[1772986] Application - 123 W Davie St., Raleigh NC(2)

Transcript of [1772986] Application - 123 W Davie St., Raleigh NC(2)

![Page 1: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/1.jpg)

December 2, 2016 VIA ELECTRONIC FILING Jocelyn Boyd, Chief Clerk/Administrator Public Service Commission of South Carolina Synergy Business Park, Saluda Building 101 Executive Center Drive Columbia, SC 29210

Re: Duke Energy Progress, LLC – Application for Approval of the Transfer and Sale of Property in Raleigh, North Carolina

Dear Ms. Boyd: Enclosed for filing is the Application for Approval of the Transfer and Sale of Property in Raleigh, North Carolina on behalf of Duke Energy Progress, LLC. By copy of this letter I am providing the Office of Regulatory Staff with a copy of same. Please contact me if there are any questions.

Yours truly, ROBINSON, MCFADDEN & MOORE, P.C. Frank R. Ellerbe, III

/tch Enclosure cc: Jeffrey M. Nelson, Chief Counsel, Office of Regulatory Staff (via email & US Mail) Shannon B. Hudson, Deputy Director, Office of Regulatory Staff (via email & US Mail) Heather S. Smith, Deputy General Counsel (via email)

ROBINSON, MCFADDEN & MOORE, P.C.

COLUMBIA, SOUTH CAROLINA

Frank R. Ellerbe, III

1901 MAIN STREET, SUITE 1200

POST OFFICE BOX 944

COLUMBIA, SOUTH CAROLINA 29202

PH (803) 779-8900 | (803) 227-1112 direct

FAX (803) 744-1556

ROBINSON MCFADDENATTORNEYS ANO COUNSELORS AT LAVII

%MERIFAS LAW RRMI WORLDWIDE

![Page 2: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/2.jpg)

BEFORE

THE PUBLIC SERVICE COMMISSION OF

SOUTH CAROLINA

DOCKET NO. 2016-__________

IN RE: ) Application of Duke Energy Progress, LLC ) APPLICATION FOR for Approval of the Transfer and Sale of ) APPROVAL OF TRANSFER Property in Raleigh, North Carolina ) AND SALE OF PROPERTY )

Duke Energy Progress, LLC (“DEP”), hereby applies to the Public Service Commission

of South Carolina (the “Commission”) for approval of the transfer and sale of certain real estate,

known as the McDowell Parking Lot in Raleigh, Wake County, North Carolina (the “Property,”

as more fully described in Exhibit A) that is currently included in the rate base of DEP. The

Property is located in the DEP service area in North Carolina. This Application is made pursuant

to S.C. Code Ann. Section 58-27-1300 (Supp. 2007), 26 S.C. Regs. 103-830, and other

applicable rules and regulations of the Commission. In support of this Application, DEP would

show the following:

1. The name and address of the Applicant is Duke Energy Progress, LLC 550 South Tryon Street Charlotte, North Carolina 28202

![Page 3: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/3.jpg)

2

2. The name and address of the Applicant’s attorneys are:

Heather Shirley Smith Deputy General Counsel Duke Energy Corporation 40 West Broad St., Suite 690 Greenville, South Carolina 29601 Telephone: (864) 370-5045 [email protected] and Frank R. Ellerbe, III Robinson, McFadden, and Moore, PC 1901 Main Street, Suite 1200 Post Office Box 944 Columbia, South Carolina 29202 Telephone: (803) 779-8900 [email protected]

3. Copies of all pleadings, orders or correspondence in this proceeding should be

served upon the attorneys listed above.

4. DEP is a public utility engaged in the generation, transmission, distribution, and

sale of electric energy in South Carolina and is subject to the jurisdiction of this Commission.

5. The Property consists of certain real estate that is not required for the Company’s

current utility operations. The legal description of The Property is attached as Exhibit A.

6. The Property is being sold to Phoenix of Raleigh LLC, a Nevada limited liability

company. This transaction will not affect the DEP’s ability to provide reliable service to its

customers at just and reasonable rates.

