1.1. B ACKGROUND OF STUDY

Transcript of 1.1. B ACKGROUND OF STUDY

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

1

I. INTRODUCTION 1.1. BACKGROUND OF STUDY

In relation with the development of domestic and international

and the challenge of global competition, it is necessary to

develop every economic sector through the exploitation of

national and local resources. It is related to the availability of

goods and services that have competitors not only from

domestic but also from overseas. To national and local

development, this condition is a challenge to use the

opportunity to increase the welfare the society. The

development of resources is done by optimizing potential

resources that are available in the region.

Various theories and practical operation in many countries

have proved that agriculture is a strategic economic sector in

the economic development of a country. Agriculture sector has

an important role to foster the economic development of a

country that is implemented by supplying food for the nation,

being a big market for production goods and consumption

goods, creating employment opportunity and supplying

manpower and also generating foreign exchange supply.

The empirical evidence proved that the role of agriculture

sector on the national economy is important. However, if it is

studied carefully, the result shows that the actors of agricultural

business or the agricultural society do not proportionally get

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

2

benefits from the economic development as equal as the

contribution that it has given. The factors that create this

phenomenon are the dualistic economic structure between

small farmers and big commercial agricultural business where

both are not supported by fair and mutual cooperation. Other

factor is cultivation activity that concentrates on producing raw

material commodity. Mean while agro industry process and

other down stream process are managed by economic

institution that is not related to the agriculture. As a result, the

value added created by the down stream sector is not well

distributed to the farming level (in the form of normal price).

In the future, the development of industrial sector has to focus on

using local potential optimally, especially agriculture sector that has a

role as an economic base in several regions for a long period.

Industrial management is also directed to the small-scale industry,

intensive labor supported by efficient technology that can process and

utilize the local potential. Therefore, the products produced do not

only supply the local needs but also the wide markets both regionally

and internationally.

Nias Regency with the great and various potentials of

resources has sea and land areas that make it possible to

develop various kinds of business supporting regional

development. The potentials considered to be properly

developed are agribusiness and industrial sectors having

agricultural-based products. The great availability of basic

commodities makes it possible to develop processing industry;

namely processing industry of agricultural products, mainly

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

3

follow-up processing of crude palm oil (CPO). The coastal area

with beaches having good water quality is the important

support for fishery development with all supporting elements.

The handicap faced in creating industrial development is

capital and good management so that it can reach a good

business that runs smoothly. In order to support and attract

local and international investment, it is necessary to create

some information regarding any business opportunity for any

kind of industry. Business opportunity information is arranged

in the form of investment project profile that has been analyzed

from the point of its feasibility, physics and finance.

1.2. THE PURPOSE OF STUDY

The study of investment project profile is aimed at giving

business opportunity information (commodity/best economic

activities) that has a good prospect and is suitable to be

developed in Nias Regency. From the commodity/economic

activities that are feasible to develop, a pre-feasibility study as

a base for investors in choosing the business sector that they

will develop is arranged.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

4

II. GENERAL CONDITION 2.1. ADMINISTRATION AND GOVERNANCE

Nias Regency geographically lies between 00 12’ - 10 32’ of

North Latitude and 970 - 980 of East Longitude

Administratively Nias Regency borders with: 1. Northern : Banyak Islands belong to Aceh

Province

2. Eastern : Mursala Islands of Central Tapanuli

Regency

3. Southern : Mentawai Islands of West Sumatera

Province

4. Western : Hindia Ocean

Nias Regency has 22 Sub-districts with 651 villages and 6

urban villages. Nias Regency covers 5,625 km2 area width.

Sub-district with the widest area is Teluk Dalam and the

narrowest sub-district is Hibala. The spread of area width in

every sub-district can be seen Table 1, as follows:

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

5

Figure 1. Map of North Sumatera Province

Figure 1. Map of North Sumatera Province

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

6

Table 1. Administrative Region of Nias Regency

No District Villages Kelurahan Area (km2)

1 Pulau-Pulau Batu 45 1 121.052 Hibala 15 54.253 Teluk Dalam 38 1 490.004 Amandraya 18 183.105 Lahusa 15 334.006 Gomo 31 158.607 Bawolato 26 363.508 Idanogawo 16 207.009 Lowowa'u 32 295.60

10 Lolomatua 18 188.6011 Sirombu 36 223.8012 Mandrehe 62 293.2013 Gido 49 338.5814 Lolofitumoi 35 236.5215 Gunung sitoli 57 3 230.8016 Liduho 39 221.6517 Alasa 27 459.4018 Namohalo Eisiwa 12 176.0019 Lahewa 26 1 446.0520 Afulu 9 159.5521 Tuhemberua 31 317.2522 Lotu 14 126.50

Total 651 6 5,625.00 2.2. LAND USE STRUCTURE

The use of land in Nias Regency includes villages 30,638.0

hectares (5.45%), Wet and dry rice fields 22,486 hectares

(4.00%), people’s plantation 81,894 hectares (4.56%), dry land

for secondary crops 47,830 hectares (8.50%), fishery area

40.5 hectares, forest and bushes, thicket trees and grass

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

7

371,225 hectares, lake/swamp 12,143 hectares, industrial

plant forest 348,790 hectares. The use of land in Nias

Regency is described in detail in the following table.

Table 2. The Use of Land in Nias Regency

No Land Use Width (ha) Percentage (%) 1 Residential 30,638.00 5.45 2 Dry-land Agriculture 47,830.00 8.50 3 Rice field 22,486.00 4.00 4 Plantation 81,894.00 14.56 5 Fishery 40.50 0.007 6 Transportation 1,392.22 0.25 7 Forestry 109,380.00 19.45 8 Critical/damage Land 161,016.00 28.63 9 Meadow 6,821.00 1.21 10 Industrial 2,190.00 0.39 11 Water body 12,143.00 2.16 12 Others 86,669.28 15.41 Total 562,500.00 100.00

2.3. CLIMATE The rainfall year 2001 in Nias Regency averages 2,735.6 mm

with 7 wet months and 5 moist months. This condition is

categorized in wet. The wet months are August until March.

Based on the classification of Oldeman et al, the type of

climate in Nias Regency belongs to B1, while according to

Schmidt and Ferguson, it is categorized in climate type A. The

spread of rainfall and monthly rained days can be seen in the

following table.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

8

Table 3. The Condition of Rainfall in Nias Regency

No Sub-district Rainfall (mm) Rained days

1 January 216.4 23 2 February 101.0 20 3 March 167.3 26 4 April 332.5 29 5 May 209.6 23 6 June 249.6 20 7 July 252.9 21 8 August 199.2 21 9 September 252.7 27

10 October 315.6 28 11 November 243.4 28 12 December 195.4 27

Total 2,735.6 293 Source: CBS

2.4. POPULATION The population of Nias Regency in 2001 numbered in 672,775

people that consist of 144,673 household. The population

density ranges 119 individuals/km2. In detail, number and

structure of population in Nias Regency are stated in Table 4.

