1 LOOKING FOR ALPHA? UNEXPECTED OPPORTUNITIES IN NORTH AMERICA September 2007 Tom Walker Director,...

-

Upload

theodora-wilkerson -

Category

Documents

-

view

215 -

download

0

Transcript of 1 LOOKING FOR ALPHA? UNEXPECTED OPPORTUNITIES IN NORTH AMERICA September 2007 Tom Walker Director,...

1

LOOKING FOR ALPHA?LOOKING FOR ALPHA? UNEXPECTED OPPORTUNITIES IN NORTH AMERICA September 2007

Tom WalkerDirector, Martin Currie Investment Management

2

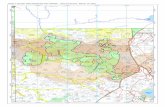

NORTH AMERICA

How investors see it:

Underperforming

Slow growth

End of Era

How Martin Currie sees it:

40 great stocks

3Past performance is not a guide to future returns. Source: Lipper Hindsight. Bid to bid, total returns in Sterling on a cumulative basis to 30 August 2007.

INVESTORS JUST DON’T WANT TO KNOW

Returns for major world indices - five years to 31 August 2007

-40

-20

0

20

40

60

80

100

120

140

160

UK Asia Pacific ex-Japan Europe ex-UK Japan North America World

4

PERCEPTION………

5

REALITY……

6

THE DOMINO EFFECT

7

THE DOLLARAt top of 25 year range versus sterling

Source: Bank of England. As at 31 August 2007.

Spot exchange rate, US $ into Sterling

0

0.5

1

1.5

2

2.5

01/0

9/19

82

01/0

9/19

84

01/0

9/19

86

01/0

9/19

88

01/0

9/19

90

01/0

9/19

92

01/0

9/19

94

01/0

9/19

96

01/0

9/19

98

01/0

9/20

00

01/0

9/20

02

01/0

9/20

04

01/0

9/20

06

Spot exchange rate, US $ into Sterling

8

WHAT PRICE A BIG MAC ?Is it actually sterling that is overvalued?

Source:Economist.com;Prudential Equity Group,LLC. As at 31 January 2007

Cost and % under/over of a Big Mac

57%

21%19%0%-4%-6%

-17%-18%-28%

-46%-56%

0

1

2

3

4

5

6

Ch

ina

Ind

ia

Jap

an

Arg

en

tin

a

Au

str

alia

Bra

zil

Can

ad

a

US

Eu

ro A

rea

UK

Sw

itzerl

an

d

US

D

9

-20

-15

-10

-5

0

5

10

15

20

25

30

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Exports: Goods and Services

Imports: Goods and Services

US Nominal Goods and Services Exports and Imports, Y/Y%

THE DEFICITUS nominal goods and services exports and imports, Y/Y%

Source Citigroup, August 2007

10

INFLATION Inflation is trending down

Source: Bear Sterns. As at 31 August 2007.

Core PCE Deflator

12

mo

nth

s ch

an

ge

, %

2.5

2.0

1.5

1.0

1995 1997 1999 2001 2003 2005 2007

1.0

11

0

5

10

15

20

25

Mar-07 J un-07 Sep-07 Dec-07 Mar-08 J un-08 Sep-08 Dec-08

Monthly Rate Resets ($bn)Monthly Rate Resets ($bn)

0

5

10

15

20

25

Mar-07 J un-07 Sep-07 Dec-07 Mar-08 J un-08 Sep-08 Dec-08

Monthly Rate Resets ($bn)Monthly Rate Resets ($bn)

HOUSEHOLD DEBTStill a lot of resets ahead of us

Source: JP Morgan.

12

HOUSING (MONTHS OF INVENTORY)Home sales will take time to recover

Source: National Association of Realtors.

13

…BUT DON’T UNDERESTIMATE THE US CONSUMERUS Household Net Worth (ex Real Estate)

Source: FRB Flow of Funds and Citi Investment Research – US Equity Strategy

14

OUTLOOK FOR NORTH AMERICAN EQUITIES

North American economy has slowed but Q1 2007 may well be the low point The US dollar is at a level which makes US companies highly competitive Inflation is trending back within Fed target range Interest rates declining – supportive of equity valuations Earnings growth robust across many sectors – some obvious exceptions

2005 2006 2007 2008

USA 3.2 2.9 1.9 2.6

Eurozone 1.5 2.9 2.7 2.3

Japan 1.9 2.2 2.4 2.1

UK 1.9 2.8 2.8 2.2

Source: Consensus Economics. As at 13 August 2007.

