20 - 30 Years of Service...Thank you for your commitment and years of service Pat Crawford ~ 30...

Transcript of 20 - 30 Years of Service...Thank you for your commitment and years of service Pat Crawford ~ 30...

Wyoming Community Development Authority

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

2014 - 2015 Annual Report

Thank you for your commitment and years of service

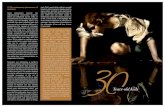

Pat Crawford ~ 30 YearsGeorge Axlund ~ 30 Years*

Cheryl Gillum ~ 28 YearsJohn Van Nes ~ 25 Years*Gayle Andress ~ 23 Years

Gayle Brownlee ~ 23 YearsRonda McCarthy ~ 22 Years*

Brenda Rice ~ 20 Years*Nancy Jolley ~ 20 Years

*Retired from WCDA

20 - 30 Years of Service

A native of Douglas, Wyoming, Dan Sullivan’s roots run deep in the Wyoming political landscape. Following a successful banking career in Denver, Sullivan returned to Wyoming to serve as the first Executive Director of the Wyoming Community Development Authority in 1975. Dan served on the WCDA Board from 2006 - 2014 as a Board Member, Secretary, and Board Chairman. He was elected to the Wyoming State Senate in 1984 and re-elected in 1988, serving as Chairman of the Senate Revenue Committee. In 1990, he established his Government Relations and Consulting firm in Casper.

Dan is a proven strategist in public affairs and political campaigns at the local, state and national level. He represents Fortune 500 companies in government relations before the state of Wyoming and is a known commodity when it comes to advocacy for his clients.

Known for his quick wit, Dan cuts to the heart of an issue and is respected for his opinion by colleagues, elected officials and members of government.

Besides building a winning government relations firm, Dan is recognized as a public speaker and professional auctioneer. His familiar auctioneer’s chant has raised millions of dollars for charities.

Dan is a graduate of the University of Wyoming and is an Outstanding Alumni of the Arts and Science College. He and his wife Sue have two grown children and two granddaughters.

2014 Board of Directors

Managing UnderwritersBank of America - Merrill Lynch

Kaiser & CompanyRoyal Bank of Canada (RBC)

TrusteeWells Fargo - Trust Management

AuditorPorter Muirhead Cornia &

Howard

Bond CounselKutak Rock

Local CounselMurane & Bostwick

Underwriter’s CounselChapman & Cutler

Financial ConsultantscfX

DerivActiv/Blue Rose

Computer ConsultantsEmphasys/AOD

Computer Associates

Demographic &Economic Consultant

Western Economic Services

Judy Lane, Executive Director David Haney, Rob Boner, State Treasurer Representative Sharon Garland, Chairman Pat Hand, Kristin Lee, Vice Chairman Lesli Wright, George Parks, Governor Representative Merit Thomas, Secretary Kari Cooper

Not Pictured: Governor Matt Mead & State Treasurer Mark Gordon

Professional Associates

Table of Contents

22014 WCDA Annual Report

Chairman’s & Director’s Letter 3WCDA Staff 4WCDA Lenders 4WCDA Achievements 5

2014December

2015JanuaryFebruaryMarchAprilMayJuneJulyAugustSeptemberOctoberNovemberDecember

Audited Financialwww.wyomingcda.com

Wyoming CommunityDevelopment Authority155 N. Beech St.Casper, WY 82601

Main Phone: (307) 265-0603Main Fax: (307) 266-5414Loan Servicing Phone: (307) 265-5102Loan Servicing Fax: (307) 265-0306

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

Chairman’s & Director’s LetterTo: The Honorable Matthew Mead Governor, State of Wyoming

Members of the Wyoming Legislature

We are pleased to present to you the Annual Report for the Wyoming Community Development Authority (WCDA) in the form of an annual calendar. Consistent with our approach from last year, and in an attempt to provide more electronic communication, our annual audited fi nancial statements for the period ending June 30, 2014 are on our web site - www.wyomingcda.com. This allows those who have an interest in our fi nancial performance to see the signifi cant details. By utilizing our web site, you can also see a complete list of the many programs for housing that we provide throughout the State including our demographic studies (Profi le/Blue Book).