7. The Property is located at 123 W. Davie Street, Raleigh, North Carolina 27601.

This site housed operations that have been relocated to newer facilities, consolidated into other

company facilities, or moved to more appropriate space, rendering the Property as surplus.

![Page 4: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/4.jpg)

3

8. DEP has entered a contract with Phoenix of Raleigh LLC to sell The Property for

$1,197,000.00. The Property is a section of an existing parking lot that is reserved for Duke

Energy Parking consisting of 0.19 acres or 8,276 square feet. The Property is zoned DX-20-SH,

Downtown Mixed Use, which permits a variety of retail, office, multifamily and hotel uses with

a permissible height up to 20 stories with shop front footage. It has a current net book value of

$86,229. DEP has had the property appraised by Integra Realty Resources of Raleigh. That

company determined the Fair Market Value of the Property to be $1,050,000 as of April 15,

2016. A copy the appraisal letter and a portion of the appraisal is attached as Exhibit B.

9. The original cost of the Property being sold will be credited as a reduction of the

amount carried upon the books of the Company under Account 101, “Electric Plant in Service.”

The difference between the sales price and the original cost of the non-depreciable Property will

be applied to Account 421.10, “Gain on Disposition of Property” or Account 421.20, “Loss on

Disposition of Property.”

10. The South Carolina Office of Regulatory Staff has been served with a copy of this

application and exhibits. S.C. Code Ann. Section 58-27-1300 provides that an electric utility

must first obtain Commission approval prior to selling or otherwise transferring utility property

with a fair market value greater than $1 million. Therefore, DEP applies to the Commission for

permission to sell the Property.

11. Applicant requests that this Commission inquire into this matter and if no

substantial opposition develops, that this Commission: (i) hear and approve this matter at the

next appropriate weekly agenda session; (ii) issue an appropriate order approving the relief

sought in the Company’s Application; and (iii) grant such other and further relief as this

Commission may deem just and proper.

![Page 5: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/5.jpg)

4

WHEREFORE, Applicant prays that, pursuant to S.C. Code Section 58-27-1300, (Supp.

2007) and other applicable rules and regulations, the Commission enter an order approving the

transfer and sale of the Property.

Dated this 2nd day of December, 2016.

Heather Shirley Smith, Esquire Deputy General Counsel Duke Energy Progress, LLC 550 South Tryon Street/DEC45A Charlotte, NC 28201 Telephone: (980) 373-7725 [email protected] and

________________________________ Frank R. Ellerbe III, Esquire

ROBINSON, MCFADDEN & MOORE, PC 1901 Main Street, Suite 1200

Post Office Box 944 Columbia, South Carolina 29202 Telephone: (803) 779-8900 [email protected]

Attorneys for Duke Energy Progress, LLC

![Page 6: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/6.jpg)

5

EXHIBIT A

LEGAL DESCRIPTION

![Page 7: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/7.jpg)

POINT, the intersection of the south line of Davie Street with the east line of South McDowell Street, said Beginning point being 33 feet southwardly and perpendicularly from the teclmical center line of West Davie Street and 33 feet eastwardly and perpendicularly from the technical center line of South McDowell Street; thence with the south line of Davie Street South 83 degrees 30 minutes East 100 feet to a point; thence South 6 degrees 30 minutes West 87.5 feet to a point in the north line of an 8-foot alley; thence with the north line of said 8-foot alley North 83 degrees 30 minutes West 100 feet to a point in the east line of McDowell Street; thence with the east line of McDowell Street North 6 degrees 30 minutes East 87.5 feet to the point and place of BEGINNING, being the property of Charles W. Bradshaw, according to survey and map of John A. Edwards & Company bearing date of December 20, 1968; and further being the same property described in that deed from Andrew H. McDaniel and wife, Louise B. McDaniel, to Carolina Power & Light Company recorded on January 24, 1975, in Book 2294, Page 230, Wake County Registry.

