2011.04.29 GS Market_monitor

Transcript of 2011.04.29 GS Market_monitor

-

8/7/2019 2011.04.29 GS Market_monitor

1/2

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solic itation to buy or sell securities.

18.5%

12.5%11.7%

9.1% 8.9%7.9%

6.9% 6.8% 6.7% 6.5%

3.1%

Energy

Hea

lthcare

Industrials

S&P500

Discre

tionary

S

taples

Utilities

Materials

Telecom

Info

.Tech.

Fin

ancials

6.5%

5.2%4.0% 4.0%

3.0% 2.9% 2.8%2.2% 1.7% 1.5%

0.0%

H

ealthcare

Staples

Utilities

Dis

cretionary

S&P500

Info.

Tech.

Industrials

Materials

Telecom

Energy

Financials

1000

1050

1100

1150

1200

1250

1300

1350

1400

4/29/10 7/29/10 10/29/10 1/29/11 4/29/11

2.0

2.5

3.0

3.5

4.0

4.5

4 /2 9/ 08 1 0/ 29 /0 8 4 /2 9/ 09 1 0/ 29 /0 9 4 /2 9/ 10 1 0/ 29 /1 0 4 /2 9/ 11

1

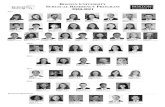

Morningstar US Equity Size & Style Returns3

10-Year Treasury Note Yields2

S&P 500 Trailing 1-Year Index Levels2

S&P 500 Sector Returns: Month-to-Date2 (As of 4/29/2011)

S&P 500 Sector Returns: Year-to-Date2 (As of 4/29/2011)

Past performance is not indicative of future results, which may vary.

For More Information:Contact your Goldman Sachs representative:ICG: 800-292-GSAM Bank: 888-444-1511

Retirement:800-559-9778 IAC: 866-473-8637Global Liquidity Management: 800-621-2550

Value Core Growth Value Core Growth

1.97% 2 .59% 3 .33% 8.80% 12.56% 13.09%Small

8 .3 5% 6 .7 3%Large

(as of 4/ 29/ 11)

1 2. 38 % 1 2. 97 %M id2.45% 3.01% 2.81% 10.01%

M ont h- to- Dat e Y ear- to-D at e

3.26% 3.34% 2.56% 11.13%

April 29, 2011

Index Returns2

(as of 4/29/2011) 1 We ek M TD QTD YTD

DJIA 2.47% 4.13% 4.13% 11.49%S&P 500 1.99% 2.96% 2.96% 9.06%NASDAQ 1.91% 3.37% 3.37% 8.59%

MSCI EAFE (USD) 2.47% 6.02% 6.02% 9.74%

Barclays Aggregate 0.63% 1.27% 1.27% 1.70%

S&P GSCI 0.90% 4.41% 4.41% 16.49%GS A RT Index 0.28% 1.17% 1.17% 2.94%

Bond Rates2 4/29/11 3/31/11 3/31/11 12/31/10

Fed Funds Tar get 0.25% 0.25% 0.25% 0.25%3-Month Libor 0.27% 0.30% 0.30% 0.30%2- Year Tr eas ur y 0.61% 0.83% 0.83% 0.60%10- Year Tr eas ur y 3.29% 3.47% 3.47% 3.30%2-10 slope 2.68% 2.65% 2.65% 2.70%

HY Corp. spread (bps) 482 495 495 561IG Corp. spread (bps) 138 142 142 156EMD spread (bps) 281 277 277 274

High 4.27

Low 2.06

Current 3.31

High 1363.61

Low 1022.58

Current 1363.61

Commodities2 4/29/11 3/31/11 3/31/11 12/31/10

Oil ($/bar rel) $113.93 $106.72 $106.72 $91.38Gold ($/oz) $1,563.70 $1,432.30 $1,432.30 $1,420.78Gasoline ($/gallon) $3.931 $3.619 $3.619 $3.073

Currencies2 4/29/11 3/31/11 3/31/11 12/31/10

Euro ($/) $1.4807 $1.4158 $1.4158 $1.3384Pound ($/) $1.6707 $1.6028 $1.6028 $1.5612Yen (/$) 81.19 83.13 83.13 81.12