In the last year, we again demonstrated both fi nancial integrity and creativity by surviving the largest housing downturn in the country’s history since the Great Depression. We’ve continued to meet our mission of providing affordable housing to the State of Wyoming while maintaining profi tability during a period of signifi cantly reduced resources.

In the past year, we purchased 584 loans and invested $90 million in new, fi rst time homebuyer loans. The average loan amount was $154,476, while the average income of those borrowers was $51,774. The average age of our fi rst-time homebuyer was 31 years old and only 39 percent of our borrowers were married. This continues to be indicative of the changing demographics of Wyoming’s population, particularly within our market niche. Additionally, the homebuyer education required by WCDA (883 households) and others in the industry have made a signifi cant difference for our borrowers as they better understand the responsibilities of homeownership.

In late 2009, federal relief was provided to the housing fi nance industry based upon the reality that the HFA’s underwrote their mortgages in a more conservative fashion and were experiencing much better performance than the overall housing market despite their attention being focused on low down payment fi rst-time homeownership. Justifi cation for the support was the belief that until the fi rst time homeowner tier was stabilized, it would be very diffi cult to stabilize the remainder of the market. By utilizing the HOME Investment Partnerships Program and the Low Income Housing Tax Credits, funding was approved during calendar year 2014 for an additional 154 new units of affordable rental housing. The combined investment in those programs represented more than $27 million invested in housing throughout Wyoming.

The Neighborhood Stabilization Program (NSP) also allowed WCDA to purchase foreclosed or abandoned homes, rehabilitate those houses, and resell them to fi rst-time homebuyers. Through fi scal year 2014, we have acquired and rehabilitated 126 foreclosed homes expending almost $30 MM.

Thanks to the implementation of a quality strategic planning process over the last six years, strategies were formulated to identify and manage areas of risk within the institution while ensuring the accomplishment of its mission and still maintain its fi nancial integrity. Each line of business has also completed its own strategic plan, thereby establishing larger goals for departments and then translating those goals into customer value statements and more practical

operating budgets. Those plans were then amalgamated into an annual program plan for the year 2014 – 2015 and approved by the Board of Directors in June of 2014.

Delinquency continues to be troublesome, but at levels far below what exists elsewhere in the country. There continues to be a gap between wages and the cost of maintaining one’s household, however, affordability is at one of its all time highs. Because of the relative stability of our natural resource-based economy, we expect to see continued improvement and be able to avoid the 1980’s boom and bust cycle.

The efforts of an engaged and active Board of Directors, strong management, and a terrifi c professional team, have positioned the WCDA for the future. Despite the challenges, performance continues to be solid. We have been able to maintain the fi nancial integrity of the Authority while continuing to meet the mission originally envisioned by the Legislature.

Pat Hand, Board Chair

David M. Haney, Executive Director

32014 WCDA Annual Report

WCDA Staff

Participating LendersAfton1st Bank Alpine1st BankUniversal American MortgageBasinSecurity State BankBuffaloFirst Northern Bank of WyomingFirst Interstate BankCasperFirst Interstate BankHilltop National BankJonah BankWallick & VolkWells Fargo Home Mortgage, Inc.CheyenneCentennial LendingCentral Bank & TrustCheyenne State BankFirst Interstate BankJonah BankPinnacle Bank of Wyoming, Inc.

Security First BankWallick & VolkWells Fargo Home Mortgage, Inc.Wyoming Bank & TrustCodyFirst Bank of WyomingPinnacle Bank of Wyoming, Inc.Wells Fargo Home Mortgage, Inc.Evanston1st Bank Wells Fargo Home Mortgage, Inc. GilletteFirst Interstate BankFirst Northern Bank of WyomingFirst National Bank of GillettePinnacle Bank of Wyoming, Inc.Premier Home MortgageSecurity State Bank Wells Fargo Home Mortgage, Inc.

Green RiverWells Fargo Home Mortgage, Inc.GuernseyFirst State Bank of GuernseyJacksonFirst Interstate BankKemmerer1st BankLanderCentral Bank & TrustFirst Interstate BankWells Fargo Home Mortgage, Inc.LaramieFirst Interstate BankSecurity First BankWells Fargo Home Mortgage, Inc.LovellFirst Bank of WyomingLymanWells Fargo Home Mortgage, Inc.

