2011 CAUBO Finance Presentation - Nat D'Ercole - Final - June 18

description

Transcript of 2011 CAUBO Finance Presentation - Nat D'Ercole - Final - June 18

Presenting Complex Financial

Canadian Association of University Business Officers

© 2011 Deloitte Touche Tohmatsu

June 2011

Presenting Complex Financial

Information

Speaker Profile

Nat D’Ercole is an associate partner at Deloitte and a leader in Deloitte’s Information Management & Analytical Technologies practice with a specialization in Performance Management Technology.

He brings 18 years of consulting experience in information transformation projects across various industries in fortune 100 as well as public sector and projects across various industries in fortune 100 as well as public sector and mid-market clients.

Nat leads transformation programs by engaging senior leaders to define their target information needs, processes, governance and overall business performance improvements.

As a result, Nat’s clients have improved their transparency, cycle time and controls over financial, management and operational information to enable improved decision support. Nat is a graduate of the Schulich School of Business, and holds a CPA, and a CA with a specialization in information technology.

© Deloitte & Touche LLP and affiliated entities.

Agenda

• Recap – 2010 CAUBO Finance Survey Results

• Information Management Challenges and Preparing Your

Business Case

• Capabilities and Business Analytics Maturity Model

© Deloitte & Touche LLP and affiliated entities.

• Capabilities and Business Analytics Maturity Model

• Information and Data Management – What’s Important

• Technology Architecture for Dummies – What’s Important

• Your Roadmap and Best Practices for Getting Started

• Appendix

2

CAUBO Finance Survey Results 2010

© Deloitte & Touche LLP and affiliated entities.3

Deloitte’s Global Survey: Mastering Finance in Government

Defining the Roles of Finance

Setting direction in order to

enhance business

performance and

shareholder value. Provide

financial leadership in

determining strategic

Stimulate behaviors across

the organization to achieve

strategic and financial

objectives while at the

same time achieving a risk

intelligent culture.

The roles of a CFO or the “four faces” of a CFO as defined by Deloitte’s Finance Transformation Framework

were used to understand the challenges facing the finance function in government organizations and how the

finance function is evolving to improve the whole organization’s performance.

Threshold

performance

Leading edge

© Deloitte & Touche LLP and affiliated entities.

determining strategic

business direction.

Balance capabilities, costs

and service levels to fulfill

the finance organization’s

responsibilities efficiently.

Protect and preserve the

assets of the organization

and accurately report on

the financial position and

operations to internal

stakeholders and external

stakeholders.

intelligent culture.

As organizations evolve their finance functions, they move from an environment where finance plays the role

of a steward/operator to that of where they are more of strategist/catalyst.

4

CFO Focus

Triangle

CFO Focus

Triangle

Financefunction

2011 – CAUBO Finance Presentation

CAUBO 2010 Survey Results

Framework for Results

• CAUBO respondents were compared to Sector

Peers in the Education Sector:

Comparator Groups Number of

Respondents

CAUBO Survey

Respondents20

• Responses to survey questions were given on a

scale of 1-5, based on the respondents’

assessment of maturity in the rated functional

areas:

Maturity Level Description

Leading practices thoroughly embedded in

• Based on the responses to the survey questions, CAUBO respondents were compared to

respondents from both the Global Education Sector and to those classified as Finance Masters.

© Deloitte & Touche LLP and affiliated entities.

• Respondents were also compared against

participating government organizations that have

been classified as Finance Masters. Finance

Masters are organizations with a finance function

that supports the business in making strategic

decisions and that acts as a catalyst for change,

built on a foundation of excellence in finance

stewardship and operations.

Respondents

Sector Peers –

Education Sector44

5: Leadingprocesses; tools with internal and external

data to support processes. Real-time

information.

4: Advanced

Leading practices introduced. Enterprise

integration of processes and internal data.

Widespread automation.

3: BaselineStandardized process. Some integration

across enterprise. Moderate manual effort.

2: DevelopingProcess capability partially defined. Different

approaches used in the organization.

1: Non-existentCapability not in place in any structured

sense.

5 2011 – CAUBO Finance Presentation

CAUBO 2010 Survey Results

Improving Financial Performance

CAUBO Education Sector Finance Masters

Top Five Important Areas to Improve over the Next Three Years

• Each comparator group ranked ‘Improve decision-making capability’ as the most important area

to improve financial performance over the next three years.

• Both the Education Sector and Finance Masters ranked ‘Improve transparency & integrity of

financial information’ as the second most important area to improve financial performance over the

next three years, while CAUBO did not rank this area in the top five.

• CAUBO is the only group that identified “Grow service / non-tax revenue” in the Top 5 area to

improve over the next three years.

© Deloitte & Touche LLP and affiliated entities.6

1. Improve decision-making

capability

2. Reduce transaction processing

costs

3. Improve supply chain

(efficiency of procurement-to-

payment process)

4. Grow service/non-tax revenue

5. Reduce administration

expenses

1. Improve decision-making

capability

2. Improve transparency &

integrity of financial information

3. Reduce transaction processing

costs

4. Reduce administration

expenses

5. Improve supply chain

(efficiency of procurement-to-

payment process)

1. Improve decision-making

capability

2. Improve transparency &

integrity of financial information

3. Reduce administration

expenses

4. Improve asset management

5. Reduce transaction processing

costs

6 2011 – CAUBO Finance Presentation

CAUBO 2010 Survey Results

Barriers to Performance

CAUBO Education Sector Finance Masters

Top Five Barriers to Performance

• The top five barriers to performance were consistent across all Comparator Groups, with a few

exceptions.

• CAUBO ranked ‘inadequate investment in finance function’ as one of the top five barriers to

performance, while both the Education Sector and Finance Masters did not.

• “Lack of integrated risk management” was a barrier for Finance Masters and Education Sector,

however was not identify by CAUBO.

© Deloitte & Touche LLP and affiliated entities.7

CAUBO

1. Spiraling structural cost (e.g.,

healthcare, pensions,

infrastructure)

2. Lack of up-to-date information

for strategic decision-making

3. Lack of process standards,

clarity or discipline

4. Lack of real-time information

for operations and execution

5. Inadequate investment in

finance function.

