145365264 Project on Innovative Banking Service to NRI

-

Upload

shilpa-sadaphule -

Category

Documents

-

view

56 -

download

4

Transcript of 145365264 Project on Innovative Banking Service to NRI

NRI BANKING

1

Project On

INNOVATIVE BANKING SERVICES

PROVIDED TO NRI

BACHELOR OF BUSINESS MANAGEMENT

(INTERNATIONAL BUSINESS)

SEMESTER VI

2012-2013

Submitted By

SHUBHAM SHUKLA

ROLL NO- 10312

MARATHWADA MITRA MANDAL COLLEGE OF

COMMERCE

UNIVERSITY OF PUNE

NRI BANKING

2

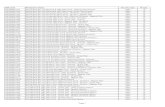

Unit No.

TOPIC NAME PAGE NO

EXECUTIVE SUMMARY

OBJECTIVES OF THE STUDY

SCOPE OF STUDY

RESEARCH DESIGN

REVIEW OF LITRETURE

LIMITATION OF STUDY

04

05

06

07

01. INTRODUCTION ON NRI BANKING:-

Who is an NRI?

Key benefits

Types of accounts

Opening of NRI A/c

08

10

11

12

15

02. DEPOSITORY’S SCHME FOR NRI’S:-

NRE A/c

Types of Accounts

FCNR A/c

NRO A/c

Tax Benefits for NRI’s

25

28

30

35

03. SERVICES OFFERED BY VARIOUS BANK TO NRI’S:-

Banking Services

Services offered by ICICI Bank

Facility available as per RBI/FEMA guidelines

36

37

38

NRI BANKING

3

04. INNOVATIVE SERVICES

E-Statement

Mobile Banking

Internet Banking

Money Transfer

Exchange Rate Calculator

NRI edge Account

Innovation in Banking Branches

37

37

38

40

44

46

05. NRI INVESTMENTS:-

Investment opportunities in India for NRI

RBI forms

50

52

06. PAN CARD FOR NRIs:-

Applying for pan card, necessity for pan card,

charges of pan card

Demat a/c

53

55

07. QUESTIONNAIRE

DATA INTERPRETATION

FINDING AND SUGGESTION

CONCLUSION

BIBLIOGRAPHY

58

60

75

76

77

NRI BANKING

4

ACKNOWLEDGEMENT

First and Foremost I thank the ALMIGHTY for the Inspiration and strength to

complete this project report successfully.

I would firstly like to thanks Prof. UDAY KIRAN Sir who has provided me the

kind opportunity to do this project and to finish it in a successful manner.

My heartily thanks to Mrs. UJJAWALA JOSHI & KALPANA VAIDYA the

coordinator of my BBA/BBM and other faculties, who have right from the

beginning encouraged me to do the project well.

On a personal note, I wish to thank my family members and friends for their

constant support in helping me accomplish my mission

NRI BANKING

5

EXECUTIVE SUMMARY:-

NRI Banking is becoming popular among the Non-resident customers. As India is

showing progress more & more NRI investing in the country. Banks should try to

give their top class service to the NRI‘s as they are looking for convenience, speed,

high yield on investments with manageable risk, reasonable cost & quality

services.

Bank should lower the minimum balance requirement which is Rs.50, 000 for NRI,

s as compared to resident who have to keep Rs.1000. The documentation

procedure in case of opening of A/C in banks, investing in any property, for buying

shares & debt. Should be reduced and in case of loan at a faster speed.

Banks should also extend their services by providing ATM‘s abroad, E -banking

with efficient facility & balance inquiry message through mobilizes.

Investment of NRI would help to bring more inflow of foreign exchange through

taxes & investment policy & this would help Indian government to repay its debt

to the World Bank. Indian government should give their best services &

Efforts to encourage NRI to invest in India, This would help our economy to

flourish & grow in future.

Study Area of my project: Brief study of NRI Account How to Operate and How

to Open an account, DEMAT account, Interest rate, RBI Policy, Innovation in

banking system, Mobile banking, internet banking, Bank facilities, etc.

NRI BANKING

6

OBJECTIVE OF THE STUDY

To get an overview of NRI BANKING SERVICES

To analyze the growth of NRI banking services

To study the innovative concepts emerging in the banking industry for NRI‘s

To observe the facility provided to NRI by Indian banks

To analyze the response of the NRI given to the computerization & new

invention in an Indian banks.

SCOPE OF STUDY:-

The scope of the study is to extend the knowledge about the NRI Banking services

provided by banks.

To know about process of Banking system and service and exact know all process

A/C Open, Facilities, Interest Rate, etc

NRI BANKING

7

RESEARCH DESIGN: - In order to conduct the research an appropriate

research design became necessary. In this direction of secondary data were

attempted to be collected. The methodology for collecting data with reference to

the secondary data was taken from the different published articles, books, Projects,

journals, and the relevant websites. My Questionnaires is cover whole innovative

banking services to NRI. Find out data interpretation of all questionnaires.

Analysis of this survey got result of Innovation required at may many places in

banking system. My sampling is 50 people for survey. After survey I got 50

review of my questionnaire from this review with help of Uday sir and miss.

Kalpana, Madam we analysis data interpretation work and give final reveal of my

project result.

Review of literature: Study about Innovative banking services to NRI, To

Know about new Innovation in baking service for NRI. Studies type account of

NRI. And RBI policy, Tax exemption, etc. I use my Use Secondary data and make

Questionnaires for NRI; my sampling is 50 for survey after survey make data

interpretation and gives finding and suggestion. My result is Innovation required at

various place of banking system and work for satisfaction to NRI.

WHY:- To get an overview of NRI BANKING SERVICES

When: - this is study of 2 month project.

WHAT: - TO Know innovation about banking service for NRI

WHERE: - With help of secondary data and questionnaire and survey.

NRI BANKING

8

Limitation of the study:

For Survey NRI is not available easily.

Data interpretation part in some problem came.

Sometime secondary data is miss match from my topic.

Bank people are not giving proper suggestion.

NRI BANKING

9

NRI Banking – An Introduction:-

As per RBI guidelines, the residential status of an Indian changes to that of the

Non-Resident, in the event of his stay abroad being more than 183 days. This

period of 183 days is not applicable in certain cases like going overseas for

employment or business. It is mandatory to inform the bank of your change of your

residential status.

With a view to attract the savings and other remittance into India through banking

channels from the person of Indian Nationality / Origin who are residing abroad

and bolster the balance of payment position, the Government of India introduced in

1970 Non-Resident(External) Account Rules which are governed by the Exchange

Control Regulations. The funds held in Non-Resident (External) Accounts (NRE

Accounts) qualify for certain benefits like exemptions from taxes in India, free

repatriation facilities, etc.

NRI banking facilities are available to NRIs and PIOs.

1.

INTRODUCTION

NRI BANKING

10

WHO IS A NON – RESIDENT INDIAN [NRI]?

A Non Resident Indian (NRI) as per FEMA 1999 is an Indian citizen or Foreign

National of Indian Origin resident outside India for purposes of employment,

carrying on business or vocation in circumstances as would indicate an intention to

stay outside India for an indefinite period. An individual will also be considered

NRI if his stay in India is less than 182 days during the preceding financial year.

To meet the specific needs of non-resident Indians related to their remittances,

savings, earnings, investments and repatriation, the Government of India

introduced in 1970 Non-Resident (External) Account Rules which are governed by

the Exchange Control Regulations.

"Non Resident Indian" (NRI) means an Indian citizen or a foreign citizen of Indian

origin (excluding citizens of Bangladesh and Pakistan) residing outside India.

Students studying abroad are also treated as NRIs.

Indian citizen who stays abroad for an indefinite period on employment, business

or on any vocation is a Non-Resident. Diplomats posted abroad, persons posted in

UN Organizations and Officials deputed by PSU on temporary assignments are

also treated as Non-residents.