MoorcroftPinnacle Bank of Wyoming, Inc.Mountain View1st BankNewcastlePinnacle Bank of Wyoming, Inc.Pinedale1st BankWells Fargo Home Mortgage, Inc.PowellFirst Bank of WyomingPinnacle Bank of Wyoming, Inc.Wells Fargo Home Mortgage, Inc.RivertonCentral Bank & TrustFirst Interstate BankWells Fargo Home Mortgage, Inc.Rock Springs1st BankRSNB BankWells Fargo Home Mortgage, Inc.

SheridanFirst Federal Savings BankFirst Interstate BankFirst Northern Bank of WyomingPremier Home MortgageSecurity State Bank Wells Fargo Home Mortgage, Inc.ThermopolisCentral Bank & TrustPinnacle Bank of Wyoming, Inc.TorringtonFirst State Bank of TorringtonPinnacle Bank of Wyoming, Inc.WheatlandFirst State Bank of WheatlandWorlandPinnacle Bank of Wyoming, Inc.

42014 WCDA Annual Report

Executive TeamDavid Haney, Shannon Hillibush, Tara Smith, Cheryl Gillum

Federal ProgramsPaula Travers, Edie Phillips, Gayle Brownlee, Carole Linton, Judy Koski

Administration & FinanceNancy Jolley, Daren Cook, Scott Hoversland, Pat Crawford, Candice Ohnstad, Valeria Johnson, James Cochran, Mary Knoll

Loan ServicingMatt Swanson, Gayle Andress, Rebel McAtee, Marla Genetti, Linda Bentz, Liz Wolz, Stacey Tichy, Rob Schauss, Becky Hinton, Chris Roberts, Connie WilliamsNot pictured: Stacy Howard

Single Family Tom Price, Connie Stinson, Keith Vlastos, Christina Pelton, Orson Badger, Jessica Howard, Rick Juday, Linda Jordan, Gina Hayden, Wendy Kindel

WCDA AchievementsProgram

2013/2014 No. of Loans

2013/2014 Amount

Cumulative Households

Cumulative Communities

Cumulative Amount

Single Family Mortgage 506 $77,276,671 50,648 160 $3,865,528,975Spruce Up Wyoming I 18 $2,735,377 338 42 $40,489,401Spruce Up Wyoming II 3 $471,025 155 30 $17,676,337Down Payment Assistance Loans 246 $1,196,838 15,972 133 $56,110,295Wyoming Energy Savers Program 0 $0 58 17 $334,094Spirit! of Wyoming Program 57 $9,730,642 355 36 $58,518,608HFA Preferred 163 $25,553,419 248 26 $39,339,503Habitat for Humanity 5 $513,675 84 12 $7,600,210

CountyTotal Dollars

LoanedNo. ofLoans

Avg. Loan Amount

Avg. Income of Borrower

Avg. Age of Borrower

PercentageMarried

Albany $1,983,673 13 $152,590 $43,549 31 52%Big Horn $2,246,728 22 $111,215 $54,155 33 58%Campbell $14,193,319 86 $165,039 $60,768 30 37%Carbon $1,854,659 12 $154,555 $50,405 28 26%Converse $640,887 5 $128,177 $45,873 33 33%Crook $533,832 4 $133,458 $52,787 26 57%Fremont $3,106,882 22 $141,222 $47,539 35 56%Goshen $847,396 6 $141,233 $60,739 33 43%Hot Springs $142,755 1 $142,755 $42,000 34 66%Johnson $812,172 5 $162,434 $51,136 32 83%Laramie $25,852,577 169 $152,974 $52,194 31 40%Lincoln $876,676 6 $146,446 $53,928 37 60%Natrona $20,425,300 126 $162,106 $49,711 31 33%Niobrara $56,122 1 $56,122 $42,768 24 0%Park $3,375,559 22 $153,436 $48,204 30 52%Platte $734,926 5 $146,985 $53,939 43 0%Sheridan $9,625,322 57 $168,865 $46,794 31 31%Sublette $117,346 1 $117,346 $88,041 46 100%Sweetwater $535,899 3 $178,633 $66,965 29 20%Teton $36,630 1 $36,630 $17,985 41 0%Uinta $517,964 3 $172,655 $57,127 29 50%Washakie $920,352 9 $102,261 $42,528 33 40%Weston $576,739 5 $115,348 $45,675 26 50%