Education Sector

1. Spiraling structural cost (e.g.,

healthcare, pensions,

infrastructure)

2. Lack of process standards,

clarity or discipline

3. Lack of up-to-date information

for strategic decision-making

4. Lack of real-time information

for operations and execution

5. Lack of integrated risk

management

Finance Masters

1. Lack of process standards,

clarity or discipline

2. Lack of up-to-date information

for strategic decision-making

3. Lack of real-time information

for operations and execution

4. Lack of integrated risk

management

5. Spiraling structural cost (e.g.,

healthcare, pensions,

infrastructure)

7 2011 – CAUBO Finance Presentation

Improvement Opportunities

CAUBO Focus Areas

• Within each of the four faces of the CFO, CAUBO is performing below the Education Sector and at a

level lower than ‘Baseline, in the following areas:

CFO Role Improvement Area

Steward 1. Define management reporting requirements

2. Conduct environmental scan and risk analysis

3. Identify, manage and report risks

Operator 4. Capital asset planning and resource allocations

© Deloitte & Touche LLP and affiliated entities.8

Operator 4. Capital asset planning and resource allocations

Strategist 5. Establish performance measurements

6. Performance target setting

Catalyst 7. Support business analysis

2011 – CAUBO Finance Presentation

• 6 out of 7 improvement priorities directly relate to a need to improve information management and

analytics practices in order to move towards a Finance Masters maturity level.

Information Management Challenges and Preparing Your Business Case

© Deloitte & Touche LLP and affiliated entities.

Your Business Case

9

Information challenges that organizations

are trying to overcome:

What reporting problems are organizations trying to solve?

• Limited flexibility in

ease of analysis

Analyzing &

Presenting

Accessing &

Transparency

© Deloitte & Touche LLP and affiliated entities.

• Makeshift assembly &

effort for ad-hoc

• Increase compliance

reporting

• Processes not efficient

enough to absorb new

or increase report

activity without adding

staff

• Cut and paste into

word and PowerPoint

docs

• Email distribution

• Unable to get desired

level of detail or desired

view

• Inability to track data to

its source or drill from

summarized to detail

•Unable to view

information across

function areas

• Information in various

systems & format

•Significant effort to find

format information

• Inconsistent definitions

and rules

•Multiple views of the

“truth” – information

accuracy

• Lack of integration

between systems

sharing the same data

• Information not

captured consistently or

complete

• Information not

available in a timely

manner based upon

business needs

Capturing &

Storing

Transforming

& Validating

10 2011 – CAUBO Finance Presentation

Why solve these reporting problems?

© Deloitte & Touche LLP and affiliated entities.11 2011 – CAUBO Finance Presentation

Analyze &

Present

Effort

Spent GOALS

• Speed to information

• Speed to analysis

• Speed to reporting

• Speed to disclosure

Representative CAUBO Financial

Reporting Areas

• external disclosure reporting (audited)

• revenue and expenses by category

• cost allocation models

• internal fund accounting reporting

• endowment reporting

• enrollment reporting

• pension plan reporting

• staff planning

Workarounds represent a vast and unmeasured cost, managerial burden and source of quality and speed problems

Capture &

Storage

Transform &

Validate

Access &

Transparency

Capture &

Storage

Analyze &

Present

Transform &

Validate

Access &

Transparency

Activities of

highest

business value

Current Future

Time

• staff planning

• space reporting

• financial budgeting / forecasting

Common Information Challenges

• Availability and timeliness of information

• Aligning effort with value

• Excessive manual collection efforts

• Multiple iterations, reconciliations, tick and ties

• Efforts focused on “chasing” discrepancies

• Poor integration of planning spreadsheets

• Email distribution of static reports

• Frequent manual cut and paste

• Different data definitions and lack of data

governance across the organization

• Little time for higher-value analysis

12 © Deloitte & Touche LLP and affiliated entities.

� Defining information needs based on the decisions that need to be made rather

than by the reports that are expected to be delivered

� Leveraging leading indicators to signal trouble ahead and enable the planning of

potential mitigating actions

� Driving global, consistent performance measures to all levels of the organization

and integrating into all elements of the performance management process

� Partnering with the IT organization and taking ownership of the collection and

What leading companies are doingD

� Partnering with the IT organization and taking ownership of the collection and

governance of financial data including standardizing data definitions, systems and

processes across the organization

� Incorporating strategic planning, budgeting, variance analysis, and management

reporting as part of an integrated cycle versus independent financial cycles

� Effecting a cultural shift and driving the rigor required to shift from stale planning

methodologies to driver-based planning

� Linking compensation to forecast accuracy versus beating the forecast

Enabling CAUBO’s Improvement Priorities through Integrated Performance Management

Strategy

Planning

Strategy

Planning

Intervention

Forecasting

PLANand Target

INTERVENE and Realign

“Strategist Priority”“Operator Priority”

“Are we measuring the

right things?”

“Are we making

appropriate capital and

resource allocation

Decision support is a function of a continuous and integrated process

© Deloitte & Touche LLP and affiliated entities.14

Budgeting

Operational ReportingManagement

Reporting

External Reporting

Analysis

ValueCreation

MEASURE and Evaluate

“Operator Priority”

“How can I deliver

information most

efficiently?”

“Catalyst Priority”

“Steward Priorities”

2011 – CAUBO Finance Presentation

“Are we spending

enough time to support

business analysis and

effect change”?

“Information quality – are

we reporting with the best

available information

within the organization?”

right things?”resource allocation

decisions?”

IPM is an integrated approach to improve Information Effectiveness – Get ready to prepare your business case

Tools

Process

People

• Enabled to be analytical

• Empowered to make decisions in a

decentralized environment

• Collaborative across all business

functions and processes

Information

Effectiveness

• Scales to support growth

• Standardized to lower

support costs and risks

• Matched to the information

needs of the organization

• Widely adopted

© Deloitte & Touche LLP and affiliated entities.15

Data• Captured across the organization

• Conformed and standardized to

support comparability

• Accurate, complete and integrity

preserved

Process• Integrated across the

enterprise

• Efficient data entry, analysis and

reporting

• Controls to ensure integrity and

security

Effectiveness

An effective information environment is one where people are empowered to access and use

information, processes are efficient in capturing and sharing information, governance is effective in

maintaining a current and reliable data architecture and the right use and mix of technology enables the

system to be efficient and secure.

2011 – CAUBO Finance Presentation

Benefits are usually expressed more so in terms of intangible rather than tangible enterprise value

Efficiency

Cost Savings

Effectiveness

Business ImprovementRisk Reduction

Leanness Standards Accuracy GovernanceAccuracy Agility Availability

Typical Benefits

© Deloitte & Touche LLP and affiliated entities.

