2011 12 23 Migbank Daily Technical Analysis Report

Transcript of 2011 12 23 Migbank Daily Technical Analysis Report

-

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

1/15

MIG BANK / Forex Broker 14, rte des Gouttes dOr CH-2008 Neuchtel Switzerland

Tel +41 32 722 81 00 Fax +41 32 722 81 01 [email protected] www.migbank.com

Please note: None of the strategies below represent trading advice or trading recommendations of any kind. Please refer to our full disclaimer.

WINNER BEST SPECIALIST RESEARCH

MA

S-TERMMULTI-DAY

L-TERMMULTI-WEEK

STRATEGY/POSITION

ENTRYLEVEL

OBJECTIVES/COMMENTS STOP

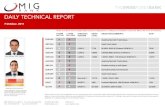

EUR/USD Await fresh signal.GBP/USD Await fresh signal.USD/JPY Await new buy trade setup above 80.00.USD/CHF Looking to sell.USD/CAD Awaiting new buy trade setup.AUD/USD Exited at 1.0050.GBP/JPY Await fresh signal.EUR/JPY Await new setup.EUR/GBP Sell limit 3 0.8425 0.8325/0.8142/0.8050 0.8525EUR/CHF Sell Stop 3 1.2130 1.2030/1.1526/1.1002 1.2230GOLD SHORT 2 1705 1530/1300 (Entered 12/12/2011) 1705SILVER SHORT 2 34.1300 26.0700/23.3400 (Entered 01/11/2011) 34.1300

DISCLAIMER &DISCLOSURESPlease read the disclaimer and thedisclosures which can be found atthe end of this report

DAILY TECHNICAL REPORT23 December, 2011

Ron William, CMT, MSTA

Bijoy Kar, CFA

Notes: Entries are in 3 units and objectives are at 3 separate levels where 1 unit will be exited. When the first objective (PT 1) has been hit the stop will be moved to the entry

point for a near risk-free trade. When the second objective (PT 2) has been hit the stop will be moved to PT 1 locking in more profit. All orders are valid until the next report is

published, or a trading strategy alert is sent between reports.

-

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

2/15

2

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Short-covering around the key 1.3000 level.

EUR/USD is unwinding mildly from oversold conditions, driven by short-

covering as the market adjusts to a new bearish paradigm, following the

break beneath that all-important psychological level at 1.3000.

Our cycle analysis successfully signalled increased volatility within the

first two weeks of December across risk proxies, including the equity

and commodity markets. Expect some respite ahead of the holiday

period.

Watch for a sustained close beneath 1.3000 (psychological level) to

resume EUR/USDs multi-month downtrend into 1.2870 (2011 major low).

Near-term resistance can be found at 1.3215 and potentially even 1.3550

(02 Dec high). Any rebound into these levels is likely to be short-lived.

Inversely, the USD Index has extended its recovery higher to new 11-

month highs, (a move worth over 10% from the summer 2010 lows).

Speculative (net long) liquidity flows are strengthening once again and will

continue to help resume the USDs major bull-run from its historic

oversold extremes (momentum, sentiment and liquidity).

Special Report:EUR/USD A Fall From Grace ? Decline Targets 1.3770/1.3410. VIDEO

MIG Bank Webinar: Why the US dollar is likely to gain up to 30% in 6-12 months.US Dollar Interview on Bloomberg

S-T TREND L-T TREND STRATEGY

Await fresh signal.