From the data displayed, it is seen that sub-districts having

quite dense population are Gunung Sitoli, while Alasa Sub-

district has the smallest number of population.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

9

Table 4. Number and Structure of Population in Nias Regency

No District Male Female Total Household

1 Pulau-Pulau Batu 8,694 8,645 17,339 4,1952 Hibala 4,620 4,499 9,119 1,9113 Teluk Dalam 36,867 35,563 72,430 16,5644 Amandraya 12,546 12,751 25,297 5,1845 Lahusa 13,519 13,656 27,175 6,0396 Gomo 21,822 25,196 47,018 9,6887 Bawolato 10,045 10,352 20,397 3,7588 Idanogawo 14,299 14,452 28,751 5,7699 Lowowa'u 16,375 16,510 32,885 6,417

10 Lolomatua 12,792 13,688 26,480 5,14011 Sirombu 8,441 8,918 17,359 4,51112 Mandrehe 23,034 23,347 46,381 9,35913 Gido 22,425 26,393 48,818 10,13714 Lolofitumoi 16,385 18,412 34,797 7,80415 Gunung sitoli 35,054 35,190 70,244 16,43216 Liduho 14,993 15,834 30,827 6,40117 Alasa 14,004 14,437 28,441 5,50918 Namohalo Eisiwa 6,285 6,682 12,967 2,56719 Lahewa 12,216 12,664 24,880 5,92920 Afulu 4,435 4,522 8,957 2,14921 Tuhemberua 20,835 21,378 42,213 9,21022 Lotu 5,970 5,951 11,921 2,675

Total 335,656 343,089 672,775 144,673Source: Central Bureau of Statistics of Nias Regency

2.5. THE CONDITION OF REGIONAL ECONOMY

The progress indicator of regional economy can be seen through Gross

Domestic Products (here after: PDRB). PDRB of Nias Regency and its

growth can be observed in Table 5, as follows:

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

10

Table 5. The Progress of PDRB of Nias Regency

No Year PDRB (Rp) Growth (%)1 1996 807,989,090,000 2 1997 834,873,210,000 3.333 1998 751,319,140,000 -10.014 1999 801,294,000,000 6.655 2000r) 831,204,360,000 3.736 2001*) 832,439,990,000 0.15

Note r) = Revision Value; *)=Temporary Value

In year 2001, PDRB of Nias Regency based on constant price

was Rp. 832,439.9 million and PDRB per capita was Rp.

1,199,466. Except in 1998, the growth of PDRB was usually

positive. It means that the economic development in this

regency keeps on growing up. The greatest contribution to

PDRB came from agricultural sector 51.11%, sector of

commerce, hotel, and restaurant 16.10%, and service sector

10.01%.

2.6. THE CONDITION OF FACILITY AND INFRASTRUCTURE The total length of roads in Nias Regency is 426.99 km, that

consist of hotmix road 136.36 km, asphalt road 183.251 km,

gravel road 31.501, under lag 8.675 km and the rest is ground

road 67.203 km. Based on the condition, roads in Nias

Regency can be categorized in good condition 136.36 km, fair

183.25 km, extremely damage 129.79 km, and damage at all

96.595 km.

Other facilities and infrastructure available in this regency are

telephone, and electricity supplied by State Electricity

Enterprise (PLN). In 1999, the telephone lines numbered in

1995 lines, of all are main lines.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

11

III. THE SELECTION OF BUSINESS FIELD

3.1. REGIONAL DEVELOPMENT PRIORITY

Vision The vision of Nias Government for the next five years is

making efficient use of Nias society through reformation and

performance improvement of regional state apparatus that free

from collusion, corruption and nepotism and building close

cooperative relationship between executive and legislative

towards progressive Nias.

Missions 1. Restructuring regional governmental organization referring

to the spirit of reformation by placing the right man on the

right place.

2. Raising regional income by making use of new sources

for regional income through marine or fishery sector,

estate tourism, and agriculture towards regional

independence.

3. Building harmonious relationship with legislative to create

effective, efficient, and accommodative performance in

maximizing developmental potentials.

4. Developing people’s agriculture technically to meet food

demand for society and making food crop agriculture,

fishery/marine, plantation, and tourism sectors as

mainstays of people economy supporting regional income.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

12

5. Building facility and infrastructure of information and

transportation as a leading sector to open Nias from

isolation, especially villages, to develop people’s

production centers.

6. Striving to attract local or foreign investors to invest their

capital in Nias for marine and fishery, plantation and

tourism development sectors.

7. Developing supreme and competitive commodity

supporting tourism and growing small and medium-scaled

industry exploiting agricultural products and people’s

plantation

8. Developing education and training and enhancing health

services to improve quality of human resources through

development of educational facility and infrastructure,

including study duty, by cooperating with related

institutions in local or foreign countries.

9. Building harmonious and integrated relationship with all

sides including provincial government and related

institutions of central government.

10. Creating religious life in a harmony.

11. Making conducive climates for politic, culture, and public

order and security for the acceleration of governmental

coordination, development, and public service

improvement.

12. Building good relationship with international institutions,

including religious institutions and NGO’s to contribute

Nias’ development.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

13

13. Enhancing roles and functions of functional, social, and

private supervisory to create good governance.

14. Developing information system for regional development

integrally, including program socialization commenced

from program implementation, monitoring, and evaluation.

3.2. THE POTENTIAL OF COMMODITY RESOURCES To support progress of Nias Regency, it requires development

and restructuring on several sectors, namely transportation

and information, education and health sectors. Sectors to be

potentially developed in Nias Regency include sectors of

agriculture and forestry, plantation, sea and fishery, animal

husbandry, tourism, and industry. Of several sectors, there are

some potential commodities, as stated in Table 6.

Table 6. The Potential Commodities in Nias Regency

Agriculture Industry Tourism

Kerapu Fish Coconut Processing

Sea Tourism

Lobster Fish meal Seaweed Crumb rubber Coconut Pig Husbandry Mangoes

3.2.1. Sea and Fishery Resources

Nias regency is an area of islands consisting of 132 islands

and only 37 islands are occupied. It is concluded that Nias

Regency has large potential coastal and sea area for the

development of sea or coastal cultivation, and sea tourism.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

14

The fishery potential in Nias Regency is dominant for sea fish.

It is seen through the fish production, as displayed in the

following table.