Better information leads to Better information leads to more accurate decision

making

Increase responsiveness to emerging opportunities

Minimize mechanics and improve timeliness of

information availability –where and when needed

Reduce process cycle time and improve staff productivity

Standardize and improve enterprise wide processes and data to reduce non-

value activities

Improved quality and integrity of data for compliance

Improved governance structure for

maintenance and translation of

transaction data

16 2011 – CAUBO Finance Presentation

How do leaders justify investments to improve information effectiveness?

• Many don’t understand the real cost of current “information processes”

• Information management processes are not given the same attention

given as other business processes

• When building Information Management businesses cases, organziations

© Deloitte & Touche LLP and affiliated entities.17

• When building Information Management businesses cases, organziations

often focus only on what they can see

• Many wish they had the ability to develop more thorough business cases

• Those who are more thorough, consistently achieve better results

2011 – CAUBO Finance Presentation

Executives realize that in retrospect they should have considered many (other) dimensions more fully

© Deloitte & Touche LLP and affiliated entities.18 2011 – CAUBO Finance Presentation

Strategically thinking about the value of Information to the enterprise is key

• The ability to produce relevant, timely, and accurate information is a

competitive advantage

• It requires the same intense focus that has been afforded to other

business processes and assets

• Embrace information management capability as a strategic asset and an

enterprise imperative

• Think broadly when you assess the value of improved information quality

© Deloitte & Touche LLP and affiliated entities.

• Think broadly when you assess the value of improved information quality

• Look closer, look further when analyzing the costs of current approaches

and the benefits of improved information management capabilities

• Persist and overcome the inertia that holds back much needed

improvements

• Identify a business sponsor to ‘pilot’ a solution and demonstrate linkages

back into the organization enterprise

2011 – CAUBO Finance Presentation1919

Four key benefit categories emerge in most information management initiatives

Decision

Support

� Shorten Cycle Time

– reduce “time to

� Standardization –

improved process,

people and

technology cost

efficiencies

� Alignment – organization

common focus on

strategic goals and

objectives

� Accountability – able to

measure business and

ProductivityEngagement /

Collaboration

� Transparency – clear

view of financial and

operational performance

� Agility / Flexibility – able

to quickly respond to

market shifts, allowing

Risk Mitigation

� Compliance – meet 3rd

party information

requirements or

standards

� Integrity - completeness,

accuracy and security of

© Deloitte & Touche LLP and affiliated entities.20

Consider improvements in decision-making, productivity, collaboration and risk mitigation

when building your business case for improving information effectiveness.

– reduce “time to

information” and “time

– to-design”; convert

savings to value

added processes

measure business and

individual performance

throughout organization

against Key Performance

Indicators (KPI’s) that

represent strategic goals

� Transparency – shared

view of financial and

operational performance

managers to effectively

manage performance

� Integrity – completeness,

accuracy and security of

information

� Comparability – able to

compare results and

forecasts across the

business

accuracy and security of

information

� Continuity – ability to

provide timely and on-

going information

requirements regardless

of changes in the

business structure,

changes in management

or changes in key

resources

2011 – CAUBO Finance Presentation

Making the shift towards business analytics

It’s time to take control of spiraling structural costs over transaction processing,

reporting and decision support and enable greater benefits with business

analytics.

Threshold

performance

Leading edge Efficient finance operations result in

greater capacity Ishifting resources

to serve the catalyst’s and

strategist’s priorities.

© Deloitte & Touche LLP and affiliated entities.

CFO Focus

Triangle

CFO Focus

Triangle

Financefunction

“Change what you do”

Finance Governance starts here,

forming the foundation of a thriving

finance function through investments

in Reporting and Analytics.

“Do what you do better”

21 2011 – CAUBO Finance Presentation

Capabilities and Business Analytics Maturity Model

© Deloitte & Touche LLP and affiliated entities.22

Transactional systems Data & business analytics

Over the last two decades, organization have been investing in both system ERP revitalization and best of

breed transactional systems. This has resulted in a significant increase in organized data — and a shift in

focus toward analyzing information and improving performance.

From “what I need to do” to “what I need to know”

Integrated core platform implementation

Front office systems

Back office / ERP systems

Advanced analytics

Performance management

Business intelligence

Data management

© Deloitte & Touche LLP and affiliated entities.

Looking back Looking forward

Understand Predict

Analyze Optimize

What happened? What will happen?

Slice & dice Discover & simulate

Key Performance

Indicators (KPI’s)

Key Performance

Predictors (KPP’s)

Operational reporting Uncommon insights

Pre

sen

t

Information value

23 2011 – CAUBO Finance Presentation

What Business Analytics capabilities are needed to deal with information complexity?

Advanced

AnalyticsForesight

High

Advanced Analytics is the use of modern data mining,

pattern matching, data visualization, and predictive

modeling tools to produce analyses and algorithms that help

businesses make better decisions.

Performance Management is an umbrella term that

Business analytics is the practice of using data to drive business strategy and performance. It includes a

range of capabilities – from looking backward to evaluate what happened in the past, to forward-looking

approaches like scenario planning and predictive modeling. It spans data management and business

intelligence up through performance management and advanced analytics.

© Deloitte & Touche LLP and affiliated entities.24

Hindsight

Performance

management

Business intelligence

Data management

Insight

Low

People / Organization

Decision Process

Technology

Strategy and Governance

Performance Management is an umbrella term that

describes the methodologies, metrics, processes and

analytical applications used to monitor and manage the

business performance of an enterprise.

Business intelligence is querying, reporting, OLAP, and

“alerts” that can answer the questions: what happened; how

many, how often, where; where exactly is the problem; what

actions are needed.

Data Management is the development and execution of

architectures, policies, practices and procedures that

properly manage the collection, quality, standardization,

integration and aggregation of data across the enterprise.

