2012 sin tax presentation oct10

-

Upload

kristela-castronuevo -

Category

Documents

-

view

201 -

download

1

Transcript of 2012 sin tax presentation oct10

COMMITTEE ON WAYS & MEANS

SENATE OF THE PHILIPPINES

Senate Bill 3299 under

Committee Report 411

O/S Recto

October 10, 2012

The measure we are about to debate poses a deterrent that willKEEP PEOPLE FROM BEING SICK

and will GENERATE REVENUESthat will TREAT THEM when they

get sick.

O/S Recto

Taxationis what makes

appropriationspossible.

O/S Recto

P1.3T BillionBIR 2013 Collections

P75 BillionBIR 2013 Excise Tax

Collections

~P20.00

P1.00 for every P20.00 from sin products

O/S Recto

1912

Distilled Spirits 3,049,684

Wines and Imitation Wines 173,391

Fermented Liquors 202,178

ALCOHOL Sub- Total 3,425,254

Smoking and Chewing Tobacco 283,025

Cigars 255,700

Cigarettes 4,378,680

TOBACCO Sub-Total 4,917,406

GRAND TOTAL 8,908,788

Taxes Collected (in Php) from Alcohol and Tobacco 100 Years Ago

Source: Report of the Philippine Commission to the Secretary of War, FY 1912 O/S Recto

Firemen and

fire trucks

(BJMP Budget)

P8.6 BExcise Taxes Paid

(2011)

O/S Recto

P1.5 BExcise Taxes Paid

(2011)

classrooms

O/S Recto

P1.0 BExcise Taxes Paid

(2011)

pension of

senior citizens

O/S Recto

A government in need of money would always prefer

a TAXABLE VICE, like drinking, to a tax-exempt virtue like staying sober.

O/S Recto

DISTILLED SPIRITSGin Whisky Brandy Rum Vodka Tequila Siok Tong

WINESSparkling wine Champagne Still wine Fortified Wine

ALCOHOL INDUSTRYProduct Classifications

FERMENTED LIQUORBeer Lager Ale Porter Basi Tapuy

O/S Recto

2011 Volume of Removals

DISTILLED SPIRITS FERMENTED LIQUOR

1.56 bi l l ion l i ter s or

4.7 bi l l ion bott les255 mil l ion l i ter s

17.4 l i ter s per per son

O/S Recto

G r o s s S a l e s ( 2 011 )ALCOHOL INDUSTRY

Fermented Liquor Distilled Spirits

P67 B P57 B

TOTAL

P124 B

WinesP 263 M

Source: BIR O/S Recto

To t al Ta x e s Pa i d ( 2 011 )ALCOHOL INDUSTRY

Fermented Liquor Distilled Spirits

P30 B P12 B*

TOTAL

P42 B

WinesP 35 M** *includes BOC data; Source: DSAP

** excise tax only (no data for other taxes paid)Source: BIR

O/S Recto

TAX BURDEN ON FERMENTED LIQUOR (2011)

Excise

VAT

TOTAL

Income &other taxes

19 B

6 B

30 B

5 B

28%

9%

8%

45%

O/S Recto

To t al Ta x e s Pa i d ( 2 011 )ALCOHOL INDUSTRY

Fermented Liquor Distilled Spirits

P30 B P12 B*

TOTAL

P42 B

WinesP 35 M** *includes BOC data; Source: DSAP

** excise tax only (no data for other taxes paid)Source: BIR

O/S Recto

TAX BURDEN ON DISTILLED SPIRITS (2011)

Excise

VAT

TOTAL

5.2 B

5.2 B*

12 B

Income &other taxes 1.6 B

9%

9%

3%

21%

*with BOC data

Source: BIRO/S Recto

*with BOC data

Source: BIR

Alcohol

34%*

Telecoms

15%

Power

15%

Automobile

4%

Tax Burden of Selected Industries (2011)

O/S Recto

Distil led SpiritsCURRENT TAX RATES

1. FROM LOCAL SOURCES

(sap of nipa , coconut , cassava, camote or bur i

pa lm or f rom the ju ice, syrup or sugar of the

cane)

P 14.68

2. FROM RAW MATERIALS OTHER THAN THOSE

ENUMERATED ABOVE

Net reta i l pr ice (NRP) [exc lud ing the exc ise and

VAT] per bot t le of 750 ml vo lume capac i ty is :

Less than P250.00

P250.00 to P675.00

More than P675.00

P 158.73

P 317.44

P 634.90

O/S Recto

WinesCURRENT TAX RATES

1. SPARKLING WINES/ CHAMPAGNES

Net Retail Price, per bottle, regardless of proof:

P500.00 or less

More than P500.00

P 183.42

P 550.24

2. STILL WINES

Less than 14% of alcohol by volume

14% to 25% of alcohol by volume

P 22.00

P 44.02

3. FORTIFIED WINES

More than 25% of alcohol by volume

Same as distilled

spirits

O/S Recto

Fermented LiquorCURRENT TAX RATES

1. Beer, lager beer, ale, porter and other fermented

liquors except domestic fermented liquor (e.g. tuba,

basi, tupuy)

Net Retail Price, per liter of volume capacity :

Less than P14.50 (low)

P 14.50 to P 22.00 (medium)

More than P22.00 (high)

P 10.42

P 15.49

P 20.57

2. Fermented liquor brewed and sold at micro

breweries, pubs, restaurants P 20.57

O/S Recto

Source: DSAP, August 2012

2011 Major Corporat ions

ALCOHOLINDUSTRY

Source: BIR

O/S Recto

EmperadorDistillers

GinebraSan Miguel, Inc.

TanduayDistillers

DestileriaLimtuaco & Co.

ALCOHOL INDUSTRYDistilled Spirits Fermented Liquor

Source: DSAP, August 2012

San Miguel Breweries Inc.

Asia Brewery Inc.

Source: BIR O/S Recto

PERCENTAGE OF ALCOHOL EXPENDITURE

0.9 0.9

0.7 0.7 0.7 0.7

1994 1997 2000 2003 2006 2009

F a m i l y I n c o m e a n d E x p e n d i t u r e S u r v e y ( 1 9 9 4 - 2 0 0 9 )

O/S Recto

*Source: DOF

201192 billion sticks/4.6 billion packs

200917.3 million smokers

O/S Recto

92% sold in sari-sari stores

60% sold by tingiSource: PMFTC (2012, 1st Half)

Per capita consumption: 13 sticks

O/S Recto

G r o s s S a l e s ( 2 011 )TOBACCO INDUSTRY

Manufactured Tobacco

P827 MTOTAL

P89.3 B

Source: BIR

Cigars

P75.6 M

Cigarettes Packed by Machine (in 20s)

P87 BCigarettes Packed by Hand (in 30s)

P1.4 B

O/S Recto

G r o s s S a l e s ( 2 011 )TOBACCO INDUSTRY

Manufactured Tobacco TOTAL

P89.3 B

Source: BIR

Cigars

Cigarettes Packed by Machine (in 20s)Cigarettes Packed by Hand (in 30s)

97.4%1.6%

0.9% 0.08%

O/S Recto

TAX BURDEN ON TOBACCO

Excise

VAT

TOTAL

25.8 B

5.6 B

35.6 B

Income &other taxes 4.2 B

O/S Recto

PERCENTAGE OF TOBACCO EXPENDITURE

F a m i l y I n c o m e a n d E x p e n d i t u r e S u r v e y ( 1 9 9 4 - 2 0 0 9 )

1.41.3

1.1 1.1

0.9

0.8

1994 1997 2000 2003 2006 2009

O/S Recto

TAX BURDEN ON TOBACCO

Excise

VAT

TOTAL

Income &other taxes

29%

6%

5%

40%

of every

O/S Recto

Tobacco Products & Cigar sCURRENT TAX RATES

Tobacco Products

Tobacco not for chewing

Tobacco for chewing

P 1.19

P 0.94

Cigars

NRP per piece:

P500.00 OR LESS

More than P500.00

10% OF THE NRP

P 50.00 + 15% of the NRP in

excess of P 500.00

O/S Recto

CigarettesCURRENT TAX RATES

Cigarettes packed by hand (in 30s) P 2.72

Cigarettes packed by machine (in 20s)

Net Retail Price

Below P5.00 (Low)

P5.00 to P6.50 (Medium)

More than P6.50 to P10.00 (High)

More than P10.00 (Premium)

P 2.72

P 7.56

P 12.00

P 28.30

O/S Recto

CIGARETTES (PACKED BY MACHINE)

Tier/ Tax Rate

Low

P2.72

Medium

P7.56

High

P12.00

Premium

P28.30

Total

Source: DOF

Removals

(packs)

3.0 B

451 M

1.15 B

-

4.60 B

Excise Taxes

Collected (Php)

8.1 B

3.4 B

13.9 B

-

25.4 B

O/S Recto

CIGARETTES (PACKED BY MACHINE)

Tier/ Tax Rate

Low

P2.72

Medium

P7.56

High

P12.00

Premium

P28.30

Total

Source: DOF

Removals

(packs)

3.0 B

451 M

1.15 B

-

4.60 B

Excise Taxes

Collected (Php)

8.1 B

3.4 B

13.9 B

-

25.4 B

O/S Recto

2011

Cigarettes

Philip Morris Fortune Tobacco Corp. Inc. (PMFTC)

Japan Tobacco International (JTI)

Mighty Corp.

