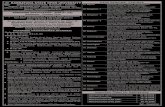

18 - 08 - 2020

Transcript of 18 - 08 - 2020

CREDAI Bengal Daily News Update |18.08.20

____________________________________________________________________________________

Newspaper/Online Hindustan Times ( online )

Date August 17, 2020

Senior living projects' demand may rise amid COVID-19

uncertainties: Report

The ongoing Covid-19 pandemic may reshape the future of the senior living segment in

India, with demand for such homes likely to move up amid the present uncertainties. In

line with the demand, the supply is also expected to increase on the outskirts of metros in

addition to existing supply in tier II and III cities.

The ongoing Covid-19 pandemic may reshape the future of the senior living segment in India, with demand for such homes likely to move up amid the present uncertainties. In line with the demand, the supply is also expected to increase on the outskirts of metros in addition to existing

supply in tier II and III cities. At present, tier II and III cities dominate the senior living segment with 60% share of ongoing and completed projects of top 12 developers and operators that have

55 ongoing and ready projects, said ANAROCK Property Consultants. Prominent tier II cities with these projects include Coimbatore, Puducherry, Kodaikanal,

Vadodara, Bhopal, Jaipur, Mysuru, Dehradun, Kasauli and Kanchipuram, among others. Key Tier 1 cities are Bengaluru, Chennai, Pune, Noida, etc. “Due to the rise of nuclear families,

increased life expectancy and people living across geographies, 'independent seniors' are becoming a new demography. Such seniors do not settle for traditional old-age homes as they prefer - and can afford - autonomy and the company of age peers in well-equipped retirement

communities,” said Anuj Puri, Chairman – ANAROCK Property Consultants.

According to the United Nations Population Fund & Help Age India estimate, India’s aged population above 60 years is likely to touch 17.3 crore by 2026. The Covid19 is likely to accelerate demand for senior living - the pandemic has highlighted the elderly’s need for safety,

care, well-being and companionship. “A recurring theme of this pandemic has been seniors living alone, struggling for basics, managing without house help and anxious about existing and

potential medical issues. The need for homes in a setting where these factors are taken care of is now undeniable,” Puri said.

Among current projects, some are entirely for seniors, while in others, only certain blocks or towers are dedicated to senior-specific facilities. The latter option allows seniors to live in the

same integrated township as their families, but among their age peers. Senior living projects have sprung up mainly in the outskirts of the major cities and in tier II and III cities across the country. Bhiwadi in NCR, Neral in Mumbai, Talegaon in Pune and Devanahalli in Bengaluru

are some of the prominent locations around tier I cities. ____________________________________________________________________________________________

Newspaper/Online Economics Times ( online )

Date August 17, 2020

Link https://economictimes.indiatimes.com/industry/services/property-/-

cstruction/senior-living-projects-demand-may-rise-amid-covid-19-uncertainties-

report/articleshow/77589089.cms

Government eases credit guarnatee scheme norms for stressed

HFCs

"It is expected that the above modification will provide greater flexibility to PSBs in

purchasing bonds/CPs under PCGS 2.0," a finance ministry statement said.

With a view to provide additional liquidity to crisis-ridden NBFCs and housing finance

companies (HFCs), the government on Monday relaxed norms for Partial Credit Guarantee

Scheme (PCGS) for purchase of bonds and commercial papers by public sector banks and

extended its period by three months.

Keeping in view the progress under the Scheme and the fact that the stipulated limit for

AA/AA- rated bonds/CPs (commercial papers) has been nearly reached, while the appetite for

lower rated papers is nearing saturation considering their lower ticket size, the government has

now decided to modify PCGS 2.0.

"Additional 3 months have been granted to build up the portfolio. At the end of six months, i.e.

by November 19, 2020, the portfolio shall be crystallised based on actual amount disbursed, for

the Guarantee to come into effect," a finance ministry statement said.

At the portfolio level, AA and AA- investment sub-portfolio under the Scheme should not

exceed 50 per cent of the total portfolio of bonds/CPs purchased by public sector banks (PSBs)

under the Scheme as against 25 per cent stipulated earlier.

"It is expected that the above modification will provide greater flexibility to PSBs in purchasing

bonds/CPs under PCGS 2.0," it said.

As part of Rs 20.97 lakh crore 'Aatmanirbhar Bharat Abhiyan', announced by the government,

PCGS 2.0 was launched on May 20 to provide portfolio guarantee for purchase of papers with a

rating of AA and below, issued by NBFCs/HFCs/micro finance institutions (MFIs), by PSBs.

It was envisaged to purchase bonds or CPs of Rs 45,000 crore under PCGS 2.0 of which the

maximum headroom permissible for purchase of papers rated AA/AA- was 25 per cent of the

total portfolio i.e. Rs 11,250 crore, the statement said.

