2014-04 Study on Nonprofit Investing (SONI) Results

-

Upload

raffa-learning-community -

Category

Economy & Finance

-

view

188 -

download

0

description

Transcript of 2014-04 Study on Nonprofit Investing (SONI) Results

Thrive. Grow. Achieve.

The Study on Nonprofit Investing (SONI) Survey ResultsDennis Gogarty, CFP®, AIF®

Chase Deters, CFP®, ChFC®

Mark Murphy, CFA

Copyright Raffa Wealth Management, LLC All Rights Reserved

22nd Annual 2014 SONI Survey Results/ Page

DISCLAIMER

This presentation summarizes the results of an informal, non-scientific study compiled by analyzing the results of 261 surveys completed by nonprofit finance executives.

This presentation is for information purposes only. Participant responses have not been verified. Data analysis was performed by Raffa Wealth Management.

When stating “nonprofit” responses it should be noted that all responses are limited to the nonprofits that participated in the survey. No broader indications should be assumed.

32nd Annual 2014 SONI Survey Results/ Page

STUDY ON NONPROFIT INVESTING

Nonprofits plan every fiscal move with great caution, backed up with thorough analysis. Yet when it comes time to plan their investment policies and gauge their investment performance, they operate in a vacuum, without access to information about how similar organizations manage their reserves and perform on their investments.

The Study on Nonprofit Investing (SONI) is providing senior nonprofit finance executives with peer benchmarking data on investment policies and ROI. Raffa Wealth Management, LLC (RWM) has commissioned this annual study to help all nonprofits strengthen investment policies, gauge investment performance, and ultimately provide them with the tools they need to better serve their communities.

42nd Annual 2014 SONI Survey Results/ Page

INTRODUCTION

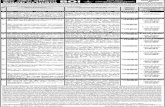

In February of this year 261 nonprofit finance executives completed a survey about their organization’s investment policies and results.

The survey was developed and distributed with the help of a third-party research provider (Visionary Marketing). Raffa Wealth Management has analyzed the results of the survey and is preparing the full SONI report for review.

*Other Includes: Educational, Religious, Cultural, & Community Development

Budget Of: Association Public CharityPrivate/Community

Foundation Other Overall$0-5M 44 41 16 30 131$5-25M 56 27 2 17 102$25+M 10 9 1 8 28Total 110 77 19 55 261

Second Annual

Study On Nonprofi

t Investing (SONI)

52nd Annual 2014 SONI Survey Results/ Page

AGENDA

Second Annual

Study On Nonprofi

t Investing (SONI)

• Budget and Reserve Balances

• Portfolio Investment Policy Review

• Portfolio Results & Analysis

• Key Takeaways and Custom Reports

62nd Annual 2014 SONI Survey Results/ Page

BUDGETS AND RESERVE BALANCES

How does the

budget size and type of

nonprofit impact where cash

assets are held?

What percentage of a nonprofit’s reserves is held in cash?

• For most nonprofits, the relative size of their operating cash reserves tend to decrease as their operating budget increases.

What percentage of a nonprofit’s reserves are held in a long term portfolio?

• Once operational cash reserves are funded, most nonprofits focus the majority of their investable assets in long term investment portfolios

Budget Of: Association Public CharityPrivate/Community

Foundation Other Overall$0-5M 22.2% 32.8% 23.7% 39.4% 29.8%$5-25M 18.4% 16.7% 51.4% 21.0% 18.9%$25+M 8.5% 22.1% 4.9% 11.4% 13.7%

Budget Of: Association Public CharityPrivate/Community

Foundation Other Overall$0-5M 46.7% 28.2% 44.7% 21.4% 34.5%$5-25M 49.0% 59.8% 10.0% 42.5% 50.5%$25+M 53.7% 57.6% 94.1% 50.6% 55.5%

72nd Annual 2014 SONI Survey Results/ Page

BUDGETS AND RESERVE BALANCES

What is the

average level of

investable assets with

respect to budget size?

What is the minimum target for reserves?

• Most of nonprofits participating in the survey target 4-6 months for their minimum level of reserves.

• Most of nonprofits participating in the survey held more in reserves than their minimum target.