EUR/USD

Ron William, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 454

EUR/USD

EUR/USD daily chart, Bloomberg Finance LP

USD Index daily chart, Bloomberg Finance LP

http://www.migbank.com/research/howard/2011-06-17_migbank_daily-technical-analysis-report_special-focus-EURUSD.pdfhttp://www.migbank.com/research/howard/2011-06-17_migbank_daily-technical-analysis-report_special-focus-EURUSD.pdfhttp://www.migbank.com/research/howard/2011-06-17_migbank_daily-technical-analysis-report_special-focus-EURUSD.pdfhttp://www.migbank.com/research/howard/2011-06-17_migbank_daily-technical-analysis-report_special-focus-EURUSD.pdfhttp://www.migbank.com/research/howard/2011-06-17_migbank_daily-technical-analysis-report_special-focus-EURUSD.pdfhttp://www.youtube.com/watch?v=8JxLscMBUHY&feature=player_embeddedhttp://www.youtube.com/watch?v=8JxLscMBUHY&feature=player_embeddedhttp://www.fxstreet.com/webinars/sessions/session.aspx?id=8e1265eb-a0b4-4b43-87d3-e5be91699f54http://www.fxstreet.com/webinars/sessions/session.aspx?id=8e1265eb-a0b4-4b43-87d3-e5be91699f54http://www.fxstreet.com/webinars/sessions/session.aspx?id=8e1265eb-a0b4-4b43-87d3-e5be91699f54http://www.fxstreet.com/webinars/sessions/session.aspx?id=8e1265eb-a0b4-4b43-87d3-e5be91699f54http://www.bloomberg.com/video/75644864/mailto:[email protected]:[email protected]:[email protected]:[email protected]://www.bloomberg.com/video/75644864/http://www.fxstreet.com/webinars/sessions/session.aspx?id=8e1265eb-a0b4-4b43-87d3-e5be91699f54http://www.youtube.com/watch?v=8JxLscMBUHY&feature=player_embeddedhttp://www.migbank.com/research/howard/2011-06-17_migbank_daily-technical-analysis-report_special-focus-EURUSD.pdf -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

3/15

3

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Range bound for now in a thin Christmas market.

GBP/USD continues to trade in a tight hourly range just under the

1.5770/80 double top. The thin Chritmas markets may see some sharp

moves, however, they are unlikley to be sustained. Near-term a returnback to 1.5409 is favoured.

Medium-term GBP/USD may experience a degree of support given the

negative structure that we are also seeing in EUR/GBP. Thus a

continuation to the downside in EUR/GBP may be associated with the

years range being maintained in GBP/USD.

We are now approaching 7.000% again in 10 year Italian sovereign

yields, which should support the arguements that we have detailed

above.

Failure to remain above 1.5423 will see an immediate target at 1.5272

and then potentially trend-line support at 1.5110.

S-T TREND L-T TREND STRATEGY

Range bound trade likely t o persist near-term.

GBP/USD

Bijoy Kar, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 424

GBP/USD hourly chart, Bloomberg Finance LP

GBP/USD daily chart, Bloomberg Finance LP

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

4/15

4

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Weakening beneath 78.24 (DeMark Level).

USD/JPY is still weak beneath 78.24 (DeMark Level), as pricecontinues to hold within a multi-day trading range (see hourly chartbelow).

Confirmation beneath 77.25 (pivot level) would help trigger a third price

retracement back to pre-intervention levels and potentially even a new

post world war record low beneath 75.35.

Sentiment in the option markets continues to suggest that USD/JPY

buying pressure remains overcrowded as everyone continues to try and

be the first to call the market bottom, within the end of this multi-year

contracting pattern.

This may first inspire a temporary, but dramatic, price spike through

psychological levels at 75.00 and perhaps even sub-74.00. Such a move

would help flush out a number of downside barriers and stop-loss orders,

which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward

a major long-term 40-year cycle upside reversal. Expect key cycle

inflection points to trigger over the next few weeks, offering a sustained

move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Please select the link below to review our special coverage on USD/JPY.

Special Report: USDJPY Verging on a major 40 year cycle reversal VIDEO

Webinar: USD/JPYs Long-Term Structural Change

Media Reports: CNBC /Squawk Box &Bloomberg

S-T TREND L-T TREND STRATEGY

Awaiting Renewed Buy Trade Setup above 80.00.

