1163-1303-1-PB

-

Upload

anmoldhillon -

Category

Documents

-

view

214 -

download

0

Transcript of 1163-1303-1-PB

-

7/23/2019 1163-1303-1-PB

1/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 671

A Study on Role of Depository Participants in

Capital Market

*Dr.B.VenuGopalMBA., PhD, UGC Post Doctoral Fellow, Dept of SKIM, S.K.University, Anantapuramu, Andhra

Pradesh, INDIA,[email protected]

**Prof.C.N.Krishna NaikMBA., PhD ,FDP (IIMA), Professor, Dept of SKIM, S.K.University, Anantapuramu, Andhra

Pradesh, INDIA,[email protected]

ABSTRACT:

A Depository is an organization

where the securities of shareholders areheld in an electronic form at the request of

shareholder. It is an electronic solution to

problems of dealing in physical form andconducting transactions in capital market in

a more efficient and effective manner. The

Depository holds securities in an account,transfer securities between accountholders,

facilitates safekeeping of securities and

facilitates transfer of ownership without

transfer of securities. Depository system islong prevalent in the advanced countries

and has been playing a significant role in

the stock market around the world. Thesystem is time tested and reliable. In this

research paper attempt to bee made

objectives (i) To study residential status ofthe depository participants influence in

capital market.(ii) To study market segment

dealing of select depository participants.

This paper reveals chi-square calculated

value of 54.12 for 4 degrees of freedom ismore than the chi-square table value of

11.34 at 0.01 level of significance.Therefore it is concluded that the area statusof the depository participants has influence

on their capital market segment dealings.

the F calculated value = 97.22

which is more than F- table value(4.98) for 1= 2 and 2 = 47 at 0.01 level

of significance .There is significancedifference in the capital market segment

dealings of depository participants.

Key Words:Investor; Depository; DepositoryParticipants; Capital Market

INTRODUCTIONA Depository is an organizationwhere the securities of share holders areheld in the electronic format the request ofthe share holder through the medium of adepository participant. In September, 1995the Government have accepted in principlethe proposed law for settling up ofdepositories and of a central depository forimmobilization of physical certificates. Thecentral depository is to be set up as trust tohold the physical custody of shared andeffect transfers by book entries without theneed to deal and transfer the physicalcertificates between parties. This is to besponsored by public financial institutionsand banks and will have a minimum networth of Rs. 50-100 Crores as proposed bythe SEBI. A national securities depository

mailto:[email protected]:[email protected]:[email protected] -

7/23/2019 1163-1303-1-PB

2/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 672

corporation was set up in November, 1996.In the Depository system, the Depositoryextends its services to investors throughintermediaries called depository participants(DP) who as per SEBI regulations could be

organizations involved in the business ofproviding financial services like banks,broker, custodians and financial institutions.The admission of the DPs involve anevaluation by Depository of their capabilityto meet with the strict services standards ofDepository and a further evaluation andapproval by SEBI. Towards, the end of thetwentieth century three was two interestingprognostications about Indias potential. Thefirst was by a professor of business

management in the United States(Rosenweig, 1998). He estimated that by2025, India would be the third largesteconomy in the world (After the US andChina). The second projection was by awell-known Indian Economist (Parikh,1999). It was projected that India wouldreach a per capita income of U.S. $ 30,000or higher by 2047, making it one of thefastest growing countries in the world.Indian capital market has been linked to the

International Financial Market, and thestandard has been increased in terms ofefficiency and transparency throughDematerialization of the Indian CapitalMarket. In this context dematerialization isone of the right steps taken by theGovernment to make the share transferprocess easier and on other hand the earlierdemerits of the paper transfer process can berectified. Dematerialization is a process inwhich the company takes the physicalcertificates of an investor back andequivalent number of shares is credited inthe electronic holdings of the investor.

REVIEW OF LITERATUREThis section covers the review of

literature of some of the important studies,

research papers and articles on the variousaspects of depository system.Shah (1996)

1 highlighted that resolution of

the single vs. multiple depositories,immobilization vs. dematerialization and

role of capital adequacy norms for thecustodians which is helpful in quickimplementation of depository system inIndia.Aggarwal and Dixit (1996)

2expressed their

views about the legal framework fordepository system in India. They alsoexplained the benefits of the paperlesstrading, responsibilities of depository orparticipants and eligibility criteria, etc.Sarkar (1996)

3analyzed the implications of

the scrip less trading and share transferbased on book entry merely due to theexistence of the depository ordinance 1995.George (1996)

4 explained the role of the

NSDL in revolutionizing the paperless stocksettlement system of the country. He alsoexamined the steps taken by the depositoryto ensure that the scrip less trading system isa success and stressed on the importance ofthe role of the regulator in making thedepository system successful.