2011 – CAUBO Finance Presentation

Business Analytics Maturity ModelStage Strategy and Governance People/ Organization Decision Processes Information Processes Technology

Stage 1

Non-

Existent

�Minimal to no governance

over data, reporting and

analytics

� No executive awareness of

Business Intelligence or

Performance Management

� Little to no focus on

developing data management,

performance management

and analytic skills

� IT exists to support

transaction-oriented systems

� Experience-based

decision making

� Strategy based on

hindsight

� Lack unique data

oriented market insight

�Minimal focus on data capture

quality

� Data management practices;

centered around report or analytical

requests (reactive culture)

�Minimal to silo business intelligence

applications (IT based investments)

�Manual and spreadsheet -based

reports, budgets, forecasts,

analysis, scorecards , dashboards

and content storage

Stage 2

Developing

� Departmental vision for

Business Intelligence need

� Proof-of-value analytics

initiated at functional level

� BI Roadmaps begin to emerge

� Business and IT begin to

recognize need to manage

data strategically

� Functional business analyst

competencies begin to

emerge

� Power user adoption of apps

� IT begins to build data

management skills to support

business requests and drive

improved data access

� Decision-making based

on fact based

departmental information

� Awareness that

enterprise wide decision-

making is not based on

consistent information

� Controls over data capture quality

� Progress on development of critical

data management processes; but

highly departmental

� Use of KPIs, but not consistent

enterprise wide

� Desire for more forward looking

operational and finance information

� Departmental or IT driven

investments in BI, Planning and

Content management begin to

replace spreadsheets

� Need for a financial and operational

data foundation emerges by IT and

or Finance

Stage 3

Enterprise

Defined

� C-level and senior

management commitment to

business analytics strategy

�Governance model emerges

� Senior business roles for

business analytics begin to

emerge and analysts become

more process oriented across

� Decision-making based

on process oriented and

fact based KPIs

� Predictive analytic

� Enterprise wide and standard data

models emerge for reporting,

forecasting and content

management

� Enterprise standardization in BI,

Data Management , Planning,

Disclosure and Content

Management and Portal tools �Governance model emerges

to align business, BI systems,

and IT processes

� Performance Management

Roadmaps begin to emerge

more process oriented across

the enterprise

� Business leaders understand

their role in data accountability

� IT roles are established to

support data foundation

� Predictive analytic

processes begin to

emerge as a reaction to

internal or external

events or requests;

“reactive state”

management

� Driver-based operational and

financial models emerge

� Desire for predictive information

models

Management and Portal tools

� Investments in data marts and data

warehouse technologies supported

by the business (multiple sponsors)

� Isolated use of predictive and data

mining technologies

Stage 4

Advanced

� C-Level sponsorship to

integrate analytics into select

decision processes

� Executive endorsement for

competency center emerges

for long-term sustainment

� Roadmaps begin to include

predictive analytics initiatives

� Extensive investments in BA

training across the enterprise

� Collaborative, process

oriented teams emerge to

support business analytics

� Incentive and reward culture

linked to business analytics

begins to emerge

� Link strategic and

operational KPIs across

value chains to support

decision-making

� Analytics-driven insights

integrated into select

decision processes;

“predictive state”

� KPI trees embedded into the

information culture

� Integration of external data into the

enterprise data model (structured

and unstructured)

� Test-learn-improve cycle of

adopting & embedding predictive

analytics into key processes

� Initial adoption of data mining,

pattern matching, visualization, and

predictive tools into key processes

�Growing enterprise adoption of

information management and

analytical technologies; business

value of analytic tools is well

understood

Stage 5

Leading

� Business-IT governance

model is critical to continuous

improvement and mainstream

acceptance of analytics and

predictive modeling

� Improvement in the business

is driven by a continuous loop

from analytics to predictive

modeling, to planning &

performance management

� Annual roadmap updates

� Reward for analytics-driven

experimentation (test and

learn) solidifies culture change

� Teams seek new opportunities

to collaborate on analytic

processes

� Skill levels are sufficient to

develop reusable Business

Analytic approaches /

solutions

� Analytics-driven insights

are embedded into

decision-making

processes for competitive

advantage

� Predictive modeling is

embedded into planning

and performance

management decision-

making

� Data management processes

operating effectively to support

continuous loop business analytics

processes

� High quality data and reliable

information which can be easily

mined and “re-packaged “as

needed

� Business strategy drives additional

investments in business analytics

technologies

� IT leader understanding of business

strategy and application of relevant

technologies (beyond the CIO)

25

Business Analytics Maturity Model – Rate your organization

Stage Governance

Stage 1

Non-Existent

� Minimal to no governance over data, reporting and analytics

� No executive awareness of Business Intelligence or Performance Management

Stage 2

Developing

�Departmental vision for Business Intelligence need

�Proof-of-value analytics initiated at functional level

�BI Roadmaps begin to emerge

�Business and IT begin to recognize need to manage data strategically

Stage 3

Enterprise Defined

�C-level and senior management commitment to business analytics strategy

�Governance model emerges to align business, BI systems, and IT processesEnterprise Defined �Governance model emerges to align business, BI systems, and IT processes

�Performance Management oriented roadmaps begin to emerge

Stage 4

Advanced

�C-Level sponsorship to integrate analytics into select decision processes

�Executive endorsement for competency center emerges for long-term sustainment

�Roadmaps begin to include predictive analytics initiatives

Stage 5

Leading

�Business-IT governance model is critical to continuous improvement and

mainstream acceptance of analytics and predictive modeling

�Improvement in the business is driven by a continuous loop from analytics to

predictive modeling, to planning & performance management

�Annual roadmap updates

26 2011 – CAUBO Finance Presentation © Deloitte & Touche LLP and affiliated entities.

Stage People / Organization

Stage 1

Non-Existent

�Little to no focus on developing data management, performance management and

analytic skills

�IT exists to support transaction-oriented systems

Stage 2

Developing

�Functional business analyst competencies begin to emerge

�Power user adoption of apps

�IT begins to build data management skills to support business requests and drive

improved data access

Stage 3

Enterprise Defined

�Senior business roles for business analytics begin to emerge and analysts become

more process oriented across the enterprise

Business Analytics Maturity Model – Rate your organization

Enterprise Defined more process oriented across the enterprise

�Business leaders understand their role for data accountability

�IT roles are established to support a technical data foundation

Stage 4

Advanced

�Extensive investments in business analytics training across the enterprise

�Collaborative, process oriented teams emerge to support business analytics

�Incentive and reward culture linked to business analytics begins to emerge

Stage 5

Leading

�Reward for analytics-driven experimentation (test and learn) solidifies culture

change

�Teams seek new opportunities to collaborate on analytic processes

�Skill levels are sufficient to develop reusable Business Analytic approaches /

solutions

27 2011 – CAUBO Finance Presentation © Deloitte & Touche LLP and affiliated entities.