Ron William, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 426

USD/JPY

USD/JPY hourly chart, Bloomberg Finance LP

USD/JPY daily chart, Bloomberg Finance LP

http://www.youtube.com/watch?v=rDHE6uEqm6whttp://www.youtube.com/watch?v=rDHE6uEqm6whttp://www.fxstreet.com/webinars/sessions/session.aspx?id=d77a35a0-4a11-44fa-a883-c95e01661d21http://www.fxstreet.com/webinars/sessions/session.aspx?id=d77a35a0-4a11-44fa-a883-c95e01661d21http://www.fxstreet.com/webinars/sessions/session.aspx?id=d77a35a0-4a11-44fa-a883-c95e01661d21http://www.fxstreet.com/webinars/sessions/session.aspx?id=d77a35a0-4a11-44fa-a883-c95e01661d21http://www.cnbc.com/id/45301945http://www.cnbc.com/id/45301945http://www.cnbc.com/id/45301945http://65.55.53.237/id/15840232?video=3000062126&play=1http://65.55.53.237/id/15840232?video=3000062126&play=1http://65.55.53.237/id/15840232?video=3000062126&play=1http://www.bloomberg.com/news/2011-11-24/dollar-may-rise-20-to-94-yen-on-elliot-wave-rebound-technical-analysis.htmlhttp://www.bloomberg.com/news/2011-11-24/dollar-may-rise-20-to-94-yen-on-elliot-wave-rebound-technical-analysis.htmlhttp://www.bloomberg.com/news/2011-11-24/dollar-may-rise-20-to-94-yen-on-elliot-wave-rebound-technical-analysis.htmlmailto:[email protected]:[email protected]:[email protected]:[email protected]://www.bloomberg.com/news/2011-11-24/dollar-may-rise-20-to-94-yen-on-elliot-wave-rebound-technical-analysis.htmlhttp://65.55.53.237/id/15840232?video=3000062126&play=1http://www.cnbc.com/id/45301945http://www.fxstreet.com/webinars/sessions/session.aspx?id=d77a35a0-4a11-44fa-a883-c95e01661d21http://www.youtube.com/watch?v=rDHE6uEqm6w -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

5/15

5

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

A return to the 200 day moving average now favoured.

USD/CHF is likely to be affected by movement in EUR/CHF over

coming days and particularly into next year. As EUR/CHF nears the

1.2000 level again the probability of intervention by the SNB will beheightened. Thus the near-term fate of USD/CHF may be determined by

EUR/CHF.

Movement in USD/CHF is also tied to the direction of selected core

Euro-Zone yields and in particular the yield on Italian sovereign debt.

Overnight we have seen a move back up to the 7.000% region in the 10

year maturity. Next year is likely to see a return to focusing on rollover

funding issues for the Italian economy. This has the potential to exert

downside pressure on USD/CHF.

10 year yields in Spain and Italy are currently trading at 5.375% and

6.952% versus 6.478% and 7.355%, before the US Dollar based swap

agreement. Thus, Spanish debt is experiencing a stronger positive

effect, in contrast to the Italian market. These yields were trading at

5.328% and 6.760% respectively yesterday.

S-T TREND L-T TREND STRATEGY

Looking to sell.

USD/CHF hourly chart, Bloomberg Finance LP

Bijoy Kar, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 424

USD/CHF

USD/CHF daily chart, Bloomberg Finance LP

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

6/15

6

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Unwinding from intraday resistance at 1.0425.

USD/CAD is unwinding sharply from intraday resistance at 1.0425, which

coincided with a short-term DeMark exhaustion signal.

We prefer to wait for a strong directional confirmation higher before

initiating a buy trade setup.

A sustained break under 1.0220 now suggests further downside into

1.0000.

Meanwhile, the bulls need to push back above 1.0425 and 1.0524 (25

Nov swing high), in order to trigger a larger breakout from the rates multi-

month triangle pattern.

In terms of the big picture, a directional confirmation above 1.0680 is still

needed to unlock the recovery into 1.0850 plus. This would extend the

upside breakout from the rates ending triangle pattern, which was part of

a major Elliott wave cycle (see top chart insert).

EUR/CAD has breached the base of an important multi-month distribution

pattern. A sustained break beneath 1.3393-79 (19th

Sept low/61.8% Fib),

signals an important breakdown into 1.3140 and would provide

substantial correlation pressure onto EUR/USD.

S-T TREND L-T TREND STRATEGY

Awaiting New Buy Trade Setup above 1.0425.Ron William, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 454

USD/CAD

USD/CAD daily chart, Bloomberg Finance LP

USD/CAD hourly chart, Bloomberg Finance LP

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

7/15

7

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Strong unwinding from oversold conditions.