La Suerte Cigar andCigarette Factory

Associated Anglo-American Tobacco Corp.

British American Tobacco

Source: BIR

94.12%

2.59%

2.12%

0.66%

0.51%

---

O/S Recto

Companies are just COLLECTING AGENTSof the government.

O/S Recto

Under our system, it is the CONSUMERS, NOT THE

MANUFACTURERS,who eventually shoulder the excise tax, on account of its

nature as a PASS-ON TAX.

O/S Recto

The ones who will ultimately bear the

additional tax burden are ORDINARY FOLKS.

O/S Recto

It is not BIG TOBACCO or the GIANT BREWERY

who will pay but,SMALL PEOPLE.

O/S Recto

O/S Recto

Cigarette smoking, like a

cigarette butt, should be crushed.

But in the real world, IMPOSSIBLE.

O/S Recto

If we ban cigarettes, this government will weaken

from lack of cigarette taxes.That would be the real

FISCAL SHOCK.

O/S Recto

It seeks to getMORE BUCKS out of

FEWER PACKS.

O/S Recto

A HIGHER TAX RATE

DOES NOTautomatically result in HIGHER COLLECTIONS.

O/S Recto

The void will be filled bySMUGGLERS.

O/S Recto

COUNTRY CASE STUDIES ON ILLICIT TRADE

o CANADA – high excise levels (22%), increasedconsumption of illicit cigarettes, underminedregulatory & fiscal objectives.

o HUNGARY – sharp, above-inflation increase inexcise rate led to increased revenues initially buteventually to a revenue decline.

o IRELAND – steep excise tax increase resulted inswift emergence of illicit trade, virtually flatcigarette duty revenues.

O/S Recto

o MALAYSIA – staggering increase in excise tax (in2011, 172% of 2004 rates) led to illicit trade growing toalmost 40% of the market.

o NEW YORK – excise duty hikes above underlyinginflation level led to a sharp drop in legalvolumes, decline in government revenues, decreasedsmoking incidence and illicit trade reaching almost40% of the market.

o ROMANIA – continuous massive exciseincreases, increased government revenue, constantsmoking incidence, illicit trade is more than ⅓ of totalconsumption.

COUNTRY CASE STUDIES ON ILLICIT TRADE

O/S Recto

o SINGAPORE – 135% increase in 2005 over2000, declining government revenues despite taxincrease, smoking incidence was virtuallyunchanged from 2001, illicit trade grew.

o SWEDEN – reduction in excise rates used tocounter extreme levels of illicit trade (late 1990s);massive increase led to increased illicit trade (2007and 2008) and reduction in total cigaretteconsumption.

o UNITED KINGDOM – ‘duty escalator’ tobaccotaxation led to down-shifting byconsumers, increased illicit trade, governmentrevenue loss but with no impact on smokingincidence levels.

COUNTRY CASE STUDIES ON ILLICIT TRADE

O/S Recto

o “The tax-induced increase in cigarettes will

certainly lead to smuggling or illicit trade. It might

even lead to some illegal cigarette manufacturing

within the country.”

o “The net incremental revenues should take into

account the additional expenses on the part of

the government to improve anti-smuggling

efforts.”

-- Dr. Benjamin Diokno

O/S Recto

Are we willing to OUTSOURCE even the

MANUFACTURE OF SIN to distant lands?

O/S Recto

Use taxes as a deterrent to the consumption of unhealthy products

Create predictable, dependable, and reliable stream of revenues

Eliminate the annexes

Herald the imposition of a unitary tax rate

Index tax increases to inflation

Earmark portion of the proceeds to health care programs

O/S Recto

O/S Recto

Newly-introduced products shall be

initially classified using the suggested

NRP as declared in the sworn

statement submitted to the BIR.

O/S Recto

We believe that the variety of products sold should

beget a variation of taxes.

O/S Recto

We adopted aCONSERVATIVE FRAMEWORK

that we believe hedges CLOSER TO REALITY.

O/S Recto

ReasonableRealistic and

Responsible rendering of our power to tax the industry of

alcohol and cigarettes.