$90,213,715 584 $154,476 $51,774 31 39%

The following statistics are as of December 2013:

52014 WCDA Annual Report

Low-Income Housing Tax Credits Cumulative Units 4,156Cumulative Communities 22Cumulative Amount $293,512,943.30

HOME Program Cumulative Units 1,348Cumulative Communities 32Cumulative Amount $69,179,082.72

WRAP ProgramCumulative Units 81Cumulative Communities 5Cumulative Amount $15,885,338.77

Homebuyer Education2013/2014 No. of Students 883Cumulative No. of Students 19,442

1975

In 1973, WCDA was conceived by a select committee of the Wyoming Legislature to finance both housing and a broad range of community and economic development projects, using “moral obligation” bonds and a pledge of mineral severance tax earnings.

The legislative path to the creation of WCDA was, therefore, fraught with disagreement and conflict. At one point, the agency was declared unconstitutional by the Supreme Court. During a special legislative session, the constitutional wrinkles of the law were ironed out, overcoming representatives’ doubt and confusion about the nature and functions of the agency. Passionately advocated on the Senate floor by state Senator Dick Sedar, a member of the original select committee, WCDA was created as we know it today.

The Wyoming Community Development Authority Act was passed in the 1975 legislative session and in early 1976, WCDA hired its first staff and began determining how this innovative agency would work.

December 2014Sunday Monday Tuesday Wednesday Thursday Friday Saturday

30 1 2 3 4 5 6

7 8 9 10 11 12 13

14 15 16

*Late Fee Assessment

First Day of Hanukkah

17 18 19 20

21

First Day of Winter

22 23 24

Christmas Eve

25

WCDA ClosedLast Day of HanukkahChristmas Day

26 27

28 29 30 31

**Last Business Day

New Year’s Eve

1

WCDA ClosedNew Year’s Day

2 3

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

Su M Tu W Th F Sa

1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 27 28 29 30 31

January 2015

Su M Tu W Th F Sa

1

2 3 4 5 6 7 8

9 10 11 12 13 14 15

16 17 18 19 20 21 22

23 24 25 26 27 28 29

30

November 2014

1977

George Axlund began his 30 year journey with Wyoming Community Development Authority in 1977 when he was hired as the Authority’s Director of Housing Programs. In 1979, George was appointed as Executive Director and stood at the helm until his retirement in 2007. George was instrumental in the continued growth of the Authority even as Wyoming experienced a major decline in its energy based economy. During the downturn in the economy in the 1980’s, WCDA was fi ghting to retain the property values by working with the U.S. Department of Housing and Urban Development to fi nance hundreds of FHA foreclosures with special programs like the Red, White and Blue Program .

During his 30 years, the Authority experienced tremendous growth and developed programs that met the need for affordable housing. In addition to the major task of raising capital that would fi nance 43,226 homes for fi rst time homebuyers during his tenure, WCDA also tackled the need for affordable rental housing. WCDA worked with the Cheyenne Housing Authority to implement a Section 8 rental assistance program for the rural areas of the state and developed 75 units of Low Rent Public Housing in Laramie. In the late 1980s, WCDA partnered with the state’s Economic Development and Stabilization Board to develop housing for the homeless and persons with special needs with a set-aside of funding from the state’s Community Development Block Grant Program and in 1986, WCDA began funding apartment units across the state through the federal Low Income Housing Tax Credit Program. In 1992, WCDA took on the HUD HOME Investment Partnerships Program which has been an essential funding source in Wyoming for the fi nancing of both affordable rental and homeownership Programs. WCDA established its own Housing Trust Fund which has provided more than 56 million dollars in down payment and closing cost assistance for Wyoming’s fi rst time homebuyers.

Housing Rehabilitation Programs like the Spruce Up Wyoming Programs and the Community Pride & Revitalization Program have funded rehab for many of Wyoming’s low-income homeowners. More than $7,000,000 in funding has been dedicated to the purchase of Habitat for Humanity Program loans.

While at the Authority, George chaired several committees for the National Council of State Housing Agencies with the most recent being the National Task Force on Disclosure.

Prior to coming to WCDA, George served as Executive Director of the Urban Renewal Agency of the City of Casper.