Table 7. The Description of Fish Production in Nias Regency

Production (tons) Year Sea Fish Fresh-Water Fish Total (tons)

1991 13,360.0 70.0 13,430.0 1992 13,064.0 71.0 13,135.0 1993 13,351.0 71.0 13,422.0 1994 14,795.8 56.1 14,851.9 1995 14,271.8 41.5 14,313.3 1996 15,858.0 48.1 15,906.1 1997 16,326.1 47.9 16,374.0 1998 14,208.4 57.7 14,266.1 1999 15,151.9 36.8 15,188.7 2000 15,363.6 45.6 15,409.2 2001 15,974.4 45.1 16,019.5

The quite enormous sea and coastal potential makes Nias

Regency possible to have great chance developing sea

cultivation, such as kerapu fish, seaweed, and fish-catch.

Besides, it has a great potential to develop fish-processing

industry; such as, fish-flour industry and fish-canning industry.

3.2.2. Plantation Sector

The types of estate plants dominantly cultivated in Nias

Regency are coconut and rubber. The case meets land and

climate typology of this area. The description of estate plants

production in Nias Regency can be seen in the following table.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

15

Table 8. Estate Plant Production According to the Types (Ton) in 1999-2001

No Plant 1997 1998 1999 1 Rubber 13,624 14,238 14,0902 Coconut 42,230 42,820 42,8923 Coffee 791 808 7724 Patchouli 371 371 2735 Clove 142 132 896 Cacao 293 354 3927 Cocoa 13,624 14,238 14,090

Annual coconut production in this regency reaches 42 tons,

and rubber production numbers in more than 13 tons.

Therefore; it is potential to develop coconut and rubber

processing industries, like crumb rubber industry.

3.2.3. Animal Husbandry Sector

From the livestock population dominantly cultivated in this

regency, livestock of pig is the most potential commodity to be

developed. The condition of livestock population in Nias

Regency is as stated in the following table.

Table 9. Livestock Population according to Type (Individual) in 1999-2001

No Livestock 1999 2000 2001 1 Buffalo 1,331 1,365 1,3922 Cow 2,320 2,525 2,6343 Goat 14,509 16,275 17,3284 Pig 51,227 67,452 71,9815 Duck 20,434 23,760 29,978

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

16

In the last two years, the progress of pig livestock population

in this region reached 34 %. Market and environmental

condition makes pig livestock potential to grow up.

3.2.4. Tourism Sector

This region has considerable potential of sea resort for surfing

and nature tourism. The tourists’ visit reached the greatest

number in 1996, namely 29.165 visitors. They were 10.787

foreign tourists and 18.378 domestic ones. The tourists’ visits

dramatically decreased because of multi-dimensional crisis. In

1999, number of tourists is only 7.932 people. Since then, the

tourism potential of this region is quite great to develop; mainly

natural and marine

3.3. MAINSTAY COMMODITY

From the analysis of potentials and paying attention to regional

development priority of Nias Regency, therefore; mainstay

commodities to be profiles are :

♦ Crumb Rubber Industry ♦ Coconut Processing ♦ Fish Meal ♦ Kerapu-Fish Cultivation ♦ Seaweed Cultivation ♦ Marine Tourism ♦ Pig Animal Husbandry

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

17

IV. PRELIMINARY STUDY OF FEASIBLE PROSPECT

4.1. CRUMB RUBBER INDUSTRY

1. Market Prospect 1.1. Natural Rubber Production Improvement in the production of Indonesian natural rubber is

dominated more by the area extension and increase in

productivity trough “PIR”, project implementation unit (UPD)

small scale rubber development project (PPKR), and partial

pattern. In the decade of 1970 ‘s the growth of Indonesia

nature rubber production was 2.22 % in average. As it has

been experienced by the main country rubber producer at the

time, Malaysia, Indonesia had to replace part of its estate

plants with oil palms and cacao as the price of rubber keep

declining In 1990’s there was an increase of 3.50 % per year.

This increase in production was followed by that in

consumption as the demand for the supply of row material in

the industry of rubber manufactured goods also increased.

There was also then some investment for country producers of

fires and rubber shoes (south Korea and Taiwan) in Indonesia.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

18

Table 10. Development of National Natural Rubber Production, 1993-1998

Year

PR PBN PBS Total

(Ton) Growth

(%)

1993 1,102,006 207,425 166,007 1,475,438 1994 1,138,099 188,122 172,409 1,498,630 1.57 1995 1,191,145 199,943 182,217 1,573,305 4.98 1996 1,193,000 203,943 179,281 1,576,224 0.19 1997 1,175,000 188,000 190,133 1,553,133 (1.46) 1998 1,243,000 192,000 227,000 1,662,000 7.01

Source : GAPKINDO

Description :

PR = Small Holder

PBN = Government Estate

PBS = Private Estate

Table 11. Development of World Natural Rubber Production, 1994 -1998

Year Total (ton) Growth (%)

1994 5,720,000 1995 6,040,000 5.59 1996 6,390,000 5.79 1997 6,390,000 - 1998 6,680,000 4.54

Source : GAPKINDO

1.2. Export Import of Natural Rubber The volume of natural rubber export is increasing from a year to

another. Since there is a decreased price, the export value is also

decreasing on the other hand. There has been some import for

particular types of product.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

19

Table 12. Development of National Natural Rubber Export, 1993 – 1998

Year Volume (Ton)

Growth (%)

Value (US $ 000)

Growth (%)

1993 1,214,328 976,781 1994 1,244,754 2.51 1,271,703 30.19 1995 1,323,812 6.35 1,962,835 54.35 1996 1,434,284 8.34 1,917,905 (2.29) 1997 1,403,937 (2.12) 1,493,188 (22.14) 1998 1,641,186, 16.90 1,101,453 (26.23)

Source : GAPKINDO

Table 13. Development of National Natural Rubber Import, 1994 – 1998

Year Volume (Ton)

Growth (%)

Value (US $ 000)

Growth (%)

1994 2,254 N/A - 1995 2,312 2.57 N/A - 1996 902 (60.99) 1,538 - 1997 517 (42.68) 1,160 (24.58) 1998 1,188 129.79 1,149 (0.95)

Source : GAPKINDO/International Rubber

Description :

N/A = Data is not available

1.3. Natural Rubber Consumption

The local consumption of natural rubber tends to decrease as

people now switch to synthetic rubber. This is in contradiction

with the world rubber consumption which is switching to natural

rubber.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

20

Table 14. Development of Indonesia Natural Rubber Consumption

Year Production (Ton)

Export (Ton)

Import (Ton)

Consumption (Ton)

Growth (%)

1994 1498,630 1,244,754 2,254 256,130 1995 1,573,305 1,323,812 2,312 251,805 (1.69) 1996 1,576,224 1,434,284 902 142,842 (43.27) 1997 1,553,133 1,403,937 517 149,713 4.81 1998 1,662,000 1,641,186, 1,188 22,002 (85.30)