NRI BANKING

11

KEY BENEFITS

NRI-Banking follows a modular structure. The various modules render our NRI

Banking solution offerings (which are stated below) in a seamlessly integrated

fashion.

The Masters module permits maximum parameterization to be done, enabling the

end user to make all changes with regard to Interest Rates or with regard to any

changes as per directives from Head Office/RBI.

Maintains Bank, Branch and holiday details

Facilitates maintenance of Instrument, Interest rate and overdue interest rate details

Masters. Inventory, Currency, Country, Exchange rate and return reason details are

also maintained Favors opening, authorization and freezing of Accounts

Transaction entry and passing is made easy

Provisions availed for issuing, passing and stop payment of cheques.

Supports Account closure, Preclosure, Renewal & overdue renewal of Deposits.

Aids Day Begin, Day End & Month End Processing

Processes Quarterly, and transfer to Inoperative & Half Yearly - SB Interest

Calculation.

Hastens Deposit Receipt Printing, Changing to RFC, Interest Payment & Overdue

Process.

Supports Acceptance and Execution of standing instruction.

NRI BANKING

12

Types of accounts

NRI accounts are maintained by banks which hold authorized dealers' licences from

the Reserve Bank of India. Some cooperative and commercial banks have also been

specifically permitted to maintain NRI accounts in rupees even though they are not

authorized dealers. The financial budget for 2007-08 extends NRI accounts to

regional rural banks (RRBs) as well. This would boost remittances from NRIs

particularly in Bihar, Kerala, Uttar Pradesh and Gujarat where a large number of

persons from rural areas from these states are employed overseas.

Banking Laws for NRIs allow for accounts with authorized dealers to be maintained

in Indian rupees and in foreign currency.

Various accounts:-

NRE A/c - non residential (external) rupee account.

FCNR-B A/c - foreign currency non residential account.

NRO A/c - nonresident ordinary account.

RFC A/c - resident foreign currency account.

All NRIs can open such accounts, with the exception of individuals residing in

Pakistan and Bangladesh, who require special permission from the RBI. Joint

accounts of two or more non-residents and nomination facility are permitted.

While the FCNR (B) is a term deposit only, the NRE and NRO accounts can be

operated as either savings, current, recurring or fixed deposit accounts. As for

interest rates, FCNR (B) and NRE are subject to a cap, and should not exceed the

LIBOR/SWAP rates. In the case of NRO accounts, rates are determined by the

banks. The interest rates, currently at 3.5% apply to a period of 1 to 3 years.

NRI BANKING

13

The total NRE/ FCNR deposits during 2006-2007, as per RBI statistics, are USD

37,751 million and are expected to grow with regional rural banks also mopping up

funds. Banks are expected to offer lucrative interest rates to bolster NRI funds.

Banks offer two types of accounts to NRIs, based on their reparability.

Repatriable Accounts

Funds that can be transferred or repatriated abroad are maintained in a Non

Resident External Bank account. Generally, funds remitted from outside India are

credited to this account. Investments made from foreign funds can be repatriated

overseas, and such investments are maintained in a Repatriable Demat account.

Non-Resident (External) Rupee (NRE) Accounts

Both Principal and Interest can be repatriated/transferred out of India

Savings rate on NRE accounts is at par with savings rates in resident accounts

Term deposits can be made for 1 to 3 years.

The interest rates on (NRE) Term deposits cannot be higher than LIBOR/SWAP

rates as on the last working day of the previous month, for US dollar of

corresponding maturity plus 50 basis points.

The interest rates on three year deposits also apply in case the maturity period

exceeds three years. The change in interest rate also applies to NRE deposits

renewed after their present maturity period.

NRI BANKING

14

FCNR (B) Accounts

As in NRE accounts, both principal and interest are repatriable.

Presently, deposits can be made in 6 specific foreign currencies (US Dollar,

Pound Sterling, EURO, Japanese Yen, Australian Dollar and Canadian Dollar).

Interest rate- Fixed or floating within the limits of LIBOR/SWAP rates for the

respective currency/corresponding term minus 25 basis points (except Japanese

Yen).

The term of deposits can range between 1 to5 years.

NRO Accounts

Only current earnings are repatriable.

Savings NRO accounts are normally operated to credit rupee income from

shares, interest, rent from property in India, etc.

In case of term deposits, banks are allowed to determine their own interest rates.

Banks can allow remittance up to USD 1 million per financial year for bonafide

purposes from balances in the NRO accounts once taxes are paid out. This limit

includes the sale proceeds of immovable properties held by NRIs and PIOs.

NRI BANKING

15

Resident Foreign Currency (RFC) Account

NRIs and PIOs returning to India can maintain an RFC account with an authorized

bank in India to transfer funds from their NRE/FCNR (B) accounts. Proceeds of

assets held outside India before their return to India can be credited to the RFC

account. These funds are free from all restrictions as to their utilization or in

investment in any form outside India.

Non-Repatriable Accounts

Non-repatriable funds are those which cannot be taken out of India. These have to

be maintained in a separate bank account i.e. a Non Resident Ordinary Bank

account. Investments made from non-repatriable accounts cannot be repatriated but

have to be maintained in a Non-Repatriable Demat account. Money once

transferred from an NRE account to an NRO account cannot be transferred back to

an NRE account.

Non Resident Ordinary (NRO) Account

When a resident becomes an NRI, his existing savings account is designated as a

Non-resident Rupee (NRO) account.

The NRO accounts could be maintained in the nature of current, saving,

recurring or term deposits. NRIs can also open NRO accounts for depositing

their funds from local transactions.

The interest earned from NRO accounts is accountable to tax laws.

NRO accounts can be opened in the name of NRIs who have left India to take up

employment or business temporarily or permanently in a foreign country.

Funds from NRO accounts are not repatriable or transferred to NRE accounts

without the prior approval of the RBI.

NRI BANKING

16

However, NRIs, PIOs, Foreign Nationals, retired employees or non-resident

widows of Indian citizens can remit, through the Authorized Dealer, up to USD

one million per calendar year from the NRO account or from income from sale of

assets in India

OPENING OF NRI ACCOUNT

HOW TO OPEN NRI ACCOUNTS WITH A BRANCH IN INDIA

To open an NRE account please complete the account opening form and mail it to

the branch of your choice along with ;

Passport copy

Visa/residence permit

2 photographs

initial money remittance

Your signature may be verified by anyone of the following;

Indian Embassy/consulate

Any person known to the Bank

Notary public

Any of our offices abroad

You can open

NRE Saving Bank a/c / Current Accounts

Fixed Deposits in Indian Rupees

Fixed Deposits in Foreign Currency

NRO accounts (Rupee accounts for crediting income in India )

NRI BANKING

17

You can authorize a resident to operate your account through a Power of Attorney

or Letter of Authority

Nomination Facility available (Nominee can be a resident Indian also)

Procedures & Benefits:

Non-Resident accounts can be opened along with your remittances through

banking channel.

Photograph shall be enclosed with the opening form.

There is no ceiling on the amounts remitted for your credit in Non-Resident

account.

When the NRI depositor returns to India, the NRE account will be automatically

treated as Resident account. However NRE term deposit will continue to earn

same rate till maturity even after such conversion.

NRE accounts earn more interest than domestic deposits.

Nomination facilities are available for registration in favor of a non resident or

resident.

Loans against deposits are allowed for purposes other than investment up to 90%

of the deposit.

The income from deposit is free from Indian Income Tax.

It is also free from Gift tax for one time gifting.