Stage Decision Processes

Stage 1

Non-Existent

�Experience-based decision making

�Strategy based on hindsight

�Lack unique data oriented market insight

Stage 2

Developing

�Decision-making based on fact based departmental information

�Awareness that enterprise wide decision-making is not based on consistent

information

Stage 3 �Decision-making based on process oriented and fact based KPIs

Business Analytics Maturity Model – Rate your organization

Stage 3

Enterprise Defined

�Decision-making based on process oriented and fact based KPIs

�Predictive analytic processes begin to emerge as a reaction to internal or external

events or requests; “reactive state”

Stage 4

Advanced

�Link strategic and operational KPIs across value chains to support decision-making

�Analytics-driven insights integrated into select decision processes; “predictive state”

Stage 5

Leading

�Analytics-driven insights are embedded into decision-making processes for

competitive advantage

�Predictive modeling is embedded into planning and performance management

decision-making

28 2011 – CAUBO Finance Presentation © Deloitte & Touche LLP and affiliated entities.

Stage Information Processes

Stage 1

Non-Existent

�Minimal focus on data capture quality

�Data management practices centered around report or analytical requests

�Reactive culture

Stage 2

Developing

�Controls over data capture quality

�Progress on development of critical data management processes; but highly

departmental

�Use of KPIs, but not consistent enterprise wide

�Desire for more forward looking operational and finance information

Stage 3

Enterprise Defined

�Enterprise wide and standard data models emerge for reporting, forecasting and

content management

Business Analytics Maturity Model – Rate your organization

Enterprise Defined content management

�Driver-based operational and financial models emerge

�Desire for predictive information models

Stage 4

Advanced

�KPI trees embedded into the information culture

�Integration of external data into the enterprise data model (structured and

unstructured)

�Test-learn-improve cycle of adopting & embedding predictive analytics into key

processes

Stage 5

Leading

�Data Management, Performance Management and Analytic data management

processes operating effectively to support continuous loop business analytics

processes

�High quality data and reliable information which can be easily mined and “re-

packaged “as needed

29 © Deloitte & Touche LLP and affiliated entities.

Stage Technology

Stage 1

Non-Existent

�Minimal to silo business intelligence applications (IT based investments)

�Manual and spreadsheet -based reports, budgets, forecasts, analysis, scorecards ,

dashboards and content storage

Stage 2

Developing

�Departmental or IT driven investments in BI, Planning and Content management

begin to replace spreadsheets

�Need for a financial and operational data foundation emerges by IT and or Finance

Stage 3

Enterprise Defined

�Enterprise standardization in BI, Data Management, Planning, Disclosure, Content

Management and Portal tools

Business Analytics Maturity Model – Rate your organization

Enterprise Defined Management and Portal tools

�Investments in data marts and data warehouse technologies supported by the

business (multiple sponsors)

�Isolated use of predictive and data mining technologies

Stage 4

Advanced

�Initial adoption of data mining, pattern matching, visualization, and predictive tools

into key processes

�Growing enterprise adoption of information management and analytical technologies;

business value of analytic tools is well understood

Stage 5

Leading

�Business strategy drives additional investments in business analytics technologies

�IT leader understanding of business strategy and application of relevant technologies

(beyond the CIO)

30 2011 – CAUBO Finance Presentation © Deloitte & Touche LLP and affiliated entities.

Reporting Vision

Common environment

Data integrity Efficient processesEnhanced

capabilities

� Integrated toolset

across the enterprise

�Shared data

repositories

promote “one

version of the truth”

� Implementation of leading

practice processes

�Web-based interactive

reporting tools

�Common processes

and procedures

�Common data

definitions and

business rules

�Less time spent on

processing and more time

available for analysis

�Greater opportunity to

use exception

reporting

�Central �Less reliance on �More timely planning, �Focus on key business

OperatorStewardStrategist Catalyst

© Deloitte & Touche LLP and affiliated entities.31

�Central

administration and

management

�Less reliance on

spreadsheets and

similar tools

�More timely planning,

reporting, and analysis

processes

�Focus on key business

metrics

�Scalable environment

to support future

needs

�Greater control and

integrity of

reporting and

analysis data

�Reduced reliance on IT

support to enhance

flexibility and timeliness of

reporting and analysis

�Use of more strategic

reporting such as

“connected”

scorecards and

dashboards

�Reporting and

analysis tools shield

end users from

complexity of and

changes to transaction

systems

�Role-based

security to provide

appropriate access

to data

�“Slice and dice”

analytical capabilities to

quickly find answers

�Ability to support

multiple structures or

views of data

2011 – CAUBO Finance Presentation

Information and Data Management – What’s important?

© Deloitte & Touche LLP and affiliated entities.

– What’s important?

32

Know the information requirements and how to model it

Push/Pull/Mobile

Responsibility

Structure

� What roles need information?

� What questions do they ask?

Performance

Decision Areas

� What business questions do they ask?

� What decisions to the need to make?

Information

� What is the information scope?

� How deep to people analyze?

Determine The Optimal Way To Deliver Information

To All Levels In The Organization

Executives

Management

Program

Operations

Information Blueprint Key Considerations

© Deloitte & Touche LLP and affiliated entities.33

Other

Standardized

Tools

Push/Pull/MobileInformation

Dimensions

� How deep to people analyze?

� What hierarchies are required? How

often do hierarchies change?

Usage

Considerations

� How will they use the information? How

frequent?

� Example: push vs. pull, routine vs. ad

hoc, mobile

Information

Processes

� How is the information generated? Is

the process reliable? Quality?

� Are processes and measures

standardized and defined?

Corporate Performance Mgm’t System

Mgt Reporting

MetricsPlanning/

Forecasting

Business

Modeling

Data Model / Repository

PS SAP HRIS Payroll Other Other

2011 – CAUBO Finance Presentation

Moving Towards Data Standardization

Moving to an enterprise set of metrics and supporting data repository requires a management framework including governance and standards, not just a consistent technical approach and toolset.

Governance Well defined oversight and standards

ComponentsMost companies as it relates to DS have Leading best practices

No formal governance

Clearly assigned ownershipLimited ownership defined Ownership

Embraced by all usersStewardshipData stewardship not in place

Clearly defined & accessibleMeta Data Poorly defined and documented

© Deloitte & Touche LLP and affiliated entities.34

Corporate-wide standards enforcedStandardsLimited standards established

Defined quality metricsData QualityNo formal data quality process

Move to a single ETL toolETLNumerous tools and technologies

Single enterprise-wide data repositoryEDWNumerous data marts and data stores

Common corporate reporting standards and toolsReportingNo common delivery approach for tools

Services Oriented ArchitectureTechnologyNon-scalable and inflexible environment

# Key questions

1 • What data standards currently exist?

