2014 Brooklyn Retail Report

-

Upload

crainsnewyork -

Category

Documents

-

view

5.766 -

download

0

description

Transcript of 2014 Brooklyn Retail Report

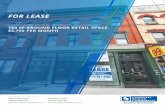

CPEX Real Estate Services is pleased to present our annual Brooklyn Retail Report for 2014, a comprehensive survey of the primary retail corridors throughout the borough.

The 2014 CPEX Brooklyn Retail Report continues the work started in 2009 by the CPEX Retail Leasing Team, with as-sistance from our research and graphics departments. It is a tale of two Brooklyns; the south didn’t experience much in the way of growth or appreciation, while Northern Brooklyn underwent an explosion in newly established retail destina-tions and in corridors that saw a significant increase in pric-ing. In this latest version, we have identified 43 additional retail corridors in the last five years to account for the rap-idly expanding retail scene in flourishing neighborhoods like Greenpoint and Crown Heights. This brings the total num-ber of significant retail arteries in the borough to an im-pressive 88. Of those 88, 10 different corridors average over $100 per square foot for retail rentals, compared to just two that barely surpassed triple digits five years ago.

Careful attention has been paid to summarize current market conditions. The pricing for each corridor provided is an es-timate and a snapshot of the current period, based on data collected from internal and external sources, including: CPEX completed transactions, market reports from our in-house re-search studies, and various data resources (aptsandlofts.com; Brooklyn Tech Triangle, Economic Impacts of Tech and Cre-ative Sectors, April 2012; Brownstoner.com; Commercial Ob-server; Downtown Brooklyn Partnership; NYC MTA; New York Daily News; StreetEasy; The Real Deal; U.S. Census Bureau; and the Wall Street Journal).

Timothy D. King Ryan Condren Kristina Triglia George DanutManaging Partner Managing Director Associate [email protected] [email protected] [email protected] [email protected](718) 687-4210 (718) 687-4212 (718) 687-4206 (718) 687-4220

Considering the dynamics of the New York Retail Market and the overall economic conditions, these pricing levels are not only subject to change, but will most likely fluctuate as various market conditions, supply, demand, and economic indicators change from quarter to quarter. While the actual pricing levels may change in the coming months, this report can be an im-portant tool for leasing comparisons, for calculating percent changes across neighborhoods and boroughs, and for quan-tifying Net Operating Income levels in estimating cap rates and performing property valuations. This report can assist property owners and business owners with a current and up-to-date synopsis of their marketplace.

For retail landlords and tenants with specific site analysis re-quirements, please note that each and every property provides unique characteristics which affect its potential lease pricing levels. Characteristics such as location, build-out, neighboring tenants, available transportation, street conditions, residential density, traffic, etc., all have an important impact on contract-ed leasing rates. As the economic market impacts the retail industry, we at CPEX will continue to monitor such changes and make them available to our clients. Please call us if you have any questions regarding this report or if you require fur-ther information pertaining to your real estate or business.

WWW.CPEXRE.COM

Introduction

The CPEX New York Retail Leasing Team

COURT STREET & JORALEMON STREET

WWW.CPEXRE.COM WWW.CPEXRE.COM

#123456789

1011121314151617181920212223242526272829303132333435363738394041424344

Street Range75th St - 86th StUnion St - Prospect AveAtlantic Ave - 18th StFlatbush Ave - Bergen St12th St - 16th St75th St - 86th St47th St - 54th St17th St - 23rd StBergen St - 12th St9th St - Berkeley St44th St - 49th St75th St - 82nd St61st St - Bay Ridge Pkwy23rd Ave - Stillwell Ave4th Ave - Fort Hamilton Ave18th Ave - 20th AveBay Pkwy - 23rd Ave20th Ave - Bay Pkwy20th Ave - Bay Pkwy53rd St - 61st StSmith St - 4th AveClinton St - Smith StConey Island Ave - E. 15th StConey Island Ave - Haring StNorth 8th St - Metropolitan AveNorth 3rd St - North 8th StBrighton 4th St - Coney Island AveFlushing Ave - Park StKent Ave - Roebling StMetropolitan Ave - Johnson AveFlatbush Ave - Ocean AveE. 49th St - E. 53rd StDeGraw St - President StAvenue J - Cortelyou RdConey Island Ave - E. 16th StAtlantic Ave - Bergen StBergen St - Baltic StBaltic St - 4th PlMontague St - Atlantic AveBelt Pkwy - Neptune AveGrand St - North 11th StSchenectady Ave - Utica AveNostrand Ave - Ocean AveAvenue V - Avenue S