AUD/USD is unwinding strongly from oversold conditions, which also

coincided with an intraday DeMark buy signal (see lower chart).

Although this recovery is sharp, it is likely to be short-lived as signaled by

the DeMark signal. The bears must sustain below 1.0000 to further

compound downside pressure on the rates multi-year uptrend and push

back towards 0.9611.

Elsewhere, the Aussie continues to weaken sharply, against the New

Zealand dollar. Near-term price activity is mean reverting back into the

200-day MA and we watch for further setbacks over the multi-day/week

horizon.

The Aussie dollar is also pairing back its mild recovery against the

Japanese yen, while holding above the neck-line of its two-year

distribution pattern. Watch for further downside scope into support at

72.00 which would signal further unwinding of global risk appetite.

S-T TREND L-T TREND STRATEGY

Exited at 1.0050.

AUD/USD

Ron William, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 454

AUD/USD daily chart, Bloomberg Finance LP

AUD/USD hourly chart, Bloomberg Finance LP

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

8/15

8

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Approaches the key level near 123.00.

GBP/JPY appears to be forming an exhaustion pattern in the hourly

timeframe. This warns of a degree of resistance close to 123.00, ahead

of a further swing lower. However, if a sustained break can be held over

123.00 then a return to 127.32 will become more likely.

Longer-term it is anticipated that a much larger recovery will develop

with scope for a return to 163.09 and then potentially on to 192.65.

However, signs of basing are still not evident, with the bias still to the

downside in the near-term.

S-T TREND L-T TREND STRATEGY

Await fresh signal.

GBP/JPY

GBP/JPY daily chart, Bloomberg Finance LP

Bijoy Kar, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 424

GBP/JPY hourly chart, Bloomberg Finance LP

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

9/15

9

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Continues to find support close to the 101.00 region.

EUR/JPY is maintaining its hold over the 101.00 level after basing at

101.05 recently.

The negative effects of the breakdown in EUR/USD remain a potentiallarge factor for this pair going forward, which warns of a re-test of

100.76 and then possibly lower.

However, the structure present since 100.76 is suggestive of a further

swing to re-test 111.60 over the medium-term. Thus, while trade is

maintained above 101.05, a further leg higher is favoured.

This clash between structure and event risk in the Euro-Zone keeps us

on the side lines for now.

Sustained under 100.76 will warn of a much larger continuation to the

downside.

S-T TREND L-T TREND STRATEGY

Await fresh signal.

EUR/JPY hourly chart, Bloomberg Finance LP

Bijoy Kar, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 424

EUR/JPY daily chart, Bloomberg Finance LP

EUR/JPY

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

10/15

10

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Lower high sought near 0.8425.

EUR/GBP has found initial support after bouncing from daily channel

support near the 0.8300 region. Scope is seen for a minor continuation

of the recovery higher. However, hourly structure remains bearish with

a lower high sought versus 0.8613 for a fresh swing to re-test 0.8303.

If a sustained break under 0.8303 can be realized then an extension

back to the 0.8068 0.8142 region would become viable. This view is

assisted by the recent push under 1.3146 in EUR/USD, which may act

to make EUR cross shorts easier to maintain.

Rising yields in the core Euro-Zone sovereign bond markets is a

continued concern and one that may destabilise the FX markets going

forward. Within this environment Sterling may well be judged the best of

a bad bunch and to a degree be seen as a short-term safe haven,

further adding to the potential for downside pressure ahead.

S-T TREND L-T TREND STRATEGY

Sell limit 3 at 0.8425, Objs: 0.8325/0.8142/0.8050, Stop: 0.8525

EUR/GBP hourly chart, Bloomberg Finance LP

EUR/GBP daily chart, Bloomberg Finance LP

EUR/GBP

Bijoy Kar, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 424

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

11/15

11

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Hourly structure remains bearish.