2 • Which components are standardized in each department? To what extent?

2011 – CAUBO Finance Presentation

Technology Dimension

© Deloitte & Touche LLP and affiliated entities.35

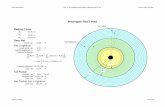

Conceptual BI Architecture for Dummies

Source

Enterprise Data Warehouse (EDW)

End-User Applications

Extract, Transform, & Load Facilities

ETL and Middleware products to extract

© Deloitte & Touche LLP and affiliated entities.

SourceData

products to extract and transform/ cleanse data from sources; and in turn load it to the target database.

Both internal data (mostly transactional) and/or external competitive data.

Formatting and structuring data to facilitate decision support, usually based on a specific data modeling methodology, e.g. Star Schema.

Tools for providing reporting and analyzing capabilities to the end users, e.g., multidimensionality OLAP, drill down, data mining, portal, mobile, etc.

36 2011 – CAUBO Finance Presentation

High Level – BI Architecture

© Deloitte & Touche LLP and affiliated entities.37

“The purpose of business intelligence is to support better

business decision making.” DJ Power

2011 – CAUBO Finance Presentation

Analytical Abstraction (OLAP)

Scorecards

and DashboardsModeling &

Visualization

Analytics and

Reporting

Business Intelligence Center of Excellence

OrganizationGovernance

Change

Management

Business Language

Standardization

Process Monitoring

Statistical Modeling,

Budgeting, and

Forecasting

Meta Data Services

Adoption

Understand how your requirements map to a target end

state in order to deliver information speed and quality

© Deloitte & Touche LLP and affiliated entities.

Information

Quality

Analytical Abstraction (OLAP)

Transactional

Infrastructure

Extract, Transform and Load (ETL)

CRM SCM ERP Legacy

Process Monitoring

Data WarehouseSecurity

Meta Data Services

38

“The purpose of business intelligence is to support timely and

fact-based decision-making.”

2011 – CAUBO Finance Presentation

Simplify selection by understanding how BI products map on to the BI architecture

• Stack Vendors: Provide comprehensive BI solutions that target the entire BI architecture.

• Pure Play Vendors: Primary focus is on providing analytical and reporting solutions.

• Component Vendors: Point solutions for a single component of the BI architecture (e.g.

analysis).

© Deloitte & Touche LLP and affiliated entities.39 2011 – CAUBO Finance Presentation

Focus on Stack and Pure Play vendors – Component vendors augment or replace specific elements of an overarching BI solution

Stack Vendors

•

Pure Play Vendors

•

Component Vendors

DW

Tools

© Deloitte & Touche LLP and affiliated entities.

ETLTools

Other

40 2011 – CAUBO Finance Presentation

Stack or Pure Play? The choice boils down to product integration vs. vendor independence

Organizations choose BI stack vendors for two main reasons:

1. Demand for broader functionality to address current and/or future

needs.

2. Commitment to the vendor’s product portfolio and the promise of

better integration across the BI architecture.

© Deloitte & Touche LLP and affiliated entities.

Organizations choose pure play vendors:

1. To avoid over-committing to a single vendor.

2. For a predictable product roadmap and vendor competence in

niche areas.

41 2011 – CAUBO Finance Presentation

Your Path Forward and Lessons Learned

© Deloitte & Touche LLP and affiliated entities.

and Lessons Learned

42

Information Management Roadmap Planning Strategies

In early IM planning, organizations should consider these strategies:

� Narrow the focus to true business drivers; remove the focus on tools

� Set the strategic direction by defining key performance indicators (KPIs)

as common ground across organizational silos

� Assess operational and financial areas for opportunities to link

information across the enterprise

� Establish early governance and iterative re-planning checkpoints

© Deloitte & Touche LLP and affiliated entities.

� Establish early governance and iterative re-planning checkpoints

� Identify data management needs and data stewards

� Plan for an appropriate methodology

� Traditional waterfall system development life cycle methodologies can have

shortcomings when applied to BI initiatives

43

Dashboarding is the easy part - the tip of the iceberg. It is everything

below the surface that has the potential to sink the ship.

2011 – CAUBO Finance Presentation

Your roadmap forward

• Visioning

• Roadmap

• High Level Project Planning

Technology

Planning

Requirements

Definition &

Conceptual

Design

Phase 0 - Roadmap

DesignBuild &

Test

Deliver &

Operate

Tool ImplementationDetailed Analysis

Each ProjectKey Step

Checkpoint

Phase 0 (Roadmap)

�Conduct current state

Detailed Analysis (Project-Based)

�Develop functional

Tool Implementation (Project-Based)

�Design future state information

© Deloitte & Touche LLP and affiliated entities.

�Conduct current state

assessment

�Develop future state vision

� Identify and prioritize multi-

functional projects

�Develop directional budget

estimates and high level

timeline

�Cross-functional executive

sponsorship

�Develop functional

requirements

�Create conceptual

architecture design

�Visualize requirements

through simple prototypes

� Identify skills/resources

�Finalize detail project

timeframe and milestones

�Tool selection/confirmation

� Budget confirmation

�Design future state information

processes and determine data

requirements / specifications

�Develop 3-5 prototypes to confirm

design for each dashboard / model

�Design and set up technical

environments

�Develop dashboards, models,

reports and interfaces

�Test, Train and Deploy

�Augment support model

2011 – CAUBO Finance Presentation44

Lessons Learned in BI/Analytics Implementations

Set Expectations Early And

Often

Manage Your Stakeholder

Activities

Educating and Institutionalizing

Takes time

� Think-Big, Develop your

Roadmap, Deliver in Phases –

Communicate your vision, deliver

and sell the business benefits in

incremental projects, tune your

roadmap every 6 months

� IPM Assessment - critical to

� Senior Management: Will support

you, but don’t assume they know

what to doI Give them specific

tasks, timelines and tools...

Follow-up.

� Champions: Find your agents of

change within the business, sell

� Leverage Champions: Teach

them to educate; give them tasks,

timelines & tools. Follow-up.

� Governance and Compliance:

Create Tickets to entry for

management meetings

Recognize you are Selling benefits throughout the project"

© Deloitte & Touche LLP and affiliated entities.45

understand process, information

and organization gaps and

include closure on the roadmap

� Priorities Triangle - Formalize

alignment on priorities with your

customers early, and continue to

re-validate with them throughout

the process to maintain alignment.