Associations Public Charity Other45.5% 36.6% 37.5%23.4% 31.7% 41.7%22.1% 24.4% 12.5%9.1% 4.9% 8.3%

Operational Budget in Reserve4 - 6 Months in Reserve1 - 3 Months in Reserve

More than 1yr in Reserve7 - 12 Months in Reserve

82nd Annual 2014 SONI Survey Results/ Page

BUDGETS AND RESERVE BALANCES

How many nonprofits maintain a line of

credit for operation

al shortfalls?

How many nonprofits use a line of credit?

• Overall, 14.5% of the nonprofits who responded to the survey said they utilized a line of credit

• Of those, the average interest rate on the line of credit was 3.4%, with a high of 7.0% and a low of 1.0%

• Most nonprofits use their line of credit to pay expenses due to the timing of cash flows

• Those nonprofits who used a line of credit, tended to maintain lower cash reserves (21.2% of total reserves) than those who did not (24.7%)

Budget Of: Association Public CharityPrivate/Community

Foundation Other Overall$0-5M 7.0% 14.6% 16.7% 19.4% 13.8%$5-25M 12.7% 7.4% 0.0% 23.5% 13.1%$25+M 10.0% 33.3% 0.0% 12.5% 29.4%

92nd Annual 2014 SONI Survey Results/ Page

BUDGETS AND RESERVE BALANCES

Did more nonprofits add to, or withdrawa

l from their

investment reserves

during 2013?

What percent of nonprofits had cash flows to/from their investment reserves?

• Close to half added to reserves in 2013• Few nonprofit organizations needed to

withdraw money from their reserves

What percent of nonprofits have formal goals to contribute to their reserves?

• Most nonprofits only contributed to their reserves on an ad hoc basis, with no formal guideline

Association Public CharityPrivate/Community

Foundation Other OverallAdded 47.4% 34.9% 43.8% 31.8% 40.5%Withdrew 10.3% 22.2% 18.8% 4.5% 13.2%No Change 42.3% 42.9% 37.5% 63.6% 46.4%

Association Public CharityPrivate/Community

Foundation Other OverallGuideline 34.5% 22.1% 36.8% 18.2% 27.6%Ad-Hoc 46.4% 51.9% 36.8% 56.4% 49.4%

102nd Annual 2014 SONI Survey Results/ Page

AGENDA

Second Annual

Study On Nonprofi

t Investing (SONI)

• Budget and Reserve Balances

• Portfolio Investment Policy Review

• Portfolio Results & Analysis

• Key Takeaways and Custom Reports

112nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

How many nonprofits maintain a

formal investmen

t policy and who is

given authority

over investmen

t decisions?

What is the percentage of nonprofits with Investment Policy Statements?

• The majority (~75%) of nonprofits maintain formal Investment Policy Statements to govern their reserves

Who maintains decision-making authority over the investments in the portfolio?

• Most nonprofits (53%) give their investment advisor discretionary authority to make investment changes within the guidelines of the IPS

Association Public CharityPrivate/Community

Foundation Other Overall

90 51 12 30 183

88.2% 67.1% 70.6% 62.5% 75.3%

Association Public CharityPrivate/Community

Foundation Other Overall60.0% 51.0% 58.3% 36.7% 53.6%38.9% 39.2% 25.0% 40.0% 38.3%1.1% 9.8% 16.7% 23.3% 8.2%

DiscretionaryNon-DiscretionaryDon't Know

Inv Adv Authority

122nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

What nonprofits maintain

target asset

allocations and who

made changes?

How many organizations had formal asset allocation targets?

• The majority of associations have formal asset allocation targets, but barely half of the other nonprofit groups maintain these targets

How many organizations changed their asset allocation targets?

• Nearly 30% (23/79) of those Associations with formal asset allocation targets chose to make adjustments to their policy last year

Association Public CharityPrivate/Community

Foundation Other OverallCount 79 41 10 20 150Percentage 71.8% 53.2% 52.6% 36.4% 57.5%

Association Public CharityPrivate/Community

Foundation Other Overall23 17 3 7 50

21.7% 11.8% 33.3% 28.6% 20.0%39.1% 23.5% 33.3% 28.6% 32.0%26.1% 29.4% 28.6% 26.0%8.7% 17.6% 14.3% 12.0%8.7% 33.3% 6.0%

Made a ChangeMore ConservativeMore AggressiveNew CategoryIncreased AltsDecreased Alts

132nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

How does the

reserve size of a nonprofit

impact the target asset

allocation of their

long term reserve?

How do nonprofits with a $0-5M reserve structure their Long Term portfolio?