EUR/CHF is developing a structure in the hourly timeframe which is

currently suggestive of a sizeable extension lower. If a break can be

realised under 1.2170 then stops under 1.2123/30 will become

vulnerable. If these are triggered, there may be sufficient momentum to

target the large cluster of stops that are expected under the 1.2000

region.

The Italian 10 year sovereign yield remains elevated, with a re-test of

the 7.000% level anticipated. A large tranche of rollover funding is

expected in the new year and growth is also likely to contract in Italy.

Thus, there is plenty of scope for the Swiss Franc to be sought once

again as a safe haven. The low yield available on Swiss Franc deposits

is unlikely to act as an impediment to it being sought as a safe haven.

As mentioned above, an initial breakout from the recent range has the

potential to trigger clustered stops which may add to downside

momentum. A failure to hold over the 1.2000 level will almost certainly

see a return to the larger downtrend.

S-T TREND L-T TREND

Sell stop 3 at 1.2130, Objs: 1.2030/1.1526/1.1002, Stop: 1.2230.

EUR/CHF daily and weekly charts, Bloomberg Finance LP

EUR/CHF

EUR/CHF hourly chart, Bloomberg Finance LP

Bijoy Kar, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 424

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

12/15

12

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Gold re-testing its 200-day average.

Gold is temporarily re-testing its 200-day average, which was recently

broken for the first time in 3 years. The move was triggered by a multi-month

triangle pattern breakout (see both daily and intraday charts). Downside pressure remains heavy from inter-market weakness across

related risk proxies such as EUR/USD and equity markets. Moreover, there

is still heightened risk for a much larger decline if we confirm a weekly close

beneath $1600 and $1530 (swing low).

A number of bargain hunting trend-followers will be watching this

benchmark line in the sand for repeat support or a potential big squeeze

lower into $1300 and perhaps even $1040-1000 (12-year channelfloor/see

top chart insert).

Speculative (net long) flows also support this view having recently breached

a key downside level which may threaten over 2 years of sizeable long gold

positions. This will trigger a temporary, but dramatic setback that would

ultimately offer a unique buying opportunity into summer 2012.

Please select links for in-depth Gold coverage:

Special ReportGolds mountainous peak at riskbeneath $1600 VIDEO

Bloomberg Countdown CNBC Squawk Box MIG Bank Gold Webinar video(BLOOMBERG&CNBCREPORTS)

S-T TREND L-T TREND STRATEGY

SHORT 2: 1705, Objs: 1530, 1300, Stop: 1705

GOLD

Gold daily and weekly charts, Bloomberg Finance LP

Ron William, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 454

Gold hourly chart, Bloomberg Finance LP

http://www.migbank.com/research/howard/2011-09-13_Gold_Special_Report_(RW).pdfhttp://www.migbank.com/research/howard/2011-09-13_Gold_Special_Report_(RW).pdfhttp://www.migbank.com/research/howard/2011-09-13_Gold_Special_Report_(RW).pdfhttp://www.youtube.com/watch?v=haKdlGKWyjQ&feature=player_embedded&list=PL953E96C7BE48D2FAhttp://www.youtube.com/watch?v=haKdlGKWyjQ&feature=player_embedded&list=PL953E96C7BE48D2FAhttp://www.bloomberg.com/video/78409176/http://www.bloomberg.com/video/78409176/http://video.cnbc.com/gallery/?video=3000042202http://www.fxstreet.com/webinars/sessions/session.aspx?id=8f81a2e3-e29b-4031-b370-a85149271145http://www.bloomberg.com/news/2011-09-11/gold-may-fall-below-1-700-before-extending-bull-rally-technical-analysis.htmlhttp://www.bloomberg.com/news/2011-09-11/gold-may-fall-below-1-700-before-extending-bull-rally-technical-analysis.htmlhttp://www.bloomberg.com/news/2011-09-11/gold-may-fall-below-1-700-before-extending-bull-rally-technical-analysis.htmlhttp://www.cnbc.com/id/44310840http://www.cnbc.com/id/44310840http://www.cnbc.com/id/44310840mailto:[email protected]:[email protected]:[email protected]:[email protected]://www.cnbc.com/id/44310840http://www.bloomberg.com/news/2011-09-11/gold-may-fall-below-1-700-before-extending-bull-rally-technical-analysis.htmlhttp://www.fxstreet.com/webinars/sessions/session.aspx?id=8f81a2e3-e29b-4031-b370-a85149271145http://video.cnbc.com/gallery/?video=3000042202http://www.bloomberg.com/video/78409176/http://www.youtube.com/watch?v=haKdlGKWyjQ&feature=player_embedded&list=PL953E96C7BE48D2FAhttp://www.migbank.com/research/howard/2011-09-13_Gold_Special_Report_(RW).pdf -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

13/15

13

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Weak bounce retesting $30.0000.