In addition, the government had separately announced the Special Liquidity Scheme (SLS) for

purchase of CPs and non-convertible debentures (NCDs) issued by NBFCs/HFCs with a

residual maturity of up to 3 months, which could be extended for a further period of upto 3

Newspaper/Online ET Realty ( online )

Date August 18, 2020

Link https://realty.economictimes.indiatimes.com/news/allied-industries/government-

eases-credit-guarnatee-scheme-norms-for-stressed-hfcs/77605183

months, of a total value not exceeding Rs 30,000 crore to be extended by the amount required as

per need.

Under PCGS 2.0, PSBs have approved purchase of bonds/CPs rated AA/AA- issued by 28

entities and bonds/CPs rated below AA- issued by 62 entities, amounting to Rs 21,262 crore

overall.

The average ticket size of bonds/CPs rated below AA- is significantly lower than the average

ticket size of bonds/CPs rated AA/AA-.

Under SLS, proposals of Rs 7,464 crore have been approved for purchase so far, it said.

Any NBFC, including MFIs registered with RBI under the RBI Act, 1934 (excluding those

registered as Core Investment Companies) and any HFC registered with the National Housing

Bank under the National Housing Bank Act, 1987 which is complying with certain specified

conditions, is eligible to raise funding from this facility.

Earlier this month, the government widened the scope of the Rs 3-lakh crore MSME credit

guarantee scheme by doubling the upper ceiling of loans outstanding to Rs 50 crore and

including certain individual loans given to professionals like doctors, lawyers and chartered

accountants for business purposes under its ambit.

Briefing the media about the changes made, Finance Minister Nirmala Sitharaman had said the

scheme will now include individual loans given for business purposes within the ambit of the

Emergency Credit Line Guarantee Scheme (ECLGS), subject to the eligibility criteria of the

scheme.

To include more companies to take benefit of the scheme, the upper ceiling of loans outstanding

as on February 29 for being eligible under the scheme was increased from Rs 25 crore to Rs 50

crore.

The maximum amount of guaranteed emergency credit line (GECL) funding under the scheme

would also correspondingly increase from Rs 5 crore at present to Rs 10 crore, she said.

Announced as part of the government's economic package to tackle the impact of COVID-19,

the scheme is now applicable for companies with an annual turnover of Rs 250 crore as against

the earlier Rs 100 crore.

The finance minister had said that the intended changes are likely to expand the ambit of

ECLGS to make an additional amount of more than Rs 1 lakh crore eligible under the scheme.

________________________________________________________________

South Delhi civic body deseals all 11 farmhouses on SC's direction

The Supreme Court on Friday ordered desealing of these 11 residential premises that had

faced action for allegedly flouting norms but were not used for commercial purposes.\

South Delhi Municipal Corporation (SDMC) on Monday desealed 10 residential farmhouses

in Vasant Kunj sealed last year on the direction of the Supreme Court-appointed monitoring

committee. Another property was desealed on Friday evening.

The Supreme Court on Friday ordered desealing of these 11 residential premises that had faced

action for allegedly flouting norms but were not used for commercial purposes.

The committee “had no power to look into the matter and to take any action” in these cases, the

court said, clarifying that checking unauthorised constructions was beyond the jurisdiction of

the panel.

The corporation is examining the order to find out if more such properties can be desealed, a

senior SDMC official said. On whether the corporation will serve notices to these farmhouses

for flouting norms, he said, “After desealing these premises, the engineering department of the

zone concerned may take action as per norms but our priority is now to adhere to the court’s

directions.”

The 11 properties that were desealed were located at MG Road, Mall Road and Church Road in

Vasant Kunj. These were sealed on March 25 and 26, 2019 by the municipal corporation on the

direction of the monitoring committee.

The sealing drive started with the action against nine properties in south Delhi’s Chhatarpur on

December 17, 2017, which was followed by a similar exercise against 51 units in the Defence

Colony market on December 22. Close to 8,000 establishments or properties have been

completely or partially sealed for illegal construction or misuse since 2017.

These include close to 1,500 traders’ establishments at Defence Colony, Greater Kailash, Hauz

Khas, Green Park and other local shopping complexes in south and north Delhi. Despite

amendments in the Delhi master plan and the municipal corporations’ guidelines, they are yet to

get any relief.

The affected traders of Green Park now plan to move the apex court for desealing of their shops

that were totally “commercial”.

Newspaper/Online ET Realty ( online )

Date August 18, 2020

Link https://realty.economictimes.indiatimes.com/news/regulatory/south-delhi-civic-

body-deseals-all-11-farmhouses-on-scs-direction/77605019

“Shops in markets such as Defence Colony, Green Park and South Extension were sealed for

misuses such as using upper residential floors for commercial purposes without payment of

conversion charges. But the master plan doesn’t allow any charge as owners have purchased

these properties at prime rates. This area was always commercial,” said Vijay Israni, vice-

president of Green Park Market Association.