Gurusamy (1996)

5

explained that theintroduction of depository system wouldhelp in transfer of securities in the capitalmarket by a mere book entry. He alsopointed out the advantages of depositorysystem such as delay in transfer, registration,fake certificates, soaring cost oftransactions, more paper work, nonavailability of depositories in when thetransfer of securities take place by physicaldelivery.Hurkat and Ved (1999)

6discussed the role

of depository system in many advancedcountries in the stock and capital marketsthe world over. They also analyzed theservices offered by NSDL,dematerialization, re-materialization, tradingand fee or charges, comparison of a bank

-

7/23/2019 1163-1303-1-PB

3/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 673

and a depository for the benefits of thedepository.Ravi Shah (2002)

7 highlighted that NSDL

and CDSL have changed the face of theIndian capital market. The move from an

account period settlement in paper form onlyto a T+3 settlement in pure electronic formhas been achieved in a record span of fewyears, whereas it took anywhere between10-20 years in most of the developedcountries.Schmiedel et. al. (2006)

8 analyzed the

existence and extent of economies of scalein depository and settlement systems. Thestudy indicated the existence of significanteconomies of scale but degree of such

economies differs by settlement, institutionand region.Kanan (2008)

9 highlighted that

dematerialization has certainly broughtabout lot of improvement in the investmenthabits in our country and is bane for thecompanies and has created havoc inmaintaining the members register and inconducting the members meeting.Sultan Sing (2011)

10 tried to study the

factors affecting the decision making of the

investors in depository system. Most of theinvestors are of the view that shortersettlement period, safety of securities withthe depositories, attitude of the staffavailable with the DPs, timely servicesprovided by the DPs to the investors,reduction in transaction cost, repatriation ofsales proceeds of shares/debentures by NRIsare some of the factors which affects thedecision making of the investors indepository system.Dr.Dhiraj jain,P.Mehta (2012)

11The

investors level of awareness about servicesoffered by depository participants and aboutclosing and termination of demat account ismoderate through the vary in their educationqualification will be a sort of feedback forthe investor, brokers and regulatory bodies

as to what extent have the investors educateprogramme reached.

The earlier studies covered thedepository system and environment, whichmainly pertain to depository legislation, how

a viable alternative of depository,implications of depositories ordinance,internal audit of depository participants, anoverview of the Depositories Act,responsibilities of auditing profession, roleof depository in stock and capital market,SEBI guidelines in the depository system,services provided by different depositoriesor accessibility of depositories to retailinvestors. But it is very important to studythe Role and performance of depositories

itself. Therefore, the present study is anattempt to fill this gap.

NEED FOR THE STUDYIndian stock exchanges nowadays

are following screen based trading andelectronic settlement system. The marketwidth are also enlarged, quantity ofinvestors spread to various distance placesfrom trading and settlement place. There aresome problems arising in the settlement andtransfer system, in stock and share

trading. In this circumstance there are alimited number of studies in thisarea. Hence there is a need for evaluation ofdepository system with in the area ofinvestors perspective. The present study isin this direction of research analysiscovering role and performance of depositoryparticipants and the factors affecting thedecision making of investor towardsdepository participant.

SCOPE OF THE STUDYThe present study covers the role and

performance of the DPs and investors

Factors, attitudes towards depositoryparticipants and the four listed depositoryparticipants with special reference to aRayalaseema region of Andhra Pradesh.The scope of the study is very wide and

deep of a role of depository participants and

-

7/23/2019 1163-1303-1-PB

4/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 674

investors factors affecting and comparativeanalysis among listed four depositoryparticipants, impacts of concept as far asIndian Capital market is concerned. Further,globalization has given a new fillip into

financial markets and varied financialcompetitive Environment.

STATEMENT OF THE PROBLEMThe studies have explored the

various aspects in the depository system likecost aspects. Difficulties faced by theinvestor and others of the benefits availableto the investor. The Indian capital markethas witnessed numerous changes in therecent past as seen earlier. Traditionallystock market booms and decline have

resulted in a number of problems for the layinvestor. A close introspection of theseproblems will reveal that most of them aredue to intrinsic nature of the paper basedtrading and settlement system. The capitalmarket exposed the limitation of handlingand dealing in securities in physical/papermode. The short learnings of the marketbecame manifest in terms of bad deliveries,delays in transfer and irregular settlement.The remedial measure for this may be the

system of dematerialization (also calleddemat) under depositary system. Hence it isan attempt to study about The Role ofDepository Participants and Present scenarioWorking Frame work of NSDL(nationalsecurities depository limited)andCDSL(central depository system limited),factors affecting to investors perceptiontowards depository participants,performance, comparative analysis amonglisted depository participants inRayalaseema Region.

The Objectives of the Study Are

To study residential status ofthe depository participantsinfluence in capital market.

To study market segmentdealing of select depositoryparticipants.