Source : GAPKINDO

Table 15. Development of The World Natural Rubber Consumption

Year Production (Ton)

Growth (%)

Consumption (Ton)

Growth (%)

1994 5,720,000 5,650,000 1995 6,040,000 5.59 5,950,000 5.31 1996 6,390,000 5.79 6,100,000 2.52 1997 6,390,000 - 6,460,000 5.90 1998 6,680,000 4.54 6,550,000 1.39

Source : GAPKINDO/International Rubber

2. Capacity of row material : 5,000 ton dry rubber/year 3. Location : Gunung Sitoli, Bawolato

4. Production Technology 4.1. Row material needs : Lump and Scrape 5,000 ton/year

4.2. Production Technology :

a. Lump washing : done by putting lump into a vessel

and washed under running water.

b. The lean Lump is then ground into crumb.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

21

c. Drying, done using a bin dryer to reach 15 % water

content.

d. Pressing crumb rubber into bull weighing 50 kg.

e. Packing and labeling of quality standard

differentiated based on Indonesian Rubber Standard

value (SIR).

4.3. Source of technology : local

4.4. Land needs : 5,000 m square

4.5. Labor needs : 5 staff and 45 labor

4.6. Water needs : 5,000 m3/year

4.7. Electricity needs : 85 KVA

5. Investment needs A. Fixed capital : US $ 881,288.00

B. Working capital : US $ 4,079,300.00

Total Investment : US $ 4,960,588.00 6. Financial Profitability

• Return On Investment (ROI) : 2.65

• Internal Rate of Return (IRR) : 25%

• Net Present Value (NPV) : US $ 752,120.00

• Payback Period : 6 years

• Break Even Point (BEP) : 4,017 ton

• Benefit Cost Ratio (BCR) : 1.16

• Profitability Index (PI) : 1.18

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

22

4.2. INTEGRATED COCONUT INDUSTRY 1. Market Chance

Products to be resulted by the integrated processing industry

of coconut are milk squeezed from coconut, coconut flour

(desiccated coconut), and side-products (by product), as

briquette charcoal, Natta de Coco, and coconut fiber. The

planned capacity of production is 30.000 tons coconut fruit per

year.

The main marketing target of integrated coconut processing

products is export market without ignoring potential local

markets. The main market targets are Singapore, Malaysia

and India. Besides, other countries with potential demand are

Japan, Korea, Europe countries and the United States of

America. While the condition of the local market shows that,

up to now, Indonesia still conducts import of pieces coconut

and coconut flour in big amount.

To guarantee the continuous market, since very beginning the

company keeps in commercial touch with several potential

buyers. Some potential buyers seem to easily found because

the products to be manufactured are intermediate-products to

become basic commodity of important industry. That can be

made a reality if the quality of products meets the

requirements.

1.1. Coconut Flour

The data obtained from the Ministry of Industry indicate that

national production of coconut flour had relatively small

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

23

increase. It was not any production improvement at all in the

period 1988 to 1989. From year 1989 up to 1992 the

production little by little began to raise.. The increased

production from 1989 until 1990 reached 3,3%, while in the

following year, it grew up 4,8%. The production bounced

around 10,1% in 1992. The data of national coconut flour

production from 1998-1992 can completely seen in the

following table :

Table 16. National Production of Coconut Flour

Year Volume (kg) Number of Company

1988 68,347,500 13 1989 68,347,500 13 1990 70,597,500 14 1991 73,972,500 16 1992 81,472,500 16

Source: Ministry of Industry, Directorate of Industries, 1993

Even though production total kept on increasing, the total

number of demand was also mounting, either from local or

foreign countries. The capacity of foreign markets to absorb

the products grew more and more from year to year.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

24

Table 17. Realization of Coconut Flour Export and Projection up to 2000

Total Export Year

Volume (kg) Value (US$) 1989 857,996 454,999 1990 1,718,816 1,152,437 1991 6,844,967 3,632,099 1992 8,930,243 5,283,568 1993 11,923,728 6,872,118 1994 14,858,018 8,568,655 1995 17,792,307 10,265,192 1996 20,726,596 11,961,729 1997 23,660,885 13,658,266 1998 26,595,175 15,354,802 1999 29,529,464 17,051,339 2000 32,363,753 18,747,876

Source : Central Bureau of Statistics processed

Based on the data above, it can be seen that the capacity of

markets, local or export, to absorb the products is still

enormous, if the production quality meets the buyers’

standard. Marketing aspect is, therefore, not a problem. It is

shown by the progress of export and import of coconut flour as

stated in the following table.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

25

Table 18. The Realization of Coconut Flour Import and the Projection until 2000

Total Import Year Volume (kg) Value (US$)

1989 180,584 219,178 1990 171,363 221,364 1991 216,728 344,305 1992 217,840 581,754 1993 235,912 644,317 1994 251,625 886,451 1995 267,339 1,007,518 1996 283,052 1,128,585 1997 298,765 1,249,652 1998 314,478 1,370,719 1999 330,192 1,370,719 2000 345,905 1,491,786

Source : Central Bureau of Statistics, processed

1.2. Natta de Coco, Coconut Fiber /Dust and Briquet te Charcoal

Like coconut flour, the side-effect products such as natta de

coco, coconut fiber and coconut charcoal briquette have a

good marketing prospect. Natta de coco as a product of

coconut water processing is a popular freshener food that has

great demand for cocktail production of fruit-canned.

Therefore, natta de coco industry is a complemented industry

with canned fruit industry.

Cocofiber and cocopeat are two products resulted from

coconut fiber processing. Cocofibers are supporting materials

for automobile industry and aircraft, as well as households,

such as mattress, pillow and chairs. The side-effect product

of cocofiber is cocopeat that invented from dust/powder

derived from the result of cocofiber processing. The cocopeat

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

26

has a great deal demand from foreign countries for agricultural

pots on the land requiring organic materials for vegetable

cultivation.

1.3. Coconut Shell Charcoal (active carbon)

Coconut shell charcoal can be made briquet for fuel and also

can be made charcoal of active carbon for clean water

sanitation. The demand of coconut charcoal, up to now, is still

high in either local or foreign markets. Due to the wide range

of use, the market of the side-product of integrated coconut

processing has widely opened market with additional

relatively big value.