16 #5448384v7 (Final Execution Version)

EXHIBIT A

(Description of the Land)

Lying and being in Raleigh Township, Wake County, North Carolina:

BEGINNING AT A POINT, the intersection of the south hne of Davie Street withthe east line of South McDowell Street, said Beginning point being 33 feet southwardlyand perpendicularly from the teclmical center line of West Davie Street and 33 feeteastwardly and perpendicularly from the technical center line of South McDowell Street;thence with the south line of Davie Street South 83 degrees 30 minutes East 100 feet to apoint; thence South 6 degrees 30 minutes West 87.5 feet to a point in the north line of an8-foot alley; thence with the north line of said 8-foot alley North 83 degrees 30 minutesWest 100 feet to a point in the east line of McDowell Street; thence with the east line ofMcDowell Street North 6 degrees 30 minutes East 87.5 feet to the point and place ofBEGINNING, being the property of Charles W. Bradshaw, according to survey and mapof John A. Edwards & Company bearing date of December 20, 1968; and further being thesame property described in that deed from Andrew H. McDaniel and wife, Louise B.McDaniel, to Carolina Power & Light Company recorded on January 24, 1975, in Book2294, Page 230, Wake County Registry.

¹S448384v7 (F&nol Exeennon Veen&onl

16

![Page 8: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/8.jpg)

EXHIBIT B

APPRAISAL LETTER AND PORTION OF APPRAISAL

![Page 9: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/9.jpg)

Integra Realty Resources Raleigh

Appraisal of Real Property

Land Vacant Land 123 W. Davie Street Raleigh, Wake County, North Carolina 27601

Prepared For: Duke Energy Corporation

Effective Date of the Appraisal: April 15, 2016

Report Format: Appraisal Report – Standard Format

IRR - Raleigh File Number: 167-2016-0271

II'I:

![Page 10: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/10.jpg)

Land 123 W. Davie Street Raleigh, North Carolina

I

I

II

,„,ylr,j ~;)1~-L

,4I'llI I-i;,"I

IA

I

I

IW h

~ E ~~ ~

A%1

g'i

![Page 11: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/11.jpg)

Integra Realty Resources 8382 Six Forks Road T 919.847.1717 Raleigh Suite 200 F 919.847.1714 Raleigh, NC 27615 www.irr.com

April 27, 2016 Ms. Patricia Sutton Duke Energy Corporation 550 S. Tryon St. Charlotte, NC 28202 SUBJECT: Market Value Appraisal Land 123 W. Davie Street Raleigh, Wake County, North Carolina 27601 IRR - Raleigh File No. 167-2016-0271 Dear Ms. Sutton:

Integra Realty Resources – Raleigh is pleased to submit the accompanying appraisal of the referenced property. The purpose of the appraisal is to develop an opinion of the market value as is of the fee simple interest in the property. The client for the assignment is Duke Energy Corporation, and the intended use is for asset valuation.

The appraisal is intended to conform with the Uniform Standards of Professional Appraisal Practice (USPAP), the Code of Professional Ethics and Standards of Professional Appraisal Practice of the Appraisal Institute and applicable state appraisal regulations. The appraisal is also prepared in accordance with the appraisal regulations issued in connection with the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA).

To report the assignment results, we use the Appraisal Report option of Standards Rule 2-2(a) of the 2014-2015 edition of USPAP. As USPAP gives appraisers the flexibility to vary the level of information in an Appraisal Report depending on the intended use and intended users of the appraisal, we adhere to the Integra Realty Resources internal standards for an Appraisal Report – Standard Format. This type of report has a moderate level of detail. It summarizes the information analyzed, the appraisal methods employed, and the reasoning that supports the analyses, opinions, and conclusions. It meets or exceeds the former Summary Appraisal Report requirements that were contained in the 2012-2013 edition of USPAP.