Research Hypotheses

The main hypotheses formulated forthe study are as given below.

H0: The residential status of the depository

participants has no influence on theircapital market segment dealings.

H1: The residential status of the depositoryparticipants has influence on their capital

market segment dealings.

H0: There is no significance difference in

the market segment dealings of selectDepository participants.

H1: There is significance difference in the

market segment dealings of selectDepository participants.

Research Methodology

In order to achieve the objectives statedabove data and information have beencollected from both the primary andsecondary sources. The primary data havebeen collected through two structuredquestionnaires to investors (Annexure-I)

and intermediaries (Annexure-II). Apartfrom the questionnaires, discussions havebeen undertaken with the stock marketspecialists to elicit their opinion on variousmatters relating to depository system andinvestment decisions. Secondary data havebeen collected from reports, bulletins ofRBI, bulletins of SEBI, books, journals,magazines, conference papers etc.

Sampling

Four listed depositoryparticipant companies are selectedpurposively for the study via. 1.Karvy Securi ties Ltd. 2. India

Infoline Finance Ltd. 3. PCS

Securities Ltd. 4. Net Worth

Secur it ies Ltd. Rayalaseema regionis taken for the study. All the four

-

7/23/2019 1163-1303-1-PB

5/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 675

districts via. Anantapuramu,Kurnool, Kadapa and Chittoredistricts are covered for the study. Inorder to understand the attitude ofthe investors towards depository

system, depository participants andinvestment, a sample of 300investors are taken for the study onthe basis of simple random samplingmethod covering 160 investors infour urban areas, 100 investors infour semi urban areas and 40investors in four rural areas in all thefour districts of rayalaseema region.The places covred are Anantapuram,Dharmavaram, Kalyandurgam,

Kurnool, Nandyal, Arlagadha,Kadapa, Prodhuture, Mydhukure,Tirupathi, Chittoore, andMadanapalli.

A sample of 50 branches andfranchises of the select fourdepository participants in urban,semi-urban and rural areas are takenfor the study to understand theattitude of DPs on depository system.

The data and information

collected through questionnaire andfrom all the available sources areproperly analyzed and inferred toidentify the problems in depositorysystem to the investors and stockbrokers by using the followingstatistical tools.

Statistical Tools UsedThe data is analyzed based on

the following statistical Tools ANOVA, SD, Ratio,

Covariance.

Limitations of the Study

Any research by its inherentnature is bound to have some

limitations and this study is not anexception to that rule. The majorlimitation of the study is that it isrestricted to the Rayalaseema Regiononly and the size of the sample is

also limited. However an effort isbeing made to minimize the impactof this limitation by selectinginvestors from different areas of allthe districts of rayalaseema region.As this study is based on theresponses of the investors andintermediaries there is a possibilityof personal bias. Care has taken tobring down the impact by askingcross reference questions. Some of

the investors could not relatethemselves to the role of depositoryparticipants, depository services asthey were new entrants to themarket. The investment activity isthe outcome of innumerable factors.Where as in this study only a limitednumber of factors are considered.With all these limitations all theefforts are made to evaluate thesituation as accurately and

objectively as possible.Data Analysis:

It is an organized marketmechanism for effective and efficienttransfer of money capital or financialresources from the investing class ( abody of individual or institutionalsavers) to the entrepreneur class(individual or institutions engaged in

industry business or services) in theprivate and public sector of theeconomy.

-

7/23/2019 1163-1303-1-PB

6/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 676

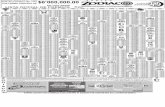

Table 1.1: Market Segments Dealt by Depository ParticipantsArea Wise

Source: Primary data and SPSS

The table 1.1 indicates thatall urban depository participantsconstitute 52 % of total depositoryparticipants who invested in equitysegment only but invested incommodity and other marketsegments. All semi-urban depositoryparticipants constitute 34 % of total

depository participants out of them26 % depository participantsinvested in all capital marketsegments where as eight percent ofdepository participants invested incommodities only. All ruraldepository participants constitute 14% of total depository participants

Segments Area wise Status Total

Urban Semi

Urban

Rural

Equity Count%within Segments

Deals with%within Area wise

status% of Total

26100.0%

100.0%

52.0%

0.0%

.0%

.0%

0.0%

.0%

.0%

26100.0%

52.0%

52.0%

CommodityCount

%within SegmentsDeals with

%within Area wisestatus

% of Total

0.0%

.0%

.0%

4100.0%

23.5%

8.0%

0.0%

.0%

.0%

4100.0%

8.0%

8.0%

ALLCount

%within SegmentsDeals with

%within Area wisestatus

% of Total

0.0%

.0%

.0%

1365.0%

76.5%

26.0%

735.0%

100.0%

14.0%

20100.0%

40.0%

40.0%

Total

Count%within Segments

Deals with%within Area wise

status% of Total

2652.0%

100.0%

52.0%

1734.0%

100.0%

34.0%

714.0%

100.0%

14.0%

50100.0%

100.0%

100.0%

-

7/23/2019 1163-1303-1-PB

7/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 677

and they invested in all capitalmarket segments. Therefore, it isobserved that majority of thedepository participants were fromurban area followed by semi-urban

and rural area. Moreover, majority(52 % of total) of the depositoryparticipants who comes under urbanare invested in equity segment onlyfollowed by semi urban and ruralarea (40% of total ) who invested inall capital market segments and 8 %

of total depository participants whocomes under semi-rural areainvested in commodities only.

