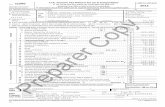

1120S U.S. Income Tax Return for an S Corporation …. Income Tax Return for an S Corporation Sign...

Transcript of 1120S U.S. Income Tax Return for an S Corporation …. Income Tax Return for an S Corporation Sign...

Practice

Return 13

1120S2017

U.S. Income Tax Return for an S Corporation

SignHere

PaidPreparerUse Only

Do not file this form unless the corporation has filed or is

attaching Form 2553 to elect to be an S corporation.

DA

TYPEB EOR

PRINTF

C

G

H (1) (2) (3) (4) (5)

I

1 a 1a

b 1b

c 1c

2 2

3 3

Inco

me

4 4

5 5

6 6

7 7

8 8

9 9

10 10

11 11

12 12

13 131414

15 15

16 16

17 17

18 18

19 19

20 20Ded

ucti

ons

21 21

22 a 22a

b 22b

c 22c

23 a 23a

b 23b

c 23c

d 23d

24 24

Tax

and

Pay

men

ts

25 25

26 26

27 Refunded 27

For Paperwork Reduction Act Notice, see separate instructions.

OMB No. 1545-0123

Go to www.irs.gov/Form 1120S for instructions and the latest information.

For calendar year 2017 or tax year beginning , 2017, ending , 20

$

Is the corporation electing to be an S corporation beginning with this tax year? Yes No If "Yes," attach Form 2553 if not already filed

Check if: Final return Name change Address change Amended return S election termination or revocation

Enter the number of shareholders who were shareholders during any part of the tax year

Caution: Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information.

Gross receipts or sales

Returns and allowances

Balance. Subtract line 1b from line 1a

Cost of goods sold (attach Form 1125-A)

Gross profit. Subtract line 2 from line 1c

Net gain (loss) from Form 4797, line 17 (attach Form 4797)

Other income (loss) (see instructions - attach statement)

Total income (loss). Add lines 3 through 5

Compensation of officers (see instructions - attach Form 1125-E)

Salaries and wages (less employment credits)

Repairs and maintenance

Bad debts

Rents

Taxes and licenses

InterestDepreciation not claimed on Form 1125-A or elsewhere on return (attach Form 4562)

Depletion (Do not deduct oil and gas depletion.)

Advertising

(see

inst

ruct

ions

for

limita

tions

)

Pension, profit-sharing, etc., plans

Employee benefit programs

Other deductions (attach statement)

Total deductions. Add lines 7 through 19

Ordinary business income (loss). Subtract line 20 from line 6

Excess net passive income or LIFO recapture tax (see instructions)

Tax from Schedule D (Form 1120S)

Add lines 22a and 22b (see instructions for additional taxes)

2017 estimated tax payments and 2016 overpayment credited to 2017

Tax deposited with Form 7004

Credit for federal tax paid on fuels (attach Form 4136)

Add lines 23a through 23c

Estimated tax penalty (see instructions). Check if Form 2220 is attached

Amount owed. If line 23d is smaller than the total of lines 22c and 24, enter amount owed

Overpayment. If line 23d is larger than the total of lines 22c and 24, enter amount overpaid

Enter amount from line 26 Credited to 2018 estimated tax

Form 1120S (2017)

Employer identification number

Form

Department of the TreasuryInternal Revenue Service

NameS election effective date

Number, street, and room or suite no. If a P.O. box, see instructions.Business activity code Date incorporatednumber (see instructions)

City or town, state or province, country, and ZIP or foreign postal code Total assets (see instructions)

Check if Sch. M-3 attached

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to May the IRS discuss this returnthe best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on

with the preparer shown belowall information of which preparer has any knowledge.

(see instructions)? Yes No

TitleSignature of officer Date

Print/Type preparer's name Preparer's signature Date PTINCheck if

self-employed

Firm's name Firm's EIN

Firm's address Phone no.

EEA

.................

...............................................

...............................................................................................................

.............................................

...............................................

..................................................................

............................................................................................

.......................................................................................

.....................................

..............................................................................

......................................................................

...............................................

......................

......................

...............................

................................................

...........

SUNSHINE S CORP05-15-2003 40-0006013

464 BRIGHT LANE 05-15-2002424400

NORTH MIAMI BEACH FL 33160 131,434X

4

575,00033,200

541,800146,960394,840

Statement #1 22,477417,31769,00055,0004,000

24,000Wks Tax/Lic 24,500

1,875

7,000

Statement #2 55,175240,550176,767

XSOLAR WINDS PRESIDENT, CEO, AND DIR

John Doe 03-01-2018 P12345678The Tax Firm1234 Tax LaneAnytown US 28734

Practice

Return 13Schedule B Other Information (see instructions) 1 a b Yes No

c

2

3

4

a

b

5 a

(i)

(ii)

b

(i)

(ii)

6

7

8

9

10

a

b

11

12

13 a

b

Form 1120S (2017) Page 2

Check accounting method: Cash Accrual

Other (specify)

See the instructions and enter the:

a Business activity b Product or service

At any time during the tax year, was any shareholder of the corporation a disregarded entity, a trust, an estate, or a

nominee or similar person? If "Yes," attach Schedule B-1, Information on Certain Shareholders of an S Corporation

At the end of the tax year, did the corporation:

Own directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any

foreign or domestic corporation? For rules of constructive ownership, see instructions. If "Yes," complete (i) through (v)

below

Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or

capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a

trust? For rules of constructive ownership, see instructions. If "Yes," complete (i) through (v) below

At the end of the tax year, did the corporation have any outstanding shares of restricted stock?