� Manage - Admit to what you can’t

deliver, Sell what you know you

can deliver

them on your “Vision” and draft

them as your missionariesI Give

them specific tasks, timelines and

tools... Follow-up.

� Doubters: Understand that not

everyone will “Get on the bus”.

Develop strategy to get them to at

least neutralI Don’t ignore

themI Follow-up.

� Grapevine: Work the grapevineI

figure out what is really going on,

and understand the implications.

� Use Management’s Competitive

Nature: What gets measured,

gets done. Scorecard behaviors

your trying to drive (not just the

results), and publish it.

� Don’t Stop Selling: Stay in front

of the business. Your customers

need a consistent message, but

continue to evaluate its

effectiveness

2011 – CAUBO Finance Presentation

Define your business process,

then apply technology

Source system data is a bigger

problem than you think

System requires on-going

“Care and Feeding”

�Understand business

requirements and Process –

Have a discussion about business

requirements, not a discussion of

features. Don’t get hung up on

features.

� Just because it can be done it

�Atomic Level Of Detail:

Summarized data may be

“Materially Correct”, but there is

significant noise and holes in data.

Determine whether you need a

data cleansing project first.

�Data Governance, the business

�Business will want “MORE!”:

You need to prepare early for

success, and put the structures in

place early. Don’t drop the ball or

slow the momentum! Your tactics

will evolve, but understand how

you are going to operate, govern

and enhance business value.

You are solving a business problem"

Lessons Learned in BI/Analytics Implementations

© Deloitte & Touche LLP and affiliated entities.46

� Just because it can be done it

doesn’t mean it should be done

– If the tools have trouble meeting

a business requirement, make

sure you understand the business

requirement; don’t over-engineer

the BI environment rather dig

deeper to understand the business

requirement

�Ensure you have an

Experienced balanced team –

Technology and Business; work

together to understand and trust

each other.

�Data Governance, the business

shoots the messenger: Don’t be

surprised if you find your source

systems data is poor. Be

prepared to work around, or help

build missing information integrity

processes.

�Communicate with the “Run”

team: BI systems are not the

same as ERPs. Make sure the

“Run” team truly understands the

requirements and timing of

business needs!

�Resources for subsequent

phases: Understand how you are

going to resource Phase 2, 3,

etc... Get creative.

2011 – CAUBO Finance Presentation

Contact Information

Deloitte5140 Yonge StreetToronto, ON M2N 6L7Canada

Direct: 416-643-8063Nat D’Ercole, CA.IT, CPA

Information Management &

© Deloitte & Touche LLP and affiliated entities.47

Direct: [email protected]

Member ofDeloitte Touche Tohmatsu

Information Management &

Analytics Technology

Consulting

2011 – CAUBO Finance Presentation

Appendix

48

Deloitte Analytics Thought Leadership We have published Analytics research and thought leadership

Information-Driven Business

Analytics book published by Australian Partner Robert Hillard

Summary: Information doesn't just provide a window on the business, increasingly it is the business. The global

economy is moving from products to services which are described almost entirely electronically. Even those

businesses that are traditionally associated with making things are less concerned with managing the

manufacturing process (which is largely outsourced) than they are with maintaining their intellectual property.

Dozens of Analytics Case Studies & Thought Leadership Articles

Deloitte has published a plethora of industry-specific articles on how analytics can be applied

Articles spanning the actuarial, claims, customer insights, Medical malpractice, underwriting and banking

industries have been published. Additional articles on general analytics are available as well.

© Deloitte & Touche LLP and affiliated entities.

Research-based Publications

Deloitte has become known for our objective, research-based insights on information

management. The following are several of our recent publications

• Look Closer, Look Further – Comprehensive study published by CFO Research Services and

Deloitte.

• Turning Points - a guide to help clients ask the right questions on how to manage the ever

increasing threats of today’s digital world

• Using an EIM Strategic Plan to Ease the Pain – An EIM Strategic Plan will aids in addressing

information quality, risk and compliance challenges, global and regional information requirements,

business growth and change challenges

• Positioning Master Data Management for Effective Results – How to Drive Value, Bottom line

Benefits and Getting it Done

• Driving Improved Business Performance with Data Governance – The Four Key Roles: Owner,

Steward, Custodian, and User

49 2011 – CAUBO Finance Presentation

Agriculture

Energy

Foreign Affairs

Sector

Deloitte’s Global Survey: Mastering Finance in Government

Overview

• The survey was conducted between 2008 and 2010 and included more than 300 government

organizations from 28 countries.

• The following is a breakdown of respondents by Sector, as well as a breakdown of the Education

Sector by Region:

Canada

14.63%

18%

Education Sector: Regional Classification

© Deloitte & Touche LLP and affiliated entities.

0.0% 10.0% 20.0% 30.0% 40.0% 50.0%

Other

Education

Transportation

Defense

Economic development

Social services

Healthcare

Justice

Environment

50

Education was the

2nd largest

respondent group,

accounting for

14% of

respondents.

Canada

14.63%

APAC: Australia, New Zealand

EMEA: Netherlands, Slovak Republic, Spain, United Kingdom

Americas: Canada, United States

14%

23%

45%

APAC

EMEA

Americas

CAUBO

2011 – CAUBO Finance Presentation

Approach matters!

Wa

ve

1 Requirements

Development

Testing

Wa

ve

2

Rollout

Requirements

Development

Testing

Rollout

Requirements

Prototype

Update/ Validate

Requirements

Develop / Update

Prototype

Yesterday - “Waterfall” Approach Today - “Iterative” Approach

© Deloitte & Touche LLP and affiliated entities.51

Wa

ve

3

Requirements

Development

Testing

Rollout

Prototype

This approach follows a traditional development

approach that supports the completion of each

phase before activities for the following phase begin.

• Lack of Flexibility – Completed phases could not

re-visited

• Siloed activities – Lack of collaboration between

Requirements and Development activities due to

minimal interaction between IT and the Business

This approach promotes prototyping, which

allows an early view to system performance and

an opportunity for taking early correction action

to design. Early visualization and understanding

of requirements will also accelerate project

design and build activities.