O/S Recto

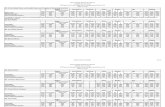

INCREMENTAL REVENUE (HB 5727 ORIGINAL)

Year Cigarettes Distilled Spirits Fermented

Liquor

Total

2012 30.13 B 11.19 B 19.35 B 60.66 B

2013 36.10 B 26.51 B 21.68 B 84.28 B

2014 41.27 B 52.99 B 24.14 B 118.40 B

2015 43.36 B 58.35 B 26.73 B 128.45 B

2016 45.51 B 64.24 B 29.59 B 139.33 B

Total 196.37 B 213.27 B 121.49 B 531.12 B

O r i g i n a l R e v e n u e E s t i m a t e s

Source: DOF O/S Recto

INCREMENTAL REVENUE (HB 5727 ORIGINAL)

Elasticity CigarettesDistilled

Spirits

Fermented

LiquorTotal

-0.584 16.54 6.71 18.61 41.85

-0.727 7.10 6.71 18.61 32.42

-0.870 -1.91 6.71 18.61 23.41

R e v i s e d R e v e n u e E s t i m a t e s ( i n B i l l i o n P h p )

Source: DOF

Assumptions:

Average Industry Growth: 1.97% Cigarettes, 2.62% Fermented Liquor, 3.69% Distilled Spirits

(1997-2011)

O/S Recto

O/S Recto

Cut-offs increased by 8%

O/S Recto

O/S Recto

Cut-offs increased by 8%

O/S Recto

INCREMENTAL REVENUE (SENATE COMM. REPORT)

YearDistilled

Spirits

Fermented

LiquorCigarettes Total

2013

Source: DOF

1.38

( i n B i l l i o n P h p )

O/S Recto

O/S Recto

INCREMENTAL REVENUE (SENATE COMM. REPORT)

YearDistilled

Spirits

Fermented

LiquorCigarettes Total

2013 1.38

Source: DOF

3.81

( i n B i l l i o n P h p )

O/S Recto

O/S Recto

O/S Recto

4 tiers 3 tiers 2 tiers

O/S Recto

O/S Recto

NET RETAIL PRICE CUTOFFS

CIGARETTES

LOW

< P15M E DI U M

P15-P18H I G H

> P18

O/S Recto

O/S Recto

INCREMENTAL REVENUE (SENATE COMM. REPORT)

YearDistilled

Spirits

Fermented

LiquorCigarettes Total

2013 1.38 3.81

Source: DOF

9.79

( i n B i l l i o n P h p )

O/S Recto

INCREMENTAL REVENUE (SENATE COMM. REPORT)

YearDistilled

Spirits

Fermented

LiquorCigarettes Total

2013 1.38 3.81 9.79 14.98

Source: DOF

( i n B i l l i o n P h p )

O/S Recto

HB 5727 (AMENDED)

Range

Cigarettes -5.6 B 5.8 B

Alcohol 5.2 B

TOTAL -0.4 B 11 B

Year: 2013Elasticity: -0.584

Attachment

Attachment

O/S Recto

Cut-offs increased by 8%

O/S Recto

Our proposal is not just to earmark the incremental revenues

but a portion of theENTIRE EXCISE TAX COLLECTIONS

from alcohol and tobacco.

O/S Recto

+ P15 B incremental revenues on 2013

= P65 B

This measure:

O/S Recto

O/S Recto

O/S Recto

P65 B

RA 7171

1B to provinces producing burley and native tobacco

40% of total sin tax proceeds = P26 B to PhilHealth

10% of total sin tax proceeds = P6.5 B to DOH

•3.25 B to 16 regional hospitals

•3.25 B to 618 district hospitals operated by LGUs

100 M for public information and education campaign program

100 M for displaced workers

EARMARKING

50% of total sin tax proceeds = P33 B to public health sector

= 200 M

= 5.25 M

O/S Recto

Extinction of vices cannotbe affected through

taxation.

O/S RectoO/S Recto

This bill is not the magic pill that will

restore the fiscal health of the government

either.

O/S Recto

Other industries must do their share, not through a round of new taxes, but bySHUTTING DOWN THELOOPHOLESthrough which their companies breathe.

O/S Recto

Two of theHARDEST THINGS

a Senate can do is toVOTE FOR WAR and

VOTE FOR NEW TAXES.

O/S Recto

Lalo na sa isang batasna papataw ng buwis

hindi sa mgadambuhalang kumpanya

pero sa ordinaryongmamamayan.

O/S Recto

O/S Recto

![HES UserGuide Oct10[1]](https://static.fdocuments.in/doc/165x107/55cf981d550346d03395a8eb/hes-userguide-oct101.jpg)