If "Yes," complete lines (i) and (ii) below.

Total shares of restricted stock

Total shares of non-restricted stock

At the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments?

If "Yes," complete lines (i) and (ii) below.

Total shares of stock outstanding at the end of the tax year

Total shares of stock outstanding if all instruments were executed

Has this corporation filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide

information on any reportable transaction?

Check this box if the corporation issued publicly offered debt instruments with original issue discount

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount

Instruments.

If the corporation: (a) was a C corporation before it elected to be an S corporation or the corporation acquired an

asset with a basis determined by reference to the basis of the asset (or the basis of any other property) in

the hands of a C corporation and (b) has net unrealized built-in gain in excess of the net recognized built-in gain

from prior years, enter the net unrealized built-in gain reduced by net recognized built-in gain from prior years (see

instructions) $

Enter the accumulated earnings and profits of the corporation at the end of the tax year. $

Does the corporation satisfy both of the following conditions?

The corporation's total receipts (see instructions) for the tax year were less than $250,000

The corporation's total assets at the end of the tax year were less than $250,000

If "Yes," the corporation is not required to complete Schedules L and M-1.

During the tax year, did the corporation have any non-shareholder debt that was canceled, was forgiven, or had the

terms modified so as to reduce the principal amount of the debt?

If "Yes," enter the amount of principal reduction $

During the tax year, was a qualified subchapter S subsidiary election terminated or revoked? If "Yes," see instructions

Did the corporation make any payments in 2017 that would require it to file Form(s) 1099?

If "Yes," did the corporation file or will it file required Forms 1099?

Form 1120S (2017)

(v)(ii) (iii) (iv)

(i)

(iv) (v)(i) (iii)

If Percentage in (iv) is 100%, Enter theEmployer Identification Number Country of Percentage of Stock

Name of Corporation Date (if any) a Qualified Subchapter S(if any) Incorporation Owned

Subsidiary Election Was Made

(ii) Employer Identification Number Country of Maximum Percentage Owned in Profit,Name of Entity Type of Entity

(if any) Organization Loss, or Capital

EEA

........

.............................................................

...............

.................

....................................

......

............

....................................................

.......................

.........................................

................................

............................

................................

SUNSHINE S CORP 40-0006013

X

WHOLESALE FOOD

X

X

X

X

X

X

X

X

XX

Practice

Return 13

Alt

ern

ativ

e

(AM

T)

Item

sM

inim

um

Tax

Bas

isS

har

eho

lder

Item

s A

ffec

tin

g

Schedule K Shareholders' Pro Rata Share Items Total amount

11 1

2 2

3a 3a

b 3b

c 3c

4 4

5 5a

5b

6 6

7 7

Inco

me

(Lo

ss)

8a 8a

b 8b

c 8c

9 9

10 10

11 11

12a 12a

b 12b

c (1) (2)

Ded

ucti

ons

12dd13a 13a

b 13b

c 13c

d 13d

e 13e

Cre

dits

f 13f

g 13g

14a

b 14b

c 14c

d 14d

e 14e

f 14f

g 14g

h 14h

i 14i

Fore

ign

Tra

nsac

tio

ns

j 14j

k 14k

l 14l

m 14m

n

15a 15a

b 15b

c 15c

d 15d

e 15e

f 15f

16a 16a

b 16b

c 16c

d 16d

e 16e

Form 1120S (2017) Page 3

Ordinary business income (loss) (page 1, line 21)

Net rental real estate income (loss) (attach Form 8825)

Other gross rental income (loss)

Expenses from other rental activities (attach statement)

Other net rental income (loss). Subtract line 3b from line 3a

Interest income

Dividends: a Ordinary dividends

b Qualified dividends

Royalties

Net short-term capital gain (loss) (attach Schedule D (Form 1120S))

Net long-term capital gain (loss) (attach Schedule D (Form 1120S))

Collectibles (28%) gain (loss)

Unrecaptured section 1250 gain (attach statement)

Net section 1231 gain (loss) (attach Form 4797)

Other income (loss) (see instructions) Type

Section 179 deduction (attach Form 4562)

Charitable contributions

Investment interest expense

Section 59(e)(2) expenditures Type Amount

Other deductions (see instructions) Type

Low-income housing credit (section 42(j)(5))

Low-income housing credit (other)

Qualified rehabilitation expenditures (rental real estate) (attach Form 3468, if applicable)

Other rental real estate credits (see instructions) Type

Other rental credits (see instructions) Type

Biofuel producer credit (attach Form 6478)

Other credits (see instructions) Type

Name of country or U.S. possession

Gross income from all sources

Gross income sourced at shareholder level

Foreign gross income sourced at corporate level

Passive category

General category

Other (attach statement)

Deductions allocated and apportioned at shareholder level

Interest expense

Other

Deductions allocated and apportioned at corporate level to foreign source income

Passive category

General category

Other (attach statement)

Other information

Total foreign taxes (check one): Paid Accrued

Reduction in taxes available for credit (attach statement)

Other foreign tax information (attach statement)

Post-1986 depreciation adjustment

Adjusted gain or loss

Depletion (other than oil and gas)

Oil, gas, and geothermal properties - gross income

Oil, gas, and geothermal properties - deductions

Other AMT items (attach statement)

Tax-exempt interest income

Other tax-exempt income

Nondeductible expenses

Distributions (attach statement if required) (see instructions)

Repayment of loans from shareholders

Form 1120S (2017)

12c(2)

EEA

...............................................