NRI BANKING

18

Documents Required:-

In case account opened in person:

Indian passport with overseas resident address or work permit (i.e. Green Card as

residence permit for USA, H1 Visa as work permit for USA or Hongkong ID card

for residence of Hongkong)

Separate proof of Non Resident status if the passport holds Indian address and

resident Visa permit is not included in passport. Photograph of individual account

holder

For persons employed with foreign shipping company

Initial work contract

Last wage slip

For contract employees

Last work contract

Letter from local agent confirming next date of joining the foreign vessel (not

more than six months from date of last return to India)

Principal's overseas address or current work contract

In case of documents sent by mail

All the relevant above mentioned documents / signatures to be attested by any

one of the following:

Indian embassy overseas notary

Local bank

NRI BANKING

19

Minimum balance in which one can open an account (Differs from bank to

bank):-

NRO – Saving Account – Rs.5, 000/-

NRO - Current Account – Rs.10, 000/-

NRO – Term Deposit Account – Rs.5, 000/-

NRE – Savings Account – Rs.5, 000/-

NRE – Current Account – Rs.10, 000/-

NRE – Term Deposit Account – Rs.10, 000/-

FCNR – Term Deposit Account – USD 500/- or its equivalent in GBP or Euro

If you submit the money for opening/credit to an account. Frequency of Interest

payment on accounts:

NRO – Term Deposit Account – Half yearly

NRE – Savings Account – Quarterly

NRE – Term Deposit Account – Half yearly

FCNR – Term Deposit Account – Quarterly

NRI BANKING

20

Opening of JOINT ACCOUNTS:-

Type of account Joint Account with

Resident Indians

Joint Account with

Non-Resident Indians

NRO Yes Yes

NRE No Yes

FCNR No Yes

NRI BANKING

21

Non-Resident (External) Account - NRE Account

Eligibility -

Non Resident Indians (NRIs) and Persons of Indian Origin (PIOs) can open and

maintain NRE accounts with authorized dealers and with banks (including co-

operative banks) authorized by the Reserve Bank of India (RBI) to maintain such

accounts.

The account has to be opened by the Non Resident account holder himself and not

by the holder of the power of attorney in India.

Opening NRE accounts in the names of individuals/entities of Bangladesh/Pakistan

nationality/ownership requires approval of RBI

Types of Accounts - Savings, Current, Recurring or Fixed Deposit accounts.

Debits & Credits:

Payments for local expenses and investments are allowed freely. Credits to an

account, of funds emanating from a local source would be permissible only if the

funds are of a repatriable nature.

2. DEPOSITORY’S

SCHEME FOR

NRI’S

NRI BANKING

22

Permitted Credits

Proceeds of remittances to India can be in any permitted currency.

Proceeds of personal cheques drawn by the account holder on his foreign

currency account and of travelers cheques, bank drafts payable in any permitted

currency including instruments expressed in Indian rupees for which

reimbursement will be received in foreign currency, deposited by the account

holder in person during his temporary visit to India provided the authorized

dealer/bank is satisfied that the account holder is still resident outside India, the

travelers‘ cheques/drafts are standing/endorsed in the name of the account holder

and in the case of travelers‘ cheques, and they were issued outside India.

Proceeds of foreign currency/bank notes tendered by account holder during his

temporary visit to India, provided

(i) the amount was declared on a Currency Declaration Form (CDF), where

applicable,

(ii) the notes are tendered to the authorized dealer in person by the account

holder himself and the authorized dealer is satisfied that account holder is a

person resident outside India.

Permitted Debits

Remittances outside India

Transfer to NRE/FCNR accounts of the account holder or any other person

eligible to maintain such account.

Investment in shares/securities/commercial paper of an Indian company or for

purchase of immovable property in India within prescribed regulations.

Any other transaction if covered under general or special permission granted by

the Reserve Bank.

NRI BANKING

23

Rate of Interest - as per the directives of the Reserve Bank of India.

Loans against Security of Funds held in the Account

To the account holder

i) For personal purposes or for carrying on business activities (except

agricultural/plantation activities/investment in real estate business).

ii) For making direct investment in India on non-repatriation basis.

iii) For acquisition of flat/house in India for his own residential use.

In January 2007, the RBI imposed a restriction on loans against deposits and

securities for NRIs to a maximum of up to Rs. 20 lakh

To third parties

The loan should be utilized for personal purposes or for carrying on business

activities (other than agricultural/plantation activities/real estate business). The

loan should not be utilized for re-lending.

Loans outside India

Authorized dealers may allow their overseas branches/correspondents to grant

fund based and/or non-fund based facilities to Non Resident depositors against

the security of funds held in the NRE accounts and also agree to remittance of

funds from India if necessary, for liquidation of debts.

Change of Resident Status of Account Holder

NRE Accounts should be re designated as resident account or the funds held in

these accounts may be transferred to the Resident Foreign Currency (RFC)

Accounts (if the account holder is eligible for maintaining RFC Account) at the

option of the account holder immediately upon the return of the account holder to

NRI BANKING

24

India (except where the account holder is on a short visit to India).

Repatriation of funds to Non Resident Nominee can be permitted by the authorized dealer

or bank in the case of an account holder who is deceased.

Foreign Currency (Non-Resident Indians) FCNR (B) Account

Eligibility to Open and Maintain FCNR A/c

With the exception of persons of Indian origin from Bangladesh and Pakistan, all

NRIs and PIOs are eligible to maintain an FCNR account with an authorised

bank in India.

Accounts may be opened with funds remitted from outside, existing NRE/ FCNR

accounts, etc.

Remittances should be in the designated currency.

Conversion to currency other than the designated currency also permitted at the

risk and cost of the remitter.

Features of FCNR Account

The account can be opened with funds remitted from abroad, or transferred from

an existing NRE/FCNR account.

FCNR accounts can be opened with designated currencies, which are: GBP,

USD, Deutsche Mark, Japanese Yen and the Euro.

Conversion to another designated currency is permitted at a cost to the account

holder.

Only term deposits can be maintained in FCNR accounts, in a time range of 6

months to 3 years.

As per RBI guidelines, banks are free to offer interest on FCNR deposits below

LIBOR rates, less 25 basis points for deposits between 6 months to one year,

NRI BANKING

25

and LIBOR rates plus 50 basis points for deposits over a year.

Banks are also free to decide on a fixed or a floating rate of interest on FCNR

term deposits.

Interest rates are reviewed periodically and determined by directives from the

Reserve Bank (Department of Banking Operations and Development).

The account holder can choose the periodicity of interest, from half-yearly to

annual payments. The interest can be credited to a new FCNR (B) account or a

NRE/NRO account.

For permissible debits and credits, the regulations for FCNR accounts are similar

to the NRE accounts.

For conversion of currencies, from designated currency to rupees and vice versa,

the day‘s rate of conversion will apply.

Funds from the FCNR account are allowed to move within the country at no

extra cost to the account holder.

FCNR A/c after Change in Resident Status

NRI deposits such as the FCNR can continue till the maturity date at the

contracted rate of interest even after the account holder‘s resident status changes

to resident Indian.

However, except for interest rates and reserve requirements of FCNR deposits,

these accounts are treated as resident accounts effective from the account

holder‘s date of return to India.

As for joint accounts, the same rules as those for NRE accounts apply to FCNR

deposits too.

For repatriation of funds from the FCNR account, the same conditions as those

for NRE accounts apply.

NRI BANKING

26

Non-Resident Ordinary Rupee (NRO) Account

Eligibility

Any person or entity residing outside India is entitled to open a NRO account

with an authorized dealer or an authorized bank for transactions conducted in

Indian Rupees.

Individuals or entities of Bangladeshi or Pakistani nationality or ownership

require approval from the RBI.

Types of Accounts

NRO accounts can be opened as current, savings, recurring or fixed deposit

accounts. The RBI determines the rate of interest on these accounts and issues

guidelines for opening, operating and maintaining them.

Joint Accounts with Residents/Non-residents

Joint accounts are permitted with resident and non-residents.

Permissible Credits/Debits -

Credits -

Any freely convertible foreign currency can be deposited into the account during

the account holder's visit to India. Foreign currency exceeding USD 5000/- or its

equivalent in the form of cash has to be supported by a Currency Declaration

Form. Rupee funds must be supported by an Encashment Certificate, if they are

funds brought from outside India.

