1 chapter 8 continued. 2 review Remember in our example of the sales tax we considered the...

-

Upload

letitia-garrett -

Category

Documents

-

view

212 -

download

0

Transcript of 1 chapter 8 continued. 2 review Remember in our example of the sales tax we considered the...

1

chapter 8 continued

2

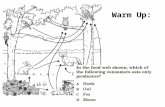

reviewRemember in our example of the sales tax we considered the consumers’ and producers’ surplus both before and after the tax. With the tax we also considered the tax receipts that could be distributed to members in society.

On the next few screens I will reproduce that work and add some stuff as well.

3

applying the concepts - a sales tax

DbtDat

Sbt

Pat

Pat + taxPbt

Qat Qbt

a

b

c d e

f g h

i

4

applying the concepts - a sales tax

before tax after tax Robin Hoodconsumers’surplus a + b + c + d + ea + b a + b + .5eproducers’ surplus f + g + h + i i i + .5htax c + d + f + g c+ d + .5e +

f + g + .5h

social gain a + b + c + d a +b +c + d a + b + c + d

+ e + f + g + h + i f + g + i + e + f + g+ h + i

5

Robin HoodInstead of our sales tax example, let’s imagine that Robin Hood and his gang ride into town and take the equivalent of c + d + .5e from consumers and f + g + .5h from producers and give this amount to those who would have gotten the tax benefits.

6

Pareto CriterionPolicy A can be said to be better than Policy B only when every individual prefers Policy A to Policy B.

The Robin Hood policy would be Pareto preferred to the sales tax policy because consumers, producers, and tax recipients all prefer Robin Hood to the tax policy because they all have more under the Robin Hood Policy.

We CAN NOT say the no tax policy is preferred to the sales tax policy because consumers and producers prefer no tax while tax recipients prefer the tax policy. The same can be said for comparing Robin Hood and the no tax policy.

7

Pareto OptimalA policy is Pareto optimal if no other policy is Pareto preferred. The no tax and the Robin Hood Policies are Pareto optimal, the sales tax isn’t.

Sales tax policies, by the way, cause deadweight losses. It seems the deadweight loss can be overcome, at least in theory, by a Robin Hood type policy.

Note in our discussion here we have looked at the consumers, producers and tax recipients separately and asked how each faired. Now we turn to another criterion that looks at the outcome from the point of view of all of society.

8

Efficiency criterionWe will call a policy more efficient if it yields a higher social gain.

In our example, the no tax policy and the Robin Hood policy are equivalent and are more efficient than the tax policy.

The efficiency criterion judges the no tax policy over the tax policy, while the Pareto policy didn’t. The reason for this is that the gain of the gainers is less than the loss of the losers, and so in total the collection is worse off.

9

The invisible handA couple of centuries ago Adam Smith said of individuals ‘... He intends only his own gain and is ...led by an invisible hand to promote an end which was no part of his intention.’

Our modern form of this statement is that social gain is maximized by the self-interest actions of people.

10

invisible handP D S

Q1 Q2 Q3

Individual actions lead to the S = D outcome and at this level MB = MC in society. If the economy stopped at Q1 - at levels individuals do not stop at, we would have losses in surplus value. A similar interpretation holds for Q3.

So individual action leads to the highest surplus value.