.........................

..............................................................

.................................

...............................................................

................

....................................

...................................

..............................

.........................................................................

..............................

.......................................

.........

.......................................

..............................................................

.........................................

.............................................. ...............................

........................................................................................

.........................................

..............................................................................

.......................................

.......................................................................

..........................................................

..........................................................

..............................................................................................................

.................................................

SUNSHINE S CORP 40-0006013

176,767

150,000

Practice

Return 13Mortgages, notes, bonds payable in less than 1 year

Mortgages, notes, bonds payable in 1 year or more

Adjustments to shareholders' equity (attach statement)

Balance Sheets per Books

Shareholders' Pro Rata Share Items (continued)Schedule K

Schedule L

Total amount

17 a 17a

b 17b

c 17c

d

18

18

Assets (a) (b) (c) (d)

1

2a

b

3

4

5

6

7

8

9

10a

b

11a

b

12

13a

b

14

15

Liabilities and Shareholders' Equity

16

17

18

19

20

21

22

23

24

25

26

27

Form 1120S (2017) Page 4

Investment income

Investment expenses

Dividend distributions paid from accumulated earnings and profits

Other items and amounts (attach statement)

Income/loss reconciliation. Combine the amounts on lines 1 through 10 in the far right

column. From the result, subtract the sum of the amounts on lines 11 through 12d and 14I

Beginning of tax year End of tax year

Cash

Trade notes and accounts receivable

Less allowance for bad debts ( ) ( )

Inventories

U.S. government obligations

Tax-exempt securities (see instructions)

Other current assets (attach statement)

Loans to shareholders

Mortgage and real estate loans

Other investments (attach statement)

Buildings and other depreciable assets

Less accumulated depreciation ( ) ( )

Depletable assets

Less accumulated depletion ( ) ( )

Land (net of any amortization)

Intangible assets (amortizable only)

Less accumulated amortization ( ) ( )

Other assets (attach statement)

Total assets

Accounts payable

Other current liabilities (attach statement)

Loans from shareholders

Other liabilities (attach statement)

Capital stock

Additional paid-in capital

Retained earnings

Less cost of treasury stock ( ) ( )

Total liabilities and shareholders' equity

Form 1120S (2017)

Oth

erIn

form

atio

nR

eco

n-

cilia

tio

n

EEA

.............................................................................

................

....

.....................

......................

...........

................

.....

..................

..............

................

................

............

..........

....................

.....................

..........

SUNSHINE S CORP 40-0006013

176,767

31,477 58,8196,000 8,500

6,000 8,50020,000 18,000

304,000 304,000256,010 47,990 257,885 46,115

105,467 131,434

3,600 2,800

5,000 5,000

96,867 123,634

105,467 131,434

Practice

Return 13Income recorded on books this year not included

Income included on Schedule K, lines 1, 2, 3c, 4, on Schedule K, lines 1 through 10 (itemize):

5a, 6, 7, 8a, 9, and 10, not recorded on books this

year (itemize):

Income (loss) (Schedule K, line 18). Line 4 less line 7

Balance at end of tax year. Subtract line 7 from line 6

Analysis of Accumulated Adjustments Account, Other Adjustments Account, and Shareholders'Undistributed Taxable Income Previously Taxed (see instructions)

Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return

Schedule M-2

1 5

2

a

3 6

a a

b

7

4 8

1

2

3

4

5

6

7

8

Form 1120S (2017) Page 5

Note: The corporation may be required to file Schedule M-3 (see instructions)

Net income (loss) per books

Tax-exempt interest $

Expenses recorded on books this year not Deductions included on Schedule K,

included on Schedule K, lines 1 through 12 and lines 1 through 12 and 14l , not charged

14l (itemize): against book income this year (itemize):

Depreciation $ Depreciation $

Travel and entertainment $

Add lines 5 and 6

Add lines 1 through 3

(a) Accumulated (b) Other adjustments (c) Shareholders' undistributedadjustments account account taxable income previously taxed

Balance at beginning of tax year

Ordinary income from page 1, line 21

Other additions

Loss from page 1, line 21 ( )

Other reductions ( ) ( )

Combine lines 1 through 5

Distributions other than dividend distributions

Form 1120S (2017)EEA

........

.......................

..........

........................

.......................

.

SUNSHINE S CORP 40-0006013

176,767

176,767 176,767

96,867176,767

273,634150,000123,634

Practice

Return 13OMB No. 1545-0123

Cost of Goods Sold1125-AAttach to Form 1120, 1120-C, 1120-F, 1120S, 1065, or 1065-B.

1 1

2 2

3 3

4 4

5 5

6 6

7 7

8

8

9a

b

c

d

9d

e

f

For Paperwork Reduction Act Notice, see instructions

Form

Information about Form 1125-A and its instructions is at www.irs.gov/form1125a.

Inventory at beginning of year

Purchases

Cost of labor

Additional section 263A costs (attach schedule)

Other costs (attach schedule)

Total. Add lines 1 through 5

Inventory at end of year

Cost of goods sold. Subtract line 7 from line 6. Enter here and on Form 1120, page 1, line 2 or the

appropriate line of your tax return. See instructions

Check all methods used for valuing closing inventory:

(i) Cost

(ii) Lower of cost or market

(iii) Other (Specify method used and attach explanation.)