Current income earned in India, such as rent, dividend, pension or interest. Even

proceeds from sale of assets including immovable property acquired out of

rupee or foreign currency funds or through inheritance.

NRI BANKING

27

Debits -

All payments towards expenses and investments in India

Payment outside India of current income like rent, dividend, pension, interest etc.

in India of the account holder.

Repatriation up to USD One million, per calendar year, for all bonafide purposes

with the approval of the authorized dealer.

Remittance of Assets

NRIs and PIO may remit upto USD One million per calendar year, out of balances

held in the NRO account which could be acquired from the sale proceeds of assets

acquired in India out of rupee or foreign currency funds or by way of inheritance

from a resident Indian, provided:

Assets acquired in India out of rupee/foreign currency funds

(a) Immovable property: NRIs and PIO may remit sale proceeds of immovable

property purchased by them when they were resident or out of Rupee funds as

NRI or PIO.

(b) Other financial assets: There is no lock-in period for remittance of sale

proceeds of other financial assets

Assets acquired by way of inheritance:

Sale proceeds of assets acquired through inheritance can be remitted. No lock-in

period applies here if the authorized dealer is satisfied that the proceeds are from

inherited property.

Remittance of assets out of NRO account by a person resident outside India other than

NRI/PIO A foreign national who is not a citizen of Pakistan, Bangladesh, Nepal or Bhutan

and who

NRI BANKING

28

has retired as an employee in India,

has inherited assets from a resident Indian, or

is a widow residing outside India and has inherited assets of her deceased

husband who was a resident Indian can remit upto USD one million per calendar

year on production of documentary evidence to support the acquisition by way

of inheritance or legacy of assets to the authorised dealer.

Restrictions

The above facility of repatriation from sale of immovable property is not extended

to citizens of Pakistan, Bangladesh, Sri Lanka, China, Afghanistan, Iran, Nepal and

Bhutan. Remittance of sale proceeds from other financial assets is not extended to

citizens of Pakistan, Bangladesh, Nepal and Bhutan.

Foreign Nationals of non-Indian origin on a visit to India

Foreign nationals of non-Indian origin are permitted to open a NRO account

(current/savings) on their visit to India with funds remitted from outside India

through normal banking channels or by foreign exchange brought to India. The

balance in the NRO account is converted by the bank into foreign currency for

payment to the account holder when he leaves India provided the account was

maintained for less than six months. The account should not be credited with any

local funds during the term, except for interest accrued on it.

Grant of Loans/ Overdrafts by Authorised Dealers/ Bank to Account Holders and Third

parties

Loans to NRI account holders and to third parties is granted in Indian Rupees by

authorized dealers (banks) against the security of fixed deposits provided:

The loans are utilized only for meeting the borrower's personal requirements or

for business and not for agricultural/plantation /real estate or relending activities

NRI BANKING

29

RBI regulations pertaining to margin and rate of interest will apply

All norms and considerations which apply to loans to trade and industry will

apply to loans and facilities granted to third parties.

The authorized dealer/bank may allow an overdraft to the account holder subject to

his commercial discretion and compliance with the interest rate directives.

Change of Resident Status of Account holder -

(a) From Resident to Non-resident

When a resident Indian leaves India for taking up employment or for carrying on

business outside India, his existing account is designated as a Non-Resident

(Ordinary) Account, except in the case of persons shifting to Bhutan and Nepal.

For the latter, the resident accounts do not change to NRO accounts.

(b) From Non-Resident to Resident

NRO accounts may be re-designated as resident rupee accounts once the account

holder returns to India for taking up employment, or for carrying on business or for

any other purpose indicating his objective to stay in India for an uncertain period.

Where the account holder is only on a temporary visit to India, the account

continues to be treated as non-resident during the visit.

Treatment of Loans/ Overdrafts in the Event of Change in the Resident Status of the

Borrower

In case of a resident Indian who had availed of loan or overdraft facilities while

resident in India and who subsequently becomes a NRI, the authorised dealer may

at its discretion allow the loan facility to continue. In this case, payment of interest

and repayment of loan may be made by inward remittance or out of bonafide

NRI BANKING

30

resources in India.

Payment of funds to Non-resident/Resident Nominee

The amount payable to a non-resident nominee from the NRO account of a

deceased account holder is credited to the NRO account of the nominee.

Facilities to a person going abroad for studies

Students going abroad for studies are treated as Non-Resident Indians (NRIs) and

are eligible for all the facilities enjoyed by NRIs. All loans availed of by them as

residents in India will continue to be extended as per FEMA regulations.

International Credit Cards

Authorized dealers are allowed to issue International Credit Cards to NRIs and

PIO, without the permission of the RBI. Such transactions can be made by inward

remittance or out of balances held in the cardholder's FCNR/NRE/NRO Accounts.

Income Tax

The remittances, after payment of tax are allowed to be made by the authorized

dealers on production of a statement by the remitter and a Certificate from a

Chartered Accountant in the formats prescribed by the Central Board of Direct

Taxes, Ministry of Finance, and Government of India

NRI BANKING

31

TAX BENEFITS for NRIs

Interest on NRE & FCNR deposits is free of income tax.

Tax @ 30% will be deducted at source on all interest income in NRO accounts.

On permanent return to India, income on all investments out of foreign

exchange funds would be eligible for a flat tax rate of 20% (excluding

surcharge) till maturity of the investments.

NRI BANKING

32

BANKING SERVICES

NRI banking services including deposits, savings accounts, finance like home

loans, personal loans etc. Various banks like ICICI Bank, Citibank, HDFC Bank

and many other nationalized and private banks that hold authorized dealer's

incenses from the Reserve Bank of India (RBI) provide remittances, savings,

earnings, investments and repatriation services.

Besides the major commercial banks, certain cooperative and regional rural banks

(RRB's) have also been specifically permitted to maintain NRI accounts. This

would increase NRI remittances in Bihar, Kerala, U.P. and Gujarat where a large

chunk of the rural population have settled abroad.

Another FDI (Foreign Direct Investment) magnet has been the various money

transfer services provided. Various banks provide quick, convenient and

economical fund remit to India. These include:

Online remittance services

Remittance of funds to partner exchange houses in India

Fund transfer through cheques/ DD's and Travelers' cheques.

3. SERVICES OFFERED

BY VARIOUS BANK TO

NRI’S

NRI BANKING

33

Many banks also offer Demat account services to the NRI's that enable NRI's

online stock investment and share trading services. Special NRI credit cards

acceptable globally are available with various banks. These specialized services

and banking accounts have drawn enormous NRI funds to India.

SERVICE OFFERED BY ICICI BANK:-

Rupee plus plan: - At ICICI Bank, we believe in providing you with the most

competitive returns on your hard earned money. Now you can earn even higher

returns on your deposits by investing in Rupee plus plan.

What does the Rupee plus plan offer you: - NRE-FD interest rates rate being

regulated by RBI is nearly same across banks? In Rupee plus plan we have devised

a way to make your money work harder and smarter and earn higher returns in

terms of NRI as compared to a NRE FD.

Currencies: - you can be funds in any convertible currency, which will be

converted to USD (if not in USD already).

Minimum Deposit: - USD 25,000 or equivalent.

Tenor: - for 1 year only.

How does the Rupee plus plan work? Instead of putting the money in NRE FD

directly, the money is put in USD denominated FCNR. This FCNR earns interest

as per prevailing FCNR interest rates.

Additionally, at the time of booking the FCNR a Forward Agreement is also drawn

to exchange the maturity amount of USD to Rupees at a given rate (Forward Rate).

NRI BANKING

34

The following banking facilities are available to NRIs, as per the current

RBI/FEMA guidelines.