January 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

28 29 30 31 1

WCDA ClosedNew Year’s Day

2 3

4 5 6 7 8 9 10

11 12 13 14 15

Mortgage Interest Statement Mailed

16

*Late Fee Assessment

17

18 19

WCDA ClosedEquality Day

20 21 22 23 24

25 26 27 28 29 30

**Last Business Day

31

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

February 2015

Su M Tu W Th F Sa

1 2 3 4 5 6

7 8 9 10 11 12 13

14 15 16 17 18 19 20

21 22 23 24 25 26 27

28 29 30 31

December 2014

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

1978

When WCDA sold its fi rst bond issue in 1978, actual bonds were printed and distributed to holders. Now the process is electronic; transactions are performed as book entry accounts held by security depositories.

In 1979, prospective homebuyers throughout Wyoming camped outside banks and savings and loans, holding their places in line in order to secure a WCDA loan commitment.

February 2015 Sunday Monday Tuesday Wednesday Thursday Friday Saturday

1 2

Groundhog Day

3 4 5 6 7

8 9 10 11 12 13 14

Valentine’s Day

15 16

WCDA ClosedPresident’s Day

17

*Late Fee Assessment

18

Ash Wednesday

19 20 21

22 23 24 25 26 27

**Last Business Day

28

1 2 3 4 5 6 7

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

29 30 31

March 2015

Su M Tu W Th F Sa

1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 27 28 29 30 31

January 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

1984

In 1984, the Legislature chose to authorize WCDA to structure an economic development program for business loans in the State of Wyoming. With WCDA’s experience in raising capital, the agency was a natural choice for fi nancing economic development projects. This four year venture into the economic development arena was a success for the agency and the State of Wyoming. Twelve projects were fi nanced, defaults stayed at a remarkably low seven percent and jobs were created around the state at a time when they were desperately needed. Many of the companies are still in existence today, employing hundreds of Wyoming residents.

Wright, Wyoming 1975

Wright, Wyoming 1979

March 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

1 2 3 4 5 6 7

8

Daylight Saving Time Begins

9 10 11 12 13 14

15 16

*Late Fee Assessment

17

St. Patrick’s Day

18 19 20

First Day of Spring

21

22 23 24 25 26 27 28

29

Palm Sunday

30 31

**Last Business Day

1 2 3 4

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4

5 6 7 8 9 10 11

12 13 14 15 16 17 18

19 20 21 22 23 24 25

26 27 28 29 30

April 2015

Su M Tu W Th F Sa

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

February 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

1989

Located close to Kelly Walsh High School in Casper, WY, the Spring Hill Apartments marked a major milestone for Wyoming Housing Network, a non-profi t organization dedicated to affordable housing development.

In 2006, the Wyoming Housing Network (WHN) purchased the Spring Hill Apartments, which were built in 1989, and in need of repairs but did not qualify for federal funds because of its initial HUD fi nancing. This project could have easily become market rate rentals, however in an attempt to keep the rental units affordable WHN succeeded in putting together a fi nancing package, which included using HUD’s “Mark to Market” program and HUD insured fi nancing for the fi rst mortgage. Because Spring Hill Apartments did not qualify for Low Income Housing Tax Credits, the gap was fi nanced utilizing the WCDA Housing Trust Fund. The fi nal result was a rehabilitated project and a 20-year extension of the Rental Assistance on 127 rental units.

In 1989, WCDA established the Community Development Block Grant Program for housing activities benefi ting low to moderate income families. The goals of this program were to expand housing opportunities for low and moderate income neighborhoods, to improve the living conditions of low and moderate income groups and allow each local government to determine their own serious problems. The fi rst allocations from the program were made to Natrona and Laramie Counties and the Town of Superior.

In 1995, WCDA purchased 36 mortgages on a single-family development now called Mountain View Meadows in Jackson Hole, WY. Mountain View Meadows was built in 1992 on leased land owned by the Jackson Hole Community Housing Trust. This unique development combined several funding sources in order to provide much needed affordable homeownership opportunities in Jackson Hole.