Check if there was a writedown of subnormal goods

Check if the LIFO inventory method was adopted this tax year for any goods (if checked, attach Form 970)

If the LIFO inventory method was used for this tax year, enter amount of closing inventory computed

under LIFO

If property is produced or acquired for resale, do the rules of section 263A apply to the entity? See instructions Yes No

Was there any change in determining quantities, cost, or valuations between opening and closing inventory? If "Yes,"

attach explanation Yes No

Form 1125-A (Rev. 10-2016)

Employer identification number

(Rev. October 2016)

Department of the TreasuryInternal Revenue Service

Name

EEA

.............................................................................................................................

...................................................................................................

.......................................

.........................

....................................................

.....................................................

...................................................

SUNSHINE S CORP 40-000601320,000130,96014,000

164,96018,000

146,960

X

X

Practice

Return 13OMB No. 1545-0123

For calendar year 2017, or tax year

beginning ending2017

For

IRS

Use

Onl

y2017

671117

Shareholder's Share of Income, Deductions,Credits, etc.

Schedule K-1Part III(Form 1120S)

Part I Information About the Corporation

Part II Information About the Shareholder

Shareholder's Share of Current Year Income,

Deductions, Credits, and Other Items

%

* See attached statement for additional information.

1 13

2

3See page 2 of form and separate instructions.

4

A

5a

B

5b 14

6

7

C 8a

8b

8cD

9E

10 15

F

11 16

12

17

For Paperwork Reduction Act Notice, see the Instructions for Form 1120S. Schedule K-1 (Form 1120S) 2017

Final K-1 Amended K-1

Department of the Treasury Ordinary business income (loss) CreditsInternal Revenue Service

Net rental real estate income (loss)

Other net rental income (loss)

Interest income

Corporation's employer identification number

Ordinary dividends

Corporation's name, address, city, state, and ZIP code

Qualified dividends Foreign transactions

Royalties

Net short-term capital gain (loss)

IRS Center where corporation filed return Net long-term capital gain (loss)

Collectibles (28%) gain (loss)

Unrecaptured section 1250 gainShareholder's identifying number

Net section 1231 gain (loss)Shareholder's name, address, city, state, and ZIP code

Other income (loss) Alternative minimum tax (AMT) items

Shareholder's percentage of stockownership for tax year

Section 179 deduction Items affecting shareholder basis

Other deductions

Other information

www.irs.gov/Form1120S

EEA

..........

17,677

40-0006013

SUNSHINE S CORP

464 BRIGHT LANE

NORTH MIAMI BEACH FL 33160

E-FILE

400-00-8111

SOLAR WINDS

444 TULIP LANEMIAMI FL 33180

10.00000

D 15,000

Practice

Return 13Schedule K-1 Distribution Information 2017

Total Amount of Ownership % at Shareholder's Pro Rata

Date of Distribution Distribution Date of Distribution Shares Share of Distribution

Shareholder's name Shareholder's ID Number

Name of S Corporation S Corporation's EIN

1120SK_1.LD2

SOLAR WINDS 400-00-8111

SUNSHINE S CORP 40-0006013

03-03-2017 50,000 10.00 020.00000 5,00011-06-2017 100,000 10.00 020.00000 10,000__________

____________________TOTAL 15,000

Practice

Return 13OMB No. 1545-0123

For calendar year 2017, or tax year

beginning ending2017

For

IRS

Use

Onl

y2017

671117

Shareholder's Share of Income, Deductions,Credits, etc.

Schedule K-1Part III(Form 1120S)

Part I Information About the Corporation

Part II Information About the Shareholder

Shareholder's Share of Current Year Income,

Deductions, Credits, and Other Items

%

* See attached statement for additional information.

1 13

2

3See page 2 of form and separate instructions.

4

A

5a

B

5b 14

6

7

C 8a

8b

8cD

9E

10 15

F

11 16

12

17

For Paperwork Reduction Act Notice, see the Instructions for Form 1120S. Schedule K-1 (Form 1120S) 2017

Final K-1 Amended K-1

Department of the Treasury Ordinary business income (loss) CreditsInternal Revenue Service

Net rental real estate income (loss)

Other net rental income (loss)

Interest income

Corporation's employer identification number

Ordinary dividends

Corporation's name, address, city, state, and ZIP code

Qualified dividends Foreign transactions

Royalties

Net short-term capital gain (loss)

IRS Center where corporation filed return Net long-term capital gain (loss)

Collectibles (28%) gain (loss)

Unrecaptured section 1250 gainShareholder's identifying number

Net section 1231 gain (loss)Shareholder's name, address, city, state, and ZIP code

Other income (loss) Alternative minimum tax (AMT) items

Shareholder's percentage of stockownership for tax year

Section 179 deduction Items affecting shareholder basis

Other deductions

Other information

www.irs.gov/Form1120S

EEA

..........