Features of various Deposit Schemes available for Non-Resident Indians (NRIs)

Particulars Foreign Currency (Non-

Resident) Account (Banks)

Scheme [FCNR (B)

Account]

Non-Resident (External)

Rupee Account Scheme

[NRE Account]

Non-Resident Ordinary

Rupee Account Scheme

[NRO Account]

(1) (2) (3) (4)

Who can open

an account NRIs (individuals / entities

of Bangladesh / Pakistan

nationality / ownership

require prior approval of

RBI)

NRIs (individuals /

entities of Bangladesh /

Pakistan

nationality/ownership

require prior approval of

RBI)

Any person resident

outside India (other than a

person resident in Nepal

and Bhutan). Individuals /

entities of Bangladesh /

Pakistan nationality /

ownership as well as

erstwhile Overseas

Corporate Bodies2 require

prior approval of the

Reserve Bank.

Joint account In the names of two or

more non-resident

individuals provided all

the account holders are

persons of Indian

nationality or origin;

Resident close relative

(relative as defined in

Section 6 of the

Companies Act, 1956) on

‗former or survivor‘ basis.

The resident close relative

shall be eligible to operate

the account as a Power of

Attorney holder in

accordance with extant

instructions during the life

time of the NRI/ PIO

account holder.

In the names of two or

more non-resident

individuals provided all

the account holders are

persons of Indian

nationality or origin;

Resident close relative

(relative as defined in

Section 6 of the

Companies Act, 1956)

on ‗former or survivor‘

basis. The resident close

relative shall be eligible

to operate the account as

a Power of Attorney

holder in accordance

with extant instructions

during the life time of

the NRI/ PIO account

holder.

May be held jointly with

residents

NRI BANKING

35

Nomination Permitted Permitted Permitted

Currency in

which account is

denominated

Any permitted currency

i.e. a foreign currency

which is freely convertible

Indian Rupees Indian Rupees

Reparability Repatriable Repatriable Not repatriable except for

the following:

i) current income ii) up to

USD 1 (one) million per

financial year (April-

March), for any bonafide

purpose, out of the

balances in the account,

e.g., sale proceeds of assets

in India acquired by way of

purchase/ inheritance /

legacy inclusive of assets

acquired out of settlement

subject to certain

conditions.

Type of Account Term Deposit only Savings, Current,

Recurring, Fixed

Deposit

Savings, Current,

Recurring, Fixed Deposit

Period for fixed

deposits For terms not less than 1

year and not more than 5

years.

At the discretion of the

bank.

As applicable to resident

accounts.

Rate of Interest

Deposits of all maturities

contracted effective from

the close of business in

India as on November 23,

2011, interest shall be paid

within the ceiling rate of

LIBOR/SWAP rates plus

125 basis points for the

respective

currency/corresponding

maturities (as against

LIBOR/SWAP rates plus

100 basis points effective

from close of business on

Subject to cap as

stipulated by the

Department of Banking

Operations and

Development, Reserve

Bank of India:

Banks are free to

determine the interest

rates of saving have and

term deposits of maturity

of one year and above.

Interest rates offered by

banks on NRE deposits

cannot be higher than

Banks are free to determine

their interest rates on

savings deposits under

Ordinary Non-Resident

(NRO) Accounts.

However, interest rates

offered by banks on NRO

deposits cannot be higher

than those offered by them

on comparable domestic

rupee deposits.

NRI BANKING

36

November 15, 2008).

On floating rate deposits,

interest shall be paid

within the ceiling of

SWAP rates for the

respective

currency/maturity plus 125

basis points. For floating

rate deposits, the interest

reset period shall be six

months.

those offered by them on

comparable domestic

rupee deposits.

Operations by

Power of

Attorney in

favour of a

resident by the

non-resident

account holder

Operations in the account

in terms of Power of

Attorney are restricted to

withdrawals for

permissible local payments

or remittance to the

account holder himself

through normal banking

channels.

Operations in the

account in terms of

Power of Attorney are

restricted to withdrawals

for permissible local

payments or remittance

to the account holder

himself through normal

banking channels.

Operations in the account

in terms of Power of

Attorney is restricted to

withdrawals for

permissible local payments

in rupees, remittance of

current income to the

account holder outside

India or remittance to the

account holder himself

through normal banking

channels.

Remittance is subject to the

ceiling of USD 1 (one)

million per financial year.

Loans

a. In India

i) to the

Account holder

i) to Third

Parties

Permitted only up to

Rs.100 lakhs

Permitted only up to

Rs.100 lakhs

Permitted up to Rs.100

lakhs

Permitted up to Rs.100

lakhs

Permitted subject to the

extant rules3

Permitted, subject to

conditions4

b. Abroad

i) to the

Account

holder

ii) to Third

Permitted

(Provided no funds are

remitted back to India and

are used abroad only)

Permitted

Permitted

(Provided no funds are

remitted back to India

and are used abroad

only)

Not Permitted

Not Permitted

NRI BANKING

37

Parties (Provided no funds are

remitted back to India and

are used abroad only)

Permitted

(Provided no funds are

remitted back to India

and are used abroad

only)

c. Foreign

Currency Loans

in India

i) to the

Account holder

ii) to Third

Parties

Permitted up to Rs.100

lakhs

Not Permitted

Not Permitted

Not Permitted

Not Permitted

Not Permitted

Purpose of Loan

a. In India

i) to the

Account holder

i) Personal purposes or for

carrying on business

activities *

ii) Direct investment in

India on non-repatriation

basis by way of

contribution to the capital

of Indian firms /

companies

iii) Acquisition of flat /

house in India for his own

residential use. (Please

refer to para 9 of Schedule

2 to FEMA 5).

i) Personal purposes or

for carrying on business

activities.*

ii) Direct investment in

India on non-repatriation

basis by way of

contribution to the

capital of Indian firms /

companies.

iii) Acquisition of flat /

house in India for his

own residential use.

(Please refer to para 6(a)

of Schedule1 to FEMA

5).

Personal requirement and /

or business purpose.*

ii) to Third

Parties Fund based and / or non-

fund based facilities for

personal purposes or for

carrying on business

activities *. (Please refer to

para 9 of Schedule 2 to

FEMA 5).

Fund based and / or non-

fund based facilities for

personal purposes or for

carrying on business

activities *. (Please refer

to para 6(b) of Sch. 1 to

FEMA 5)

Personal requirement and /

or business purpose *

b. Abroad

To the account

holder and

Third Parties

Fund based and / or non-

fund based facilities for

bonafide purposes.

Fund based and / or non-

fund based facilities for

bonafide purposes.

Not permitted.

NRI BANKING

38

1. E-statement

It is Safer

It is Faster

It comes in your Mail Box

It is Environment Friendly

Now receive an Electronic Deposit Confirmation Advice (E- DCA) for your Fixed

Deposits within 1 working day.

Note: You need to subscribe for Account Statement via E-mail to avail of this

facility.

Subscribing to an E-statement is just [4] steps away:-

Log on to your Bank Account

Click on the link - Account Statement by Email

Check in "Subscribe to statements by Email"

Enter your email id & press "Submit"

4. Innovative Services to NRI

NRI BANKING

39

2. Mobile Banking

Discover the quick, simple and convenient way to take command of your Bank

Account, from your mobile phone.

With ICICI Bank Mobile Banking, you can check your account balance, transfer

funds 24 x 7, pay your bills, book bus and flight tickets, recharge your prepaid

mobile or DTH connection and do a lot more effortlessly and securely. Our Mobile

banking services work with almost all types of handsets and help you access your

Bank account easily and securely.

You can access Mobile banking services through:

SMS: You can simply send keywords as SMS. Click here for the list of

keywords.

Dial *525#: A menu based session connects you to your bank.

iMobile: A rich mobile application to carry your bank in your phone. (Also

available for your Android / iPhone / Blackberry or other smart phones)

Operator WAP sites: Easy to use menu driven banking on leading operator

WAP sites.

