labor, materials, other costs of providing services)

= Gross Profit* = Gross Profit* = Gross Profit*

- Selling, General, & Administrative, R&D Expenses

- Selling, General, & Administrative, R&D Expenses

- Selling, General, & Administrative, R&D Expenses

= EBITDA = EBITDA = EBITDA

Dawnbreaker Proprietary 18

*Does not include depreciation

19

20

Pro Forma Income statement example –cont…

Modify, add, or remove lines in the spreadsheet as needed to properly illustrate your business model (i.e., include several revenue lines for multiple products, multiple revenue streams such as licensing, etc.)

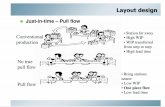

Strategy for Developing Financials

• Product pricing (basis of pricing - value)

• Channels of distribution (discounts or commissions)

• Develop orders forecast (units & $ by product line)

• Develop sales forecast (units & $ by product line)

• Develop a production forecast

• Develop purchased materials schedule

• Develop organizational chart and staffing plan (direct in indirect) by department with salary rates and benefit costs

• Develop a supporting expense forecast by department (chart of accounts) (Admin, R&D, Sales, Marketing, legal, facilities)

• Develop a facility plan

• Develop supporting capital planDawnbreaker Proprietary 21

Sense CheckTest your assumptions and benchmark against industry averages:

• Can you sustain and support the growth projected?

• Can you hire and train the people at the rate you are projecting?

• Look at head count to sales ratio. Is the ratio realistic?

• If using reps or distributors how fast can you sign them on and how

much do you expect them to sell?

• Have you taken commissions and discounts into account?

• Be careful about using industry averages early on. It is doubtful a

startup will look like the industry average. It is more important to

know why you are different and what is good and what is bad.

Dawnbreaker Proprietary 22

Partner Strategy

23

Year 1 = ????Your

Company

Contract

manufacturer

Distributor

/RepsLicensee Joint Venture

Manufacture

Near Term (1-2)

Long Term (3-5)

Market

Near Term (1-2)

Long Term (3-5)

Sales

Near Term (1-2)

Long Term (3-5)

Customer Service

Near Term (1-2)

Long Term (3-5)

Quality Control

Near Term (1-2)

Long Term (3-5)

Tool for deciding strategy on how to cover required business functions

Resources

• Sales Forecast

– http://www.startuproar.com/forecast/revenue/

• Revenue Curves

– http://steveblank.com/2010/02/16/death-by-

revenue-plan/

– https://www.udacity.com/course/ep245

(Lesson 3 and Lesson 6)

Dawnbreaker Proprietary 24

DOE Return on Investment

Dawnbreaker Proprietary 25

DOE Return on Investment

• DOE requires separate calculation of the Return on Investment (ROI) or the Net Present Value (NPV) of the SBIR grant.

– Primer on NPV & ROI: https://courses.engr.illinois.edu/ge494/econanalysisbasics.pdf

• Compares present value of product’s profits to grant “investment”– 10 year window of product sales

– Requires you to extend out detailed 5 year pro forma

• Spreadsheet template is provided on eLearning website – Also available on DOE

website:http://science.energy.gov/sbir/applicant-and-awardee-resources/grant-application/

Dawnbreaker Proprietary 27

Worksheet

Worksheet – DOE Funding

The initial investment for the DOE calculation is associated only with the SBIR funds provided by DOE.

Worksheet – Company Revenue

Worksheet – Company Revenue

Market size and growth rates are based on your analysis of the Served Available Market (SAM)

Market share percentages can just be carried over from detailed proforma in years where they overlap

Market share – estimate market penetration in latter years, back up with reasonable logic and assumptions

Check that revenue agrees with your detailed pro forma where they overlap

Worksheet – Company Revenue

Operating Margin and Operating Profits (EBITDA) are based on your analysis. Longer term projections should trend to industry averages.

(Fill in percentages from your detailed proforma in years where they overlap)

Worksheet – Company Revenue

Discount Rate is the cost of raising debt and equity investments (aka the weighted average cost of capital) and risk of the investment – 15% is a reasonable first pass.