88,384

40-0006013

SUNSHINE S CORP

464 BRIGHT LANE

NORTH MIAMI BEACH FL 33160

E-FILE

400-00-8112

SUN FLOWERS

333 IRIS ROADMIAMI FL 33180

50.00000

D 75,000

Practice

Return 13Schedule K-1 Distribution Information 2017

Total Amount of Ownership % at Shareholder's Pro Rata

Date of Distribution Distribution Date of Distribution Shares Share of Distribution

Shareholder's name Shareholder's ID Number

Name of S Corporation S Corporation's EIN

1120SK_1.LD2

SUN FLOWERS 400-00-8112

SUNSHINE S CORP 40-0006013

03-03-2017 50,000 50.00 100.00000 25,00011-06-2017 100,000 50.00 100.00000 50,000__________

____________________TOTAL 75,000

Practice

Return 13OMB No. 1545-0123

For calendar year 2017, or tax year

beginning ending2017

For

IRS

Use

Onl

y2017

671117

Shareholder's Share of Income, Deductions,Credits, etc.

Schedule K-1Part III(Form 1120S)

Part I Information About the Corporation

Part II Information About the Shareholder

Shareholder's Share of Current Year Income,

Deductions, Credits, and Other Items

%

* See attached statement for additional information.

1 13

2

3See page 2 of form and separate instructions.

4

A

5a

B

5b 14

6

7

C 8a

8b

8cD

9E

10 15

F

11 16

12

17

For Paperwork Reduction Act Notice, see the Instructions for Form 1120S. Schedule K-1 (Form 1120S) 2017

Final K-1 Amended K-1

Department of the Treasury Ordinary business income (loss) CreditsInternal Revenue Service

Net rental real estate income (loss)

Other net rental income (loss)

Interest income

Corporation's employer identification number

Ordinary dividends

Corporation's name, address, city, state, and ZIP code

Qualified dividends Foreign transactions

Royalties

Net short-term capital gain (loss)

IRS Center where corporation filed return Net long-term capital gain (loss)

Collectibles (28%) gain (loss)

Unrecaptured section 1250 gainShareholder's identifying number

Net section 1231 gain (loss)Shareholder's name, address, city, state, and ZIP code

Other income (loss) Alternative minimum tax (AMT) items

Shareholder's percentage of stockownership for tax year

Section 179 deduction Items affecting shareholder basis

Other deductions

Other information

www.irs.gov/Form1120S

EEA

..........

35,353

40-0006013

SUNSHINE S CORP

464 BRIGHT LANE

NORTH MIAMI BEACH FL 33160

E-FILE

400-00-8113

SUMMER FLOWERS

555 ROSE CIRCLEMIAMI FL 33180

20.00000

D 30,000

Practice

Return 13Schedule K-1 Distribution Information 2017

Total Amount of Ownership % at Shareholder's Pro Rata

Date of Distribution Distribution Date of Distribution Shares Share of Distribution

Shareholder's name Shareholder's ID Number

Name of S Corporation S Corporation's EIN

1120SK_1.LD2

SUMMER FLOWERS 400-00-8113

SUNSHINE S CORP 40-0006013

03-03-2017 50,000 20.00 040.00000 10,00011-06-2017 100,000 20.00 040.00000 20,000__________

____________________TOTAL 30,000

Practice

Return 13OMB No. 1545-0123

For calendar year 2017, or tax year

beginning ending2017

For

IRS

Use

Onl

y2017

671117

Shareholder's Share of Income, Deductions,Credits, etc.

Schedule K-1Part III(Form 1120S)

Part I Information About the Corporation

Part II Information About the Shareholder

Shareholder's Share of Current Year Income,

Deductions, Credits, and Other Items

%

* See attached statement for additional information.

1 13

2

3See page 2 of form and separate instructions.

4

A

5a

B

5b 14

6

7

C 8a

8b

8cD

9E

10 15

F

11 16

12

17

For Paperwork Reduction Act Notice, see the Instructions for Form 1120S. Schedule K-1 (Form 1120S) 2017

Final K-1 Amended K-1

Department of the Treasury Ordinary business income (loss) CreditsInternal Revenue Service

Net rental real estate income (loss)

Other net rental income (loss)

Interest income

Corporation's employer identification number

Ordinary dividends

Corporation's name, address, city, state, and ZIP code

Qualified dividends Foreign transactions

Royalties

Net short-term capital gain (loss)

IRS Center where corporation filed return Net long-term capital gain (loss)

Collectibles (28%) gain (loss)

Unrecaptured section 1250 gainShareholder's identifying number

Net section 1231 gain (loss)Shareholder's name, address, city, state, and ZIP code

Other income (loss) Alternative minimum tax (AMT) items

Shareholder's percentage of stockownership for tax year

Section 179 deduction Items affecting shareholder basis

Other deductions

Other information

www.irs.gov/Form1120S

EEA

..........

35,353

40-0006013

SUNSHINE S CORP

464 BRIGHT LANE

NORTH MIAMI BEACH FL 33160

E-FILE

400-00-8114

OCEAN BREEZE

777 DAISY COURT PLACEMIAMI FL 33180

20.00000

D 30,000

Practice

Return 13Schedule K-1 Distribution Information 2017

Total Amount of Ownership % at Shareholder's Pro Rata

Date of Distribution Distribution Date of Distribution Shares Share of Distribution

Shareholder's name Shareholder's ID Number

Name of S Corporation S Corporation's EIN

1120SK_1.LD2

OCEAN BREEZE 400-00-8114

SUNSHINE S CORP 40-0006013

03-03-2017 50,000 20.00 040.00000 10,00011-06-2017 100,000 20.00 040.00000 20,000__________

____________________TOTAL 30,000

Practice

Return 131125-E Compensation of Officers

Attach to Form 1120, 1120-C, 1120-F, 1120-REIT, 1120-RIC, or 1120S.