H0 : The residential status of the

depository participants has no

influence on their capital marketsegment dealings.

H1 : The residential status of the

depository participants hasinfluence on their capital market

segment dealings.

Table 1.2 Chi-Square Test for testing the above Hypothesis

Value df Asysmp.Sig.

(2-sided)

Chi-Square

table value

Decision

Pearson Chi-Square

Likelihood Ratio

Linear-by-Linear

Association

N of Valid cases

54.118a

72.311

37.316

50

4

4

1

.000

.000

.000

11.34H0 is

Rejected

and H1is

Accepted

a. 5 cells (56.6%) have expected count less than 5.

The minimum expected count is 56.

The chi-square calculated

value of 54.12 for 4 degrees offreedom is more than the chi-squaretable value of 11.34 at 0.01 level ofsignificance. H0is rejected and H1isaccepted. Therefore it is concludedthat the area status of the depositoryparticipants has influence on theircapital market segment dealings.

Hence It is suggest todepository participants, SEBI ,mutual funds, investment advisor

and other intermediaries of capital

market should take necessary

measures for enhancing capitalmarket dealings of depositoryparticipants by considering theirresidential status and other manyfactors like risk bearing capacity,education, experience in thebusiness, income level, expectedreturns , capita requirements,etc.which promotes capital marketgrowth in addition to the increase inprofits and turnover of the depository

participants.Table 1.3 DP- Market Segment wise Analysis (ANOVA)

Source Sum of

Squares

Df Mean

Square

F Sig. Decision

Between

Groups

Within

47.418

11.462

2

47

23.709

.244

97.224 .000*

H0is

Rejected

-

7/23/2019 1163-1303-1-PB

8/8

International Journal of Research (IJR) Vol-1, Issue-11 December 2014 ISSN 2348-6848

P a g e | 678

Groups

Total 58.880 49

and H1is

Accepted

Source: Primary data & SPSS

* Significant at 0.01 level of significance.

H0: There is no significancedifference in the market segment

dealings of select Depository

participants.H1 : There is significance difference

in the market segment dealings of

select Depository participants.

The table 1.3 indicates thatthe F calculated value = 97.22 whichis more than F- table value (4.98) for1= 2 and 2 = 47 at 0.01 level of

significance .H0is rejected and H1isaccepted. i.e., there is significancedifference in the capital marketsegment dealings of depositoryparticipants. It is concluded thatthere is no unanimity among theselect depository participants withregard to dealings in the capitalmarket segments. It is suggested tothe select depository participants thatthey should have dealings in all

capital market segments so thatinvestors will be provided all theservices.

References:

1. Shah, Mahesh (1996), "A Care forDepositories in India", TheManagement Accountant, April, pp.259-261.

2. Aggarwal, V. K. and Dixit, S. K.(1996), The DepositoriesLegislation: A Critical Evaluation,"Chartered Secretary, April, pp. 367-376.

3. Sarkar, A. K. (1996), "Implicationsof Depositories Ordinance, 1995,"

The Management Accountant, June-July, pp. 473-477.

4. George, Philip (1996), Towards aPaperless Settlement System,Business World, October, pp. 134-135.

5. Gurusamy, S. (1996), "DepositorySystem-How a Viable Alternative",The Management Accountant, July,pp. 478-482.

6. Hurkat, Manoj and Ved, Umesh

(1999), Depositary-An InevitableInstitution", Chartered Secretary,September, pp. 991-993.

7. 11 Ravi, Shah (2002),Understanding Dematerialization,

The Management Accountant, pp.434.

8. Schmiedel, HeiKo, Malkamaki,Markku and Tarkka, Juha (2006),Economies of Scale andTechnological Development

Securities Depositories andSettlement System, Journal ofBanking and Finance, Vol. 30, Issue-6, pp.1783-1806

9. S. Kanan (2008), Market

Comparable Approach, Journal ofFinancial Services Research, Vol.24, No.2-3, pp. 121-148.

10.Prof. Sultan Sing and Sakshi Goyal(July 2011), Analysis Factor

Affecting the decision making of the

investors in Depository system,Journal of Banking, FinancialServices and Insurance Research,Vol. 1, pp. 13-38.