Upcoming Economic Releases1

Date Indicator GS & Co. Consensus Previous

C on st ru ct io n S pe nd in g ( Ma r) +0.5% +0.3% - 1.4%

I SM Manuf ac turi ng Index (Apr) 60. 0 59. 5 61. 2

Factory Orders (Apr) +2.4% +1.7% -0.1%Li ght weig ht Mot or Vehic les ( Apr) 1 3. 0M 13. 0M 13. 1M

Domestic Motor Vehicles (Apr) 9.8M 9.8M 9.9M

Wednesday

(5/4/11)I SM N onmanuf ac turi ng I ndex (Apr ) 57. 5 58. 0 57. 3

Non fa rm Product iv ity (Q1 Pre liminary) +1.0% +1.0% +2.6%

U ni t L ab or C os ts ( Q1 P re li mi na ry ) +0.8% +0.8% - 0.6%

Unemployment Rate (Apr) 8.8% 8.8% 8.8%

No nf arm Payr oll s (Apr) +175, 00 0 + 180, 000 +2 16, 000

Average Hourly Earnings (Apr) +0.1% +0.2% Flat

Forecast

Tuesday

(5/3/11)

Thursday

(5/5/11)

Friday

(5/6/11)

Monday

(5/2/11)

Economic & Market news GS & Co.1

S&P Case-Shiller Home Price Index fell by 0.18% in February,

a decline smaller than expected. However, due to downwardrevisions in previous months, the 3.3% y-o-y decline is still in line

with the median forecast. The index is based on 3-month

averages so the declines of 0.36% in December and 0.25% in

January coupled with the most recent release, indicate that the

rate of decline continues to moderate.Real GDP increased by 1.8% (q-o-q annualized) in Q1, close to

consensus forecasts. However, the composition of the increase

was more favorable than expected with consumer spending

increasing by 2.7%, compared with the consensus estimate of

2%. Other components of GDP were broadly in line with

expectations. Initial Jobless Claims climbed to 429k in the week ending April

23, so we are now above the average levels for February and

March. Although we believe technical factors like the Easter

Holiday could be adding some noise to the figure, we also think

the rise could indicate an actual increase in filing activity.

As widely expected, theFOMC Meeting indicated unanimity in

deciding to end QE2 at the end of June. However, the committee

reiterated its expectation that current economic conditions could

warrant a low federal funds rate for an extended period of time.

-

8/7/2019 2011.04.29 GS Market_monitor

2/2

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solic itation to buy or sell securities. 2

GENERAL DISCLOSURES

April 29, 2011

The first two paragraphs of the disclosures below do not apply to the information sourced to footnote 1.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

This material has been prepared by GSAM and is not a product of the Goldman Sachs Global Investment Research (GIR) Department. The views and opinions expressed may differ from those of the GIR Department or other

departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and GSAM has no obligation toprovide any updates or changes.

The information contained in this presentation is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations. This presentation makes no implied or expressrecommendations concerning the manner in which any clients account should or would be handled, as appropriate investment strategies depend upon the clients investment objectives.

This presentation is for general information purposes only. It does not take into account the particular investment objectives, restrictions, tax and financial situation or other needs of any specific client. This information does notrepresent any Goldman Sachs product.

Special risks are inherent in international investing including those related to currency fluctuations and foreign, political, and economic events.

The economic and market forecasts presented herein have been generated by Goldman Sachs for informational purposes as of the date of this presentation. They are based on proprietary models and there can be no assurancethat the forecasts will be achieved.

Economic and market forecasts presented herein reflect our judgment as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives,restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance.

Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may changematerially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

Past performance is not indicative of future results, which may vary. The value of investments and the income derived from investments can go down as well as up. Future returns are not guaranteed, and a loss of principal may

occur.

Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may, without Goldman Sachs Asset Managements prior written consent, be ( i) copied, photocopied or duplicated in

any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.

Indices are unmanaged. The figures for the index reflect the reinvestment of dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy

and completeness of all information available from public sources.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

1 Source: Goldman, Sachs & Co. (as of 4/25/2011 4/29/2011)2 Source: Bloomberg (as of 4/29/2011)

3 Source: Morningstar (as of 4/29/2011)

Copyright 2011 Goldman Sachs. All Rights Reserved. Date of First Use: May 2, 2011Compliance Code: 28882.NPS.TMPL

Compliance Code: 51842.OTHER.MED.OTU