1

2 2

3 3

4

4

For Paperwork Reduction Act Notice, see separate instructions.

Form

OMB No. 1545-0123

Information about Form 1125-E and its separate instructions is at www.irs.gov/form1125e.

Note: Complete Form 1125-E only if total receipts are $500,000 or more. See instructions for definition of total receipts.

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

% % %

%% %

%% %

% % %

Total compensation of officers

Compensation of officers claimed on Form 1125-A or elsewhere on return

Subtract line 3 from line 2. Enter the result here and on Form 1120, page 1, line 12 or the

appropriate line of your tax return

Form 1125-E (Rev. 10-2016)

Employer identification number

(Rev. October 2016)

Department of the TreasuryInternal Revenue Service

Name

(c) Percent of Percent of stock owned(b) Social security number (f) Amount of(a) Name of officer time devoted to

(see instructions) compensationbusiness (d) Common (e) Preferred

EEA

........................................

..................

......................................

SUNSHINE S CORP 40-0006013

69,000

69,000

SOLAR WINDS 400-00-8111 100 10 10,000

SUN FLOWERS 400-00-8112 100 50 15,000

SUMMER FLOWERS 400-00-8113 100 20 15,000

OCEAN BREEZE 400-00-8114 100 20 15,000

BREAKING WINDS 400-00-8115 100 0 14,000

Practice

Return 13

OMB No. 1545-0172

AttachmentSequence No.

Section A

Section B - Assets Placed in Service During 2017 Tax Year Using the General Depreciation System

Section C - Assets Placed in Service During 2017 Tax Year Using the Alternative Depreciation System

Note: If you have any listed property, complete Part V before you complete Part I.

(Don't include listed property.) (See instructions.)

(Don't include listed property.) (See instructions.)

(See instructions.)

45622017

Depreciation and Amortization(Including Information on Listed Property)

179

Part I Election To Expense Certain Property Under Section 179

Part II Special Depreciation Allowance and Other Depreciation

Part III MACRS Depreciation

Part IV Summary

Attach to your tax return.

1 1

2 2

3 3

4 4

5

5

6

7 7

8 8

9 9

10 10

11 11

12 12

13 13

14

14

15 15

16 16

17 17

18

19a

b

c

d

e

f

g

h

i

20a

b

c

21 21

22

22

23

23

For Paperwork Reduction Act Notice, see separate instructions.

Form

Go to www.irs.gov/Form4562 for instructions and the latest information.

Maximum amount (see instructions)

Total cost of section 179 property placed in service (see instructions)

Threshold cost of section 179 property before reduction in limitation (see instructions)

Reduction in limitation. Subtract line 3 from line 2. If zero or less, enter -0-

Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing

separately, see instructions

Listed property. Enter the amount from line 29

Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7

Tentative deduction. Enter the smaller of line 5 or line 8

Carryover of disallowed deduction from line 13 of your 2016 Form 4562

Business income limitation. Enter the smaller of business income (not less than zero) or line 5 (see instructions)

Section 179 expense deduction. Add lines 9 and 10, but don't enter more than line 11

Carryover of disallowed deduction to 2018. Add lines 9 and 10, less line 12

Note: Don't use Part II or Part III below for listed property. Instead, use Part V.

Special depreciation allowance for qualified property (other than listed property) placed in service

during the tax year (see instructions)

Property subject to section 168(f)(1) election

Other depreciation (including ACRS)

MACRS deductions for assets placed in service in tax years beginning before 2017

If you are electing to group any assets placed in service during the tax year into one or more general

asset accounts, check here

3-year property

5-year property

7-year property

10-year property

15-year property

20-year property

25-year property 25 yrs. S/L

Residential rental 27.5 yrs. MM S/L

property 27.5 yrs. MM S/L

Nonresidential real 39 yrs. MM S/L

property MM S/L

Class life S/L

12-year 12 yrs. S/L

40-year 40 yrs. MM S/L

Listed property. Enter amount from line 28

Total. Add amounts from line 12, lines 14 through 17, lines 19 and 20 in column (g), and line 21. Enter

here and on the appropriate lines of your return. Partnerships and S corporations - see instructions

For assets shown above and placed in service during the current year, enter the

portion of the basis attributable to section 263A costs

Form 4562 (2017)

Identifying number

(a) (b) (c)

(b) (c)(d)

(a) (e) (f) (g)

Department of the TreasuryInternal Revenue Service (99)

Name(s) shown on return Business or activity to which this form relates

Description of property Cost (business use only) Elected cost

Month and year Basis for depreciationRecoveryplaced in (business/investment useClassification of property Convention Method Depreciation deductionperiodservice only-see instructions)

EEA

.....................................................

.........................

.......................................

............................

..........................................

..........

................................................................

..................................

............

..................................

...............................

....

.............

SUNSHINE S CORP FORM 1120S 40-0006013

1,875

1,875

Practice

Return 13Section B - Information on Use of Vehicles

Yes No Yes No Yes No Yes No Yes No Yes No

Section C - Questions for Employers Who Provide Vehicles for Use by Their Employees

Yes No

(Include automobiles, certain other vehicles, certain aircraft, certain computers, and property used for entertainment, recreation, or amusement.)

Note: For any vehicle for which you are using the standard mileage rate or deducting lease expense, complete only 24a,24b, columns (a) through (c) of Section A, all of Section B, and Section C if applicable.

Section A - Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles.)

Answer these questions to determine if you meet an exception to completing Section B for vehicles used by employees who aren'tmore than 5% owners or related persons (see instructions).