GDP growth compared

15

WHY MARTIN CURRIE FORNORTH AMERICA?

North American fund fits our ‘Big Boutique’ business model:

Stock-picking approach

Focused portfolio – 40 stocks

Partnership between a proven product manager and an experienced team of sector managers

Manager’s remuneration linked directly to performance

Distinctive investment process – combining numerical screening, fundamental research and committed stock selection

Exceptional investment performance – including on a risk-adjusted basis

Stands out in a sector with few consistent performers

Positioned to take advantage of resurgence of large-caps

Tom WalkerLead manager, North America

16

PERFORMANCE IN PERSPECTIVETop-quartile ranking in peer group

Past performance is not a guide to future returns. Returns are in sterling and net of fees.Source: Lipper Hindsight. Bid-bid basis with net income reinvested over period shown. * From 30 April 2002 to 31 August 2007.Although Martin Currie complies with the GIPS standards, and each fund return is calculated using the recommended methodology, the method of calculation used in this presentation falls outside the scope of the GIPS standards.

Cumulative performance1 year 2 years 3 years 4 years 5 years Manager’s

tenure*

Martin Currie North American Fund 11.7 17.6 39.9 34.7 50.7 20.2

Sector average 7.1 7.9 22.9 16.5 25.4 0.5

MSCI North America 9.4 13.5 30.2 27.6 40.8 13.5

Quartile ranking 1 1 1 1 1 1

vs sector average 19.1%

vs MSCI North America 5.9%

17

NORTH AMERICAN PORTFOLIOSAn experienced and well-resourced team

Product managers

Tom WalkerLead-manager, North America

Rahul SharmaConsumer

Chris Butler Head of sector managers,

materials

Duncan GoodwinEnergy

Jane CoullTechnology

Donald Barlow Utilities

Ken HughesIndustrials

Elaine MorrisonConsumer

Rachel Nimmo Healthcare

Paul Sloane Financials

Len RiddellFinancials

Sector manager team

Dealing

(Team of 10)

Performance analytics group

(Team of 12)

Dan GardnerHead of risk management

Risk management

Jamie MarianiTelecoms

David ForsythCo-manager, North America

Toby McCullaghConsumer

Luca Fasan, Technology, media & telecoms

18

3.3

2.0

1.8

1.6

1.4

0.4

-2.4

-3.3

-3.4

-3.9

Industrials

Information technology

Utilities

Telecommunication services

Energy

Consumer staples

Materials

Consumer discretionary

Healthcare

Financials

Sector weightings %

PORTFOLIO CHARACTERISTICSRelative stock and sector weightings

Top five positive positions

Martin

Currie %

Index

weight

%

Active weight

%

1. Gildan Activewear 2.9 0.0 +2.9

2. Foster Wheeler 2.8 - +2.8

3. MEMC Electronic Materials 2.9 0.1 +2.8

4. Cisco Systems 4.0 1.2 +2.8

5. Corning 3.0 0.3 +2.8

Top five negative positions

Martin Currie %

Index

weight %

Active weight %

1. Exxon Mobil - 3.4 -3.4

2. Microsoft - 1.8 -1.8

3. Citigroup - 1.6 -1.6

4. Chevron - 1.3 -1.3

5. Johnson & Johnson - 1.2 -1.2

Source: Martin Currie. As at 31 July 2007. Index: MSCI North America.This information does not constitute investment advice, nor is it an offer or invitation to subscribe for shares in any of the stocks.

19

CORNING

CorningCorning relative to S&P 500 Composite Index

Global leader in glass technology

Flat screen television sales still growing strongly

Under appreciated fibre optic, diesel emission control and polysilicon businesses

Source:Thomson Financial Datastream as at 31 August 2007. Past performance is not a guide to future returns. This information does not constitute investment advice, nor is it an offer or invitation to subscribe for shares in the stock.

2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7

8

1 0

1 2

1 4

1 6

1 8

2 0

2 2

2 4

2 6

2 8

3 0

20

GILDAN ACTIVEWEAR

Gildan ActivewearGildan Activewear relative to S&P 500/TSX Composite Index

Leader in volume T-shirt production, also socks and underwear

Make ‘em cheap – but in Central America, not China

Quality company, conservatively managed and under researched

Source:Thomson Financial Datastream as at 31 August 2007. Past performance is not a guide to future returns. This information does not constitute investment advice, nor is it an offer or invitation to subscribe for shares in the stock.