Choose the Mobile Banking option which suits your banking needs based on your

handset, GPRS connection and service operator:

NRI BANKING

40

Access Bank Account

Funds Transfer

Insta Fund Transfer (IMPS)

Bill Payment

Balance Enquiry

Cheque Book Request

Last 5 Transactions

Stop Cheque Request

Cheque Status Enquiry

Open a Fixed Deposit

Open Recurring Deposit

Mobile Recharge

Generate MPIN

(MPIN is a 4-digit number set by you to execute payments over SMS and

*525#. We suggest you choose an MPIN different from your ATM PIN and

iMobile Login PIN)

Mobile Recharge

Credit card

Balance Enquiry

Reward Points

Last Payment

Payment Due Date

Other Service

Status of Service Request Raised

Locate ATM

Locate Branch

Locate Bank @ Home Drop Box

NRI BANKING

41

3. Internet Banking Banking made convenient, efficient, and hassle-free…at the click of a button

Make the most of our internet banking facility, so that you are never farther than a

click away from safe and convenient banking 24x7.

What you can do

Go online on Obtain an account balance and transaction statement

Transfer funds

Pay your bills

Open and renew fixed deposit accounts

Place request for cheque book & debit card

Report lost card (hot listing)

Change or cancel mandate holder

Update contact details

And much more...

What you will need

To start using Internet Banking you would need the following:

Login password:

Your Login password is given in your pin mailer handed in the welcome kit while

opening your account

If you have misplaced the pin mailer or forgotten your Login password you can

generate your password online

o Visit www.icicibank.com/nri select Internet Banking and click on Generate

Password Online button.

o Enter user ID and registered email ID on Online Password Generation page.

NRI BANKING

42

o A unique number shall be generated and sent on your registered email ID.

o Enter the unique number received on the screen of online "Login Password

Generation" and generate the new Login password.

o To generate your Login password online now please click here.

Transaction Password:

After logging into Internet Banking with user ID and login password, if you want

to carry out any banking transaction, you would be prompted for the Transaction

password

Your Transaction password is given in your pin mailer handed in the welcome kit

while opening your account

If you have misplaced the pin mailer or forgotten your Transaction password you

can generate it online

o Log into your Internet Banking account with your user ID and login password

o Click on service requests tab on the left hand side and select "Online Password

Generation - Transaction Password"

o Select account number for grid card authentication. Post authentication a unique

number shall be generated and sent on your registered email ID.

o Enter the unique number received on the next step of "Transaction Password

Generation" page and generate the new Transaction Password.

o To generate your Transaction password please click here and login

How to log in

Visit our website www.icicibank.com/nri

Select Internet Banking

Enter your user ID and Login password in their respective fields

Click on Log-in

NRI BANKING

43

4. Money Transfer > Money To India

This internet-enabled wire transfer to anyone in India provides a speedy and

convenient money transfer option.

What is Power Transfer (Wire-based)?

This is Bank's online wire transfer channel–you can transfer money to India in as

less as 48 hours.

Errors associated with a normal wire transfer are minimized with Power Transfer's

a unique tracking number that enables you to keep track of your remittance.

You can also send fixed rupee amounts for your fixed expenses in India.

(Fixed Rupee transfer facility is available in SEK and CHF current A/c.

Avail Fixed Rupee transfer: (Available in SEK and CHF currencies only) o Confirmed exchange rates as applicable at the time of transaction, on sending the

funds within the Rupee Transfer Validity Date. o Exact rupee amount transfer to your receiver in India.

Fast money transfers – it takes just about 48–72 hours. Error–free – manual intervention is minimal. No limit on the amount that can be remitted. Flexible – you can remit in 10 currencies. No need for either you or your beneficiary to have an account with Bank. Range of easy money transfer options. o Electronic transfers into any Bank account with over 2,500 branches in India

o Electronic transfers into accounts with over 75,000 bank branches of over 100

banks in India

o Ready Cash payout from any of the 195 Bank branches across 23 cities in India

o Electronic transfers into any Bank Remittance card account in India

o Electronic transfers into any resident Visa Debit Card account** issued in India

o Demand Drafts issued and payable at over 700 locations in India

Online tracking of the status of your funds. Competitive exchange rates.

NRI BANKING

44

Remittance service charge: For Regular Power transfers: SEK 20 / CHF 4 (Inclusive of service tax @ 12.36%)

for amounts of SEK 8000 / CHF 1500 or below. No charge for larger amounts.

For Fixed Rupee transfers: Remittance Service charge: A nominal charge of SEK

20 / CHF 4 (Inclusive of service tax @ 12.3%) compared to the hefty charges

incurred on international wire transfers or while sending money through money

transfer agents.

Login with your Money2India login id. (New users register here).

Select Power Transfer (Web Based Wire Transfer) as transfer mode under

Home page or under 'Transfer Money' tab on the home Page

Select your bank account or choose 'Add New Account' to enter new bank

account details.

Select your existing receiver or choose 'Add New Receiver' to enter receiver

details in the case of a new receiver -- i.e., name, address, bank account

number.

Select the purpose of remittance and select 'Next'.

Once the details are verified, you will get a form on your screen that has a

tracking number and details of the remittance instructions to your bank

Take a printout of the "Wire Transfer" form and give it to your local bank

for execution, along with the required funds. Keep the customer copy for

your reference

The local bank wills then wire-transfer the money to Bank through its

correspondent bank (List of Correspondent Banks for Web Based Wire

transfer)). You can remit the amount to Bank's account through any bank of

your choice.

If the beneficiary has a Bank Account or a bank account with any of the ban

ks that are networked or has a resident Visa Debit card account, the money is

directly credited to his/her account. Else the money is sent as a Demand

Draft to the beneficiary. For Ready Cash, funds transferred can be collected

in cash by your beneficiary from any of the select Bank branches in India.

You get automatic e-mail updates on the status of your remittance. You can

also track the same online through your unique tracking number through

―Track transfer‖ facility.

The remittance amount has to be transferred to Bank's account (with its

correspondent banks).

NRI BANKING

45

5. Exchange Rate Calculator

Currency: (--Select Currency --)

Transfer Mode: (--Select Product --)

Delivery Mode: (--Delivery Mode --)

Enter Amount:

Indicative Exchange Rate Actual exchange rate applied to your transaction will be as prevailing on the

date and

time of conversion of your money

Confirmed Exchange Rate (Fixed Rupee transfer)

Exchange rate is confirmed at the time of transfer initiation. Specify amount

in Rupees

that you want your receiver to get

NRI BANKING

46

6. NRI Edge Account

(Enhanced Data Rates for GSM Evolution) Exclusive banking just for you—with top-end offerings, premium service and

privileges.

What is NRI Edge?

NRI Edge is a premium banking status that is power-packed with offerings such as

platinum debit card with high withdrawal and spends limits, dedicated 24x7 phone

banking team and remote relationship manager.

Why choose NRI Edge?

NRI Edge gets you premium offerings, priority service, and personalized

convenience for all your India banking needs.

Overview

Features and Benefits

Card benefits: free international Platinum ATM–cum–Debit card. o Higher limits: cash withdrawal limits up to INR 100,000 and spends limits up to

INR 200,000 at point of sale terminals. Limits can be customised depending on

your needs. o Customisable limits: cash withdrawal and POS spend limits can be customised

depending on your needs. o Free and unlimited access: to any ATM across India. Easy banking: free multi-city check book facility, free demand drafts and pay

orders. Dedicated service: remote Relationship Manager works exclusively with you to

make your banking convenient across distances too. Preferential exchange rate: on all your money transfers

through Money2india.com. Attractive Discounts: free multi-city check book facility, free demand drafts upto

a value of INR 1lac per day per account and free pay orders. Priority servicing: no or reduced waiting time at call centres. Travel Insurance benefits: These are

NRI BANKING

47

o Personal air accident coverage worth INR 10,000,000

o Coverage against loss of passport or baggage in India

o Coverage against accident hospitalization in India, worth INR 100,000

o Coverage for travel to India in case of medical emergency arising on immediate

family members

Exclusive Invitation: to Webinars on relevant topics like Real Estate, Financial

planning etc

Service Charge

Quarterly Average Balance There is no minimum balance that must be maintained at all times—you can bring

your account balance down to zero.