April 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

29 30 31 1 2 3

Good FridayFirst Day of Passover

4

5

Easter Sunday

6 7 8 9 10 11

Last Day of Passover

12 13 14 15 16

*Late Fee Assessment

17 18

19 20 21 22

Earth Day

23 24 25

26 27 28 29 30

**Last Business Day

1 2

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2

3 4 5 6 7 8 9

10 11 12 13 14 15 16

17 18 19 20 21 22 23

24 25 26 27 28 29 30

31

May 2015

Su M Tu W Th F Sa

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

29 30 31

March 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

1990

In 1990, as a result of the consolidation of fi nancial institutions, WCDA launched its mortgage loan servicing department. From an initial staff of two, the Servicing Department has grown to 12 full-time employees who service more than 12,800 loans.

2014

1990

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

May 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

26 27 28 29 30 1 2

3 4 5

Cinco de Mayo

6 7 8 9

10

Mother’s Day

11 12 13 14 15 16

17 18

*Late Fee Assessment

19 20 21 22 23

2431

25

WCDA ClosedMemorial Day

26 27 28 29

**Last Business Day

30

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4 5 6

7 8 9 10 11 12 13

14 15 16 17 18 19 20

21 22 23 24 25 26 27

28 29 30

June 2015

Su M Tu W Th F Sa

1 2 3 4

5 6 7 8 9 10 11

12 13 14 15 16 17 18

19 20 21 22 23 24 25

26 27 28 29 30

April 2015

1995

Pioneer Homestead III

Affordable senior housing in Teton County is a rare commodity. Many seniors here find the high cost of living to be prohibitive. The need for senior housing in Teton County was recognized early on by Pioneer Homestead, Inc., a local non-profit organization. Pioneer Homestead met the needs of the county by building their first senior housing project utilizing a Rural Development Program. As the demand for senior housing grew, the non-profit explored other means of financing and applied to the Wyoming Community Development Authority for Community Housing Development Organization status under the HOME program. For phases two and three of the project, Pioneer Homestead, Inc. received allocations of both HOME funds and Low- Income Housing Tax Credits under WCDA’s competitive application process. With each additional phase of the project, the costs of construction skyrocketed, but their all-volunteer board never lost sight of their goal as they continued to work through the complexities of housing development and federal funding. Their perseverance resulted in 78 affordable senior apartments for Teton County.

“Our Board had been struggling with project details and the necessary approvals for quite some time. Our meeting with the WCDA did in fact help us get “unstuck”, the WCDA helped us put the financial package together. We have been able to provide a wonderful housing opportunity

for many wonderful individuals, including the lady whose initial encounter with me is still etched in my heart.“

June 2014Sunday Monday Tuesday Wednesday Thursday Friday Saturday

31 1 2 3 4 5 6

7 8 9 10 11 12 13

14

Flag Day

15 16

*Late Fee Assessment

17 18

Ramadan Begins

19 20

21

First Day of SummerFather’s Day

22 23 24 25 26 27

28 29 30

**Last Business Day

1 2 3 4

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4

5 6 7 8 9 10 11

12 13 14 15 16 17 18

19 20 21 22 23 24 25

26 27 28 29 30 31

July 2015

Su M Tu W Th F Sa

1 2

3 4 5 6 7 8 9

10 11 12 13 14 15 16

17 18 19 20 21 22 23

24 25 26 27 28 29 30

31

May 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

1996HOME Investment

Partnership

The HOME Investment Partnership Program has been an extremely useful tool for affordable housing development since 1992. Over $64,334,838 million has been allocated for development of affordable rental housing, homeownership opportunities and housing rehabilitation programs in 33 communities across Wyoming.

In 1996, Grimshaw Investments developed Parker Draw Estates, a six-plex with three bedroom units. A needs analysis and contacts within the local real estate community indicated a high demand for affordable housing. With HOME funding, [Steve] Grimshaw was able to provide that housing for families, including one unit to accommodate the disabled.

July 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

28 29 30 1 2 3 4

Independence Day

5 6 7 8 9 10 11

12 13 14 15 16

*Late Fee Assessment

17 18

19 20 21 22 23 24 25

26 27 28 29 30 31

**Last Business Day

1

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1

2 3 4 5 6 7 8

9 10 11 12 13 14 15

16 17 18 19 20 21 22

23 24 25 26 27 28 29

30 31

August 2015

Su M Tu W Th F Sa

1 2 3 4 5 6

7 8 9 10 11 12 13

14 15 16 17 18 19 20

21 22 23 24 25 26 27

28 29 30

June 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

1996 The Wyoming Profi le of Demographics, Economics, and Housing

In 1996, WCDA and its housing partners formed the Wyoming Housing Database Partnership to build a vehicle that would accurately defi ne Wyoming’s housing status quo and forecast the future for housing on a statewide and county basis. A Profi le of Wyoming is the published product of those efforts, the distillation of demographic, economic, and housing data. This semi-annual publication charts economic patterns that infl uence housing, compares decades of economic data, analyzes current trends and forecasts future needs so decisions about housing development and programs can be made more soundly.