#4546474849505152535455565758596061626364656667686970717273747576777879808182838485868788

Street RangeLinden Blvd - Tilden AveAtlantic Ave - Dean StDean St - 8th AveEastern Pkwy - St. Marks AveMilton St - Eagle St-Washington Ave - Bedford AveBedford Ave - Brooklyn AveFlatbush Ave - Washington AveAdams St - Flatbush Ave-Flushing Ave - Boerum StGrand St - Skillman AveUnion Ave - Bushwick AveBroadway - Grand StNorth 3rd St - North 7th StConey Island Ave - E. 17th StMenahan St - DeKalb AveFulton St - Hancock StGreenpoint Ave - Meserole AveBerry St - Graham AveCourt St - Hicks StCarlton Ave - Steuben StBedford Ave - Kent AveEastern Pkwy - Empire BlvdAvenue T - Belt PkwyLinden Boulevard - Flatlands AveE. New York Ave - Mother Gaston Blvd15th St - 17th StFlatlands Ave - Avenue KBelt Pkwy - Seaview AveFlatlands Ave - Farragut RdAvenue Z - Voorhies AveAtlantic Ave - Union StFoster Ave - Avenue lFarragut Rd - Avenue lMetropolitan Ave - Grand StUnion St - St. Johns PlLinden Blvd - Snyder AveReed St - Commerce StAtlantic Ave - Park PlEastern Pkwy - Pacific StFlushing Ave - Myrtle AveNorth 3rd St - North 12th St

Avenue3rd Ave3rd Ave4th Ave5th Ave5th Ave5th Ave5th Ave5th Ave5th Ave7th Ave13th Ave13th St18th Ave86th St86th St86th St86th St86th St (East Side)86th St (West Side)8th AveAtlantic AveAtlantic AveAvenue JAvenue UBedford AveBerry StBrighton Beach AveBroadwayBroadwayBushwick AveChurch AveChurch AveColumbia StConey Island AveCortelyou RdCourt StCourt StCourt StCourt StCropsey AveDriggs AveEastern PkwyEmmons AveFlatbush Ave

AvenueFlatbush AveFlatbush AveFlatbush AveFranklin AveFranklin StFront/Water/Plymouth/JayFulton St Fulton StFulton StFulton Street MallGateway CenterGraham AveGraham AveGrand StHavemeyer StKent AveKings HighwayKnickerbocker AveLewis AveManhattan AveMetropolitan AveMontague StMyrtle AveN. 6th StNostrand AveNostrand AvePennsylvania AvePitkin AveProspect Park WestRalph AveRockaway PkwyRockaway PkwySheepshead Bay RdSmith StThe Junction - Flatbush AveThe Junction - Nostrand AveUnion AveUtica AveUtica AveVanbrunt StVanderbilt AveWashington AveWyckoff AveWythe Ave

JAMAICA BAY

7

20

13

19

16

17

2153

67

52

85

7371

23

79 80

40

16

12

14 24

70

77

43

44

74

75

76

28

51

86

63

3145

34

35

33

8438

48

37

39

66

68

32

4282

83

69

29 3081

27

18

10

5

11

15

64

62

46

4778

25

22 54

50

60 26

88

41 57

5859

49

2

8

34

9

36

55

56

61

72

65

87

$35 - $49 PSF$50 - $64 PSF$65 - $79 PSF$80 - $99 PSF$100 - $149 PSF$150 - $199 PSF$200 + PSF

34 Corridors from $35 - $49 PSF28 Corridors from $50 - $64 PSF8 Corridors from $65 - $79 PSF8 Corridors from $80 - $99 PSF6 Corridors from $100 - $149 PSF3 Corridors from $150 - $199 PSF1 Corridor from $200 + PSF

26 Corridors from $35 - $49 PSF10 Corridors from $50 - $64 PSF3 Corridors from $65 - $79 PSF4 Corridors from $80 - $99 PSF2 Corridors from $100 - $149 PSF

PPSF Range Total Corridors Per Price Range Total Corridor Per Price Range

Five Years of Growth!