You need to maintain a quarterly average balance of INR 15,000 in your NRE and

NRO Savings Accounts or a total relationship size (within the same customer

identity number) of INR 25,000 with ICICI Bank.

If you are unable to maintain this minimum balance, quarterly service charges of

INR 750 + service tax will be levied.

For Student's Accounts, QAB of INR 5,000/- or a total Customer ID Balance of at

least INR 25,000/- is required, or else, the account will be charged.

ELIGIBILITIY

Simple steps to upgrade your account to NRI Edge

1. Fund your account to ensure that your savings account has a minimum balance of

INR 1 lac or your Cust-ID has a minimum balance of INR 3 lacs (including FDs).

2. Ensure that you have a NRE SB account under your cust-id.

3. Log-on to your Internet Banking Account, go to Service Request section and click

on 'NRI Edge'. Make a request to Upgrade your account to NRI Edge

4. Once your account is upgraded to NRI Edge, you can apply for your Platinum

Debit card through your Internet Banking account or through our customer care

numbers.

5. You can also upgrade to NRI Edge by calling our Phone Banking team or by

visiting your nearest branch in India.

NRI BANKING

48

7. INNOVATION IN BANKING BRANCHES

Innovations in banking branches such as Universal banking, offshore banking,

retail banking, and wholesale banking for NRI. Open new branches in foreign

country to them can also use branch banking at foreign country.

Meaning: Universal banking is a multipurpose and multi functional

Financial superstore providing both banking and financial services. A

Universal bank may undertake multifarious services under one roof, which

Includes:

a) Receiving money on current or deposit accounts and lending of money

For trade, industries, exports, agriculture etc.

b) Mortgage financing; project financing infrastructure lending, asset

Securitisation, leasing, factory etc.

c) Remittance of funds, custodial services, credit/debit cards, collection of

Cheque/bills etc.

d) Corporate advisory services, insurance depository service, merchant

Banking (brokerage, underwriting new debt and equity shares) foreign

Exchange operations.

The few objectives of universal banking are as follows:

To help in bringing harmony in the role of financial institutions and banks.

To offer world-class financial services to the clients by using information

technology and cross selling.

To reduce per customer cost.

To increase per customer revenue.

To take benefit of economies of scale.

NRI BANKING

49

The Government of India has adopted a liberal policy, with respect to investment

by NRIs and OCBs in India, such investment are allowed, both, through the RBI

route and also through the Government route, i.e., through the Foreign Investment

Promotion Board (FIPB) NRIs and OCBs are permitted to invest up to 100%

equity in real estate development activity and civil aviation sectors. Investment,

made by the NRIs and OCBs, are fully repatriable, except in the case of real estate,

which has a 3 year lock-in period on original investment and, 16% cap on dividend

repatriation.

Various investment opportunities in India available to NRIs:-

If one is NRI, the following investment opportunities are open to you:

Maintenance of bank accounts in India.

Investment in securities/shares and deposits of Indian firms/companies.

Investment in mutual funds in India.

Investment Policy for Non-resident Indians (NRIs):-

Recognizing the investment potential of the Non-resident Indians, a number of

steps are being taken by the government on an ongoing basis to attract from them

in Indian companies. Some of the investment schemes presently available to Non-

resident Indians (NRIs) include the facility to invest upto 100 percent equity with

full benefits of repatriation of capital invested and income accruing thereon in high

priority industries mentioned in the Annexure-III to the industrial policy 1991, 100

5. NRI INVESTMENTS

NRI BANKING

50

percent export oriented units, sick units under revival, housing and real estate

development companies, etc,. NRIs/PIOs/OCBs are also permitted to make

portfolio investments through secondary markets. In terms of the relaxations

announced in 1998-99, investment limits for an individual NRI has been revised

upwards from 1% to 5%, aggregate portfolio investment limits by all NRIs

increased from 55 to 10% of the issued and paid-up capital of the company. The

aggregate investment limit would be separate and exclusive of FII portfolio

investment limits.

FOR NRI’S INVESTMENT:-

In order to help the tax-payers to plan their Income-tax affairs well in advance and

to avoid long drawn and expensive litigation, a scheme of Advance Rulings has

been introduced under the Income-Tax Act, 1961. Authority for advance rulings

has been constituted. The tax-payer can obtain a binding ruling from the Authority

on issues which could arise in the determination of his tax liability. A non-resident

or certain categories of resident can obtain binding rulings from the Authority on

any question of law or fact arising out of any transaction/proposed transactions

which are relevant for the determination of this tax liability.

PORTFOLIO INVESTMENT

NRIs/OCBs are permitted to make portfolio investment in shares/debentures

(convertible and non-convertible) of Indian companies, with or without repatriation

benefit provided the purchase is made through a stock exchange and also through

designated branch of an authorized dealer. NRIs/OCBs are required to designate

only one branch authorized by Reserve Bank for this purpose.

NRI BANKING

51

NRI’S INTEREST:-

NRIs invested only 5% of their investible assets in India with the balance being

parked overseas. A major reason for this was that the Indian banking system was

not a very preferred and trusted mode of investment for the NRI. The customer was

looking for convenience, speed, high yield on investment with manageable risks,

reasonable costs and quality services – A face of India he could associate with.

Competition was not only from India based banks, but also from local banks based

overseas; conventional and non conventional routes of money transfer.

FACILITATION AGENCIES

The main regulatory and facilitation agencies involved in the matters related to

NRIs/OCBs investment are Reserve Bank of India (RBI), Securities and Exchange

Board of India (SWBI), Authority for Advance Rulings (AAR), Secretariat for

Industrial Assistance (SIA), Ministry of Commerce and Industry; and Office of the

Chief Commissioner (Investments & NRIs).

RBI FORMS

NRIs/OCBs/PIOs do not have to seek specific permission for approved activities

covered under ‗General permission‘ schemes. The activities relating to

NRIs/OCBs/PIOs not covered under those schemes either require declaration to

RBI or permission from RBI. The activities requiring Declaration/Permission

along with corresponding forms are as under;

NRI BANKING

52

TS 1 Transfer of Shares/Debentures by Non-residents to Residents

FNC

1

Permission to establish a branch office in India by an Overseas Company

establishing a Representative Office by Overseas Company for Liaison

Activities to open a Project/Site Office in India.

IPI Company/Individual (declaration) acquiring property

NRI BANKING

53

For all Indian citizens who are liable to pay tax under the Income Tax Act, 1961,

or are required to enter into financial transactions in India, it is mandatory to have

a Permanent Account Number.

The Permanent Account Number (PAN) is a combination of 10 alphanumeric

numbers issued by the Income Tax Department. The Department has entrusted UTI

Investor Services Ltd. (UTIISL) with the task of managing IT PAN Service

Centers wherever the IT department has an office in the country. The National

Securities Depository Limited (NSDL) has also been engaged to allot PAN cards

from TIN Facilitation centers.

Applying for a PAN

Form 49A, which is the application form for a PAN, can be downloaded from the

Income Tax, UTIISL and NDSL websites:

www.incometaxindia.gov.in & www.utiisl.co.intin.nsdl.com

The forms care also available at the IT PAN Service Centers and TIN Facilitation

Centers. A ―tatkal‖ or priority service has been provided for, to enable speedy

allotment of the PAN card through the Internet. The PAN is allotted through e-mail

on priority in 5 days as against the normal 15 days to the applicant upon online

payment through a credit card. The PAN has lifetime validity.

The necessity for a PAN Card to NRIs

6. PAN Card for NRIs

NRI BANKING

54

Apart from income returns which must carry the PAN, it is mandatory to submit

the PAN in all financial transactions, like the purchase and sale of property in

India, payments for purchase of vehicles, foreign visits, securing a telephone

connection or making time deposits in a bank worth over Rs.50,000.

For NRI‘s, PAN is necessary to conduct monetary transactions in India, invest in

stocks, and pay tax on their Indian income.