Resources:http://ardent.mit.edu/real_options/RO_current_lectures/weighted_average_cost_of_capital.pdfhttp://ardent.mit.edu/real_options/RO_current_lectures/

Worksheet – Company Revenue

• There is no right answer - higher is better. • If you’re above 100, you might be doing something

wrong! Check to make sure you’re entering numbers in 1,000s.

Other Financial Reporting

• Statement of Cash Flow (SCF) and

Balance Sheet (B/S) will be covered in a

recorded webinar.

• Full SCF and B/S not required for

submission unless critical to strategy

• Can use cash proxy worksheet

included in templatesDawnbreaker Proprietary 34

Cash Flow

• Cash flow is paramount for startups

– Know your cash burn rate!

• Cash burn rate = Funds for Operations (salaries, IT, legal, vendors, etc.)

Time Period (generally monthly)

• Resources

– http://www.startuproar.com/burn-rate/

Dawnbreaker Proprietary 35

Cash Proxy Worksheet

Dawnbreaker Proprietary 36

• This worksheet is included in the pro forma income

statement template on eLearning

• Optional to include, but useful to track required

investments and show you have a viable plan

Resources – Profitability Ratios

1. Go to http://www.google.com/finance

2. Search for similar publicly traded company

3. Click on ‘related companies’ on left side of screen

4. Click ‘add or remove columns’ on right side of screen

5. Scroll over until you see ‘Margins’

Dawnbreaker Proprietary 37

Resources

Dawnbreaker Proprietary 38

Visit your local library . The three main sources for ratio books are: • "Industry Norms & Key Business Ratios"

by Dun & Bradstreet• "Almanac of Business & Industrial

Financial Ratios" ("Troy Almanac”) • "RMA (Risk Management Association)

Annual Statement Studies"

Other sources:• Bizminer• Integra Industry Benchmarking Data • Fintel Industry Metrics Reports • ValuSource IRS Corporate Ratios• Industry-Specific Resources

Operating Profit (EBIT) Averages

Operating profit as a % of sales

NAICS sales 1 to 3 MM 3 to 5 MM 5 to 10 Mil. 10 to 25 mil

25 mil.

And over

334413 11.6% 4.6% 8.2% 6.9%

334513 9.6% 6.4% 8.4% 8.2%

334510 6.8% 7.9% 9.8%

334516 6.8% 7.9% 9.8%

335313 4.7% 7.4% 10.9%

541330 4.8% 4.7% 5.4% 5.9% 4.8%

541511 6.2% 6.4% 6.9% 8.0% 8.2%

541512 5.9% 3.7% 4.7% 6.2% 5.7%

541690 7.0% 2.4% 11.8% 5.5% 7.5%

Custom computer programming Services

Computer Systems Design Services

Other Scientific and Technical consulting

Electromedical and Electrotherapeutic

apparatus Manufacturing

Semiconductor and related device

Instruments and related products mfg. for

Analytical Laboratory Instrument

Manufacturing

Switchgear and switchgear apparatus Mfg.

Engineering Services

Data from 2011 RMA Annual Statement Studies

Steady state operating margins from more established companies are found sources such as Annual Statement Studies published by Risk Management Associates (RMA))

Common Pitfalls• Pro forma financials provided for entire company in Section 4.4

– Correct: Financials in Section 4 should only be related to funded

technology (Section 2 has overall company revenue)

• Section 4.1 (Funding and Investments) only cover technical

milestones/expenses

– Correct: commercialization related funding needs such as marketing,

legal/patent should also be covered

• Pro forma does not match DOE Return on Investment in

years where they overlap

– Correct: in the years where they overlap, the values should match

• Revenue assumptions not validated

– Correct: Letters of support are a good place to validate that revenue

opportunities exist

Dawnbreaker Proprietary 40

41

Take Aways

• Financials are a necessary part of planning

• Clear, reasonable, logical, defensible

assumptions are key

• Don’t be overwhelmed – work with your

Dawnbreaker business acceleration manager

Questions?

Jon Sienkowski

585-617-9459

Please complete the anonymous survey

after the webinar!

Dawnbreaker Proprietary 42