2. Production Capacity : 1,200,000 seeds/month 3. Location : Pulau-pulau Batu, Sirombu and Lahewa 4. Raw Material : 48,000 Coconut fruits /day 5. Supporting Material : - SO2 solution

- ZnCl2 solution

- Sugar/Pineapple Juice

- Bacteria Acetobacter

- Packaging Materials

6. Production : Coconut Flour, Natta de Coco, Cocofiber,

and Cocopeat , Coconut Shell Briquette

7. Production Technology : 7.1. Coconut Flour coconut flour (desiccated coconut) is a product resulted from

the breaking process of fresh coconut fruit without any outer

skins that processed hygienically. The products are naturally

white, free from any pieces, fiber-powder, coloring

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

27

substances, and other materials. The product has

characteristics of coconut odor and flavor. In the production of

its making, submersion is performed by using solution SO2

(sulfate dioxide) as a stabilizer.

Coconut flour is usually used for mixture in industries

producing cake, biscuit, bread, jam, ice cream, and soon. The

special composition and specification of coconut flour that

should meet the Standard of Indonesia Industry (SII) are :

- water content (humidity) : maximum 3.5%

- fat content : maximum 65%

- free acid fat content (counted as solute acid) : maximum

0,1%

- residue content of SO2 : 15 ppm

- harmful metals : not proven

- color : white

- odor and flavor : normal

- number of bacteria : maximum 5,000 colony /gr.

- fungus and yeast : maximum 50 colony/gr.

- bacteria in e.coli form : maximum 50

- Salmonellae : negative

if the product is well packed and stored in cool place not

radiated by sunshine, then it can be long durable for several

months. Some matters to be paid attention in storing are that it

is suggested not keep the product near by strong odor

materials because it is sensitive to some odor.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

28

The production process of coconut flour, in guidelines, has

some stages, as follow :

a. Washing

After being separated from outer skins, the coconut fruit is

chopped to be small pieces, then put on the belt conveyor.

The machine brings coconut fruit to the washing tube. Washing

is performed manually. The process of washing is repeated

mechanically by using rotary-washer machine at the same

time it is sprayed water. Washing is finally conducted by

soaking the product into hot water in a sterilization container or

tank to make the coconut fruit sterilized. This process is known

as a process of pasteurization.

b. Stabilization Process

Small pieces of coconut fruit after pasteurization, after that

they are flowed into solution SO2 tank and soaked in solution

SO2 (sulfate dioxide).

c. Breaking

Coconut fruits sterilized are taken out and placed temporally in

a metal container. The container is laced on the screw

conveyor that will carry the commodities to the coconut fruit

breaker machine, called a hammer mill. The machine can work

with the capacity of 3-ton basic commodities every hour.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

29

d. Drying

According to Industrial Standard of Indonesia, the good

coconut flour is the one, which has maximum water content

3.5%. Therefore, after breaking process, coconut flour is dried

by using a controller machine, namely automatic-dryer. It

works automatically as the expected drying degree. To activate

this automatic-dryer machine is used a drier tool, called heat-

exchanger that operated by coconut shell fuel. The drying

process lasts for about an hour.

e. Filtering

After being dried coconut flour is transferred to the filtering

utensils ,vibrating screen, by using transferring machine,

called hopper. From filtering process about 0.3% are deposed

as waste. The process of screening will separate coconut flour

that meets the expected quality standard. The quality of

coconut flour is differentiated on the particle size, namely :

coarse, medium, fine/macaroon, and extra-fine.

Industry Company only produces coconut flour with medium

and fine/macaroon sizes.

f. Packaging and Storage

Coconut flour is stored in silo as the temporary place.. And

then, it is packed by packaging machine. The packaging

materials are plastic sacks with the capacity of 100 pounds

(equal to 45.75) or it is made as the buyers’s want. To maintain

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

30

the cleanliness and purity of products, The first wrapper,

plastic sack, is layered again by crept paper. After that, the

packaging is sealed by using plastic bag sealing machine. The

both packaging machines can work with the capacity of 12

bags per an hour. After packaging process, the products are

stored in a warehouse and ready for shipping..

7.2. Briquette Charcoal

Briquette Charcoal is a useful product for households or

industry. In households, briquette charcoal generally used for

fuel, mainly roasting meat, fish and so on, while in industrial

process, the products are basic commodities for active carbon

industry and carbon paper or helper materials in steel and tin

foundry.

Briquette charcoal to be made production must have the

following specification :

♦ Moisture : 0.95 %,

♦ Fixed carbon : 83.27 %,

♦ Ash : 2.99 %,

♦ Heat value : 7.970 kcal/kg,

♦ Burning time : 3.0 hour,

♦ Volatile matter : 6.93 %,

♦ Temperature : 875 oC.

The coconut fibers attaching to the coconut shell are

separated by using fiber processing machine. In the next

stage, The process is divided into two production lines, namely

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

31

coconut fiber line production and briquette charcoal production

processing the coconut shells.

The process of coconut charcoal briquette is stated, as

follows

1. Cleaning

Coconut shells produced through separating process from

the fibers, are cleaned to make them free from any

coconut fibers.

2. Breaking and Size Determination

The clean coconut shells are put into breaker machine or

(crusher), to get the next easily-performed process. From

the crusher machine, the materials flow to a screener

machine to determine maximum materials, in order

burning process can be perfectly done.

3. Burning

The informed materials are put into an oven to have

burning process. High temperate burning is done until the

coconut shells are burned into charcoal. And then, the

charcoals are made cool and given proper amount of

chemical practices (usually they soaked into solution

ZnCl2).

4. Milling and Separating

The charcoals from burning process that have been given

some chemical practices are milled by using a grinding

machine to become small pieces. The pieces are passed

by the separator, in order to obtain uniformed size.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

32

5. Heating and Activating

Charcoal pieces with uniformed size are again heated by

using oven and the activating process is performed.

6. Packaging Charcoals from the heating process are half-made

products from active carbon and even they can be used as

fuel, or mixture materials in metal foundry or asphalt. The

products are, then packed by using carton packaging..

7.3. Cocofiber and Cocodust 1. Cutting and Splitting

Dry coconut fibers or fresh are cut at the both ends by

using chopper and cutting machine. And then, the fibers

having been cut at the both ends are split by 5 - 8 cm

size.

2. Submersion

The fibers having been cut in the form of plaque are

soaked into a water tube for minimally three days, and

water keeps flowing. The purpose of submersion is in

order to remove corks that attaching fibers and also to

weaken the fiber ties, so it makes easy in the process of

fibers taking.

3. Draining and Chopping

After submersion, the fibers are taken out and drained for

one night on the draining floor. The fibers having been

drained are chopped by using a decorticator and cleaner

machine, that working continuously. Making use of this

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

33

machine, corks and fibers to be separated by themselves

and the corks that get out of the machine are collected for

drying.

4. Fiber Screening

The fiber plaques produced by decorticator machine are

collected and separated based on the fiber length by using

a revolving screener.

5. Drying

The long and short fibers having been separated are dried

under sunshine to obtain water content of 12%. In very hot

sunshine, drying can take 3-4 hours long.

