2012 4th Quarter SAFe-mail

-

Upload

sc-state-accident-fund -

Category

Documents

-

view

215 -

download

2

description

Transcript of 2012 4th Quarter SAFe-mail

How Accidents Affect Your Bottom Line

WCF Update Publication; Volume 11; Fall 2011;

www.wcfgroup.com

fourth Quarter 2012

Table of Contents

1

How Accidents Affect Your Bottom Line

NCCI Releases New Study on Effects of Obesity

Why Premium Audits are Performed

Safe-mail Fourth Quarter 2012

2

4

According to the Occupational Safety and Health Administration, costs associ-

ated with occupational injuries and illness can comprise as much as 5% of a

company's total costs. These costs include direct and indirect costs.

Direct Costs

Direct costs of an injury include medical costs, lost wages and higher insur-

ance premiums. Insurance costs increase based on the rise in claims frequency

and severity, which will directly influence an organization's experience modi-

fier, or e-mod. Your organization’s e-mod is calculated by the National Coun-

cil on Compensation Insurance and is based on your payroll and claims costs

history compared to other similar organizations in your industry. If your or-

ganization’s claims frequency and severity is above the average, your e-mod

will be above a 1.00. If your claims frequency and severity is below average,

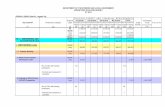

your e-mod will be less than 1.00. The following chart illustrates the increased

cost associated with a rise in claims.

Indirect Costs

Similar to the unseen portion of an iceberg, there are a number of indirect

costs associated with accidents that are not as easily seen. These indirect costs

have been estimated to be from 5 to 50 times the size of the direct costs. Indi-

rect costs include money spent on things such as repairing damaged equip-

ment, time to fill out accident reports, time and money spent on hiring and

training replacement personnel and lost productivity and quality because less

experienced employees replace key injured employees.

Revenue Required to Recover Costs

Few employers understand the additional sales and productivity efforts re-

quired to make up for lost profits associated with accidents. The two following

examples show how a company can calculate the revenues needed to maintain

profit margins and cover the cost of accidents. To calculate how much a com-

pany would have to make up in sales to pay for a claim, complete the formula

below.

How to Lower Costs

An effective safety program can help prevent injuries, reduce costs and make a

substantial contribution to your bottom line. The most effective safety program

is one that is fully integrated into the way your company conducts its business.

You should focus your safety program on the systems and processes that have

the greatest potential to cause injury.

“Actual injury costs are between 5 to 50 times the size of the obvious direct costs of medical expenses and salary for the injured worker.”

Winter Holiday Safety

3

W hen a workplace injury

occurs, how much does

that injury truly cost your

organization? Typically,

actual injury costs are between 5 to 50

times the size of the obvious direct costs

of medical expenses and salary for the

injured worker. An organization may also

be surprised to realize how much revenue

is necessary to recover the costs associ-

ated with a workplace injury.

Requirements of a Compensable Claim 5

“This new NCCI study confirms that obesity contributes in significant ways to the length of time during which claimants receive indemnity benefits.”

State Accident Fund Safe-mail Fourth Quarter 2012

2

T here is mounting evidence of obesity contributing to the

cost of workers compensation. Longitudinal studies by

Duke University of its own employees—and by Johns Hopkins University of employees of a multi-site U.S.

aluminum manufacturing company—point to substantially higher odds of injury for workers in the highest obesity category.

Further, a 2011 Gallup survey found that obese employees ac-count for a disproportionately high number of missed workdays, thus causing a significant loss in economic output. Finally, earlier

NCCI research of workers compensation claims found that claimants with a comorbidity code indicating obesity experience medical costs that are a multiple of what is observed for comparable non-obese claim-

ants.

This new NCCI study confirms that obesity contributes in significant ways to the length of time during which claimants receive indemnity benefits. Indemnity duration was measured based on Temporary Total

and Permanent Total indemnity benefit payments; in a sensitivity analysis, Permanent Partial benefits were counted toward indemnity benefit duration as well. Two concepts of aggregating observed indemnity

benefit transactions into duration were employed, with little difference in the results.

The statistical analysis shows that claimants with a comorbidity indicator pointing to obesity have an in-demnity benefit duration that is more than five times the value of claimants who do not have this comor-bidity indicator but are otherwise comparable. Inclusive of Permanent Partial indemnity payments, this

multiple climbs to more than six.

The results obtained for the effect of obesity on indemnity duration are close to what has been established by Duke University for the morbidly obese. Based on the reported means in the Duke University study,

for the morbidly obese, the number of lost workdays per claim amounts to 6.4 times the value observed for claimants of recommended weight.

NCCI Releases New Study on Effects of Obesity in

Workers’ Compensation

June 20, 2012 - WorkCompWire NCCI Study on Effect of Obesity in Workers Comp

South Carolina State Accident Fund

“At Work Since 1943.”

State Accident Fund Safe-mail Fourth Quarter 2012

3

screw-in bulbs. Read manufacturer’s instructions for number of LED strands to connect.

Use clips, not nails, to hang lights so the cords do not get damaged.

Keep decorations away from windows and doors.

HOLIDAY ENTERTAINING

Test your smoke alarms and tell guests about your home fire escape plan.

Keep children and pets away from lit candles.

Keep matches and lighters up high in a locked cabinet.

Stay in the kitchen when cooking on the stovetop.

Ask smokers to smoke outside. Remind smokers to keep their smoking materials with them so young children do not touch them.

Provide large, deep ashtrays for smokers. Wet cigarette butts with water before discarding.