How do nonprofits with a $5-25M reserve structure their Long Term portfolio?

How do nonprofits with a $25+M reserve structure their Long Term portfolio?

Association Public CharityPrivate/Community

Foundation Other Overall21 12 3 7 43

14.5% 20.0% 41.7% 19.6% 18.8%33.0% 23.7% 9.3% 35.4% 29.1%38.6% 37.4% 16.3% 33.6% 35.9%5.9% 12.9% 9.0% 6.4% 8.2%3.2% 6.0% 11.7% 0.7% 4.2%

International Alternatives

Reseve of $0-5M# of LT ReservesCashBondUS Equity

Association Public CharityPrivate/Community

Foundation Other Overall48 18 2 10 78

6.9% 4.0% 5.0% 4.5% 5.9%35.6% 34.4% 10.0% 36.5% 34.8%38.5% 38.6% 32.5% 41.0% 38.7%9.2% 12.9% 52.5% 7.0% 10.9%5.1% 4.0% 0.0% 1.0% 4.2%

Reserve of $5-25M# of LT ReservesCashBondUS EquityInternational Alternatives

Association Public CharityPrivate/Community

Foundation Other Overall9 11 5 2 27

1.6% 2.3% 2.8% 0.0% 1.9%31.9% 24.4% 21.2% 25.0% 25.4%38.9% 32.6% 28.0% 60.0% 34.6%15.9% 16.7% 10.2% 7.5% 14.0%11.7% 20.3% 16.0% 7.5% 15.1%

Reserve of $25+M# of LT ReservesCashBondUS EquityInternational Alternatives

142nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

How does the

reserve size of a nonprofit

impact the target asset

allocation of their

long term reserve?

How do Associations structure their Long Term portfolio?

• Smaller associations maintain a more conservative portfolio

• Larger associations have a greater allocation to alternatives

Cash/Bond US/Intl Equity Alternatives47.5% 44.5% 3.2%42.5% 47.7% 5.1%33.4% 54.9% 11.7%

AssociationsReserve of $0-5MReserve of $5-25MReserve of $25M+

152nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

What nonprofits included

allocations to

alternatives in their target

allocations?

How many organizations held alternative investments?

• 45% of organizations with a target asset allocation held alternative investments

• Associations were the least likely to include alternative investments in their target allocation

• Those with larger reserves were more likely to include allocations to alternatives

Reserve Of: Association Public CharityPrivate/Community

Foundation Other Overall# Responses 78 41 10 20 149$0-5M 19.0% 50.0% 33.3% 14.3% 30.2%$5-25M 47.9% 44.4% 0.0% 10.0% 41.0%$25+M 77.8% 100.0% 80.0% 33.3% 82.1%Overall 43.6% 61.0% 60.0% 15.0% 45.6%

162nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

What kind of

alternative investments are being

used?

What kind of alternative investments did organizations use?

• Real Estate most commonly held alternative• Allocations to Private Equity/Venture Capital

and Hedge Funds increase with Long Term Reserve size

• Commodities and Precious metal holdings decrease as portfolio size increases

• Given the 2013 return for Commodities, Hedge funds, precious metals, and REIT’s. Holding alternatives did not likely add value in 2013.

Reserve Of: Commodity Hedge FundPrivate Equity / Venture Capital

Precious Metals Real Estate

$0-5M 69.2% 15.4% 7.7% 30.8% 84.6%$5-25M 18.8% 12.5% 3.1% 12.5% 43.8%$25+M 8.7% 47.8% 30.4% 4.3% 26.1%Overall 42.6% 45.6% 23.5% 19.1% 69.1%

172nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

Who’s responsible

for ensuring that the

investments comply with the

IPS?

Who has the responsibility to review compliance with the IPS?

• Finance Committees are the most likely to have responsibility to review that the reserves are in compliance with the investment policy

• Associations give responsibility to internal staff members to ensure compliance with their policy, more so than any other organization type

Association Public CharityPrivate/Community

Foundation Other Overall33.0% 14.3% 8.3% 3.4% 20.9%6.8% 12.2% 8.3% 31.0% 12.4%

54.5% 69.4% 75.0% 62.1% 61.6%5.7% 4.1% 8.3% 3.4% 5.1%

IPS ReviewerStaff Member(s)Board of DirectorsFinance Comm.Investment Advisor

182nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

How often

should your IPS

be reviewed

?