6. Fixing, gluing, and packaging

Fibers having been dried under sunshine are given glue

and made it solid to gain 50 - 60 kg weight per unit and

are formed into rotundity forms, by using a pre hydraulic

machine. The rotundity fibers are then prepared for

packaging by using sacks.

7.4. Nata de Coco Nata is an accumulation of bacteria cell (cellulose) having

elastic , and white texture, like gel and floating on the surface

water. The material capable to be used as media for nata

making is coconut water, the product is called nata de coco,

other material is pineapple (nata de pine) or other fruit

containing sugar. Source of sugar can be used sucrose,

glucose, fructose, or molasses.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

34

Microbe active in this making is a acid acetate inventor

bacterium, categorized Acetobacter, namely Acetobacer

xylinum. The characteristics of the microbe are negative gram,

bar-formed, obligate aerobe, not grow spore, and create

capsule. In the medium containing sugar, the microbe will

replace sugar into cellulose. Some factors affecting on the

creation of nata are : pH, source of N, carbon, and

fermentation container. Process of nata de coco production is

described below :

1. Coconut water (1 liter) or pineapple water + sugar (7.5 –

10 %) are heated until the sugar solutes and then they are

filtered. The purpose of filtering is to remove dirties from

sugar and water coconut.

2. The mixture is, then heated again until boiling, and then it

is frozen.. After they are cool, pH is controlled by acid of

acetate glacial or main vinegar up to the acidity of about

4.5, ten inoculated with nata proliferation (10%), counted

in submersion container, closed, and drained for 10 – 14

days.

If it is needed to add nitrogen source in a nata making

container, namely urea or ammonium, then the addition is

simultaneous with sugar.

3. After fermentation finished (layer with 1 cm stick), the

white layers formed or ‘nata’ are picked up, washed,

removed the acid by boiling or submersion in water for 3

days (boiling and submersion water is changed every day).

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

35

Nata is boiled again, and drained. The next boiling is in

sugar solution 40%, for 30 – 45 minutes.

8. Labors Needed :

• Manufacturers’ employee : 104 people

• Head office Employee : 10 people

• Directors : 7 people

Total : 130 people

9. Investment Requirements :

A. Fixed capital : US $ 2,957,566.00

B. Working capital : US $ 881,275.00

Total Investment : US $ 3,838.841,00

Financial Profitability

• Return On Investment (ROI) : 2.66

• Internal Rate of Return (IRR) : 29%

• Net Present Value (NPV) : US $ 900,473.00.

• Payback Period : 4 years 10 months

• Break Even Point (BEP) : 1,582 ton

• Benefit Cost Ratio (BCR) : 1.43

• Profitability Index (PI) : 1.28

4.3. KERAPU FISH

1. Market Opportunity Production of Kerapu fish The production of Kerapu fish in Indonesia from 1991 to 1998

had increased to 18.76% with the total production of 49,864

tons in 1998.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

36

Table 19. Development of National Production of Kerapu fish from 1991 to 1998

Year Production (ton) Growth (%) 1991 16,197 1992 21,767 34.39 1993 30,015 37.89 1994 39,921 33.00 1995 34,004 (14.82) 1996 39,111 15.02 1997 44,488 13.75 1998 49,864 12.09

Sources: CBS and Agriculture department

Export and Import of Kerapu Fish According to the CBS data, the export of kerapu fish increases

every year even though it is not a large fishery commodity. The

export destiny is Singapore, Hong Kong and Japan. The export

volume of other fishes including Kerapu fish reached as many

as 546 tons with the value of US$ 1,149,600. This value is

relatively small compared with the total export of sea fish. The

current total of sea fish export is US$ 448,631,400

Table 20. Development of National Export of Sea Fish from 1994 to 1998

Year Volume

(000 ton)

Growth (%)

Value (US$ 000)

Growth (%)

1994 267.01 344,059,70 1995 292.43 9.52 426,392.80 23.93 1996 305.60 4.50 443,984.00 4.13 1997 338.58 10.79 442,589.80 (0.31) 1998 349.84 3.33 448,681.40 1.38

Sources: Agriculture department, processed National import for fish sea commodity in 1994 was 11,110

tons with the import value of US$ 3,024,000 or US$ 272 per

ton and in 1998 the fish sea import decreased to 5,460 ton with

the import value of US$ 7,320,000 or US$ 1,340 per ton.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

37

The highest percentage of national import growth for sea fish

from 1994 to 1998 was 22.97 % in 1997. The percentage of

average growth of sea fish from 1994 to 1998 was -10.39%.

Table 21. Development of National Import of Sea Fish from 1994 to 1998

Year Volume (000 ton)

Growth (%)

Value (000 US$)

Growth (%)

1994 11.11 3,024.00 1995 10.83 (2.52) 9,951.00 229.07 1996 10.26 (5.26) 8,584.00 (13.74) 1997 12.61 22.90 10,170.00 18.48 1998 5.46 (56.70) 7,320.00 (28.02)

Sources: Agriculture Department

Consumption of Sea Fish The consumption of sea fish can be calculated with production

computation method plus import and minus export.

Sea fish commodity in 1994 had national consumption level of

2,824,280 tons and in 1998 it increased to 3,379,370 ton. The

highest percentage of sea fish consumption growth from 1994

to 1998 was 6.62% in 1995. The average growth of sea fish

consumption from 19914 to 1998 was 4.61%

Based on the method above, the national consumption of sea

fish in 1998 was 3,379,370 tons. It shows that the production

of sea fish in Indonesia in 1998 as many as 3,723,750 tons

exceeded its national demand; therefore, this commodity has

market potential for export.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

38

Table 22. National Consumption of Sea Fish from 1994 to 1998

Year Production (000 ton)

Export (000 ton)

Import (000 ton)

Consumption (000

ton)

Growth (%)

1994 3080.17 267.01 11.11 2824.28 1995 3292.93 292.43 10.82 3011.32 6.62 1996 3383.46 305.60 10.25 3088.11 2.55 1997 3612.96 338.58 12.61 3286.99 6.44 1998 3723.75 349.84 5.46 3379.37 2.81

2. Business scale : 4 units of floated net karamba with

the size of 8x8 m.

Each unit consists of 4

compartments of keramba with

the size of 3 m x 3 m x 3 m.