2014 Retail Corridor Map

2014 Retail Corridor Map Legend

2014 Corridor Map Legend 2009 Flashback

100%INCREASEIN PRICING

SINCE2009

ALL NINE CORRIDORSARE LOCATED IN

NORTHERN BROOKLYN

AT LEAST 100% INCREASE IN PRICING COMPARED TO 2009

N

EW

S

WWW.CPEXRE.COM WWW.CPEXRE.COM

I N T

H E P A S T 5 Y E A R S

28 BU

S I N E S S E S O P E N E D O N F R A N K LI N

AVE

INC

REASE AT BEDFORD AVE STATION

LARGEST%L

INCREASE

S I N C E 2 0 0 1

CO M M E R C I A L S P A C E

Court Street – Having transitioned from mostly mom-and-pop shops to a row of national retailers, Court Street rep-resents the ultimate story of how a long-established corridor can still undergo a transformation. With established tenants such as Trader Joe’s, Starbucks, BareBurger, and Splendid, the demand for retail space on Court Street has never been higher, especially from regional and national tenants. With the addition of apparel giant J. Crew, the corridor is becom-ing a logical target for other apparel brands.

Bedford Avenue – Bedford Avenue sees a constant stream of consumer traffic thanks to trendy restaurants such as Fornino, The Meatball Shop, Sweet Chick, and a soon-to-arrive Flemish gastro-brasserie from the owners of ac-claimed biergarden Radegast. Whole Foods, at the corner of Bedford Avenue and N. 4th Street, will further add to its image as an extension of Union Square, not to mention its appeal. The constant rumors that Apple is eyeing a space on this coveted avenue certainly don’t hurt…

Fulton Mall – In the past few years, Fulton Mall has experi-enced quite the makeover. Recent arrivals such as H&M, Ar-mani Exchange, Banana Republic, and recent arrival Nord-strom Rack bring a different vibe to a corridor that not too long ago was mainly populated by cellphone and sneaker stores. Moreover, the continued interest in the corridor from national tenants and a recent commitment from Macy’s to upgrade its Fulton location proves that the renaissance of this iconic corridor is well underway.

Retail Corridors Transforming Due to High DemandFranklin Avenue – No corridor in Brooklyn has seen such a dramatic shift in such a short period of time. Similar to Bed-ford Avenue, Franklin Avenue is home to hip restaurants and cafés. Barboncino, Mayfield, Chavelas, Franklin Park, Lazy Ibis, and new arrival Cent’Anni are the main destinations on this rapidly developing epicurean avenue, but national tenants are already peeking around for their next Brooklyn location.

Cortelyou Road – Nestled by the beautiful Queen Anne architecture of Ditmas Park, Cortelyou Road won’t re-ceive quite the same attention from nationals as some oth-er Brooklyn locales; however, demand from locally owned businesses will be very strong in this tight-knit community. In fact, this high local demand is already evident from the presence of well-reviewed restaurants and bars such as The Farm on Adderley, The Costello Plan, and Sycamore, as well as quaintly curated shops like Collyer’s Mansion.

Manhattan Avenue – Once tenanted mainly by Polish businesses, this corridor has recently experienced a diver-sification of its storefronts. In the past five years, Manhattan Avenue has welcomed operators like Starbucks, Calexico, Konditori, and the newly opened Budin, a Scandinavian-style café and design shop.

1 4

5

6

2

3

$35-$50

$100-$199

PSFPSF

2009COURT STREET

2014

Born in Brooklyn - Now Venturing Beyond!Welcome to Brooklyn - Believe the Hype!