Part V Listed Property

Part VI Amortization

24a Yes No Yes No

25

25

26

27

28 28

29 29

30

31

32

33

34

35

36

37

38

39

40

41

42

43 43

44 44

Form 4562 (2017) Page 2

24b If "Yes," is the evidence written?

Special depreciation allowance for qualified listed property placed in service during

the tax year and used more than 50% in a qualified business use (see instructions)

Property used more than 50% in a qualified business use:

%

%

%

Property used 50% or less in a qualified business use:

% S/L-

% S/L-

% S/L-

Add amounts in column (h), lines 25 through 27. Enter here and on line 21, page 1

Add amounts in column (i), line 26. Enter here and on line 7, page 1

Complete this section for vehicles used by a sole proprietor, partner, or other "more than 5% owner," or related person. If you provided vehicles

to your employees, first answer the questions in Section C to see if you meet an exception to completing this section for those vehicles.

Total business/investment miles driven during

the year (don't include commuting miles)

Total commuting miles driven during the year

Total other personal (noncommuting)

miles driven

Total miles driven during the year. Add

lines 30 through 32

Was the vehicle available for personal

use during off-duty hours?

Was the vehicle used primarily by a more

than 5% owner or related person?

Is another vehicle available for personal use?

Do you maintain a written policy statement that prohibits all personal use of vehicles, including commuting, by

your employees?

Do you maintain a written policy statement that prohibits personal use of vehicles, except commuting, by your

employees? See the instructions for vehicles used by corporate officers, directors, or 1% or more owners

Do you treat all use of vehicles by employees as personal use?

Do you provide more than five vehicles to your employees, obtain information from your employees about the

use of the vehicles, and retain the information received?

Do you meet the requirements concerning qualified automobile demonstration use? (See instructions.)

Note: If your answer to 37, 38, 39, 40, or 41 is "Yes," don't complete Section B for the covered vehicles.

Amortization of costs that begins during your 2017 tax year (see instructions):

Amortization of costs that began before your 2017 tax year

Total. Add amounts in column (f). See the instructions for where to report

Form 4562 (2017)

(c) (e) (i)(a) (b) (d) (f) (g) (h)

(a) (b) (c) (d) (e) (f)

(e)(b) (c) (d) (f)(a)

Do you have evidence to support the business/investment use claimed?

Business/ Basis for depreciationType of property (list Date placed Cost or other basis Recovery Method/ Depreciation Elected section 179

investment use (business/investmentvehicles first) in service period Convention deduction cost

percentage use only)

Vehicle 1 Vehicle 2 Vehicle 3 Vehicle 4 Vehicle 5 Vehicle 6

AmortizationDate amortization Amortizable amount Code section Amortization for this year

period orDescription of costs beginspercentage

EEA

..........

...................................

.

...............

...........

........

....

....................................................

........................................

.............................................

..........................................

SUNSHINE S CORP 40-0006013

ASSET 4 04132010100.0 66,000 66,000 5 200 DB-HY 1,875

1,875

FORM 1120S - LINE 5 - OTHER INCOME

PG01

SUNSHINE S CORP 40-0006013

Statement #1

DESCRIPTION AMOUNTINTEREST INCOME ON RECEIVABLES 4,500TAXABLE INCOME FROM INSURANCE PROCEEDS 17,977______________

____________________________TOTAL 22,477

FORM 1120S - LINE 19 - OTHER DEDUCTIONSPG01

Statement #2

DESCRIPTION AMOUNTACCOUNTING 850BANK CHARGES 450CELL PHONE 350EDUCATION AND TRAINING 2,950INDEPENDENT CONTRACTOR 9,000BUILDING AND EQUIPMENT INSURANCE 1,200LIABILITY INSURANCE 2,500WORKERS COMP INSURANCE 5,000INTERNET 350JANITORIAL 11,000LEGAL AND PROFESSIONAL 3,000MARKETING 1,750POSTAGE/SHIPPING 750PRINTING 1,500SOFTWARE 1,000SUPPLIES 3,000TELEPHONE 575TRAVEL 6,200UTILITIES 3,750______________

____________________________TOTAL 55,175

SUNSHINE S CORP 40-0006013

PG01

Statement #EL29

Notification of Termination of S Status

This is to provide notification under Regulation 1.1362-2(b)(1) thatSUNSHINE S CORP has terminated its S status effective as of , due to .In connection with this notification, the following information ishereby submitted:SUNSHINE S CORP will file its final S corporation return for theperiod 01-01-2017 through 12-31-2017. If required, SUNSHINE S CORPwill file a short-period C corporation return for the period01-01-2018 through .___________________________________ __________________________________Signature of Officer Title

Practice

Return 132017

Taxes and Licenses Attachment

Taxes and Licenses Form 1120S Page 1, Line 12

1 1

2 2

3 3

4 4

5 5

6 6

7 7

8 8

9 9

10 10

11 11

12 12

13 13

14 14

Note: This information does not transmit to the IRS with e-filed returns.

Including with a paper filed return is optional.