After years of developing data sources and fi ne tuning the production of the information with the help of Western Economic Services, LLC, the WCDA in partnership with the State of Wyoming, Department of Administration and Information, Division of Economic Analysis, Department of Transportation, Department of Revenue, Wyoming Multiple Listing Service, and County Assessors of Wyoming have developed this 700+ page publication highlighting the economic trends affecting housing as no other data product has done before. From this, WCDA and its partners gain insight into population changes, economic trends and housing needs.

August 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

26 27 28 29 30 31 1

2 3 4 5 6 7 8

9 10 11 12 13 14 15

16 17

*Late Fee Assessment

18 19 20 21 22

2330

2431

**Last Business Day

25 26 27 28 29

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4 5

6 7 8 9 10 11 12

13 14 15 16 17 18 19

20 21 22 23 24 25 26

27 28 29 30

September 2015

Su M Tu W Th F Sa

1 2 3 4

5 6 7 8 9 10 11

12 13 14 15 16 17 18

19 20 21 22 23 24 25

26 27 28 29 30 31

July 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

2003

In 2003, WCDA developed the Habitat for Humanity Program where WCDA will purchase loans at 0% interest from Wyoming Habitat for Humanity affi liates. By recycling their funds Habitat affi liates are able to build more homes more quickly. The relationship between WCDA and Habitat has been a prosperous one resulting in 84 loans purchased for $7,600,210.

Over the years, WCDA staff has volunteered their time with local Habitat builds and has enjoyed seeing the families step into homeownership.

September 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

30 31 1 2 3 4 5

6 7

WCDA ClosedLabor Day

8 9 10 11 12

13

Rosh Hashanah

14 15 16

*Late Fee Assessment

17 18 19

20 21 22

Yom Kippur

23

First Day of Autumn

24 25 26

27 28 29 30

**Last Business Day

1 2 3

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 27 28 29 30 31

October 2015

Su M Tu W Th F Sa

1

2 3 4 5 6 7 8

9 10 11 12 13 14 15

16 17 18 19 20 21 22

23 24 25 26 27 28 29

30 31

August 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

2007

In 2007, following the retirement of 30 year veteran, George Axlund, David Haney joined the team after the board of directors conducted a nationwide search. David played a critical role in WCDA’s strategic planning efforts in 2006 and became known to the Board as a thoughtful and innovative leader. After a long and thorough search for an executive director, David rose quickly to the top of the list with his breadth of experience in the workforce housing and community development arenas.

Since coming to Wyoming, David has served on the Advisory Board for Building the Wyoming We Want and as housing’s representative on the Governor’s American Resource and Recovery Act steering committee. Under David’s leadership, the Authority has administered several housing and economic stimulus programs including the New Issue Bond Program (NIBP), the Temporary Credit Liquidity Program (TCLP), the Tax Credit Exchange Program (TCX), the Tax Credit Assistance Program (TCAP) and the Neighborhood Stabilization Program (NSP). He currently serves as board member of the National Conference of State Housing Agencies where he chairs the Rural Task Force.

David spent 20 years as senior vice president of Bank of America representing the Bank’s community development interests in Northern New England. He also served as chairman of the board of the New Hampshire Housing Finance Authority, national and New England Advisory board member for NeighborWorks America, member of Fannie Mae’s New England Advisory Board, founding chair of the New Hampshire Community Reinvestment Corporation, and has served on several boards of organizations focused on affordable housing.

David has been engaged in multiple community-based activities in the areas of affordable housing, economic development, diversity, and environmental issues, and is considered a national expert in many of the disciplines.