3M+

50%

SQUARE FEETHOUSING UNITSALREADY BUILT

BROOKLYNITESADDED SINCE 2003

ARE EATERIES

108,949

85%

47

ACRES INTHE PIPELINE

ACRES OFPARKLAND ADDED

HOUSING UNITSIN THE PIPELINE

5,5004,500

BROOKLYNITESAS OF JULY 2013

2,592,149

GREENPOINT & WILLIAMSBURG

IN THE ENTIRE SYSTEM

2012

/201

3

LINE RIDERSHIP HAD THE

SINCE 2007

INDOWNTOWNBROOKLYN

MADE AVAILABLE

WWW.CPEXRE.COM

Former Industrial HubsConverting to RetailUnable to afford the higher rents of traditional storefronts and their typical Brooklyn locations such as Downtown Brooklyn and Park Slope, many retailers have turned to alternative ar-eas and spaces out of which to run their businesses. In ad-dition, the influx of permanent residents into Brooklyn’s less expensive alternatives to Manhattan and Brooklyn Heights has created a new need for amenities and services in neigh-borhoods like Williamsburg, the Gowanus, and, soon, Sunset Park. As a result, the arrival of vendors and merchants has caused a repositioning of many previously industrial buildings for retail (and residential) use in these former manufacturing and shipping centers.

In Williamsburg, the shift has already been well-documented. Once a desolate industrial neighborhood, Williamsburg has captured the attention of the retail industry nationwide with its transformation from lofts and warehouse space into a trendy, energetic hub for retailers.

It is bound to happen again, and indeed is already underway in the Gowanus. Similar to Williamsburg, the Gowanus offers large floor plates coupled with a great location – how many other Brooklyn neighborhoods have the advantage of being nestled between Park Slope, Carroll Gardens, and Boerum Hill? – and good subway access via the R at Fourth Avenue and the F and G at Smith Street.

Whole Foods, Brooklyn Boulders, Dinosaur BBQ, and the Royal Palms Shuffleboard Club have already opened suc-cessful storefronts in this new retail frontier, while UFC Gym and Blinds-to-Go have secured their new locations. 3rd Ave-nue is also quickly becoming a gastronomic destination with restaurants such as Littleneck, The Pines, and Runner & Stone opening to rave reviews, even drawing food enthusiasts from Manhattan. In addition, the beautification of the Gowanus canal and the development of several large-scale residential projects will further alter the landscape of the neighborhood and make it more attractive to retailers.

Looking a few years into the future, we expect Sunset Park to be the next industrial area to follow suit in the borough’s retail conversion. The Industry City area is already home to Costco and MicroCenter. Others are certain to follow given the recent upgrades made to the properties and the ease of access via car (less than 20 minutes to Downtown Manhat-tan), subway (serviced by the express D and N trains, as well as the local R train), and bicycle (3rd, 5th, and 7th Avenues all have bike lanes, with a proposed expansion of the 3rd Av-enue bike plan already in the pipeline). Now that Jamestown has thrown its weight behind Industry City, we also expect cycling enthusiasts can look forward to 40 miles of pathways from Williamsburg to Rockaway Beach, Queens on the fu-ture Brooklyn Waterfront Greenway. Furthermore, the area is quickly becoming a bustling hub for artists and other creative types – a well-known retail vector.BROOKLYN BOULDERS

ROYAL PALMS SHUFFLEBOARD CLUB

$

WWW.CPEXRE.COM

Former Industrial HubsConverting to Retail

Why Brooklyn? Why Now?