Silvers weak recovery from oversold conditions is retesting key support at

$30.0000. Only a sustained close below here would trigger a test of the

previous swing low at $26.0700.

Macro price structure continues to focus on the downside risks, following

the major sell-off in September. Such a dramatic move traditionally

produces volatile trading ranges. This allows the market to have enough

time to recover and accumulate renewed buying interest.

Expect a large trading range to hold between $37.0000-26.0700 over the

multi-week/month horizon, with downside macro risk into $21.5165

(61.8% Fib-1999 bull market) and $20.0000. This would still maintain

silvers long-term uptrend and help offer a potential buying opportunity for

the eventual resumption higher.

Continue to watch the gold-silver mint ratio (see top chart insert) which

has now accelerated higher by 70%, suggesting further risk aversion over

the next few weeks. This also helps explain recent divergences between

gold and silver.

S-T TREND L-T TREND STRATEGY

SHORT 2: 34.1300, Objs: 26.0700/23.3400, Stop: 34.1300

SILVER

Spot Silver hourly chart, Bloomberg Finance LP

Ron William, Technical Strategist, E-mail:[email protected], Phone: +41 32 7228 454

Spot Silver daily chart, Bloomberg Finance LP

mailto:[email protected]:[email protected]:[email protected]:[email protected] -

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

14/15

14

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.com

Limitation of liability

MIG BANK disclaims, without limitation, all liability for any loss or damage of any kind,

including any direct, indirect or consequential damages.

Material InterestsMIG BANK and/or its board of directors, executive management and employees may have or

have had interests or positions on, relevant securities.

Copyright

All material produced is copyright to MIG BANK and may not be copied, e-mailed, faxed or

distributed without the express permission of MIG BANK.

Notes: Entries are in 3 units and objectives are at 3 separate levels where 1

unit will be exited. When the first objective (PT 1) has been hit the stop will bemoved to the entry point for a near risk-free trade. When the second objective

(PT 2) has been hit the stop will be moved to PT 1 locking in more profit. All

orders are valid until the next report is published, or a trading strategy alert is

sent between reports.

DISCLAIMERNo information published constitutes a solicitation or offer, or recommendation, or advice, to

buy or sell any investment instrument, to effect any transactions, or to conclude any legal act

of any kind whatsoever.

The information published and opinions expressed are provided by MIG BANK for personal

use and for informational purposes only and are subject to change without notice. MIG BANK

makes no representations (either expressed or implied) that the information and opinions

expressed are accurate, complete or up to date. In particular, nothing contained constitutes

financial, legal, tax or other advice, nor should any investment or any other decisions be

made solely based on the content. You should obtain advice from a qualified expert before

making any investment decision.

All opinion is based upon sources that MIG BANK believes to be reliable but they have no

guarantees that this is the case. Therefore, whilst every effort is made to ensure that the

content is accurate and complete, MIG BANK makes no such claim.

LEGALTERMS

-

8/3/2019 2011 12 23 Migbank Daily Technical Analysis Report

15/15

15

DAILY TECHNICAL REPORT23 December, 2011

www.migbank.comRon WilliamTechnical [email protected]

14, rte des Gouttes dOrCH-2008 NeuchtelTel.+41 32 722 81 00

Bjioy KarTechnical [email protected]

CONTACT

Howard FriendChief Market [email protected]

mailto:[email protected]:[email protected]://www.migbank.com/mailto:[email protected]:[email protected]:[email protected]:[email protected]://www.migbank.com/mailto:[email protected]:[email protected]