© 2004 SHRM SHRM Weekly Online Survey: September 14, 2004 Health Savings Accounts Sample comprised...

-

Upload

clinton-collins -

Category

Documents

-

view

212 -

download

0

Transcript of © 2004 SHRM SHRM Weekly Online Survey: September 14, 2004 Health Savings Accounts Sample comprised...

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

Health Savings Accounts

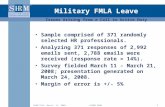

• Sample comprised of 250 randomly selected HR professionals.

• Analyzing 250 of 2012 emails sent; 1953 emails received (response rate = 13%)

• Survey fielded September 14 – 20, 2004; presentation generated on September 22, 2004.

• Margin of error is +/- 6%

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

1. Does your organization currently offer or plan to offer HSAs for employees?

18%15%

66%

0%

10%

20%

30%

40%

50%

60%

70%

Yes, we currentlyoffer HSAs

No, but we plan tooffer HSAs in the

future

No, we currently donot offer HSAs

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

1. Does your organization currently offer or plan to offer HSAs for employees?

Choice Count Percentage Answered

No, we currently do not offer HSAs

165 66.3%

Yes, we currently offer HSAs 46 18.5%

No, but we plan to offer HSAs in the future

38 15.3%

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

2. What is your organization’s reason(s) for not offering HSAs? (Check all that apply.)

2%

4%

14%

15%

17%

17%

19%

25%

0% 10% 20% 30%

Difficulty in explaining this option to the C-Suite

An older workforce

Education level of the organization’s workforce

Difficulty in managing employee expectations about this plan option

Lack of employee interest in managing their health care decisions

Lack of information from broker/vendor about this type of plan

Difficulty in educating employees about this plan option

Other

Note: Only respondents who indicated that they do not currently offer nor have plans to offer HSAs were asked this question (n = 165).

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

2. What is your organization’s reason(s) for not offering HSAs? (Check all that apply.)

Choice Count Percent of Sample

Other 63 25.2%

Difficulty in educating employees about this plan option

48 19.2%

Lack of information from broker/vendor about this type of plan

43 17.2%

Lack of employee interest in managing their health care decisions

42 16.8%

Difficulty in managing employee expectations about this plan option

37 14.8%

Education level of the organization’s workforce

34 13.6%

An older workforce 10 4.0%

Difficulty in explaining this option to the C-Suite

6 2.4%

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

Open Ended Responses to Question 2

1. We offer so many other valuable tools to the employees2. We offer an FSA instead3. We operate under State of MS regulations.4. Limited insurers offering high deductible plans; limited value in our workforce5. We provide a very low deductible and 100% paid in network plan6. Not aware of a specific reason7. Self insured now and like our plan8. In state government, plans are decided by a separate board outside the control of the

organization. Am not fully aware of the reasons they have not opted for this approach.9. Significant change in benefit design10. Retention issues11. Unknown12. Current better options for employees13. We plan to evaluate HSAs in the near future to determine whether we will offer them in the

future.14. Employer pays all or most of health insurance costs. Interest would be minimal.15. We have chosen to wait 1-2 years before looking into its options. It's too new in the

marketplace, and we want to see how it comes together for other employers over a period of time.

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

Continued…

16. These decisions made by corp.17. I do not know18. We may offer them as a health insurance option in the future. This will depend on

anticipated premium cost savings and the number of employees who historically have less claims than the dollar amount of the HDHP deductible minimums.

19. We provide quality medical plans that are 85%-90% paid for by the company. We see no advantage to offering a high deductible plan.

20. Results/Effects of HSAs not well documented yet21. We are considering as an option, but it is in the very early research stage.22. Because health insurance plans must have an annual deductible of at least $1,000 for

individuals and at least $2,000 for families and ours does not.23. Currently evaluating - may offer in future24. We are gathering information on HSAs to hopefully offer in the future.25. We are still waiting on completion of Legislation to deal with the use or lose policy that

currently exist. 26. Reviewing Option for 1/1/05 renewal27. Never been presented to management28. HR is now learning about the plan29. Corporate decision30. Currently doing research on this option and may offer it at our next open enrollment in

January31. Still investigating32. If you are referring to Health Savings Account, the minimum deductible is too high. High

Deductible Insurance Required

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

Continued…

33. Lack of union buy-in34. I am not involved in this area and truly have no idea why or why not.35. Currently researching the plan36. Lack of time to implement, I am ashamed to say37. Never has been brought to bargaining table.38. Not being offered by competitor employers at this time.39. Because we don't have to consider it yet 40. Pre-tax premiums taken out of paycheck, plus we plan to offer a flexible spending account

this year41. Lack of clear value except to the employer42. Company too new43. Management does not like the idea44. Awesome benefits with no high deductible plan needed45. Lack of understanding/education of us (HR) on this option46. Not Involved in Benefits Decisions47. Just haven't looked into them in detail yet

© 2004 SHRM

SHRM Weekly Online Survey: September 14, 2004

Continued…

48. We are considering installing an HSA in the future. However, we don't want to be the "guinea pig" and would like a better history of other employers who have installed an HSA plan.

49. Currently offering FSAs, not able to manage two50. Understanding the rules and regulations issued by the government51. Employee count not high enough52. We have already investigated this and find that, on the whole, it is not advantageous for

our mix of employees.53. We are going to look at HSAs but, at this time, do not know if we will offer one.54. Mostly part time and low wages (janitorial industry)55. Currently reviewing options56. Lack of employer interest57. Waiting to make a better evaluation of the benefit for our employees58. Insufficient Management59. Health care is subject to collective bargaining agreement and changing to an HSA would

be an inferior plan to what is in place.60. Under a Corporate Umbrella61. We are still researching the plans but could offer one in the future