BEFORE HEADING OUT OR TO BED Blow out lit candles when you leave the room or go to bed.

Turn off all light strings and decorations before leaving home or going to bed.

“Following a few simple tips will ensure a happy and fire-

safe holiday season. ”

W inter holidays are a time for families and friends to get together. But that also means a greater risk for

fire. Following a few simple tips will en-sure a happy and fire-safe holiday sea-son.

HOLIDAY DECORATING

Be careful with holiday decorations. Choose decorations that are flame resistant or flame retardant.

Keep lit candles away from decorations and other things that can burn.

Some lights are only for indoor or outdoor use, but not both.

Replace any string of lights with worn or broken cords or loose bulb connections. Connect no more than three strands of mini light sets and a maximum of 50 bulbs for

Winter Holiday

Safety

South Carolina State Accident Fund

“At Work Since 1943.”

State Accident Fund Safe-mail Fourth Quarter 2012

4

T his quarter is the last one for the year of 2012. Many of you will have annual policy renewals starting on January 1, 2013. After the January renewals, the premium audit forms for 2012 will be mailed the first week of January 2013. Now, the word “Audit” usually strikes fear in the hearts of those who hear it. So let’s review the purpose of the “Workers Compensation Premium Audit” to make it less scary.

Why is a Premium Audit Performed?

The purpose of the premium audit is to compare the estimated payrolls with the actual payrolls incurred in 2012. The premiums paid in 2012 are estimated premiums based on estimated payrolls. The audit determines the actual payrolls and adjusts the premium accordingly. The higher the payroll amount, the more risk the State Accident Fund handles for you. The lower the payroll, the less risk that the State Accident Fund handles for you. If the ac-tual payroll is higher than the estimated payroll, your account will be billed for the difference. However, if the actual payroll is lower than the estimated payroll, a credit is reflected on your account. Get a jump on this year’s audit by reviewing the information below. The more complete your audit information is, the easier the audit proc-ess is going to be.

See the following Premium Audit Highlights below. Having these items complete will speed up the processing of your audit and will maximize your premium discounts.

1. Total Gross payroll for 2012. This amount is the total payroll incurred during 2012. This number is the total payroll amount before any deductions such as pre taxed items, insurance etc.

2. Payroll Verification Documents. These documents are, frequently, forgotten which slows down the processing of your audit. The most common verification document is the Federal W-3 Form for 2012. This form lists your total payroll amount for 2012.

3. Overtime Paid. One-third of overtime payments can be deducted from your gross payroll before the premium calculation is made. If you paid overtime in 2012, be sure to list the amount on the audit form. There is a col-umn on the form labeled “Overtime”.

4. Drug and Alcohol Free workplace credit form. If you have a policy preventing the use of drugs and alcohol in your workplace, be sure to complete the drug free workplace form. It can save you an additional 5% in work-ers’ comp costs. Be sure to have the form notarized and returned with your audit information or this discount will not be applied. (This form will be mailed to you along with the other audit documents)

5. All audit forms will be available on our website at www.saf.sc.gov under “Reports & Forms/Payroll Report”

6. The website provides copies of the blank forms that you can print along with directions on how to complete the Payroll Report.

7. Have Questions? Contact your SAF premium auditor at 803-896-5800. The name of your premium auditor will be listed on the au-dit forms mailed to you in January.

Why Premium Audits are Performed

Theresa Simmons, Premium Auditor

Kirk Adair, Premium Auditor

“The purpose of the premium audit is to

compare the estimated payrolls with the actual payrolls.”

South Carolina State Accident Fund

“At Work Since 1943.”

State Accident Fund Safe-mail Fourth Quarter 2012

5 South Carolina State Accident Fund

“At Work Since 1943.”

Requirements of a Compensable Claim: Injury by Accident

A s was last discussed here, in order to be com-

pensable, a workers’ compensation claim must

be the result of an injury by accident. This acci-

dent must arise out of the claimant’s employ-

ment. S.C. Code Ann. § 42-1-160. Generally, the accident

arises out of the employment where there can be said to

be a causal connection between the conditions under

which the work is required to be performed and the re-

sulting injury. Houston v. DeLoach & DeLoach, 378 S.C.

543m 663 S.E.2d 85 (S.C. App. 2008). The accident ‘arises

out of the employment’ when the employment is a con-

tributing proximate cause. Beam v. State Workmen’s

Compensation Fund, 261 S.C. 327, 200 S.E.2d 83 (1973). An injury that arises from a hazard to which

the injured employee would have been equally exposed if not for the employment is not compensable.

Sharpe v. Case Produce Co., 329 S.C. 534, 495 S.E.2d 790 (S.C. App. 1997), rev’d on other grounds, 336

S.C. 154, 519 S.E.2d 102 (1999). An example of this is a recent case in which the claimant alleged her

position as a receptionist exposed her to perfumes brought in by the public, which exacerbated her pre-

existing asthma. The Court of Appeals denied benefits because claimant could not show she was more

exposed to perfumes in her employment than at the grocery store, dentist office, or church. Ervin v.

Richland Memorial Hospital, 386 S.C. 245, 687 S.E.2d 337 (S.C. App. 2009). Thus, in evaluating the com-

pensability of a claim, it is wise to examine the causal connection (or lack thereof) between the claim-

ant’s injury and his or her employment.

by Ellen Goodwin

“In evaluating the compensability of a claim, it is wise to ex-

amine the causal connection (or lack thereof) between the

claimant’s injury and his or her employment.”