II'I:

![Page 12: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/12.jpg)

Ms. Patricia Sutton Duke Energy Corporation April 27, 2016 Page 2

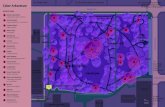

The subject is a section of an existing parking lot that is reserved for Duke Energy parking. The subject is located directly across the street from The L apartments and a parking deck. The subject contains an area of 0.19 acres or 8,276 square feet. The property is zoned DX-20-SH, Downtown Mixed Use, which permits a variety of retail, office, multifamily and hotel uses with a permissible height up to 20 stories with shopfront footage.

Based on the valuation analysis in the accompanying report, and subject to the definitions, assumptions, and limiting conditions expressed in the report, our opinion of value is as follows:

Value Conclusion

Appraisal Premise Interest Appraised Date of Value Value Conclusion

Market Value As Is Fee Simple April 15, 2016 $1,050,000

Extraordinary Assumptions and Hypothetical Conditions

1. None

1. None

The value conclusions are based on the following hypothetical conditions that may affect the assignment results. A

hypothetical condition is a condition contrary to known fact on the effective date of the appraisal but is supposed

for the purpose of analysis.

The value conclusions are subject to the following extraordinary assumptions that may affect the assignment

results. An extraordinary assumption is uncertain information accepted as fact. If the assumption is found to be

false as of the effective date of the appraisal, we reserve the right to modify our value conclusions.

+birr.

![Page 13: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/13.jpg)

Ms. Patricia Sutton Duke Energy Corporation April 27, 2016 Page 3

If you have any questions or comments, please contact the undersigned. Thank you for the opportunity to be of service.

Respectfully submitted,

INTEGRA REALTY RESOURCES - RALEIGH

Ian J. Searle Registered Trainee Real Estate Appraiser North Carolina Certificate # T5843 Telephone: 919-847-1717 Email: [email protected]

M. Scott Smith, MAI Certified General Real Estate Appraiser North Carolina Certificate # A7627 Telephone: (919)847-1717 Email: [email protected]

Chris R. Morris, MAI, FRICS Certified General Real Estate Appraiser North Carolina Certificate # A266 Telephone: 919.847.1717, ext. 101 Email: [email protected]

+birr.

![Page 14: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/14.jpg)

Table of Contents

Land

Summary of Salient Facts and Conclusions 1

General Information 2 Identification of Subject 2 Current Ownership and Sales History 2 Purpose of the Appraisal 2 Definition of Market Value 2 Definition of As Is Market Value 3 Definition of Property Rights Appraised 3 Intended Use and User 3 Applicable Requirements 3 Report Format 4 Prior Services 4 Scope of Work 4

Economic Analysis 6 Wake County Area Analysis 6 Surrounding Area Analysis 14

Property Analysis 17 Land Description and Analysis 17 Real Estate Taxes 23 Highest and Best Use 24

Valuation 26 Valuation Methodology 26 Sales Comparison Approach 27

Analysis and Adjustment of Sales 31

Explanation of Adjustments 32 Land Value Conclusion 33

Reconciliation and Conclusion of Value 34 Exposure Time 34 Marketing Period 34

Certification 35

Assumptions and Limiting Conditions 37

Addenda A. Appraiser Qualifications B. Comparison of Report Formats C. Property Information D. Comparable Data

Sale Profiles E. Engagement Letter

![Page 15: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/15.jpg)

Summary of Salient Facts and Conclusions 1

Land

Summary of Salient Facts and Conclusions

Property Name

Address

Property Type

Owner of Record

Tax ID

Legal Description

Land Area 0.19 acres; 8,276 SF

Zoning Designation

Highest and Best Use

Exposure Time; Marketing Period 3 to 6 months; 3 to 6 months

Effective Date of the Appraisal April 15, 2016

Date of the Report April 27, 2016

Property Interest Appraised

Sales Comparison Approach

Number of Sales 4

Range of Sale Dates Jul 13 to Jan 16

Range of Prices per SF (Unadjusted) $118.19 - $140.98

Market Value Conclusion $1,050,000 ($126.87/SF)

Duke Energy Progress Inc.