3. Production capacity : 4 tons of kerapu fish/6months

4. Location : Pulau-Pulau Batu, Sirombu and Teluk Dalam

5. Technology :

5.1. Types of kerapu fishes are Rat /Bebek Kerapu , Sunnu

Kerapu, Muddy Kerapu , and Lion Kerapu.

a. Ecological requirement:

• Height of Tides : 0.5 – 1 m

• Sea current : 0.05 – 0.4 m

• Depth of water from the net bottom : 4 – 10 m

• Oxygen : 3 – 5 ppm

• Salt content : 20 – 30 ppt

• Rareness of weather changes

• No pollution

• Nitrite concentrate is < 1 kg/liter

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

39

b. Breeding: the seeds can be obtained by catching them in

the sea or yields of egging. The size requirement of seeds

to be cultured is 75 – 100 gram

c. Spread density : 30 fish/m3

d. Feed: The quantity of Rucah (small uneconomical fresh

fish) feed is 6 – 10% out of the fish total weight per day

5.2. Cultivation:

• The uniformity of fish size in one net is done every two

months to avoid cannibalism.

• Change of net to get rid of the waste is done every 3 –

4 weeks

5.3. Land requirement : 500 m2.

5.4. Requirement of Production facility :

• Seeds : 9,450 tails

• Feed : 22,827 kg

5.5. Requirement of facility:

• 4 units of raft with the size of 8m x 8m

• 14 units of floated net keramba made of nylon and

ballast

• 1 unit of motorboat

• Aerator

5.6. Requirement of labor : 3 labors for 6 months

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

40

5.7. Production: Harvest is carried out when the prawns are 6

months old and 400 – 1000 grams or about 4 tons of

kerapu/14 units of keramba.

6. Investment Requirement A. Fixed capital : US $ 7.923,00

B. Working capital : US $ 5.395,00

Total Investment : US $ 13.318,00

7. Financial Profitability

• Return On Investment (ROI) : 3,.4

• Internal Rate of Return (IRR) : 35 %

• Net Present Value (NPV) : US $ 5.076,00

• Payback Period : 2 years 7 months

• Break Even Point (BEP) : 658 kg

• Benefit Cost Ratio (BCR) : 1.94

• Profitability Index (PI) : 1.46

4.4. SEA WEED CULTIVATION 1. Business Scale : 1 ha. 2. Production Capacity : 327,600 kg/year/ha 3. Location : Pulau-pulau Batu, Sirombu 4. Technology:

• The types of seaweed to be developed are: Eucheuma

spinosum and E. cottoni.

• The suitable water quality for seaweed cultivation is:

Salinity around 32 ppt, temperature 27-30, pH 6.5 – 8, far

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

41

from river water, good water movement, minimum water

purity 1m, the raised stream and wave are not so big.

• Cultivation system used is floating system. Plastic ropes

tie seaweed with 10 – 100 meters long. Planting range is

50-100 cm x 50-100 cm. Harvest is performed after aging

4-6 weeks, depending on the growth of seaweed biomass.

• Production : 327,600 kg/year

5. Investment Requirement : A. Fixed capital : US $ 24,375.00

B. Working capital : US $ 23,600.00

Total Investment : US $ 47,975.00

6. Financial Profitability

• Return On Investment (ROI) : 2.77

• Internal Rate of Return (IRR) : 29%

• Net Present Value (NPV) : US $ 11,721.00

• Payback Period : 4 years 4 months

• Break Even Point (BEP) : 247,913kg

• Benefit Cost Ratio (BCR) : 1.29

4.5. MARINE TOURISM 1. Market Chance

Many local and foreign tourists have great interest visiting

objects of tourism in Nias. The attractive objects of tourism for

visitors are the natural beauty and marine tourism. Foreign

tourists’ visits always grew up. The occurrence of multi-

dimensional crisis, nevertheless, results in the decreased

visits. The foreign tourists visiting Nias are generally from

Europe, such as England, Swiss, Holland, France, and

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

42

Belgium, besides from Australia and Asia Countries, namely

Japan, Malaysia, and Thailand. Number of foreign tourists

visiting Nias is stated in the following table.

Table 23. The Growth of Tourism Visits in Nias Regency

Tourism (people) Year Foreign Domestic Total 1990 2,009 4,570 6,579 1991 4,784 13,361 18,145 1992 4,522 14,107 18,629 1993 7,412 15,200 22,612 1994 8,016 16,638 24,654 1995 10,019 16,729 26,748 1996 10,787 18,378 29,165 1997 3,171 9,280 12,451 1998 901 6,831 7,732 1999 1,101 6,831 7,932 2000 3,541 8,675 12,216 2001 3,541 4,849 8,390

From the progress of tourism visits, it is seen that the potential

of tourism market in Nias Regency is great. The decreased

tourism visits in the last three years shows that economic crisis

and, especially security uncertainty in Indonesia greatly

contribute to this bad fact.

The objects of tourism that can be grown up are, among other

things, white-surfing, snorkeling, sand beach, sport fishing, and

wonderful natural beauty.

Investment that can be invented in marine tourism includes

tourism boat facility, hotel and restaurant, entertainment, craft

industry, beach facility, and marine facility.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

43

According to World Tourism Organization (1981) the way to

determine the standard of room requirement for coastal

tourism facilities is as follows :

Table 24. Tourism Standard of Room Requirement

1 Coast Capacity M2 /person

Optimal Number of People

Per 20-50 m Coast Low class

10 2,0 – 5,0

Middle Class 15 1,5 – 3,5 High Class 20 1,0 – 3,0 Special class 30 0,7 – 1,5

2

3 4

Coastal facilities Density Accommodation Marine Facility Size Port Capacity

Sanitation Facility with equal to 5 units of Water Closets, 2 unit bathrooms, and 4 showers for 500 people 60 – 100 sleeping rooms /ha 150 – 200 boats/tourism ship 75 – 150 boats /ha. 100 boats/ha used for parking, storing, and repairing

4.6 PIG ANIMAL HUSBANDRY

1. Production Technology 2. Types of pigs: Lard type, meat type, bacon type

3. Pigpen Requirements: a. Temperature must be maintained around 38,9 Celsius

degree as normal body temperature.

b. Pigpen must be higher than surroundings

c. Location is opened-space with good drainage

d. Near clean water source

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

44

e. Enough ventilation for pigpen

f. Morning sunshine possibly radiates pigpen

4. Cultivation Techniques:

a. Taking care of pigs

• Taking care of sows: Taking care of sows needs

special attention, especially the pregnant ones, mainly

when they are giving birth, and after giving birth,

forage must be sufficient, exercise is necessary to

give, and so on. Mating of pigs is carried out for

middle-aged pigs, which weigh 110 – 120 kilograms.

• Taking care of piglets: Taking care of piglets

commenced at their birth. They must be suckled by

sows till 8 weeks old. Castration is done at the age of

4 weeks.

• Taking care of middle-aged pigs above six months old.

Consisting of giving exercise outside of pigpen, and

forage supply 3 kg/day.

b. Forage

• Ration types for pigs: starter ration, grower ration,

fattening ration, sow- candidate ration, and suckling-

sow ration.