In November 2019, even Delhi Development Authority decided to not take conversion charges

from around 100 local shopping centres, said traders.

________________________________________________________________

Haryana resumes property registration in rural areas

Sources said the revenue officials are reviewing the process for registration in urban areas

before actually starting to register properties.

The Haryana government on Monday resumed registration of properties and farmlands in the

rural areas and commenced the process for e-appointment for registration of urban properties.

Sources said the revenue officials are reviewing the process for registration in urb an areas

before actually starting to register properties.

Notably, on July 22, property registration work in the state, whether rural or urban, had been

halted for software upgradation.

Haryana deputy chief minister Dushyant Chautala, who also holds the charge of revenue

department, said the details of registries done on Monday in the rural area are being compiled,

while the software for the urban areas is under review and e-appointments have started.

Amidst allegations of scam in property registration without obtaining no-objection certificates

from either urban local bodies (ULBs) or the town and country planning (TCP) department, the

state government had stopped registering all properties. Seven revenue officials

from Gurgaon have been placed under suspension, while several officials of both ULBs and

TCP department are under the scanner in four districts of Gurugram, Faridabad, Sonipat and

Jhajjar.

________________________________________________________________

Newspaper/Online ET Realty ( online )

Date August 18, 2020

Link https://realty.economictimes.indiatimes.com/news/industry/haryana-resumes-

property-registration-in-rural-areas/77605126

Ludhiana civic body to e-auction of prime properties on September

18

Vacant plots opposite Keys Hotel for shop-cum-offices, those in Jamalpur Awana, on the

rear of Kailash Cinema and in Bearing Market on Old GT Road will be auctioned.

To generate revenue, the fund-starved municipal corporation will e-auction some of its prime

properties located in various parts of the city. This is for the first time that the civic body will

take the online route for sale of properties.

The e-auction, which will also help check participants’ gathering, will be held on September 18

and the registrations from September 1 to September 15.

MC officials said, “Many properties are of no useful purpose, as civic body does not have

development funds. So, it is better to sell these. At least, these will help MC generate funds. ”

Vacant plots opposite Keys Hotel for shop-cum-offices, those in Jamalpur Awana, on the rear

of Kailash Cinema and in Bearing Market on Old GT Road will be auctioned.

MC superintendent Rajiv Bhardwaj said, “The entire information is uploaded on MC portal.

Residents can also meet me at Zone D for redressal of queries. Other departments have already

switched over to online auction.”

Zonal commissioner Kulpreet Singh said, “Earlier auction was held before 2017 and it was

manual. For the first time, we will organize it online.”

Months ago, Ludhiana Improvement Trust as well as Greater Ludhiana Area Development

Authority had introduced e-auction in the district.

________________________________________________________________

Newspaper/Online ET Realty ( online )

Date August 18, 2020

Link https://realty.economictimes.indiatimes.com/news/industry/ludhiana-civic-body-

to-e-auction-of-prime-properties-on-september-18/77584109

Punjab to give additional plot, not cash compensation under

pooling policy

The policy will reduce financial burden on GMADA as the acquisition of land through

cash compensation mode involves risk of enhancement of compensation by the courts

apart from being a cumbersome and time-consuming process.

To ensure prompt land acquisition, the Punjab government has decided to give additional land

as compensation to those giving up their property voluntarily for development projects. Punjab

housing and urban development department would soon issue a notification in this regard.

To make the land pooling policy more attractive, the Punjab cabinet has already approved

amendment to the land pooling policy in respect of residential sector, and its exte nsion to the

industrial sector in the jurisdiction of the Greater Mohali Area Development Authority

(GMADA).

The policy will reduce financial burden on GMADA as the acquisition of land through cash

compensation mode involves risk of enhancement of compensation by the courts apart from

being a cumbersome and time-consuming process.

The move comes as GMADA gets ready to acquire 1680 acres of land in the first phase for the

development of the Aerotropolis estate. The policy change will also facilitate development of

industrial estate in Sectors 101 and 103 in SAS Nagar (Mohali) by easing the process of

acquisition of land for timely execution of development projects.

Under the amended Land Pooling Policy of GMADA, 1000 square yards of developed

residential plots and 200 square yards of commercial plot, excluding parking, will be given in

place of cash compensation for every 1 acre of land to be acquired from land owners for the

upcoming Aerotropolis Residential Estate.

Introduced for industrial sector development for the first time, the policy will, in this case,

provide that for every 1 acre of land, land owners will ge t 1,100 square yards of industrial plots

and 200 square yards of developed commercial plot, excluding parking, in place of cash

compensation.

As per the new policy, the validity of the ‘Sahuliyat Certificate’, given to the land owners

opting for land pooling policy and providing certain benefits to them during purchase of

equivalent value of land, would be counted from the date of allotment of p lot to the land owner.