1703-67-2385

See addenda

Land

123 W. Davie Street

Raleigh, Wake County, North Carolina 27601

Land - Other

The values reported above are subject to the definitions, assumptions, and limiting conditions set forth in the accompanying report of which this

summary is a part. No party other than Duke Energy Corporation may use or rely on the information, opinions, and conclusions contained in the

report. It is assumed that the users of the report have read the entire report, including all of the definitions, assumptions, and limiting

conditions contained therein.

DX-20-SH, Downtown Mixed Use

Assemblage for mixed-use development

Fee Simple

Extraordinary Assumptions and Hypothetical Conditions

1. None

1. None

The value conclusions are based on the following hypothetical conditions that may affect the assignment results. A

hypothetical condition is a condition contrary to known fact on the effective date of the appraisal but is supposed

for the purpose of analysis.

The value conclusions are subject to the following extraordinary assumptions that may affect the assignment

results. An extraordinary assumption is uncertain information accepted as fact. If the assumption is found to be

false as of the effective date of the appraisal, we reserve the right to modify our value conclusions.

![Page 16: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/16.jpg)

General Information 2

Land

General Information

Identification of Subject The subject is a section of an existing parking lot that is reserved for Duke Energy parking. The subject is located directly across the street from The L apartments and a parking deck. The subject contains an area of 0.19 acres or 8,276 square feet. The property is zoned DX-20-SH, Downtown Mixed Use, which permits a variety of retail, office, multifamily and hotel uses with a permissible height up to 20 stories with shopfront footage.

Property Identification

Property Name Land

Address 123 W. Davie Street

Raleigh, North Carolina 27601

Tax ID 1703-67-2385

Owner of Record Duke Energy Progress Inc.

Legal Description See addenda

Census Tract Number Block 1112, Block Group 1, Census Tract 501, Wake County, North Carolina

Current Ownership and Sales History The owner of record is Duke Energy Progress Inc.. This party acquired the property from Carolina Power & Light Company on May 29, 2013 through a merger and name change. The transaction is recorded in Deed Book 15289, Page 2437, of the Wake County Register of Deeds. Carolina Power & Light initially acquired the subject for parking purposes, and it is currently still being used as an overflow parking lot.

To the best of our knowledge, no sale or transfer of ownership has occurred within the past three years, and as of the effective date of this appraisal, the property is not subject to an agreement of sale or option to buy, nor is it listed for sale.

Purpose of the Appraisal The purpose of the appraisal is to develop an opinion of the market value as is of the fee simple interest in the property as of the effective date of the appraisal, April 15, 2016. The date of the report is April 27, 2016. The appraisal is valid only as of the stated effective date or dates.

Definition of Market Value Market value is defined as:

“The most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer under conditions whereby:

+birr.

![Page 17: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/17.jpg)

General Information 3

Land

Buyer and seller are typically motivated;

Both parties are well informed or well advised, and acting in what they consider their own best interests;

A reasonable time is allowed for exposure in the open market;

Payment is made in terms of cash in U.S. dollars or in terms of financial arrangements comparable thereto; and

The price represents the normal consideration for the property sold unaffected by special or creative financing or sales concessions granted by anyone associated with the sale.”

(Source: Code of Federal Regulations, Title 12, Chapter I, Part 34.42[g]; also Interagency Appraisal and Evaluation Guidelines, Federal Register, 75 FR 77449, December 10, 2010, page 77472)

Definition of As Is Market Value As is market value is defined as, “The estimate of the market value of real property in its current physical condition, use, and zoning as of the appraisal’s effective date.”

(Source: The Dictionary of Real Estate Appraisal, Fifth Edition, Appraisal Institute, Chicago, Illinois, 2010; also Interagency Appraisal and Evaluation Guidelines, Federal Register, 75 FR 77449, December 10, 2010, page 77471)

Definition of Property Rights Appraised Fee simple estate is defined as, “Absolute ownership unencumbered by any other interest or estate, subject only to the limitations imposed by the governmental powers of taxation, eminent domain, police power, and escheat.”