How frequently is the Investment Policy Statement reviewed?

• IPS is most commonly reviewed on an annual basis (60%-77%)

• Reviewing on an as needed basis is the second most common response (10% - 20%)

Association Public CharityPrivate/Community

Foundation Other Overall14.6% 23.5% 8.3% 17.2% 17.1%77.5% 62.7% 75.0% 58.6% 70.2%7.9% 11.8% 8.3% 24.1% 11.6%

2.0% 8.3% 1.1%

IPS Review DateAs NeededWithin 1 Yr

I don't know2 Yrs or Less Often

192nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO INVESTMENT POLICY

What do nonprofits include in

their investment

policy statements?

In the IPS, what topics are addressed most frequently?

• Additional Suggestions for IPS Categories– Performance Benchmarks - Conflict of Interest– Definition of Risk - Spending Policy– Cost of Funds/Management - Portfolio Goals & Objectives– Performance Accountability - Fiduciary Status

• Permitted and prohibited investments, and the target investment allocations were the top three items addressed

• Fewer than half of policies address selection/termination guidelines of investment advisors

• Very few policies included SRI restrictions

Percentage87.7%78.2%68.2%61.5%60.9%54.7%49.2%28.5%21.2%

Target Allocation PercentagesPermitted Investments

Prohibited Investments

Socially Responsible Mandate

Diversification Requirements

Items Reviewed in Investment Policy

Selection of Investment AdvisorsTermination of Investment Advisors

Financial Advisor DiscretionInternal Staff Roles/Responsibilties

202nd Annual 2014 SONI Survey Results/ Page

AGENDA

Second Annual

Study On Nonprofi

t Investing (SONI)

• Budget and Reserve Balances

• Portfolio Investment Policy Review

• Portfolio Results & Analysis

• Key Takeaways and Custom Reports

212nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How does the

reserve size of a nonprofit impact their

bottom line

results?

What was the reported performance of the long term reserve in 2013?

• Associations with a smaller portfolio balance tended to have a lower rate of return, likely due to their more conservative asset allocation.

• As Public Charities grow in size, they tend to reallocate more of their cash to alternative investments. This did not provide a significant improvement in their investment returns in 2013.

Reserve Of: Association Public CharityPrivate/Community

Foundation Other Overall$0-5M 7.9% 8.6% 11.7% 10.5% 8.7%$5-25M 13.4% 12.4% 10.0% 13.4% 13.1%$25+M 14.9% 12.0% 12.1% 12.0% 12.9%Overall 11.8% 10.8% 11.5% 12.0%

Total United States Stock Market

Russell 1000 Index: top 1000

largest US publicly traded companies

Russell 2000 Index: remaining 2000 mid-sized and small US publicly traded

companies

S&P 500: top 500 largest US publicly traded companies

Value Stocks Growth Stocks

Russell 3000 Index: materially all publicly traded

US companies

Russell 1000 Index:

Russell 2000 Index:

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

Total International Stock Market

Large International Developed Country

Stocks

Stocks from Emerging Market

Countries

MSCI All World ExUS Index

MSCI EAFE Index

MSCI Emerging Markets

Index

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

Other: South America & Canada

Total US Bond Market

BarCap 1-5yr Gov/Credit Index:

Avg Duration ~ 2.7yrs

BarCap Long Term Gov/Credit Index:

Avg Duration ~ 14.2yrs

BarCap Aggregate Bond

Market Index: Avg Duration ~

5yrs

BarCap 1-5yr

Gov/Credit Index: Avg ~

2.7yrs

BarCap Long Term Gov/Credit

Index: Avg ~

14.2yrs

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

BarCap 5-10yr Gov/Credit

Index: Avg ~ 6.5yrs

BarCap 5-10yr Gov/Credit Index:

Avg Duration ~ 6.5yrs

BarCap US Credit Index:Avg Duration ~ 6.8yrs

BarCap US Treas Index:Avg Duration ~ 6yrs

US Government, Agency &

Treasury Bonds

US Corporate & Mortgage Backed

Bonds

252nd Annual 2014 SONI Survey Results/ Page

2013 INDEX RISK AND RETURN

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

Risk

Return

Fixed income

International stocks

US Stocks

Second Annual

Study On Nonprofi

t Investing (SONI)

262nd Annual 2014 SONI Survey Results/ Page

2013 PORTFOLIO BENCHMARK INDEX RISK AND RETURN

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

Second Annual

Study On Nonprofi

t Investing (SONI)

272nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How do the investment

results compare to a blended portfolio

benchmark?