2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7

5

1 0

1 5

2 0

2 5

3 0

3 5

4 0

21

CVS

Leading food and drug retailer – 100% domestic US sales

Beneficiary of growth in use of low cost generic drugs

Experienced acquirer and integrator of businesses

Source:Thomson Financial Datastream as at 31 August 2007. Past performance is not a guide to future returns. This information does not constitute investment advice, nor is it an offer or invitation to subscribe for shares in the stock.

CVSPrice relative to S&P 500 Composite Index

2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7

1 8

2 0

2 2

2 4

2 6

2 8

3 0

3 2

3 4

3 6

3 8

4 0

22

CANADIAN PACIFIC RAILWAY

Domestic assets – but China, et al, are the engine of growth

Strong trends in operating efficiency

Attractive valuations ….. and Warren Buffet thinks so too !

Source:Thomson Financial Datastream as at 31 August 2007. Past performance is not a guide to future returns. This information does not constitute investment advice, nor is it an offer or invitation to subscribe for shares in the stock.

Canadian Pacific Railway relative to S&P 500/TSX Composite IndexCanadian Pacific Railway

2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7

2 0

3 0

4 0

5 0

6 0

7 0

8 0

9 0

23

SUMMARYAlpha is alive and well in North America

Alpha is in companies – not politics and macro economics

North American companies are selectively the best in the world

Our investments are quoted in North America, a dynamic and growing environment….

….but many are global operators thriving in the global market place

24

REGULATORY INFORMATION

Martin Currie Investment Management Limited (MCIM) has issued and approved this presentation in its capacity as investment adviser. MCIM is referred to throughout as ‘Martin Currie’. MCIM is authorised and regulated by the Financial Services Authority and is a member of the Investment Management Association. Registered in Scotland (no 66107), registered address Saltire Court, 20 Castle Terrace, Edinburgh, EH1 2ES. The presentation may not be distributed to third parties and is intended only for the attendee. The presentation does not form the basis of, nor should it be relied upon in connection with, any subsequent contract or agreement. It does not constitute, and may not be used for the purpose of, an offer or invitation to subscribe for or otherwise acquire shares in any of the products mentioned. The information contained in this presenter has been compiled with considerable care to ensure its accuracy. But no representation or warranty, express or implied, is made to its accuracy or completeness. Martin Currie has procured any research or analysis contained in this presentation for its own use. It is provided to you only incidentally, and any opinions expressed are subject to change without notice. Martin Currie Investment Funds (MCIF) Martin Currie North American Fund (the fund) is a subfund of an Open-ended investment company (Oeic). The fund is referred to throughout as the North American Fund. Martin Currie Unit Trusts Limited is the Authorised Corporate Director for the Oeic, and is an affiliate of MCIM. It is also authorised and regulated by the Financial Services Authority. MCIM is the investment adviser to the fund. In the exceptional event that an Oeic subfund’s liabilities exceed its net assets, the Oeic structure allows for these liabilities to be allocated across other subfunds in the Oeic. Investment in the fund can only be made in accordance with the terms and conditions outlined in the Simplified Prospectus or Key features document available at the time of investing.

Past performance is not a guide to future returns. Markets and currency movements may cause the value of investments and income from them to fall as well as rise and you may get back less than you invested when you decide to sell your investments. There can be no assurance that you will receive comparable performance returns, or that investments will reflect the performance of the stock examples, contained in this presenter. Movements in foreign exchange rates may have a separate effect, unfavourable as well as favourable, on the gain or loss otherwise experienced on an investment. Funds which invest in one country carry a higher degree of risk than those with portfolios diversified across a number of markets. Investment in the securities of smaller and unquoted companies can involve greater risk than is customarily associated with investment in larger, more established, companies. In particular, smaller companies often have limited product lines, markets or financial resources and their management may be dependent on a smaller number of key individuals. In addition, the market for stock in smaller companies is often less liquid than that for stock in larger companies, bringing with it potential difficulties in acquiring, valuing and disposing of such stock. Proper information for determining their value, or the risks to which they are exposed, may not be available. Investment in derivative instruments, including futures, options or contracts for differences, carries a high risk of loss, the markets in these investments being very volatile. A relatively small adverse market movement may result not only in the loss of the original investment but also in unquantifiable further loss exceeding any margin deposited. Warrants often involve a high degree of gearing so that a relatively small movement in the price of the security to which the warrant relates may result in a disproportionately large movement, unfavourable as well as favourable, in the price of the warrant.

Performance information - with the exception of any figures calculated on a fund's net asset value, which fall outside the scope of the GIPS standards, all performance information calculated by Martin Currie complies with the GIPS standards.