(Source: The Dictionary of Real Estate Appraisal, Fifth Edition, Appraisal Institute, Chicago, Illinois, 2010)

Intended Use and User The intended use of the appraisal is for asset valuation. The client and intended user is Duke Energy Corporation. The appraisal is not intended for any other use or user. No party or parties other than Duke Energy Corporation may use or rely on the information, opinions, and conclusions contained in this report.

Applicable Requirements This appraisal is intended to conform to the requirements of the following:

Uniform Standards of Professional Appraisal Practice (USPAP);

Code of Professional Ethics and Standards of Professional Appraisal Practice of the Appraisal Institute;

Applicable state appraisal regulations;

+birr.

![Page 18: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/18.jpg)

General Information 4

Land

Appraisal requirements of Title XI of the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA), revised June 7, 1994;

Interagency Appraisal and Evaluation Guidelines issued December 10, 2010;

Report Format This report is prepared under the Appraisal Report option of Standards Rule 2-2(a) of the 2014-2015 edition of USPAP. As USPAP gives appraisers the flexibility to vary the level of information in an Appraisal Report depending on the intended use and intended users of the appraisal, we adhere to the Integra Realty Resources internal standards for an Appraisal Report – Standard Format. This type of report has a moderate level of detail. It summarizes the information analyzed, the appraisal methods employed, and the reasoning that supports the analyses, opinions, and conclusions. It meets or exceeds the former Summary Appraisal Report requirements that were contained in the 2012-2013 edition of USPAP. For additional information, please refer to Addendum B – Comparison of Report Formats.

Prior Services USPAP requires appraisers to disclose to the client any other services they have provided in connection with the subject property in the prior three years, including valuation, consulting, property management, brokerage, or any other services. We have not performed any services, as an appraiser or in any other capacity, regarding the property that is the subject of this report within the three-year period immediately preceding acceptance of this assignment.

Scope of Work To determine the appropriate scope of work for the assignment, we considered the intended use of the appraisal, the needs of the user, the complexity of the property, and other pertinent factors. Our concluded scope of work is described below.

Valuation Methodology

Appraisers usually consider the use of three approaches to value when developing a market value opinion for real property. These are the cost approach, sales comparison approach, and income capitalization approach. Use of the approaches in this assignment is summarized as follows:

Approaches to Value

Approach Applicability to Subject Use in Assignment

Cost Approach Not Applicable Not Utilized

Sales Comparison Approach Applicable Utilized

Income Capitalization Approach Not Applicable Not Utilized

We use only the sales comparison approach in developing an opinion of value for the subject. This approach is applicable to the subject because there is an active market for similar properties, and sufficient sales data is available for analysis.

+birr.

![Page 19: [1772986] Application - 123 W Davie St., Raleigh NC(2)](https://reader031.fdocuments.in/reader031/viewer/2022021022/620497d7ea25f0304938e57f/html5/thumbnails/19.jpg)

General Information 5

Land

The cost approach is not applicable because there are no improvements that contribute value to the property, and the income approach is not applicable because the subject is not likely to generate rental income in its current state.

Research and Analysis

The type and extent of our research and analysis is detailed in individual sections of the report. This includes the steps we took to verify comparable sales, which are disclosed in the comparable sale profile sheets in the addenda to the report. Although we make an effort to confirm the arms-length nature of each sale with a party to the transaction, it is sometimes necessary to rely on secondary verification from sources deemed reliable.

Inspection

Ian J. Searle conducted an on-site inspection of the property on April 15, 2016. M. Scott Smith, MAI, conducted an on-site inspection on April 15, 2016. Chris R. Morris, MAI, FRICS, has not personally inspected the property, but did review the contents of this report.

Significant Appraisal Assistance

It is acknowledged that Ian J. Searle made a significant professional contribution to this appraisal, consisting of participating in the property inspection, conducting research on the subject and transactions involving comparable properties, performing appraisal analyses, and assisting in report writing, under the supervision of the persons signing the report.

+birr.