Dan Sullivan, George Axlund, David Haney

October 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

27 28 29 30 1 2 3

4

Last Day of Sukkot

5 6 7 8 9 10

11 12

WCDA Closed Columbus Day

13 14 15 16

*Late Fee Assessment

17

18 19 20 21 22 23 24

25 26 27 28 29 30

**Last Business Day

31

Halloween

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

29 30

November 2015

Su M Tu W Th F Sa

1 2 3 4 5

6 7 8 9 10 11 12

13 14 15 16 17 18 19

20 21 22 23 24 25 26

27 28 29 30

September 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

2008

In 2008, the U.S. Department of Housing & Urban Development (HUD) established the Neighborhood Stabilization Program (NSP) for the purpose of stabilizing communities that have suffered from foreclosures and abandonment. The Neighborhood Stabilization Program (NSP) provides emergency assistance to state and local governments to acquire and redevelop foreclosed properties that might otherwise become sources of abandonment and blight within their communities. The Sunshine Apartments, both Gold LEED Certifi ed multi-family complexes were developed under NSP in a redevelopment area of downtown Casper.

Additionally, the WCDA took a creative approach to the use of NSP funding by creating the Wyoming Rehabilitation and Acquisition Program (WRAP). WRAP purchases foreclosed and abandoned single-family properties, rehabilitates the properties, and then sells the properties to qualifi ed, income eligible households. As of FYE 2014, 81 homes have been rehabilitated and sold to Wyoming citizens under WRAP utilizing NSP funding.

Sunshine Apartments, Casper 2012

Built Using NSP Funding

Henry Carr, WRAP Homeowner

November 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

1

Daylight Saving Time Ends

2 3 4 5 6 7

8 9 10 11

WCDA ClosedVeterans Day

12 13 14

15 16

*Late Fee Assessment

17 18 19 20 21

22 23 24 25 26

WCDA ClosedThanksgiving Day

27

WCDA Closed

28

29 30

**Last Business Day

1 2 3 4 5

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2 3 4 5

6 7 8 9 10 11 12

13 14 15 16 17 18 19

20 21 22 23 24 25 26

27 28 29 30 31

December 2015

Su M Tu W Th F Sa

1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 27 28 29 30 31

October 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

2009

The New Issue Bond Program (NIBP) was established in 2009 using the authority provided to the U.S. Treasury Department under the Housing and Economic Recovery Act of 2008 (HERA). The NIBP provided temporary financing for Housing Finance Agencies (HFAs) to issue new housing bonds after the financial crisis. The U.S. Treasury purchased securities of Fannie Mae and Freddie Mac which were backed by these new housing bonds. Under this program WCDA sold $193.1 million of bonds to the federal government which were rolled out over the next three years. In the first two years of the program, 60% of the bonds issued had to consist of the federal program bonds and 40% had to be sold into the public market. In the final year of the program, all bonds could be federal program bonds. The $193.1 million of federal program bonds were matched with $94.8 million of publicly issued bonds over the duration of the NIBP.

December 2015Sunday Monday Tuesday Wednesday Thursday Friday Saturday

29 30 1 2 3 4 5

6

First Day of Hanukkah

7 8 9 10 11 12

13 14

Last Day of Hanukkah

15 16

*Late Fee Assessment

17 18 19

20 21 22

First Day of Winter

23 24

Christmas Eve

25

WCDA ClosedChristmas Day

26

27 28 29 30 31

**Last Business Day

New Year’s Eve

1

WCDA ClosedNew Year’s Day

2

* Payments received after 4 p.m. are processed the next business day, and are considered late payments subject to a late fee.** Payments received after 4 p.m. are processed the next business day.

Su M Tu W Th F Sa

1 2

3 4 5 6 7 8 9

10 11 12 13 14 15 16

17 18 19 20 21 22 23

24 25 26 27 28 29 30

31

January 2016

Su M Tu W Th F Sa

1 2 3 4 5 6 7

8 9 10 11 12 13 14

15 16 17 18 19 20 21

22 23 24 25 26 27 28

29 30

November 2015

Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing40Celebrating 40 Years of Affordable Housing

Wyoming Community Development Authority155 N. Beech St. • Casper, WY 82601 • Phone (307) 265-0603 • Fax (307) 266-5414

Servicing Phone (307) 265-5102 • Servicing Fax (307) 265-0306

VALUES WE TRUST

CREATIVITY

COMMITMENT &RESPONSIVENESS

STEWARDSHIP &INTEGRITY

RESPONSIBILITY &ACCOUNTABILITY

RESPECT