2014 LIHTC Qualified Allocation Plan (QAP), Application ... · PDF fileLIHTC Qualified...

Transcript of 2014 LIHTC Qualified Allocation Plan (QAP), Application ... · PDF fileLIHTC Qualified...

2014 LIHTC Qualified

Allocation Plan (QAP), Application and

Market Study GuideChanges

We want you to know!

Tax Credit Team & Appraiser

2

Mike Pacheco

Tasha WeaverDenise Tamulis Paula Harrison

Terry BarnardKim Dillinger

Amount Available

For 2014 a total of $12 million in Housing Credit is available. $10.75 will be available in two competitive rounds

Up to $1.25 million for DHA’s Set‐Aside

4

5

DHA‐Housing Choice Vouchers

Beginning in round 2, DHA will have 50 Housing Choice Vouchers available to be Project Based.

It is anticipated 50 Vouchers per round will be allocated from a total of 300, subject to funding availability, over a three year period.

Proposals must be submitted to DHA 60 days prior to CHFA’s Letter of Intent deadline (April 1, 2014).

6

DHA‐Housing Choice Vouchers

The project must:

be located in the City and County of Denver

meet DHA’s selection criteria comply with HUD regulations receive an award of competitive tax

credits

7

DHA‐Housing Choice Vouchers

Contact Debra Gray at720‐932‐3124 [email protected]

Information will be posted after February 1st on DHA’s website www.denverhousing.org.

8

Critical Elements of the Selection Process

Strong competitive projects will align with the Guiding Principals and meet all Criteria for Approval.

Guiding Principles Criteria for Approval

9% Applicable Percentage Rate

All applications in 2014 must use the most current Floating Rate APR.

Because Colorado forward reserves the Housing Credit all Applications in 2014 will be competing for 2015 Housing Credit

Projects receiving reservations should pay special attention to the floating APR and the Gross Rent Floor elections at time of Carryover.

9

Energy Efficiency Changes

New for 2014, CHFA has made several changes to the energy efficiency requirements based on feedback from the Colorado development community. Enterprise Green Communities is still the national standard to which CHFA requires projects to comply. However, we have added several new options to meet the energy efficiency measures and have provided further clarification on others.

10

Energy Efficiency Changes

Items 4.1, Water‐Conserving Fixtures, and 5.3, Sizing of Heating and Cooling Equipment and Ducts – for projects involving rehabilitation, we are not requiring the replacement of plumbing fixtures or HVAC equipment that has more than 7 years of remaining useful life.

Item 4.3 – Water Reuse – we have eliminated points available for this option since it is not applicable to Colorado due to state water laws.

11

Energy Efficiency Changes

Item 5.1a and 5.1b – Building Performance Standard for New Construction – we have added an option to use Xcel Energy’s Energy Design Assistance Program to meet the measure.

Item 5.1c and 5.1d – Building Performance Standard for Substantial or Moderate Rehabilitation – we have added an option to use Energy Outreach Colorado’s Multifamily Weatherization program to meet the requirements.

12

Energy Efficiency Changes

Item 7.9c – Mold Prevention: Tub and Shower Enclosures – we have added an option that eliminates the requirement for cement based backerboard if the project installs a fiberglass surround in the tub/shower, given these create a water tight barrier.

13

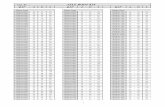

LIHTC Reservation Timeline

19

You Send the Letter of Intent, Market Study Engagement Letter , Designate your PMA census tracts, & the Quiet Period Begins

CHFA sends you the BlueApplication Tabs. For 2014 Tab Instructions will be available on the CHFA website.

Deliver to CHFA the Electronic & Hard Copy Application, Exhibits, Market Study (with the Designated Docs to the CHFA Web Portal) & the App Fee ($3,000).

1

2

3

LIHTC Reservation Timeline

20

YES NO

CHFA checks to see that Threshold Review is passed

5-Day Clarification Letter sent to you

CHFA conducts its Full Application Review & Site Visit

4

5

6

7

Application Returned

LIHTC Reservation Timeline

21

By 5-days you clear up the Clarification Items

Sponsors present their projects to CHFA’s Tax Credit committee. Then the committee meets to Select Applications for a Reservation

Notifications sent CHFA Staff meets with all non-selected applicants

8

10NOYES

9

LIHTC Reservation Timeline

22

Fee Letter sent to selected projects

You submit Fee (4%) within 10-days to CHFA

11

12

13 CHFA sends a Reservation letter

Quiet Period

Once again the quiet period begins with submittal of the Letter of Intent (February 3 & June 2)

Ends upon the issuance of reservations.

Requires that all communication for projects submitting a preliminary application applying for 9% competitive tax credits, be directed to the CHFA Tax Credit Allocation Staff only.

Communication is allowed at any time with any CHFA staff or department if the project has not submitted a letter of intent or an application for 9% Housing Credits because it would not be subject to the Quiet Period.

23

During the Quiet Period please communicate with any of the following Tax Credit Team Members

24

Mike Pacheco

Tasha WeaverDenise Tamulis

Paula Harrison

Terry Barnard

Kim Dillinger

Threshold Items #1 thru #5

In 2014 once again threshold items #1 thru #5 must be provided at the time of the application and are not subject to the five‐day cure period. #1 Minimum Score, #2 Site Control, #3 Market Study, #4 Outstanding Noncompliance Issues, #5 Submittal of the Electronic Application.

25

26

Top Three Threshold Mistakes

Site Control-incomplete or missing extensions.