What was the performance of a sample blended portfolio benchmark in 2013?

Representative, sample portfolio benchmarks are intended to give context to performance results. The benchmarks were selected because we believe they are the broadest index available in each broad category (US stock, Intl stock, Bond, and Cash). They may or may not be suitable benchmarks for comparison to any particular investor’s portfolio or for the average results reflected in this study.

2013 Return 30/70 40/60 50/50 60/40 70/30

33.55% 20% 29% 38% 47% 56%15.29% 10% 11% 12% 13% 14%-2.02% 65% 55% 45% 35% 25%0.02% 5% 5% 5% 5% 5%8.72% 0% 0% 0% 0% 0%

Traditional Market Benchmarks

Blended Portfolio Sample Benchmarks

Russell 3000

1Month US T-Bills

HFRI Fund-of-Funds

MSCI AW ExUS

BarCap Agg Bond

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

282nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How were the

investment results

relative to a blended

benchmark?

What was the performance of a sample blended portfolio benchmark in 2013?

•On an absolute basis, performance in 2013 was very strong

•Relative to a sample benchmark, performance lagged significantly as nonprofits increased exposure to equities

2013 Return

6.93%10.30%13.68%17.05%20.42%

Traditional 40/60 Portfolio BenchmarkTraditional 50/50 Portfolio BenchmarkTraditional 60/40 Portfolio BenchmarkTraditional 70/30 Portfolio Benchmark

Blended Benchmark Portfolio (Stock/Bond)*

Traditional 30/70 Portfolio Benchmark

*Indexes do not reflect the fees associated with actual investments and such fees would reduce the performance illustrated. Past performance is not an indication of future results and any investment can lose value.

# Portfolios Avg Return +/- Index9 8.59% 1.66%9 10.58% 0.28%

26 11.08% -2.60%20 12.00% -5.05%29 13.66% -6.76%

2013 Results

Growth 70/30 Portfolio (60-70% Stock)

Nonprofit Investment AllocationConservative 30/70 Portfolio (20-30% Stock)Mod Conservative 40/60 Portfolio (30-40% Stock)Balanced 50/50 Portfolio (40-50% Stock)Moderate Growth 60/40 Portfolio (50-60% Stock)

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

292nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

What level of under -

performance is

acceptable?

What level of underperformance is acceptable?

•Most nonprofits (45%) believe that over a 5 year time frame, advisors and managers should be expected to outperform their market benchmark net of all fees

•A surprisingly large number (23%) of nonprofits “didn’t know” what level of underperformance was acceptable.

33 16%

12 6%

I don't know 46 23%

45%

Advisors are expected to outperform gross of their fee, but underperformance up to the amount of their fee is reasonableAfter considering all fees, trailing benchmarks by 0.5% - 2.0% is reasonablePerformance should be measured in absolute terms (for example CPI + 5%)

10%20

Given a 5yrs, advisors are expected to outperform market benchmarks net of all fees

90

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

302nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How much do

nonprofits pay their advisors and fund

managers?

How much do you pay your investment advisor and fund managers?

•As the investment balance increases, most nonprofits tend to be able to reduce their fees

How many “don’t know” how much they pay their advisors and fund managers?

•The majority of responses “don’t know” their fees•As reserve balances grow, fewer associations are unaware of how much their advisors are being paid

Reserves Of: Association Public Charity# Responses 46 25$0-5M 1.45% 1.01%$5-25M 1.13% 0.82%$25+M 1.02% 0.99%

Reserves Of: Association Public Charity# Responses 63 52$0-5M 70% 81%$5-25M 50% 48%$25+M 45% 36%Overall 58% 66%

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

312nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How do portfolio expenses impact bottom

line portfolio results?

Does knowing how much you pay impact overall portfolio performance?

*t(150) = -1.96, p=0.078

•Portfolio results are significantly lower for those who do not know their investment expenses

How does paying higher fees impact investment returns?

•Overall, as portfolio expenses increased, average returns decreased.

Average Return12.20%9.98%

Fees are KnownFees are Not Known

# Responses Average Return35 12.54%40 12.10%17 11.56%

Annual Fee: 0.00% - 0.75%Annual Fee: 0.76% - 1.50%Annual Fee: 1.50% +For Illustration

purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

322nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How do portfolio expenses impact bottom

line portfolio results?