The application for a PAN must be accompanied by:

A recent colored photograph of size 3.5 cms x 2.5 cms on the application form.

A proof of residence and identity (attested school leaving/matriculation

certificate/degree/credit card/voter identity/ration/passport/driving

license/telephone/electricity bill/employer certificate.

Code of the concerned Assessing Officer of the IT Department obtainable from

the IT office where form is submitted.

NRI BANKING

55

DEMAT ACCOUNT:-

A demat account facilitates buying and selling shares, precluding cumbersome

paperwork and meaningless delays.

Advantages of a Demat Account -

It is a safe, secure and convenient mode of transacting in shares.

Minimizes brokerage charges

Removes uncertainty on ownership title of securities

Allows quick allotment of public issues

Avoids delays due to wrong/incorrect signatures, post, and misplacement of

certificates

Prevents risks like forgery and counterfeit, theft or damage to documents

Saves on stamp duty, paperwork on transfer deeds

Gives immediate benefits from bonus shares and stock splits

Who offers Demat Facility?

Depository Participants or DPs offer demat account services, which would include

banks. Holding a demat account with a bank enables quick on-line dealings,

NRI BANKING

56

ensuring credit of a transaction to the account holder‘s savings account by the third

day. Banks have an added advantage over other DPs with their large network of

branches.

How to Open a Demat Account in India

Fill up the demat account opening form at the nearest Depository Participant

You may refer to either

CDSLathttp://www.cdslindia.com/demat_acct/open_demat.jsp or

NSDLathttps://nsdl.co.in/for the list of DPs in India.

Joint demat accounts can be opened, retaining the same order of names

Separate demat accounts have to be opened for different combinations of names

in the case of three or more joint holders.

Any number of demat accounts and DPs are permitted

A multiple-sign demat is feasible, operated by several holders

DPs charge a fee for switching shares from electronic to physical form and vice-

versa, which varies from a flat fee to a variable fee. Remat and demat charges

may also show a discrepancy between DPs.

Some DPs offer a discount to frequent traders.

No opening balance is required for a demat account.

Supporting documents to open a demat account

Passport-size photograph

Proof of identity, address and date of birth

DP-client agreement on non-judicial stamp paper

PAN Card

The applicant receives an account number and a DP ID number which are

NRI BANKING

57

required for all future communication with the DP.

NRI Demat Accounts

NRIs need to fill in ―NRI‖ in the type and ―repatriable or ―non-repatriable‖ in the

sub-type on the form. No special permission from the RBI is required by NRIs to

open a demat account, though specific cases may require authorization from the

designated authorised dealers.

NRIs require separate demat accounts for securities under the foreign direct

investment (FDI) scheme, which is repatriable; and the Portfolio Investment

Scheme and Scheme for Investment which can be either repatriable or non-

repatriable. Repatriable and non-repatriable securities cannot be held in a single

Demat account.

Resident Indians can continue to hold non-repatriable demat accounts they hold

even after they acquire non-resident Indian status. However, when a NRI returns

to India permanently, he must inform his designated authorised dealer of his new

status, and a fresh account would have to be opened. The securities held in the NRI

Demat account would have to be transferred to the new resident demat account,

and the NRI Demat account closed. The Demat account would have to be linked

with the NRI‘s NRO account for non-repatriable accounts and NRE accounts for

repatriable accounts to credit dividends and interest.

NRI BANKING

58

QUESTIONNAIRE OF BANKING SERVEY FOR NRI

1. Which banking channel do you use mostly for banking?

( ) Branch Banking,

( ) Internet Banking,

( ) Mobile Banking,

( ) ATM,

2. Do you like to use Exchange rate Calculator?

( ) Yes ( ) No

3. Do you have PAN card?

( ) Yes ( ) No

4. Which Type of account do you use?

( ) Saving

( ) Current

( ) Fixed

( ) Other

5. Do you use DEMAT account for buying and selling of shares?

( ) Yes ( ) NO

6. How much Tax benefits you want for Tax exemption?

( ) >30%

( ) 40%

( ) 50%

( ) 50<

7. Do you like RBI Investment policy suitable For NRI?

( ) Yes ( ) No

NRI BANKING

59

8. What sort of banking activity will you use?

( ) personal accounts,

( ) investment related,

( ) overseas transactions,

( ) taking loans,

9. Which do you prefer National or Private Banks?

( ) National Bank ( ) Private Bank

10. How Many Customers are still using traditional ways of banking transaction?

( ) >20%, ( ) 30%, ( ) 40%, ( ) < 50%

11. What do you feel about overall service quality of your

bank?

( )Excellent, ( )good, ( )average, ( )poor

12. How often do you use internet banking?

( ) daily, ( ) weekly, ( ) monthly, ( ) yearly,

13. Bank officer have knowledge of bank services and product.

( ) Yes, ( ) No

14. Would you use electronic delivery of your account notice and statements?

( ) Yes, ( ) No

15. Are you satisfied with this survey?

( ) Yes, ( ) No

Name: Occupation: Location:

NRI BANKING

60

DATA INTERPRETATION AND FINDING

1. Which banking channel do you use mostly for banking?

Branch banking Internet

Banking

Mobile banking ATM

15 18 5 12

Data interpretations of which banking channel do you like most for

banking? From graph branch banking 30%, internet Banking 36%,

mobile banking 10%, ATM 24%. Final revel is internet banking 36% is

most useful for banking channel.

30%

36%

10%

24%

0%

5%

10%

15%

20%

25%

30%

35%

40%

Branch Banking

Internet banking

mobile banking

ATM

NRI BANKING

61

2. Do you like to use Exchange rate Calculator?

Yes No

30 20

Data interpretation of do you like to use exchange rate calculator From

Graph Yes 60% and No 40%, Final reveal is Yes 60% use exchange rate

calculator this is useful for currency convertibility.

60%

40%

0%

10%

20%

30%

40%

50%

60%

70%

Yes

No

NRI BANKING

62

3. Do you have PAN card?

Yes No

40 10

Data interpretation of do you have PAN card. From graph Yes 80%

and No 20%. Final reveal is 80% Yes PAN card is necessary for bank

account.

80%

20%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

Yes

No

NRI BANKING

63

4. Which Type of account do you use?

Saving Current Fixed Other

18 12 16 4

Data interpretation of which type of account do you use. From graph

Saving 36%, Current 24%, fixed 32%, other 8%. Final reveal is saving

account 36% is most use in bank account.

36%

24%

32%

8%

0%

5%

10%

15%

20%

25%

30%

35%

40%

Saving

Current

Fixed

Other

NRI BANKING

64

5. Do you use DEMAT account for buying and selling of shares?

Yes No

29 21

Data interpretation of do you have DEMAT account for buying and

selling of shares. From graph Yes 58% and No 42%.

Final reveal is Yes 58% DEMAT account is most useful for buying and

selling of shares.

58%

42%

0%

10%

20%

30%

40%

50%

60%

70%

Yes

No

NRI BANKING

65

6. How much Tax benefits you want for Tax exemption?

>30% 40% 50% 50%<

11 9 12 19

Data interpretation of how much tax benefits you wants tax exemption. From

graph >30% is 22%, 40% is 18%, 50% is 23% and last one is 50 more than is

37%. Final reveal is more than 50< is 37% want tax exemption, more tax

exemption is more profitable for bank Customers.

22%

18%

24%

38%

0%

5%

10%

15%

20%

25%

30%

35%

40%

>30%

40%

50%

50<

NRI BANKING

66

7. Do you like RBI Investment policy suitable For NRI?

Yes No

32 18

Data interpretations of do you like RBI Investment policy suitable for

NRI from graph Yes 64%, and No 36%.

Final reveal is yes RBI investment Policy is suitable for NRI.

64%

36%

0%

10%

20%

30%

40%

50%

60%

70%

Yes

No

NRI BANKING

67

8. What sort of banking activity will you use?

Personal Investment

related