Newspaper/Online ET Realty ( online )

Date August 17, 2020

Link https://realty.economictimes.indiatimes.com/news/industry/punjab-to-give-

additional-plot-not-cash-compensation-under-pooling-policy/77584133

The earlier validity was two years from the date of announcement of award. The certificate

entitles a land owner to get exemption from stamp duty, besides certain other benefits when he

purchases agricultural land with the sale proceeds from the developed plots that he gets under

land pooling.

GMADA has acquired 4,484 acres of land from 2001 to 2017. Of this, 2,145 acres has been

acquired, till date, through the land pooling policy which was introduced in the State in the year

2008 and amended from time to time.

________________________________________________________________

Mysuru civic body to issue notices to property tax defaulters

MCC, which has presented a budget of Rs 700 crore, had proposed to generate a revenue

of around Rs 160 crore through property tax.

Mysuru City Corporation (MCC) authorities on a drive to identify major property tax defaulters

and for the first time notices are being served to them asking to pay the tax dues or face stern

action.

MCC, which has presented a budget of Rs 700 crore, had proposed to generate a reve nue of

around Rs 160 crore through property tax.

As per the Karnataka Municipal Corporation Act 1976, the civic body will provide a rebate of 5

percent on the tax payable by the property owner in April, the first month after the end of the

financial year in March every year.

But due to the lockdown, MCC extended the rebate period till July 31. But even after the

extension, the property owner failed to pay the tax. Property tax is the major source of income

for the corporation to take up any development projects in the city.

There are 1,83,535 properties in MCC limits of which 1,58,156 are general properties and

25,379 are revenue properties. Out of the general properties, 13,972 are sites, 1,34,871 are

houses and 1,34,871 commercial establishments.

MCC commissioner Gurudatta Hegde has directed the revenue officials to launch a drive to

collect tax from defaulters. He has also suggested to officials to collect tax through digital

payment.

“A list of major tax defaulters will be prepared and notices will be issued to them,” he said.

________________________________________________________________

Newspaper/Online ET Realty ( online )

Date August 17, 2020

Link https://realty.economictimes.indiatimes.com/news/regulatory/mysuru-civic-body-

to-issue-notices-to-property-tax-defaulters/77584090

Gurugram: Buyers protest over new tower, M3M says got

government approval

Residents, meanwhile, alleged that the developer obtained approval from the DTCP

illegally without the consent of the existing owners, which is mandatory.

Residents of M3M Merlin in Sector 67 have launched a unique banner campaign to protest

against the developer. Alleging that the developer illegally obtained approval for constructing

an extra tower in the society, residents have hung banners from their balconies cautioning

prospective home buyers from investing in the project.

The builder, M3M Group, has refuted the claims. “The construction of the 11th tower in M3M

Merlin has been announced after all approvals were granted by the authorities. Residents have

been attempting to stop the sale of flats in the new towers and are creating groups, which is

illegal. M3M has deputed a specialised team to address all residents’ issues, and they are being

responded diligently and attended to,” a representative of the builder said.

Residents, meanwhile, alleged that the developer obtained approval from the DTCP illegally

without the consent of the existing owners, which is mandatory. “We are objecting because the

existing infrastructure is already overburdened and a new tower would only add to the society’s

woes,” a resident said.

Residents further alleged that the builder has transferred the entire corpus of interest- free

maintenance security and other funds, amounting to several crores, to a facility management

company it indirectly controls. They expressed concerns that the money will be diverted or

siphoned off.

“Residents are already being charged very high maintenance fees without adequate services.

The account audits aren’t shared with residents, and the builder is running the society with a

dummy RWA. Now, they have planned construction of tower 11 without the residents’

consent,” said Devender Singh Sethi, a retired bank official and resident.

Another homebuyer, JK Tyagi, who is a retired government official, said the developer doesn’t

pay heed to residents’ concerns. “He made false promises while selling the flats. Once sold, he

cleverly pulled out. Such an experience is very painful at this advanced age,” he said .

Residents said they are planning to take legal recourse against the builder, as it has failed to

resolve encroachments on public property as well, putting their security at grave r isk.

Newspaper/Online ET Realty ( online )

Date August 17, 2020

Link https://realty.economictimes.indiatimes.com/news/residential/gurugram-buyers-

protest-over-new-tower-m3m-says-got-government-approval/77584169

“Residents put their hard-earned money into buying a house, but it seems they have been taken

for a ride by the developer. The society already suffers from seepage problems and poor

maintenance, and the builder doesn’t share expenditure details while charging high maintenance

fees at the same time. Now, M3M has launched an extra tower without residents' consent,” said

Veenu Vashishtha, another resident.

District town planner RS Batth said he has not received any complaint in this regard, action will

be taken as per the norms if any complaint is given by the residents.

________________________________________________________________