How does the impact of not knowing fees change as asset allocations change?

•Portfolio results decline substantially when portfolio expenses are unknown

Fees are Known"Don't Know"

Fees Difference11.69% 8.40% -3.29%12.44% 10.90% -1.54%15.36% 10.57% -4.79%

Portfolio AllocationBalanced (50/50) PortfolioMod Growth (60/40) PortfolioGrowth (70/30) Portfolio

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

332nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How do portfolio expenses impact bottom

line portfolio results?

How does giving discretion to an investment advisor impact performance?

•Overall, giving discretion to your financial advisor only slightly improves bottom line results, but not significantly

How does having an SRI mandate impact performance?

•Approximately 21% of those who had formal investment policy guidelines also had a socially responsible mandate

•Those who had a SRI mandate experienced lower returns than those without the restriction

Average Return11.51%11.45%

DiscretionNon-Discretion

Average Return # Responses12.64% 14210.14% 38

No SRI RestrictionSRI Mandate

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

342nd Annual 2014 SONI Survey Results/ Page

PORTFOLIO RESULTS & ANALYSIS

How does having a formal

investment policy impact

portfolio results?

How does having a formal invest policy impact performance?

*t(148) = 4.92, p < 0.01

•Overall, organizations who have formal investment policy targets had significantly higher returns

Does changing asset allocation targets impact performance?

*t(121) = 2.44, p < 0.05

•Overall, organizations who stuck to their original asset allocation targets had significantly higher performance results

Average Return12.74%6.34%No Formal Targets

Have Formal Allocation Targets

Average Return13.79%10.99%Making Change to Target

No Change to Target

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

352nd Annual 2014 SONI Survey Results/ Page

AGENDA

Second Annual

Study On Nonprofi

t Investing (SONI)

• Budget and Reserve Balances

• Portfolio Investment Policy Review

• Portfolio Results & Analysis

• Key Takeaways and Custom Reports

362nd Annual 2014 SONI Survey Results/ Page

KEY TAKEAWAYS

Keeping it Simple in 2013 helped respondents perform better.

1. Great absolute returns in 2013 and more respondents added to reserves than withdrew.

2. Close to half of the nonprofits participating held close to 50% of their cash assets in long term investments.

3. Half of the respondents give discretion to advisors to operate within the guidelines of the IPS.

4. The majority of associations have formal IPS’s with asset allocation targets. Having a policy with asset allocation targets, and not making changes to them, improved ROI in 2013.

5. The larger the organization and the more aggressive the asset allocation policy, the better the performance results in 2013.

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

372nd Annual 2014 SONI Survey Results/ Page

KEY TAKEAWAYS

Keeping it Simple in 2013 helped respondents perform better.

6. Allocating to alternative assets likely detracted from performance results in 2013.

7. In relation to traditional broad market stock and bond benchmarks, participant returns trailed significantly.

8. The lower the fees, the better the results. In part because larger portfolios were more aggressively invested and less expensive.

9. Not knowing fees (more than 50% of respondents) correlated with lower results.

10. Portfolios with more US equity (particularly small cap), less emerging market and alternative investment exposure, and shorter term/corporate bonds performed best.

For Illustration purposes only. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. Past performance is not a guarantee of future results.

382nd Annual 2014 SONI Survey Results/ Page

CONCLUSION

Thank you for attending!

Custom SONI reports can be created to compare your organization’s policy and results to your peer group for a flat fee.

We can’t thank you enough for participating and we strongly encourage you to participate again next year.

For more information:

• Visit www.npinvesting.org

• Or email [email protected]

392nd Annual 2014 SONI Survey Results/ Page

DISCLOSURE

This information was gathered from reliable sources but we cannot guarantee accuracy. Any performance related information is based on participant responses and have not been verified. Past performance is not an indication of future results and any investment can lose value.

Performance results have been compared to balanced benchmark portfolios comprised of broad market indexes. The benchmarks were selected because we feel they are the broadest market benchmark available in each broad category. They may or may not be suitable benchmarks for comparison to any particular investor’s portfolio or for the average results reflected in this study. You should consult with your investment professional to determine suitable benchmarks for your portfolio.

Indexes do not reflect the fees associated with actual investments and such fees would reduce the performance illustrated.