13 03 29 longhornarticle ma_magazine

-

Upload

fred-mccallister -

Category

Documents

-

view

30 -

download

0

Transcript of 13 03 29 longhornarticle ma_magazine

MERGERS & ACQUISITIONS April 2013

_____________________________________________________________________________________

Longhorn Deal Spotlights Healthcare Trend M&A abounds as more patients are recovering in a “medical home” rather than a hospital

BY ANTHONY NOTO

Longhorn Health Solutions Inc.,

a provider of consumable medical

supplies and equipment, already

has a strong presence in Texas,

but there's still a large portion of the market share

remaining, says Satori Capital's co-founder Sunny

Vanderbeck, the company's newest owner.

Longhorn brings disposable medical products-

incontinence supplies, diabetes strips and specialty

foods-to the homes of Medicaid, Medicare and

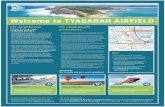

privately insured patients. The company distributes

the supplies in vans dispatched from its 10

warehouses (pictured) located across Texas: Austin,

Houston, Beaumont, San Antonio, El Paso, Fort

Worth, Corpus Christi, Harlingen, Lubbock and

Waco. It recently launched a pharmacy division so

that it can deliver medication

as well.

"It's the future," says Brent

Earles of investment bank

Allegiance Capital Corp. who

ran the sale process for

Longhorn alongside fellow

adviser Fred McCallister.

More clients, they say, are banking on the notion that

more patients are recovering in a "medical home"

rather than a hospital.

"There's certainly an interest in this space, not just in

Texas but across the country."

"We started the marketing effort in early- to mid-

April," Earles adds, with about two-thirds of the

interested bidders being outside of Texas. About 40

companies expressed serious interest, he says, with

60 percent being private equity firms.

In the end, Longhorn founder and chief executive

Britt Peterson connected with Vanderbeck and "the

classic PE deal appealed to

him," McCallister says.

Terms of the deal, announced

on Feb. 20, were not

disclosed, but Satori generally

makes investments that hover

between $25 million and $75

million.

Under Satori's ownership, Longhorn will focus on

organic growth in the near term, but add-on

acquisitions will serve as a way for the company to

eventually grow in other states, Vanderbeck explains.

"We haven't made any investments in healthcare," he

adds. "What we saw here was a great services

company in healthcare."

Prior to Satori, Vanderbeck co-founded and served as

chief executive of Data Return, a provider of

managed services and utility computing. Before that,

he worked at Microsoft Corp. (Nasdaq: MSFT).

Fred McCallister

Allegiance Capital

Brent Earles

Allegiance Capital