• Technique of forage supply: wet system and dry

system. Wet system is supplying forage by refining

and diluting forage matters to get good pig bacon.

While dry system is meant to stimulate pigs to have

optimally live-weight.

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

45

• Forage supply: The standard of forage number for

pigs. Period/Age Forage Forage type

1. Sow

2. Middle-aged pigs

3-month pregnancy

end of pregnancy

3. Adult sows

a. 3-month pregnancy

b. end of pregnancy

4. Suckling sows

a. Young

b. Adult

1-2.3 kg + greenery

2 kg + greenery

3 kg + greenery

1.5 kg + greenery

2.0 kg + greenery

2.5.kg + (0.25 kg/piglet)

2.5 kg + (0.25 kg/piglet)

Forage for seed sows

Forage for seed sows

Forage for suckling sows

Forage for seed sows

Forage for suckling sows

Forage for suckling sows

Forage for suckling sows

c. Production :

Better harvest and sale at 8 – 9 month old with 80 – 100

kg carcast weight.

5. Location : Lolomatua, Gomo, Teluk Dalam 6. Investment Requirement

A. Fixed capital : US $ 76,400.00

B. Working capital : US $ 121,800.00

Total investment : US $ 198,200.00

7. Financial Profitabilty

• Return On Investment (ROI) : 2.01

• Internal Rate of Return (IRR) : 29 %

• Net Present Value (NPV) : US $ 32.438,00

• Payback Period : 2 years 2months

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

46

• Break Event Point : 287,917 kg

• Benefit Cost Ratio (BCR) : 1.42

• Profitability Index : 1.20

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

47

LEGENDABatas kecamatanBatas kabupatenIbukota kecamatan

1

2

34

5

66

7

89

110 1112

1413

15

16

17

Nama-nama kecamatan:1. Pulau-pulau Batu2. Teluk Dalam3. Lahusa4. Amandraya5. Gomo6. Idano Gawo7. Lolohatua8. Lolowau9. Sirombu

10. Namdrehe11. Gido12. Lolofitu Moi13. Gunung Sitoli 14. Hiliduho15. Alasa16. Lahewa17. Tuhemberua

Crumb rubber

Wisata Bahari

Ternak babi

Kerapu

Kerapu

Rumput laut

Kelapa terpadu

Rumput laut

Kelapa terpadu

SAMUDERA HINDIA

SAMUDERA HINDIA

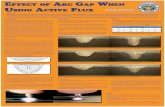

Figure 2. Map of Commodities Distribution

N

P I G

KERAPU FISH

TOURISM

COCONUT INDUSTRY

SEA WEED

SEA WEED

COCONUT INDUSTRY

Sub District

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

48

V. CONCLUSION

5.5. BUSINESS OPPORTUNITY

The result of this study indicate the sectors to be potentially

developed in Nias Regency include sectors of agriculture and forestry,

plantation, sea and fishery, animal husbandry, tourism and industry.

Some potential commodities of the several sectors these are :

• Agriculture : cultivation of Kerapu fish, Lobster,

Seaweed, Coconut, Pig Husbandry.

• Industry : Coconut processing, Fish flour and Crumb

rubber.

• Tourism : sea tourism.

Based on technical approach, market opportunity, priority of regional

development and financial feasibility analysis , the business

opportunity are recommended for development in Nias Regency, are:

• Crumb Rubber

• Coconut Processing

• Kerapu Fish Cultivation

• Seaweed cultivation

• Pig Animal Husbandry

• Marine Tourism

Profile of the business/commodities are recommended as

stated below :

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

49

5.5.1. Crumb Rubber

Location : Gunung Sitoli

Investment :

A. Fixed capital : US $ 881.288,00

B. Working capital : US $ 4.079.300,00

Total Investment : US $ 4.960.588,00

Financial Profitability

• Return On Investment (ROI) : 2.65

• Internal Rate of Return (IRR) : 25 %

• Net Present Value (NPV) : US $ 752,120.00

• Payback Period : 6 years

• Break Even Point (BEP) : 4,017 ton

• Benefit Cost Ratio (BCR) : 1.16

• Profitability Index (PI) : 1.18

5.5.2. Coconut Processing

Location at sub district : Pulau-Pulau Batu, Sirombu dan

Lahewa

Investment

. A. Fixed capital : US $ 2,957,566.00

B.. Working capital : US $ 881,275.00

Total Investment : US $ 3,838.841,00

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

50

Financial Profitability

• Return On Investment (ROI) : 2.66

• Internal Rate of Return (IRR): 29%

• Net Present Value (NPV) : US $ 900,473.00.

• Payback Period : 4 years 10 months

• Break Even Point (BEP) : 1,582 ton

• Benefit Cost Ratio (BCR) : 1.43

• Profitability Index (PI) : 1.28

5.5.3. Kerapu Fish Cultivation Location at sub district : Pulau-Pulau Batu, Sirombu dan

Teluk Dalam

Investment

. A. Fixed capital : US $ 7.923,00

B. Working capital : US $ 5.395,00

Total Investment : US $ 13.318,00

Financial Profitability

• Return On Investment (ROI) : 3.04

• Internal Rate of Return (IRR) : 35%

• Net Present Value (NPV) : US $ 5,076.00.

• Payback Period : 2 years 7 months

• Break Even Point (BEP) : 658 kg

• Benefit Cost Ratio (BCR) : 1.94

• Profitability Index (PI) : 1.46

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

51

5.5.4. Seaweed Cultivation Location at sub district : Pulau-pulau Batu, Sirombu

Investment : A. Fixed capital : US $ 24,375.00

B. Working capital : US $ 23,600.00

Total Investment : US $ 47,975.00

Financial Profitability

• Return On Investment (ROI) : 2.77

• Internal Rate of Return (IRR) : 29%

• Net Present Value (NPV) : US $ 11,721.00

• Payback Period : 4 years 4 months

• Break Even Point (BEP) : 247,913kg

• Benefit Cost Ratio (BCR) : 1.29

5.5.5 Pig Animal Husbandry

Location at sub district : Lolomatua, Gomo, Teluk

Dalam

Investment :

A. Fixed capital : US $ 76.400,00

B. Working capital : US $ 121.800,00

Total investment : US $ 198.200,00 Financial Profitabilty

• Return On Investment (ROI) : 2.01

• Internal Rate of Return (IRR) : 29 %

• Net Present Value (NPV) : US $ 32,438.00

• Payback Period : 2 years 2months

INVESTMENT PROJECT PROFILE OF NIAS REGENCY

52

• Break Event Point : 287,917 kg

• Benefit Cost Ratio (BCR) : 1.42

• Profitability Index : 1.20