State income taxes

State franchise taxes

City income taxes

City franchise taxes

Local property taxes

Intangible property taxes

Payroll taxes

Less: credit from Form 8846

Foreign taxes paid

Occupancy taxes

Other miscellaneous taxes

Built in gains tax allocated to ordinary income

Licenses

Total to Form 1120S, Page 1, Line 12

S CORPORATION NAME EIN

ATT_STL.LD

SUNSHINE S CORP 40-0006013

1,500

22,000

1,000

24,500

Practice

Return 13

Schedule M-2/Retained Earnings Worksheet

2017Form 1120S

Analysis of Current-Year Retained Earnings

6 Difference (line 4 minus line 5) (should be zero) 6

Current-Year Change to Retained Earnings Compared to Current-Year Change to AAA & OAA

Current-Year Timing Adjustments per Schedule M-1

Current-Year Timing Adjustments Per Schedule M-3

23 Net reconciliation difference (line 3 minus line 21 or 22) 23

(Keep for your records)

1 Beginning retained earnings per balance sheet (Schedule L, column b, lines 24 and 25) 1

2 Book income (loss) (Schedule M-1, line 1, or Schedule M-3, page 1, line 11) 2

3 Distributions (Schedule K, line 16d) 3

4 Subtotal (combines lines 1 through 3) 4

5 Ending retained earnings per balance sheet (Schedule L, column d, lines 24 and 25) 5

1 Ending retained earnings (Schedule L, column d, line 24) 1

2 Beginning retained earnings (Schedule L, column b, line 24) 2

3 Retained earnings change (line 1 minus line 2) 3

4 Ending AAA plus OAA 4

5 Beginning AAA plus OAA 5

6 Difference (line 4 minus line 5) 6

Subtractions from net income per books (Schedule M-1, lines 5 and 6 - not included on Schedule M-2)

7 Other income recorded on books not included on Schedule K 7

8 Depreciation on Schedule K not included on books 8

9 Other Schedule K items not included on books 9

10 Total subtractions (lines 7 through 9) 10

Additions to net income per books (Schedule M-1, lines 2 and 3 - not included on Schedule M-2, line 3)

11 Income included on Schedule K not recorded on books 11

12 Depreciation on books not included on Schedule K 12

13 Other items on books not included on Schedule K 13

14 Total additions (lines 11 through 13) 14

15 Sch M-1 timing adjustments not included on Schedule M-2, lines 2 thru 5 (subtract line 14 from line 10) 15

Permanent or temporary book-to-tax difference amounts entered on the M32, M33, 8916A, and SCH3 screens appear

on line 16 and line 17 as opposite of the actual entries. For example, an entry of -100 would appear as 100.

16 Permanent differences 16

17 Temporary differences 17

18 Timing adjustments not included on Schedule M-2 (combine lines 16 and 17) 18

19 Distributions reported on Schedule K, line 16d, not allowed on Schedule M-2, line 7 19

20 Adjustments to retained earnings (Schedule L, line 25 column d minus Schedule L, line 25, column b) 20

21 M-2 amount after M-1 timing adjustments (add lines 6, 15, 19, and 20) 21

22 M-2 amount after M-3 timing adjustments (add lines 6, 18, 19, and 20) 22

WK_M2.LD

Name(s) as shown on return Tax ID Number

.................................

...............................................................................

...............

................................

.........................................................

..................................

...........................................................................................

..........................................

...................................

................................................

......................................

................................................

.......

..................................

..................................

...................

.......................

.......................

.......................

..........................

SUNSHINE S CORP 40-0006013

96,867176,767(150,000)123,634123,634

123,63496,86726,767

123,63496,86726,767

26,767

Practice

Return 13Listing of Shareholder Distributions 2017

Name(s) as shown on return Employer Identification Number

WK_DIST.LD

SUNSHINE S CORP 40-0006013

Date Amount

03-03-2017 50,00011-06-2017 100,000__________

____________________TOTAL 150,000

Practice

Return 132017Summary of Stock Ownership

Shareholder Information Shares % Ownership

Name EIN/SSN Type Beginning Ending Beginning Ending

EINCORPORATION NAME

WK_SOWN.LD

SUNSHINE S CORP 40-0006013

SOLAR WINDS 400-00-8111 20 20 10.00000 10.00000

SUN FLOWERS 400-00-8112 100 100 50.00000 50.00000

SUMMER FLOWERS 400-00-8113 40 40 20.00000 20.00000

OCEAN BREEZE 400-00-8114 40 40 20.00000 20.00000______________

______________ ______________TOTAL 200 200

Practice

Return 13 2017Depreciation Detail Listing

For your records only

* Item was disposed

of during current year.

Social security number/EINName(s) as shown on return

AMTBasis Business Section Depreciable Prior Current AccumulatedBonusNo. Description Date Cost Life Method Rate

CurrentAdjustment percentage 179 Basis Depreciation Depreciation Depreciationdepreciation

FORM 1120S

SUNSHINE S CORP 40-0006013

PAGE 1

1 ASSET 1 07122006 13,000 100.00 13,000 5 0 13,000 13,000

2 ASSET 2 06142015 175,000 100.00 175,000PY 0 5 EXP 0 175,000 175,000

3 ASSET 3 09052006 10,000 100.00 10,000 7 0 10,000 10,000

4 ASSET 4 04132010 66,000 100.00 66,000 5 200 DB HY 0 18,010 1,875 19,885 1,875

5 ASSET 5 03122007 15,000 100.00 15,000 5 0 15,000 15,000

6 ASSET 6 03152016 25,000 100.00 25,000PY 0 5 EXP 0 25,000 25,000

Totals 304,000 104,000 56,010 1,875 257,885 1,875

ST ADJ:Land AmountNet Depreciable Cost 304,000