10$ 15MBILLI NIN PRIVATE INVESTMENT

MORE HOTEL ROOMS BY

OF FIRMS SAY MORE THAN HALFOF EMPLOYEES LIVE IN BROOKLYN

FIRMS IN TRIANGLE

FIRMS OUTSIDE TRIANGLE

FIRMS

(PROJECTED)2012 2015

SQUARE FEET OF WORK SPACE

ADDITIONAL JOBS SUPPORTED

TOTAL ECONOMIC IMPACT OUTPUT

THE TECH TRIANGLE CONSISTS OF THE NAVY YARD, DOWNTOWN BROOKLYN, AND DUMBO

OF FIRMS SAY ALLOF EMPLOYEES LIVE IN BROOKLYN

INVESTMENTS SINCE 2006

2M SQUA

RE FE

ET

SQUARE FEET

RESIDENTIAL UNITS

VISITED

LAST

YEA

R

HOTELROOMS

DEVELOPMENT

1M RETAILOFFICE

17,53826M

TECH BROOKLYN

2,215 25% 2018BROOKLYN

77.2%

31.5%

6393.1M43K$6B

61.1%5231.7M23K$3B 51.7%

WWW.CPEXRE.COM

Forecasting Brooklyn’sNext Retail Destinations

Berry Street(Williamsburg – N. 8th St. to N. 3rd St.)Popular tenants such as Radegast Hall, Blue Bottle, and Ret-ro Fitness will soon be joined by Whole Foods on this rapidly changing corridor. With exciting tenants like these, Berry Street has the potential to recreate, along with Bedford Avenue, a similar synergy in Williamsburg to that which already exists along Court and Smith Streets in Cobble Hill and Boerum Hill.

Fifth Avenue(Greenwood Heights – 17th St. to 23rd St.)As an extension of Park Slope, this stretch of Fifth Avenue is quietly emerging as a viable option for operators who are being priced out of more expensive alternatives in Northern Brooklyn. Korzo, Sekt, and Quarter Bar have already spotted the growth potential of the area and have seized the opportunity.

Nostrand Avenue(Crown Heights – Dean St. to President St.)Nostrand Avenue is the next logical destination for retailers in this part of Brooklyn. Indeed, with great access to the subway and a recent uptick in residential development in the immedi-ate area, Nostrand Avenue is slated to share in the success of preceding retail arteries such as Franklin Avenue, Vanderbilt Avenue, and Flatbush Avenue.

IN THE PAST

IN WILLIAMSBURG

HIGHER

3Q 2010 3Q 2013

IN THE PAST

IN CROWN HEIGHTS

NEW RESIDENTIALPROJECTS

RESIDENTIALCONDO SALES

OR

COMPLETED

INCREASED

4 YEARS

10YEARS

20%

$477,500

25STARTED

MEDIAN SALE PRICEGREENWOOD HEIGHTS

128%

WWW.CPEXRE.COM

CPEX New YorkRetail Leasing Team

Timothy D. KingManaging PartnerTimothy D. King aligned with partner Brian Leary to found CPEX in 2008. In his role as Managing Partner, Mr. King co-heads the firm’s business line divisions and business de-velopment. During his forty-plus years in real estate operations, he has been instrumental in attracting numerous national retailers to the outer boroughs. Under his direction, the New York Retail Leasing Team has become a powerhouse of performance and the firm of choice for landlords, tenants, and tenant representation brokers.

Ryan CondrenManaging DirectorRyan Condren was promoted to Managing Director of the New York Retail Leasing Team in 2011 after joining CPEX as an Associate Director in 2008. His achievements in retail leasing have gained him recognition as a two-time CoStar Power Broker (2011, 2012), and he was also honored in the Home Reporter and the Brooklyn Spectator for earning the 2012 Brook-lyn Rising Stars Award. With Mr. Condren as one of its leaders, the New York Retail Leasing Team has been responsible for the completion of over 80 lease transactions totaling more than 225,000 square feet of retail space with an aggregate lease value of over $175 million.

Kristina TrigliaAssociateKristina Triglia has been a part of the CPEX team since it was formed in 2008. As an As-sociate, she supports the New York Retail Leasing Team by conducting market research, valuating leases, preparing marketing packages, performing client reporting, and executing the lease of properties. Since transferring to Retail Leasing in the winter of 2011, Ms. Triglia has assisted in the completion of retail lease agreements with Capital One, LA Boxing, PM Pediatrics, SUPRA, and The Sliding Door Company, among other notable tenants.

George DanutAssociateGeorge Danut has been a part of the CPEX New York Retail Leasing Team since Sep-tember 2012. As an Associate, he supports the New York Retail Leasing Team by provid-ing market research, valuating leases, preparing marketing packages, and executing the lease of properties. Since the beginning of 2013, Mr. Danut has assisted in the lease of over 20 retail spaces with such notable tenants as Harbor Freight, LePort Schools, City MD, Capital One, and Bar Method.

RESIDENTIALCONDO SALES

®

PREPARED BY THE CPEX RETAIL LEASING TEAM81 WILLOUGHBY STREET, 8TH FLOOR | BROOKLYN, NY | 11201 | 718.935.1800

WWW.CPEXRE.COM