125184076-123546364-Cineplex-Entertainment

-

Upload

suchita-suryanarayanan -

Category

Documents

-

view

201 -

download

0

Transcript of 125184076-123546364-Cineplex-Entertainment

CRM CASE ANALYSIS:CINEPLEX ENTERTAINMENT:

THE LOYALTY PROGRAM

VIDISHA MOHAPATRAPGP/15/123

Customer relationship management

DECISIONS TO BE TAKEN

• Recommendations for Loyalty Program Development– Reward structure– Tie-in partner

• Flight Miles• Scotia bank

– Type of promotional campaign• In-theater advertising• Newspaper/Radio advertising• Online advertising• Grass root initiatives

– Whether to roll-out the program regionally or nationally

TRIGGERS• Inconsistent revenue yield per year

– Variable attendance dependant on movie genre• Weak box office attendance(2005)

– Sharp drop in Net operating Income• How to link individual customers to targeted movies and

concession purchases?– No reliable database yet of customer preferences

• Aggressive contention for customer box office retention even after 65% market share– Ongoing film piracy– Rental movies– Concerts and sorting events

CINEPLEX CORPORATE STRATEGY AND RESULTS

• Chain of movie theaters– Mergers and acquisitions

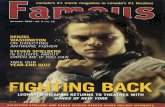

• Galaxy Entertainment Inc,Famous players(2005)

• Conglomeration of various brands– Cineplex Odeon– Galaxy– Famous Players– Cinema City

• USP– Offer movie-goers ‘an exceptional entertainment experience’– Focused on developing new markets

• Showcasing live and sporting events

– Explore new ways of enhancing share of wallet with lucrative 16-24 segment

STRATEGY FOR THE REWARD PROGRAM

• Regarding the loyalty program– Data control and ownership– Resource requirements• Cost and labor

– Length if time to establish the database• Min 500000 members

– Robust execution– Firm’s image– Value to customer

1.EVALUATION OF POTENTIAL PARTNER

PARAMETERS NO –PARTNER INTERNAL DEVELOPMENT

FLIGHT MILES SCOTIABANK

Cost incurred $5.5mn and diminishing thereafter $15 mn + $0.9 /transaction+ data access cost

Near about $6.51 mn

Penetration Rate 16.56% (5.3 mn unique visitors) 21.87%(7 mn database) 21.25%(6.8 mn customers served)

Data Ownership Complete None None

Advantages 1.Unlimited data access and control2.Would know one’s brand the best

1.Immediate entrance to data of 7 mn people and other Flight Miles partners2.Offer of $250000 by Flight Miles towards marketing campaign3.Easy reach to large number of Canadians – already widespread awareness built(exhibit 3)4.No need to carry multiple cards

1.Leverage on earlier corporate sponsorships2.One of the ‘Big 5’ banks in Canada 3.Ready to share Cineplex’s financial risk- proposed to share 50-50 cost4.Prior experience with data management companies5.No requirement to open bank accounts but each debit/credit card holder issued Cineplex loyalty card.

Disadvantages 1.Face financial risk of unredeemed points2.Difficult to divest the program3.New department and database required 4.Lenghthy time of development

1.Lenghthy commitment of 3 yrs2.No easy exit option3.Would lose all access to accumulated data on exiting4.Extra cost incurred in accessing database and to issue points

1.Naming rights on 3 major theaters2.Exlusitivity agreements on bank machines in all theaters3.Customers wouldn’t like carrying multiple cards4.Constrained decision making power5.No access to individual level banking information

RECOMMENDATION:• Opt for partnership with Scotia bank• Advantages:– Cheapest and easiest way for Cineplex to grow its customer

base – benefit from dual strategy– Financial and data management risks would be shared– No barriers for contractual exits

• Modifications:– Execute a single card/cardless strategy– Equal decision making powers– In long term, aim to gather customer preferences via

advanced technology at PoS

2.EVALUATION OF POINTS SCHEMEOPTION 1 OPTION 2 OPTION 3 OPTION 4

Membership fee None– incentive enough for customers to join

1 time membership fee of just $2 – very low but still questionable

Annual fee of $5 – customers might be deterred from joining

None– incentive enough for customers to join

Concession discounts

None – no incentive for customers

10% – customers tempted to join

15% - too high discount ;costly for the company

10% – customers tempted to join

Sign up points 500 – too many points;1 free child admission

100 – too low points; might not be attractive enough

None – customers not tempted to join

250 – adequate points to tempt customers to join; no incentive yet but motivation exists

Value sum of benefits on reaching highest point level

$51.77 – too high a value for benefits; costly to support for company

$68.37 – moderate value at 2500 points but still prove to be costly

No benefits – no incentive for customer to join

$62.22 – good enough benefits for customers and none too costly for company

Value per point /Will it be too costly for the company?

$28.97 – lowest but not justified at no membership fee

$36.56 – highest but justification questionable

0 – no cost at all but no customer gained at all

$32.14 – moderate cost for the company

Will it appeal to customers?

Yes Yes/Might be No Yes

RECOMMENDATION:

• Moderate cost for the company• Attractive enough for customers

– No upfront membership fee– Adequate sign up points(250) – no incentive yet but motivates

customers to earn more points– Permanent discount for concessions

• Enhance share-of-wallet for Cineplex (reference link)

• But at higher level of points (2500-3000),introduce still attractive incentive schemes– Free concert/live event tickets– Anniversary celebrations – free concessions combo – Sweepstakes program

Choose option 4 as the suitable reward structure

3.SELECTING THE MARKETING COMMUNICATION CAMPAIGN

OBJECTIVE: Reach 500000 customers per year for 1st 3 years with a budget constraint of $300000

By partnering with Scotiabank,increase the customer reach while decreasing cost with dual strategy.

NEWSPAPERS RADIO ONLINE ADS GRASS ROOT INITIATIVES

National newspapers don’t have reach to every targeted segment. Regional newspapers do have reach but they are very costly to insert In and develop ads.

Significant overage in key markets. Low advertisement and development costs. Free advertisement space on many radio stations’ websites.

To target the young audience (16-24) online advertisements especially on music websites like mtv.ca and muchmusic.ca as well as Google could be done.

Engage in WOM publicity in a big way for young audience. Develop more promotional campaigns for universities and more in campus offers for special events. Target young working adults too by corporate sponsorships.

Rather than relying on newspaper ads, look out for other media .

Helpful in targeting the young segment(16-24)

Low advertisement costs per thousand impressions(25 Canadian dollars)

Engage in mobile advertisement and couponing to target young Smartphone users.

Rather than relying on just traditional advertisement media ,look out for more cost effective and non traditional ,mobile and online media that can enhance reach.

4.WEBSITE VENDOR SELECTION

• Opt for Gamma company.– Lowest initial investment costs - $200000– Vast experience in IT strategy and in developing

CRM programs for leading organizationsProgram proposals• Manage marketing platform and all aspects of e-

communications• Track members on -going basis through different

promotional media• Appealing fixed price, fixed time model

5.NATIONAL OR REGIONAL ROLLOUT

• Opt for a national rollout– Having partnership with one of Canada’s

important national bank would help in• Sharing financial risk• Boost cost efficiency• Increase program coverage via branches

– Accrue revenues faster– 2006’s new PoS installation had the technical

capability of supporting the national roll out.

DECISION SNAPSHOT

• Opt for partnership with Scotia bank• Opt for option 4 in reward program• Opt for online, radio and non traditional

media to target the youth segment• Opt for a national roll out in partnership with

Scotia bank.

THANK YOU