Market Study-does not match up with the Application as to unit count, square footage, rents or AMI targeting.

Scoring-marking items that the project is not eligible for which causes the score to drop below 130.

27

2014 QAP Checklists

The checklists for all processes of the application have been updated and can be found on:

Page 17 for the Preliminary Application Page 24 for the Carryover Application Page 28 for the Placed‐In‐Service Application Page 29 for the Final Application Page 65 for the PAB Initial Determination Application Page 72 for the PAB Placed‐in‐Service Application Page 73 for the PAB Final Application

28

Clarification Letter

Top Five Clarification Letter Items (after initial threshold has been met):

Number 5: Narrative-is not provided in WORD format and/or is not on the CHFA Template.

Number 4: Zoning Letter-does not explain parking requirements or does not provide current zoning status.

Number 3: Required Charts-are not submitted, or are not received in the proper electronic format. Unit/Project Amenities Green Building Walk Score Market Study Comparables

Number 2: Green Communities Workbook-Drop down menu questions not answered and the Excel file not received.

29

Clarification Letter

The Top Clarification Letter Item is (after initial threshold has been met):

Number 1: Cost Estimate-is not submitted in Excel format and the summary and detail are not provided.

Secure File Delivery Portal

Once again the list of required documents is found starting on page 17 of the QAP.

For 2014, again all required documents must be submitted via the Secure File Delivery Portal.

Instructions on how to access the Secure File Delivery Portal will be provided to all projects submitting a Letter of Intent.

The portal will open beginning Feb 26th for Round 1 and June 27th for Round 2

30

Applicant Presentations

The same as last year each Developer will have an opportunity to present their project before the Tax Credit Committee the week that all applications will be considered for reservations.

The presentation can include a total of 3 persons (from the development team).

Presenter can handout a one page overview of the project and can use up to two story boards for schematic drawings, site plans, pictures, etc.

31

4% Non‐Competitive Projects

For 2014, all projects applying for the 4% non‐competitive credit will be required to submit a letter of intent to apply at least 60‐days prior to the submission of the application.

Development teams of these projects will be encouraged to contact CHFA’s Allocation Staff to schedule a “concept meeting” to discuss the plans for the project prior to the letter of intent.

33

4% Non‐Competitive Application Narrative

The Narrative must be submitted in WORD format and should explain why the project should receive an Initial Determination.

The PAB Narrative Template is available on CHFA’s website.

34

2014 LIHTC Application

We will now cover the changes in the 2014 LIHTC Application. Please make note that once the application is received it is merged into our data base and this data, as entered by you, is used to create a variety of reports and documents.

Please keep this in mind when completing the application and DO NOT:

Enter information in ALL CAPS

Enter spaces before or after the data; and most important

Never add formulas anywhere in the application – this will result in the application being returned

35

2014 LIHTC Application Fees

36

The Fee has increased by one percent of the annual credit amount at the time of reservation and one percent of the annual credit amount at the time of the Carryover or Final application in order to help cover costs of the application review and approval process.

2014 LIHTC Application

37

The application for Carryover and Final Allocation must be entered on the most recent LIHTC application

available.

2014 LIHTC Application Scoring

38

Secondary Selection CriteriaSection 4.a. Applicant Characteristics changed

For 2014 non-profit points are available to any qualified tax exempt organization 501(C)(3) or (4).

2014 LIHTC Application

39

Reminder, we will again request additional information for 4% Non-Competitive applications in the Development Information

Worksheet

We would like to know if the project will be seeking private activity bonds from CHFA.

2014 LIHTC Application

41

In 2014, we will again request additional information for 4% Non-Competitive Projects and Other Project Base Vouchers in the

Development Information Worksheet

Continuing with the

Development Information Worksheet

2014 LIHTC Application

42

In 2014, we again will request additional information the about Construction Loan in the Development Financing Worksheet

Now let’s go to the

Development Financing Worksheet

construction loan information.

2014 LIHTC Application

43

In 2014, we will again have a Construction Interest Test and the same additional information as last year to the Summary Worksheet

2014 LIHTC Application

44

For 2014, as a reminder we are requesting contact information about additional project members in the Applicant-Info Development Information Worksheet

Permanent Lender Construction Lender General Contractor Architect Environmental Phase I Preparer Capital Needs Report Preparer Cost Estimate Preparer Green Consultant Bond Issuer (non-competitive 4%) Bond Counsel (non-competitive 4%)

2014 Market Study Guide Update

45

Changes in 2014

1. Letter of IntentThe PMA census tracts must be includedin the Letter of Intent.

2. Senior ProjectsRegardless if the proposed project willallow tenants 55 years and older, themarket analyst should only consider the62 year and old population in theirdemand analysis.

2014 Market Study Guide Update

46

Reminders

The market study must match the LIHTC application regarding unit count, unit mix, square footage, AMI mix, and proposed rents

Proposed rents = what the tenant will actually pay

2014 Market Study Guide Update

47

Reminders

Provide a complete inventory of “like-kind” LIHTC properties in PMA

Family ≠ Senior Exclude 100% Project-based Rental

Assistance properties

Show unit count that will be used in the demand analysis calculations

CHFA Tax Credit Team Contact Information:Tasha Weaver, Mgr. (303) 297‐7429 or [email protected]

Denise Tamulis (303) 297‐7386 or [email protected] Harrison (303) 297‐7316 or [email protected] Barnard (303) 297‐4866 or [email protected] Pacheco (303) 297‐7368 or [email protected]

Kim Dillinger (303) 297‐7361 [email protected]