• Flexibility – Requirements are re-visited with

each prototype

• Collaboration – Business is involved

throughout the Requirements and Prototype

activities and provides feedback to the IT

team

2011 – CAUBO Finance Presentation

Building dashboards

• Think about your audience

• Think about the financial or management story you want to tell

• Identify your business SME’s that can provide business requirements and perform data

validation during testing

• Ensure the data you need is clean and available in your data stores

Conduct user testing

and user validation of

Develop prototype and

walk through simulation

with users (iterative

Storyboard the

dashboard scenarios

and develop

1 3 5

© Deloitte & Touche LLP and affiliated entities.52

Define backend data

values and technical

requirements

data

Finalize dashboard

solution and validate

data

with users (iterative

process)

and develop

wireframes

Deploy into production

2 4 6

2011 – CAUBO Finance Presentation

Vendor Performance Management Applications Overview

Strategy Management / Strategic Planning:

Hyperion Performance Scorecard 11.1.2

Hyperion Strategic Finance 11.1.2

Financial Close, Consolidation and External Reporting:

Hyperion Financial Management 11.1.2

Hyperion Financial Close Management 11.1.2

Hyperion Disclosure Management 11.1.2

Hyperion Financial Data Quality Management 11.1.2

Essbase Analytics Link for Hyperion Financial Management 11.1.1

Hyperion Financial Reporting 11.1.2

XBRL publisher

Planning, Budgeting, and Forecasting:

Hyperion Planning 11.1.2

Hyperion Capital Asset Planning 11.1.2

Hyperion Workforce Planning 11.1.2

Strategy Management / Strategic Planning:

SSM - Strategy Management

Pioneer

Financial Close, Consolidation and External Reporting:

BCS - Business Consolidations (Until 2016)

BPC - Business Planning and Consolidations 7.5

FCC - Financial Consolidation

IC – Intercompany

UBmatrix (XBRL)

Planning, Budgeting, Forecasting:

BPS- Business Planning and Simulation / IP-Integrated

Planning (Until 2016)

BPC - Business Planning and Consolidations 7.5

Profitability and Cost Management:

Profitability and Cost Management

Strategy Management / Strategic Planning:

Cognos 9.5 TM1 9.5.1

Cognos Planning 8.4.1

Budgeting, Planning, Forecasting:

Cognos Planning 8.4.1

Cognos TM1 9.5.1

Cognos Express (mid-market offering)

Financial Close, Consolidation and External Reporting:

Cognos Controller 9.5.1

Cognos FSR (XBRL Publisher)

Reporting and Analysis:

Cognos 10 Business Intelligence

Cognos 10 Go! Dashboard, Mobile, Office

Cognos Now!

Cognos TM1 9.5.1

© Deloitte & Touche LLP and affiliated entities.53

Hyperion Workforce Planning 11.1.2

Integrated Operational Planning 11.1.2

Integrated Margin Planning 11.1.2

Hyperion Public Sector Planning and Budgeting 11.1.2

Profitability and Cost Management:

Profitability and Cost Management 11.1.2

Enterprise Dimension/Hierarchy Management:

Hyperion Data Relationship Management 11.1.2

Reporting and Analysis:

Oracle Hyperion Essbase 11.1.2

Oracle Hyperion Financial Reporting 11.1.2

Oracle Hyperion Web Analysis 11.1.2

Oracle Hyperion Interactive Reporting 11.1.2

Oracle Hyperion SQR Reporting 11.1.2

Oracle Business Intelligence Enterprise Edition (OBIEE) 11g

Packaged BI Analytics:

Financial Analytics (GL, Profitability, Budget, Payables) 11g

Sales Analytics 11g

Human Resources Analytics 11g

Supply Chain and Order Management Analytics 11g

Data Integration:

Warehouse Builder 11g

Predictive Analytics:

Crystal Ball 11.1.2

Profitability and Cost Management

Enterprise Dimension/Hierarchy Management:

Master Data Management

Reporting and Analysis:

Xcelsius

Crystal Reports

Web Intelligence

BW/BWA - NetWeaver Business Warehouse / Accelerator

BEx - Business Explorer (Until 2016)

Polestar

Packaged BI / Analytics:

Extended Analytics - SRM, CRM & HR

SPM- Supply Chain Performance Management

Spend Performance Analytics

PCM - Profitability and Cost Management

Data Integration:

Data Integrator

Data Quality

Predictive Analytics:

Predictive Workbench

Cognos TM1 9.5.1

Cognos 10 Business Viewpoint

Cognos Express (mid-market offering)

Packaged BI / Analytics:

Cognos 8 Analytic Applications (Customer Performance,

Workforce Performance, Supply Chain Performance, Financial

Performance Analytics, Banking Risk Performance)

Enterprise Dimension/Hierarchy Management:

InfoSphere applications

Cognos 10 Business Viewpoint

Data Integration:

Ascential DataStage

Data Manager

Predictive Analytics:

SPSS Decision Management applications

ILOG supply chain applications

2011 – CAUBO Finance Presentation

About Deloitte’s PMT Practice

Performance Management Technology (PMT) is the bridge between the Finance and IT

functions that delivers solutions for our clients that are business focused and

applications enabled.

Consolidation

and Financial

Reporting

External

Reporting and

Disclosure

Management

Planning,

Budgeting,

Forecasting

� Advisory

– IPM technology visioning and roadmap

– IPM information requirements for decision support

– IPM technology requirements and selection

– IPM technology fit gap and business impact assessments

© Deloitte & Touche LLP and affiliated entities.54

Financial

Analytics

Management

Reporting

Reporting

Planning,

Management

Dashboards and

Scorecards

Performance

Management

Technology

– IPM technology fit gap and business impact assessments

� Implementation

– Solution design and tool implementation

– Data mart design and implementation

– Report rationalization, design and implementation

� Value-Added

– heath checks, upgrades & optimization services

– leading practice assessments

– Financial and non-financial advisory & management

2011 – CAUBO Finance Presentation

© Deloitte & Touche LLP and affiliated entities.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.com/about for

a detailed description of the legal structure of Deloitte Touche Tohmatsu Limited and its member firms. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries.

This presentation contains general information only and is based on the experiences and research of Deloitte practitioners. Deloitte is not, by means of this presentation, rendering business, financial, investment, or other professional advice or

services. This presentation is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your

business, you should consult a qualified professional advisor. Deloitte, its affiliates, and related entities shall not be responsible for any loss sustained by any person who relies on this presentation.

Member of Deloitte Touche Tohmatsu Limited

Copyright © 2011 Deloitte Development LLC. All rights reserved.